|

Card Association

A card association or a bank card association is a network of issuing banks and acquiring banks that process payment cards of a specific brand. Examples Familiar payment card association brands include China UnionPay, RuPay, American Express, Discover, Diners Club, Troy and JCB. While once card associations, Visa and Mastercard have both become publicly traded companies. Statistics Among United States consumer A consumer is a person or a group who intends to order, or uses purchased goods, products, or services primarily for personal, social, family, household and similar needs, who is not directly related to entrepreneurial or business activities. T ...s alone, over 600 million payment cards are in circulation. References {{DEFAULTSORT:Card Association Payment cards Merchant services ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Issuing Bank

An issuing bank is a bank that offers card association branded payment cards directly to consumers, such as credit cards, debit cards, contactless devices such as key fobs as well as prepaid cards. The name is derived from the practice of issuing cards to a consumer. Details An issuing bank (also called an issuer) is part of the 4-party model of payments. It is the bank of the consumer (also called a cardholder) and is responsible for paying the merchant's bank (called an Acquiring Bank or Acquirer) for the goods and services the consumer purchases. It issues the payment card and holds the account with the consumer (such as a credit card account or checking account for a debit card). The parties in the 4-party model are: # Consumer (also called a cardholder): Makes purchases and promises to pay the Issuing Bank for them. # Issuing Bank (also called an Issuer): The consumer's bank. Transfers money for purchases to the Acquiring Bank. Is liable for purchases made by the consumer if the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acquiring Bank

An acquiring bank (also known simply as an acquirer) is a bank or financial institution that processes credit or debit card payments on behalf of a merchant. The acquirer allows merchants to accept credit card payments from the card-issuing banks within a card association, such as Visa, MasterCard, Discover, China UnionPay, American Express. The acquiring bank enters into a contract with a merchant and offers it a merchant account. This arrangement provides the merchant with a line of credit. Under the agreement, the acquiring bank exchanges funds with issuing banks on behalf of the merchant and pays the merchant for its daily payment-card activity's net balance — that is, gross sales minus reversals, interchange fees, and acquirer fees. Acquirer fees are an additional markup added to association interchange fees by the acquiring bank, and those fees vary at the acquirer's discretion. Risks The acquiring bank accepts the risk that the merchant will remain solvent. The main so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Card

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner (the cardholder) to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer and access automated teller machines (ATMs). Such cards are known by a variety of names including bank cards, ATM cards, client cards, key cards or cash cards. There are a number of types of payment cards, the most common being credit cards, debit cards, charge cards, and prepaid cards. Most commonly, a payment card is electronically linked to an account or accounts belonging to the cardholder. These accounts may be deposit accounts or loan or credit accounts, and the card is a means of authenticating the cardholder. However, stored-value cards store money on the card itself and are not necessarily linked to an account at a financial institution. It can also be a smart card that contains a unique card n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

China UnionPay

UnionPay (), also known as China UnionPay () or by its abbreviation, CUP or UPI internationally, is a Chinese state-owned financial services corporation headquartered in Shanghai, China. It provides bank card services and a major card scheme in mainland China. Founded on 26 March 2002, China UnionPay is an association for China's banking card industry, operating under the approval of the People's Bank of China (PBOC, central bank of China). It is also an electronic funds transfer at point of sale (EFTPOS) network, and the only interbank network in China that links all the automatic teller machine (ATMs) of all banks throughout the country. UnionPay cards can be used in 180 countries and regions around the world. In 2015 the UnionPay overtook Visa and Mastercard in total value of payments made by customers and became the largest card payment processing organization (debit and credit cards combined) in the world surpassing the two. However, only 0.5% of this payment volume wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RuPay

RuPay ''(portmanteau of Rupee and Payment)'' is an Indian multinational financial services and payment service system, conceived and launched by the National Payments Corporation of India (NPCI) on 26 March 2012. It was created to fulfil the Reserve Bank of India's (RBI) vision of establishing a domestic, open and multilateral system of payments. RuPay facilitates electronic payment at all Indian banks and financial institutions. NPCI maintains ties with Discover Financial, JCB to enable RuPay card scheme to gain international acceptance. As of November 2020, around 60.3 crores (603.6 million) RuPay cards have been issued by nearly 1,158 banks. All merchant discount rate (MDR) charges were eliminated for RuPay transactions from 1 January 2020. All Indian companies with an annual turnover exceeding are required to offer RuPay payment options to their customers. Background In 2009, RBI had asked the Indian Bank Association to create a non-profit payment company which wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

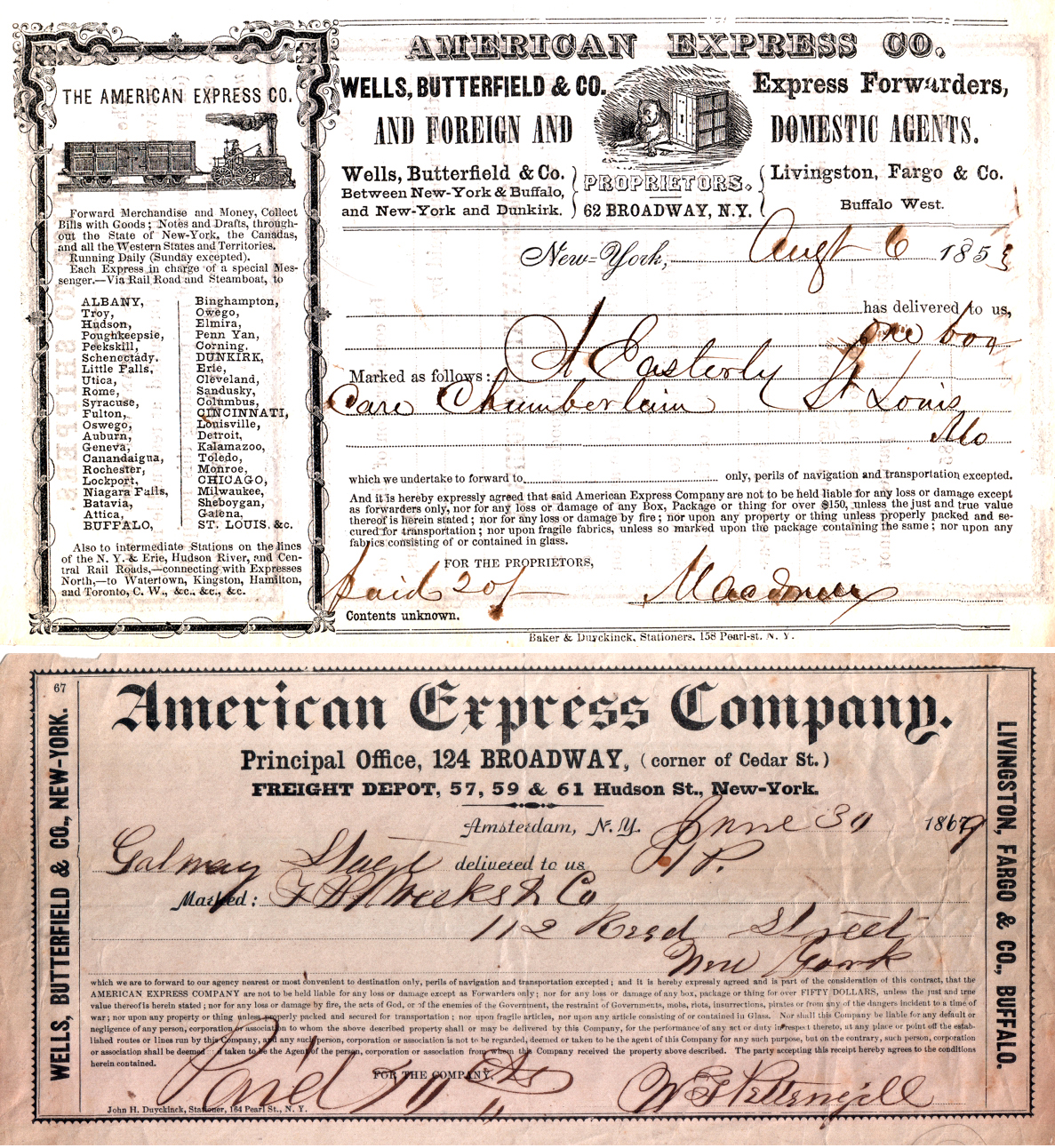

American Express

American Express Company (Amex) is an American multinational corporation specialized in payment card services headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average. The company's logo, adopted in 1958, is a gladiator or centurion whose image appears on the company's well-known traveler's cheques, charge cards, and credit cards. During the 1980s, Amex invested in the brokerage industry, acquiring what became, in increments, Shearson Lehman Hutton and then divesting these into what became Smith Barney Shearson (owned by Primerica) and a revived Lehman Brothers. By 2008 neither the Shearson nor the Lehman name existed. In 2016, credit cards using the American Express network accounted for 22.9% of the total dollar volume of credit card transactions in the United States. , the company had 121.7million cards in force, includ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discover Card

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit, features that were disruptive to the existing credit card industry. A subsequent innovation was "Cashback Bonus" on purchases. Most cards with the Discover brand are issued by Discover Bank, formerly the Greenwood Trust Company. Discover transactions are processed through the Discover Network payment network. In 2005, Discover Financial Services acquired Pulse, an electronic funds transfer network, allowing it to market and issue debit and ATM cards. In February 2006, Discover Financial Services announced that it would begin offering Discover debit cards to other financial institutions, made possible by the acquisition of Pulse. Discover is the third largest credit card brand in the U.S. based on the number of cards in circulation, behind Visa and Mastercard, with 57 milli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diners Club International

Diners Club International (DCI), founded as Diners Club, is a charge card company owned by Discover Financial Services. Formed in 1950 by Frank X. McNamara, Ralph Schneider, Matty Simmons, and Alfred S. Bloomingdale, it was the first independent payment card company in the world, successfully establishing the financial service of issuing travel and entertainment (T&E) credit cards as a viable business. Diners Club International and its franchises serve individuals from around the world with operations in 59 countries. History The idea for Diners Club was conceived at the Majors Cabin Grill restaurant in New York City in 1949. Diners Club cofounder Frank McNamara was dining with clients and realized he had left his wallet in another suit. His wife paid the bill, and McNamara thought of a multipurpose charge card as a way to avoid similar embarrassments in the future. He discussed the idea with the restaurant owner at the table, and the following day with his lawyer Ralph Schne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Troy (card Scheme)

Troy is a Turkish card scheme founded in 2015 by the Interbank Card Center. It is the only domestic card scheme in Turkey. Troy offers financial services, including credit card, debit card, and prepaid card issuing and network processing. Since 2017, Troy cards have been accepted in the United States on the Discover Card network. Within the card reciprocal agreements, Troy cards are also accepted on the Diners Club and Discover Card Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. When launched, Discover did not charge an annual fee and offered a higher-than-normal credit limit, features that were disruptive to the e ... networks. References External links * {{Credit cards Banking in Turkey Credit card issuer associations Debit card issuer associations 2015 establishments in Turkey ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japan Credit Bureau

, formerly Japan Credit Bureau, is a credit card company based in Tokyo, Japan. It is accepted at JCB merchants, and has strategic alliances with Discover Network merchants in the United States, UnionPay merchants in China, American Express merchants in Canada, and RuPay merchants in India. History Founded in 1961 as Japan Credit Bureau, JCB established itself in the Japanese credit card market when it purchased Osaka Credit Bureau in 1968. its cards are issued to 130 million customers in 23 countries. JCB also operates a network of membership airport lounges for holders of their Platinum Cards issued outside Japan. Since 1981, JCB has been expanding its business overseas. JCB cards are issued in 24 countries, in most countries JCB is affiliated with financial institutions to license them to issue JCB-branded cards. All international operations are conducted through its 100%-owned subsidiary, JCB International Credit Card Co., Ltd. In the United States, JCB is not a prim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Visa Inc

Visa Inc. (; stylized as ''VISA'') is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies. Visa does not issue cards, extend credit or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash access programs to their customers. In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion. This article is authored by a ''Forbes'' staff member. Visa was founded in 1958 by Bank of America (BofA) as the BankAmericard credit card program. Available through ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |