|

Blank Check Company

A special purpose acquisition company (SPAC; ), also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process and the associated regulations thereof. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition opportunity within a set timeframe; these opportunities usually have yet to be identified while raising funds. In the United States, SPACs are registered with the SEC and considered publicly-traded companies; the general public may buy their shares on stock exchanges before any merger or acquisition takes place. For this reason they have at times been referred to as the "poor man's private equity funds". The majority of companies pursuing SPACs do so on the Nasdaq or New York Stock Exchange in the United States, althoug ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shell Corporation

A shell corporation is a company or corporation that exists only on paper and has no office and no employees, but may have a bank account or may hold passive investments or be the registered owner of assets, such as intellectual property, or ships. Shell companies may be registered to the address of a company that provides a service setting up shell companies, and which may act as the agent for receipt of legal correspondence (such as an accountant or lawyer). The company may serve as a vehicle for business transactions without itself having any significant assets or operations. Shell companies are used regularly for tax evasion, tax avoidance, money laundering, or to achieve a specific goal such as anonymity. Anonymity may be sought to shield personal assets from others, such as a spouse when a marriage is breaking down, from creditors, or from government authorities. Shell companies can have legitimate business purposes. They may, for example, act as trustee for a trust, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dissolution (law)

In law, dissolution is any of several legal events that terminate a legal entity or agreement such as a marriage, adoption, corporation, or union. Dissolution is the last stage of liquidation, the process by which a company (or part of a company) is brought to an end, and the assets and property of the company are gone forever. Dissolution of a partnership is the first of two stages in the termination of a partnership. "Winding up" is the second stage.Slides 11-17 oPowerpoint for Chapter 21 from McGraw-Hill from 2nd Ed. of Kusabek Dissolution may also refer to the termination of a contract or other legal relationship; for example, a divorce is the dissolution of a marriage only if the husband or wife does not agree. If the husband and wife agree then it is a dissolution. Dissolution is also the term for the legal process by which an adoption is reversed. While this applies to the vast majority of adoptions which are terminated, they are more commonly referred to as disruptio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bookrunner

In investment banking, a bookrunner is usually the main underwriter or lead-manager/arranger/coordinator in equity, debt, or hybrid securities issuances. The bookrunner usually syndicates with other investment banks in order to lower its risk In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environme .... The bookrunner is listed first among all underwriters participating in the issuance. When more than one bookrunner manages a security issuance, the parties are referred to as "joint bookrunners" or a "multi-bookrunner syndicate". The bank that runs the books is the closest one to the issuer and controls the allocations of shares to investors, holding significant discretion in doing so, which places the bookrunner in a very favored position. References External linksNew Look mandate continu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

League Table

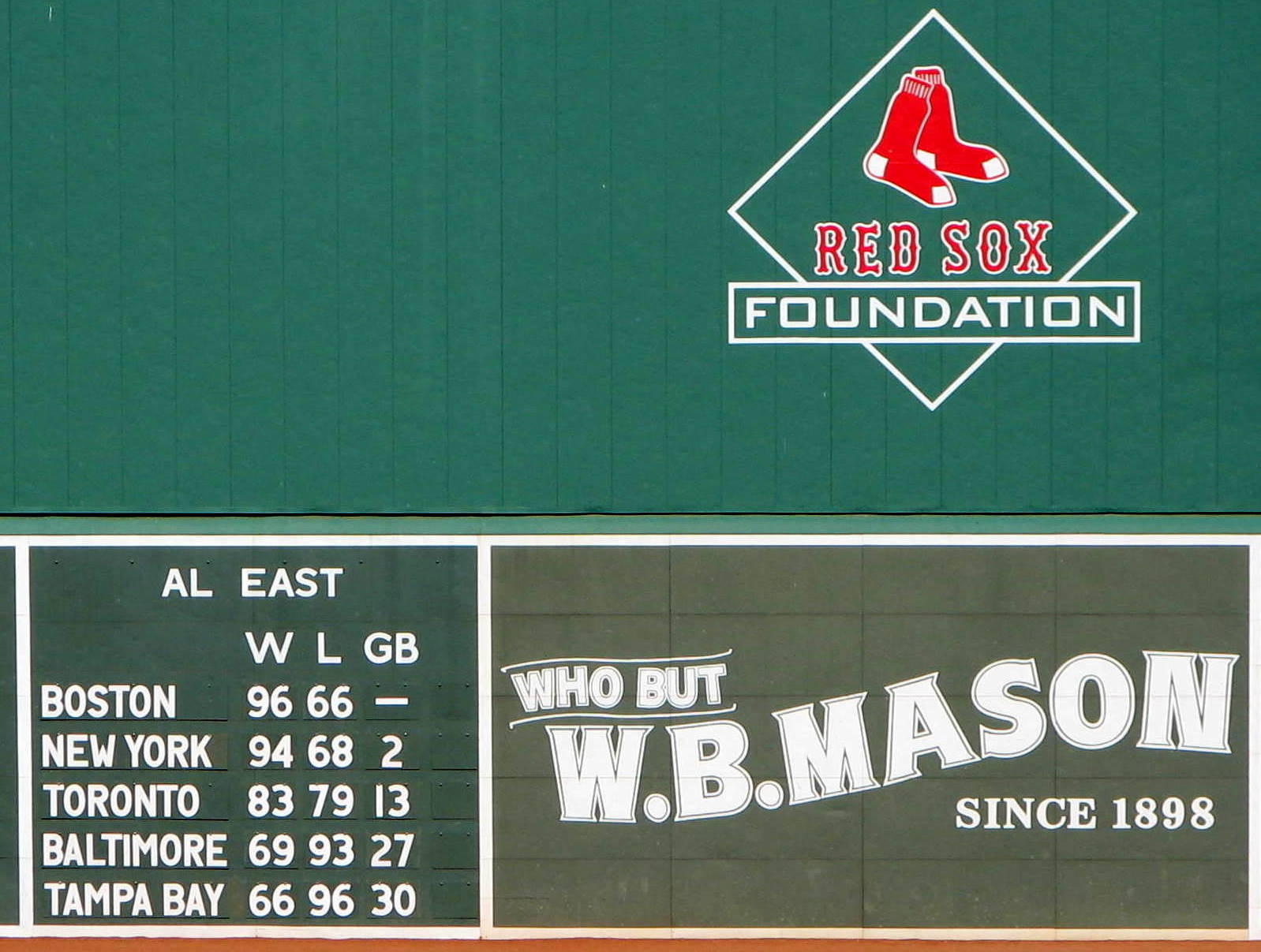

Standings or rankings are listings which compare sports teams or individuals, institutions, nations, companies, or other entities by ranking them in order of ability or achievement. A table or chart (such as a league table, a ladder or a leaderboard) may be employed to display such listings. A league table may list several related statistics, but they are generally sorted by the primary one that determines the rankings. Many industries and institutions may compete in league tables in order to help bring in new customers and clients. Those tables ranking sports teams are generally used to help determine who may advance to the playoffs or another tournament, who is promoted or relegated, or who gets a higher draft pick. Sport In sport, league tables group teams of similar abilities in a chart to show the current standing of the participants (teams or individuals) in a sports league or competition. These lists are generally published in newspapers and other media, as well as the o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fairness Opinion

A fairness opinion is a professional evaluation by an investment bank or other third party as to whether the terms of a merger, acquisition, buyback, spin-off, or privatization are fair. It is rendered for a fee. They are typically issued when a public company is being sold, merged or divested of all or a substantial division of their business. They can also be required in private transactions not involving a company that is traded on a public exchange, as well as in circumstances other than mergers, such as a corporation exchanging debt for equity. Some of the specific functions of a fairness opinion are to aid in decision-making, mitigate risk, and enhance communication. Controversy Controversy in financial and management circles surrounds the question of the objectivity of fairness opinions, as one aspect of the duty of care in the fairness of a transaction. A potential exists for a conflict of interest when an entity rendering an opinion may benefit from the transaction ei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidation

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or agency in a country responsible for collecting and safeguarding customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust") or voluntary (sometimes referred to as a ''shareholders' liquidation'', although some voluntary liquidations are controlled by the creditors). The ter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidating Distribution

A liquidating distribution (or liquidating dividend) is a type of nondividend distribution made by a corporation or a partnership to its shareholders during its partial or complete liquidation. Liquidating distributions are not paid solely out of the profits of the corporation. Instead, the entire amount of shareholders' equity is distributed. When a company has more liabilities than assets, equity is negative and no liquidating distribution is made at all. This is usually the case in bankruptcy liquidations. Creditors are always senior to shareholders in receiving the corporation's assets upon winding up. However, in case all debts to creditors have been fully satisfied, there is a surplus left to divide among equity-holders. This mainly occurs during voluntary liquidations of solvent corporations. Cases A dividend may be referred to as liquidating dividend when a company: # Goes out of business and the net assets of the company (after all liabilities have been paid) are distribute ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructuring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Limited Partnership

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner. Limited partnerships are distinct from limited liability partnerships, in which all partners have limited liability. The GPs are, in all major respects, in the same legal position as partners in a conventional firm: they have management control, share the right to use partnership property, share the profits of the firm in predefined proportions, and have joint and several liability for the debts of the partnership. As in a general partnership, the GPs have actual authority, as agents of the firm, to bind the partnership in contracts with third parties that are in the ordinary course of the partnership's business. As with a general partnership, "an act of a general partner which is not apparently for carrying on in the ordinary c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Blind Pool

Blind may refer to: * The state of blindness, being unable to see * A window blind, a covering for a window Blind may also refer to: Arts, entertainment, and media Films * ''Blind'' (2007 film), a Dutch drama by Tamar van den Dop * ''Blind'' (2011 film), a South Korean crime thriller * ''Blind'' (2014 film), a Norwegian drama * ''Blind'' (2016 film), an American drama * ''Blind'' (2019 film), an American horror film * ''Blind'' (upcoming film), an upcoming Indian crime thriller, based on 2011 South Korean film of the same name Music * Blind (band), Australian Christian rock group founded in 1999 * Blind (rapper), Italian rapper Albums * ''Blind'' (Corrosion of Conformity album), 1991 * ''Blind'' (The Icicle Works album), 1988 * ''Blind'' (The Sundays album), 1992 * ''Blind!'', a 1985 album by the Sex Gang Children Songs * "Blind" (Breed 77 song), 2006 * "Blind" (Feder song), 2015 * "Blind" (Hercules and Love Affair song), 2008 * "Blind" (Hurts song), 2013 * "B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St Paul's Cathedral in the City of London. Since 2007, it has been part of the London Stock Exchange Group (LSEG, that it also lists ()). The LSE was the most-valued stock exchange in Europe from 2003 when records began till Autumn 2022, when the Paris exchange was briefly larger, until the LSE retook its position as Europe’s largest stock exchange 10 days later. History Coffee House The Royal Exchange had been founded by English financier Thomas Gresham and Sir Richard Clough on the model of the Antwerp Bourse. It was opened by Elizabeth I of England in 1571. During the 17th century, stockbrokers were not allowed in the Royal Exchange due to their rude manners. They had to operate from other establishments in the vicinity, notably Jona ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |