|

Business Interruption Insurance

Business interruption insurance (also known as business income insurance) is a type of insurance that covers the loss of income that a business suffers after a disaster. The income loss covered may be due to disaster-related closing of the business facility or due to the rebuilding process after a disaster. It differs from property insurance in that a property insurance policy only covers the physical damage to the business, while the additional coverage allotted by the business interruption policy covers the profits that would have been earned. This extra policy provision is applicable to all types of businesses, as it is designed to put a business in the same financial position it would have been in if no loss had occurred. This type of coverage can be added onto the business's property insurance policy or comprehensive package policy such as a business owner's policy (BOP) or as part of a standalone policy in some jurisdictions. Since business interruption is included as part ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disaster

A disaster is a serious problem occurring over a short or long period of time that causes widespread human, material, economic or environmental loss which exceeds the ability of the affected community or society to cope using its own resources. Disasters are routinely divided into either " natural disasters" caused by natural hazards or "human-instigated disasters" caused from anthropogenic hazards. However, in modern times, the divide between natural, human-made and human-accelerated disasters is difficult to draw. Examples of natural hazards include avalanches, flooding, cold waves and heat waves, droughts, earthquakes, cyclones, landslides, lightning, tsunamis, volcanic activity, wildfires, and winter precipitation. Examples of anthropogenic hazards include criminality, civil disorder, terrorism, war, industrial hazards, engineering hazards, power outages, fire, hazards caused by transportation, and environmental hazards. Developing countries suffer the greatest costs ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Insurance

Property insurance provides protection against most risks to property, such as fire, theft and some weather damage. This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance. Property is insured in two main ways—open perils and named perils. Open perils cover all the causes of loss not specifically excluded in the policy. Common exclusions on open peril policies include damage resulting from earthquakes, floods, nuclear incidents, acts of terrorism, and war. Named perils require the actual cause of loss to be listed in the policy for insurance to be provided. The more common named perils include such damage-causing events as fire, lightning, explosion, cyber-attack, and theft. History Property insurance can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of conv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Owner's Policy

A business owner's policy (also businessowner's policy, business owners policy or BOP) is a special type of commercial insurance designed for small and medium-sized businesses. By bundling general liability insurance and property insurance into a single policy, BOPs typically offer a reduced premium, often making them a more cost-effective option than separately purchased policies. Specific coverage included in a business owner's policy varies among insurance providers, but most policies require that businesses meet eligibility criteria to qualify. Standard Coverage A typical business owner's policy includes property and liability insurance. The property insurance portion of a BOP is available most often as named-peril coverage, which provides compensation only for damage caused by events specifically listed in the policy (typically fire, explosion, wind damage, vandalism, smoke damage, etc.). Some BOPs offer open-peril or “all-risk” coverage; this option is available from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Statement

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet or statement of financial position, reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement—or profit and loss report (P&L report), or statement of comprehensive income, or statement of revenue & expense—reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity or statement of equity, or statement of retained earnings, reports on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Operating Expense

An operating expense, operating expenditure, operational expense, operational expenditure or opex is an ongoing cost for running a product, business, or system . Its counterpart, a capital expenditure (capex), is the cost of developing or providing non-consumable parts for the product or system. For example, the purchase of a photocopier involves capex, and the annual paper, toner, power and maintenance costs represents opex. For larger systems like businesses, opex may also include the cost of workers and facility expenses such as rent and utilities. Overview In business, an operating expense is a day-to-day expense such as sales and administration, or research & development, as opposed to production, costs, and pricing. In short, this is the money the business spends in order to turn inventory into throughput. On an income statement, "operating expenses" is the sum of a business's operating expenses for a period of time, such as a month or year. In throughput accounting, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Civil Authority

Civil authority or civil government is the practical implementation of a state on behalf of its citizens, other than through military units (martial law), that enforces law and order and that is distinguished from religious authority (for example, canon law) and secular authority. The enforcement of law and order is typically the role of the police in modern states. History Among the first modern experiments in civil government took place in 1636 when Roger Williams, a Christian minister, founded the colony of Rhode Island and Providence Plantations. He sought to create a " wall of separation" between church and state to prevent corruption of the church and maintain civil order as expounded upon in his 1644 book, ''Bloudy Tenent of Persecution''.James Emanuel Ernst, Roger Williams, ''New England Firebrand'' (Macmillan Co., Rhode Island, 1932), pg. 24/ref> Types of authority Thus four forms of authority may be seen: *Civil authority *Military government, Military authority *Relig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Curfew

A curfew is a government order specifying a time during which certain regulations apply. Typically, curfews order all people affected by them to ''not'' be in public places or on roads within a certain time frame, typically in the evening and nighttime hours. Such an order may be issued by public authorities but also by the owner of a house to those living in the household. For instance, an au pair was typically given a curfew, which regulates when they must return to the host family's home in the evening. Curfews were a common element of control used in martial law, though curfews can also be implemented for public safety in the event of a disaster, pandemic, or crisis. Etymology The word "curfew" comes from the Old French phrase "''couvre-feu''", which means "cover fire". It was later adopted into Middle English as "curfeu", which later became the modern "curfew". Its original meaning refers to a law made by William the Conqueror that all lights and fires should be covere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

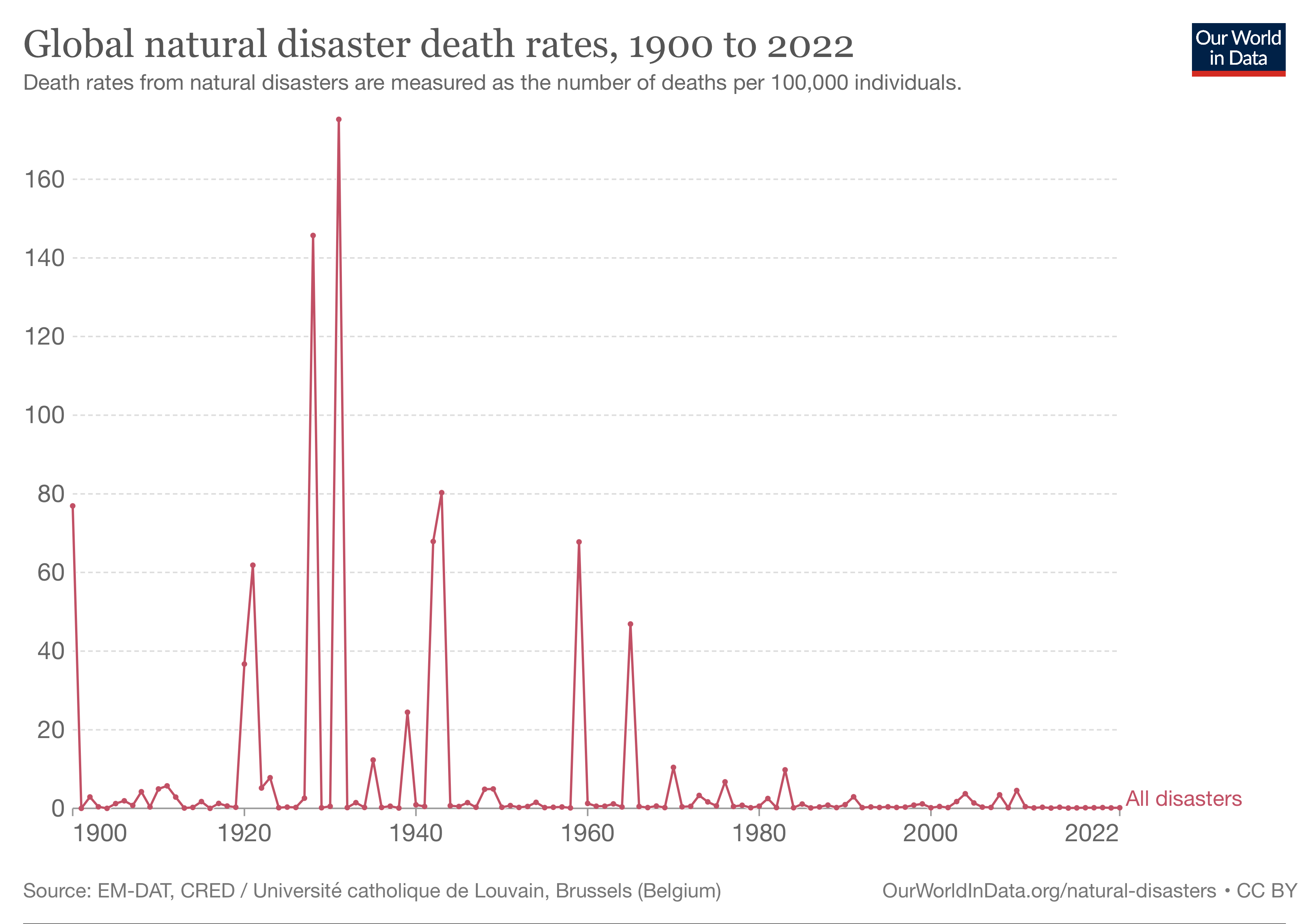

Natural Disaster

A natural disaster is "the negative impact following an actual occurrence of natural hazard in the event that it significantly harms a community". A natural disaster can cause loss of life or damage property, and typically leaves some economic damage in its wake. The severity of the damage depends on the affected population's resilience and on the infrastructure available. Examples of natural hazards include: avalanche, coastal flooding, cold wave, drought, earthquake, hail, heat wave, hurricane (tropical cyclone), ice storm, landslide, lightning, riverine flooding, strong wind, tornado, typhoon, tsunami, volcanic activity, wildfire, winter weather. In modern times, the divide between natural, man-made and man-accelerated disasters is quite difficult to draw. Human choices and activities like architecture, fire, resource management or even climate change potentially play a role in causing "natural disasters". In fact, the term "natural disaster" has been called a misnom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Types Of Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |