|

Book Closure

{{Unreferenced, date=May 2019, bot=noref (GreenC bot) Book Closure date (also known as the record date or ex-dividend date) is the date that a shareholder must hold the stock to receive certain benefits (like share bonus issue, splits and dividend payments). When shares of a joint stock company invariably change hands during market trades, identifying the owner of some shares becomes difficult. So it is difficult to pass on certain benefits. So, when a joint stock company declares dividends or bonus issues, there has to be a cut-off date for such benefits to be transferred to the shareholders. This date is termed as "Book Closure" date. It is the date after which the company will not handle any transfer of shares requests until the benefits are transferred. Only shareholders marked in the company's register at the Book Closure Date or the Record Date would be entitled to receive these benefits. In other words, shareholders that are on the company's records as on that date are eligib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Record Date

The ex-dividend date, also known as the reinvestment date, is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. Usually, but not necessarily, the opening price is the last closing price less the dividend amount. A person purchasing a stock before its ex-dividend date, and holding the position before the market opens on the ex-dividend date, is entitled to the dividend. A person purchasing a stock on its ex-dividend date or after will not receive the current dividend payment. To determine the ultimate eligibility of a dividend or distribution, the record date, not the ex-date, is relevant. Each shareholder entered in the shareholders' register at the record date is entitled to a dividend. Usually, the person owning the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ex-dividend Date

The ex-dividend date, also known as the reinvestment date, is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. Usually, but not necessarily, the opening price is the last closing price less the dividend amount. A person purchasing a stock before its ex-dividend date, and holding the position before the market opens on the ex-dividend date, is entitled to the dividend. A person purchasing a stock on its ex-dividend date or after will not receive the current dividend payment. To determine the ultimate eligibility of a dividend or distribution, the record date, not the ex-date, is relevant. Each shareholder entered in the shareholders' register at the record date is entitled to a dividend. Usually, the person owning the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shareholder

A shareholder (in the United States often referred to as stockholder) of a corporation is an individual or legal entity (such as another corporation, a body politic, a trust or partnership) that is registered by the corporation as the legal owner of shares of the share capital of a public or private corporation. Shareholders may be referred to as members of a corporation. A person or legal entity becomes a shareholder in a corporation when their name and other details are entered in the corporation's register of shareholders or members, and unless required by law the corporation is not required or permitted to enquire as to the beneficial ownership of the shares. A corporation generally cannot own shares of itself. The influence of a shareholder on the business is determined by the shareholding percentage owned. Shareholders of a corporation are legally separate from the corporation itself. They are generally not liable for the corporation's debts, and the shareholders' liabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bonus Issue

Bonus shares are shares distributed by a company to its current shareholders as fully paid shares free of charge. *to capitalise a part of the company's retained earnings *for conversion of its share premium account, or *distribution of treasury shares. An issue of bonus shares is referred to as a bonus share issue. A bonus issue is usually based upon the number of shares that shareholders already own. (For example, the bonus issue may be "''n'' shares for each ''x'' shares held"; but with fractions of a share not permitted.) While the issue of bonus shares increases the total number of shares issued and owned, it does not change the value of the company. Although the total number of issued shares increases, the ratio of number of shares held by each shareholder remains constant. In this sense, a bonus issue is similar to a stock split. Process Whenever a company announces a bonus issue, it also announces a book closure date which is a date on which the company will ideally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Split

A stock split or stock divide increases the number of shares in a company. For example, after a 2-for-1 split, each investor will own double the number of shares, and each share will be worth half as much. A stock split causes a decrease of market price of individual shares, but does not change the total market capitalization of the company: stock dilution does not occur. A company may split its stock when the market price per share is so high that it becomes unwieldy when traded. One of the reasons is that a very high share price may deter small investors from buying the shares. Stock splits are usually initiated after a large run up in share price. Effects The main effect of stock splits is an increase in the liquidity of a stock: there are more buyers and sellers for 10 shares at $10 than 1 share at $100. Some companies avoid a stock split to obtain the opposite strategy: by refusing to split the stock and keeping the price high, they reduce trading volume. Berkshire Hathawa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually a deposit into a bank account) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by a shareholder is income of the shareholder and may be subject to income tax (see dividend tax). The tax treatment of this income varies considerably between jurisdictions. The corporation does not receive a tax deduc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Stock Company

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareholders are able to transfer their shares to others without any effects to the continued existence of the company. In modern-day corporate law, the existence of a joint-stock company is often synonymous with incorporation (possession of legal personality separate from shareholders) and limited liability (shareholders are liable for the company's debts only to the value of the money they have invested in the company). Therefore, joint-stock companies are commonly known as corporations or limited companies. Some jurisdictions still provide the possibility of registering joint-stock companies without limited liability. In the United Kingdom and in other countries that have adopted its model of company law, they are known as unlimited companies. In t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 2022 are in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Record Date

The ex-dividend date, also known as the reinvestment date, is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. Usually, but not necessarily, the opening price is the last closing price less the dividend amount. A person purchasing a stock before its ex-dividend date, and holding the position before the market opens on the ex-dividend date, is entitled to the dividend. A person purchasing a stock on its ex-dividend date or after will not receive the current dividend payment. To determine the ultimate eligibility of a dividend or distribution, the record date, not the ex-date, is relevant. Each shareholder entered in the shareholders' register at the record date is entitled to a dividend. Usually, the person owning the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

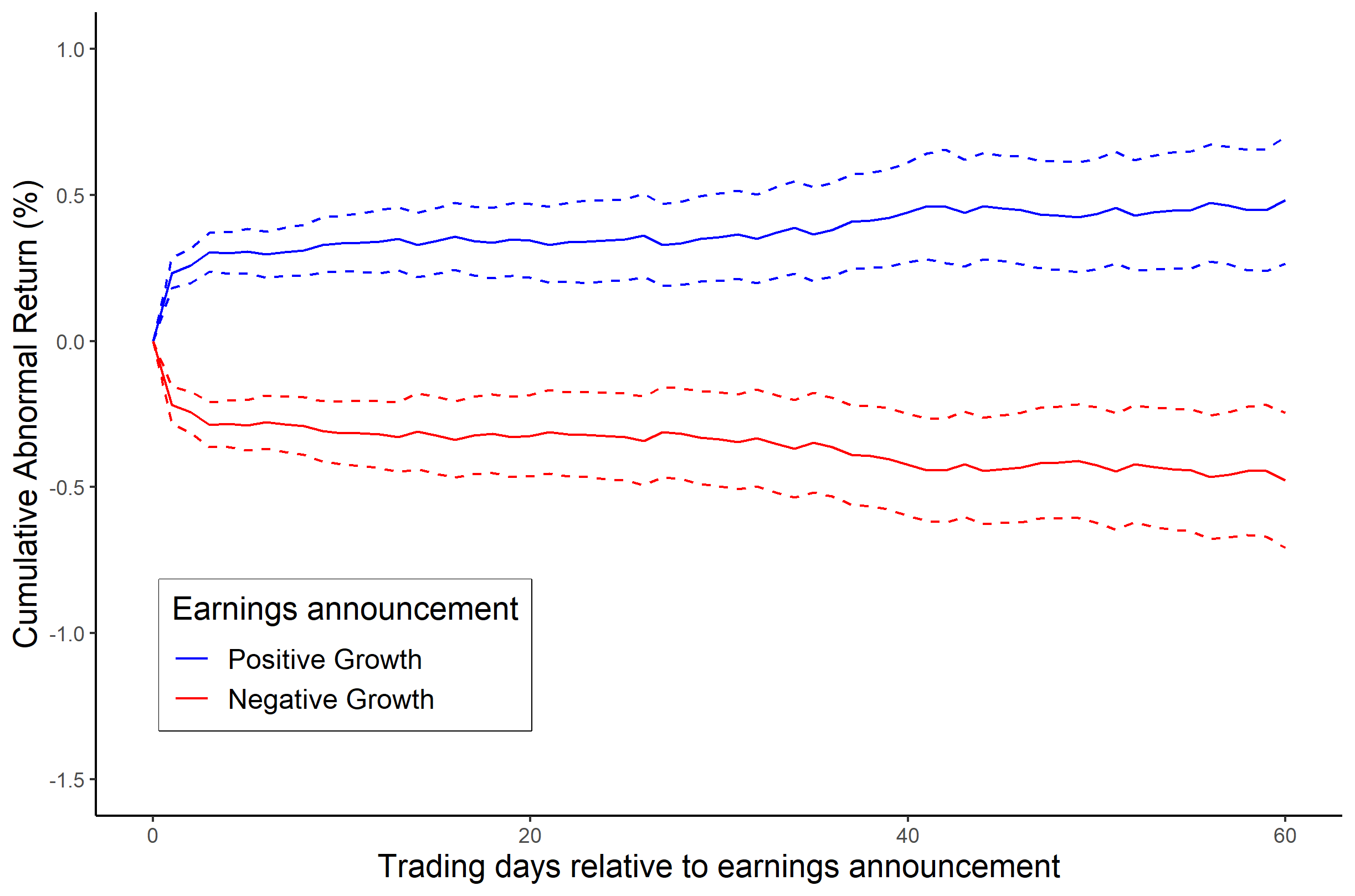

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ex-dividend Date

The ex-dividend date, also known as the reinvestment date, is an investment term involving the timing of payment of dividends on stocks of corporations, income trusts, and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. Usually, but not necessarily, the opening price is the last closing price less the dividend amount. A person purchasing a stock before its ex-dividend date, and holding the position before the market opens on the ex-dividend date, is entitled to the dividend. A person purchasing a stock on its ex-dividend date or after will not receive the current dividend payment. To determine the ultimate eligibility of a dividend or distribution, the record date, not the ex-date, is relevant. Each shareholder entered in the shareholders' register at the record date is entitled to a dividend. Usually, the person owning the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |