|

Assets Inflation

Asset price inflation is the economic phenomenon whereby the price of assets rise and become inflated. A common reason for higher asset prices is low interest rates. When interest rates are low, investors and savers cannot make easy returns using low-risk methods such as government bonds or savings accounts. To still get a return on their money, investors instead have to buy up other assets such as stocks and real estate, thereby bidding up the price and creating asset price inflation. When people talk about inflation, they usually refer to ordinary goods and services, which is tracked by the Consumer Price Index (CPI). This index excludes financial assets and capital assets. Inflation of financial assets should not be confused with inflation of consumer goods and services, as prices in the two categories are often disconnected. Examples of typical assets are shares and bonds (and their derivatives), as well as real estate, gold and other capital goods. They can also include alter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Large Salinas House

Large means of great size. Large may also refer to: Mathematics * Arbitrarily large, a phrase in mathematics * Large cardinal, a property of certain transfinite numbers * Large category, a category with a proper class of objects and morphisms (or both) * Large diffeomorphism, a diffeomorphism that cannot be continuously connected to the identity diffeomorphism in mathematics and physics * Large numbers, numbers significantly larger than those ordinarily used in everyday life * Large ordinal, a type of number in set theory * Large sieve, a method of analytic number theory ** Larger sieve, a heightening of the large sieve * Law of large numbers, a result in probability theory * Sufficiently large, a phrase in mathematics Other uses * ''Large'' (film), a 2001 comedy film * Large (surname), an English surname * LARGE, an enzyme * Large, a British English name for the maxima (music), a note length in mensural notation * Large, or G's, or grand, slang for $1,000 US dollars * Large, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Most central banks also have supervisory and regulatory powers to ensure the stability of member institutions, to prevent bank runs, and to discourage reckless or fraudulent behavior by member banks. Central banks in most developed nations are institutionally independent from political interference. Still, limited control by the executive and legislative bodies exists. Activities of central banks Functions of a central bank usually include: * Monetary policy: by setting the official interest rate and controlling the money supply; *Financial stability: acting as a government's banker and as the bankers' bank ("lender of last resort"); * Reserve management: managing a country's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubbles

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical effec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mises Institute

Ludwig von Mises Institute for Austrian Economics, or Mises Institute, is a libertarian nonprofit think tank headquartered in Auburn, Alabama, United States. It is named after the Austrian School economist Ludwig von Mises (1881–1973). It was founded in 1982 by Lew Rockwell. Its creation was funded by Ron Paul. History The Ludwig von Mises Institute was founded in 1982 by Lew Rockwell. Rockwell, who had previously served as editor for Arlington House Publishers, received the blessing of Margit von Mises during a meeting at the Russian Tea Room in New York City, and she was named the first chairman of the board. Early supporters of the institute included F.A. Hayek, Henry Hazlitt, Murray Rothbard, Ron Paul, and Burt Blumert. According to Rockwell, the motivation of the institute was to promote the specific contributions of Ludwig von Mises, who he feared was being ignored by libertarian institutions financed by Charles Koch and David Koch. As recounted by Justin Raimondo, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Hedge

An inflation hedge is an investment intended to protect the investor against (hedge) a decrease in the purchasing power of money (inflation). There is no investment known to be a successful hedge in all inflationary environments, just as there is no asset class guaranteed to increase in value in non-inflationary times. Inflation can impact investment decisions by making it difficult to predict future prices. This makes it risky to invest in certain assets, such as commodities, that may be impacted by inflation. Inflation can erode the value of investments over time. This is why it is important for investors to consider inflation when making investment decisions. ''Barron's Finance & Investment Handbook'' states: "Traditionally, gold and real estate have a reputation as good inflation hedges, though growth in stocks also can offset inflation in the long run. Money market funds, which pay higher yields as interest rates rise during inflation times, can also be a good inflation hedg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflationism

Inflationism is a heterodox economic, fiscal, or monetary policy, that predicts that a substantial level of inflation is harmless, desirable or even advantageous. Similarly, inflationist economists advocate for an inflationist policy. Mainstream economics holds that inflation is a necessary evil, and advocates a low, stable level of inflation, and thus is largely opposed to inflationist policies – some inflation is necessary, but inflation beyond a low level is not desirable. However, deflation is often seen as a worse or equal danger, particularly within Keynesian economics, as well as Monetarist economics and in the theory of debt deflation. Inflationism is not accepted within the economics community, and is often conflated with Modern Monetary Theory, which uses similar arguments, especially in relation to chartalism. Political debate In political debate, inflationism is opposed to hard currency, which believes that the real value of currency should be maintaine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2007 Subprime Mortgage Financial Crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than government securities, along with attractive risk ratings from rating agencies. While elements of the crisis first became more visible d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Asset Price Bubble

The was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion.Kunio Okina, Masaaki Shirakawa, and Shigenori Shiratsuka (February 2001):The Asset Price Bubble and Monetary Policy: Japan's Experience in the Late 1980s and the Lessons More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time.Edgardo Demaestri, Pietro Masci (2003): Financial Crises in Japan and Latin America, Inter-American Development Bank Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolonged an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

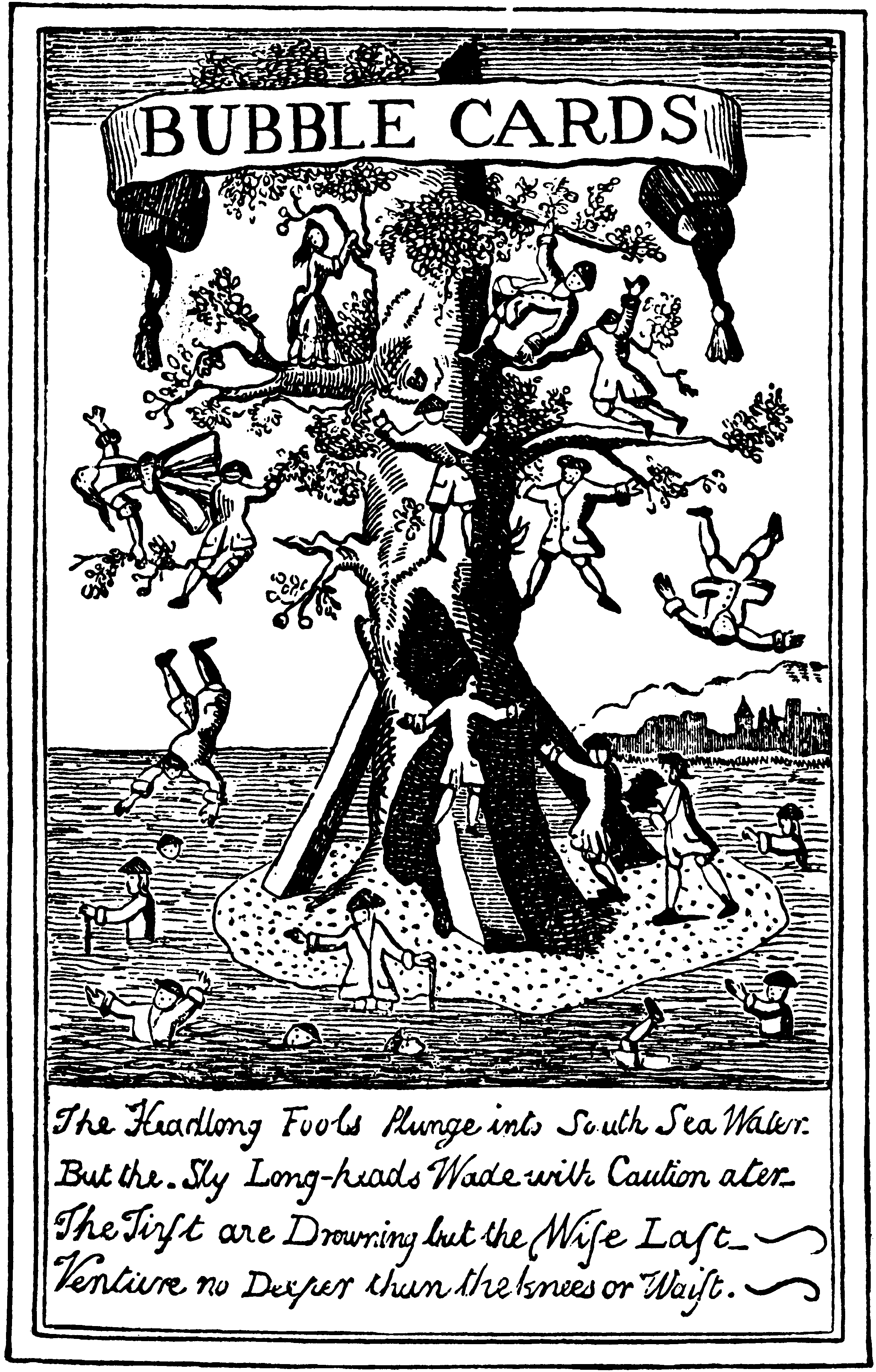

Tulip Mania

Tulip mania ( nl, tulpenmanie) was a period during the Dutch Golden Age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. The major acceleration started in 1634 and then dramatically collapsed in February 1637. It is generally considered to have been the first recorded speculative bubble or asset bubble in history. In many ways, the tulip mania was more of a then-unknown socio-economic phenomenon than a significant economic crisis. It had no critical influence on the prosperity of the Dutch Republic, which was one of the world's leading economic and financial powers in the 17th century, with the highest per capita income in the world from about 1600 to about 1720. The term "tulip mania" is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values. Forward markets appeared in the Dutch Republic during the 17th century. Among the most notable cent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpeg/1200px-Dutch_Tulips_(209942087).jpeg)