|

Arrears

Arrears (or arrearage) is a legal term for the part of a debt that is overdue after missing one or more required payments. The amount of the arrears is the amount accrued from the date on which the first missed payment was due. The term is usually used in relation with periodically recurring payments such as Renting, rent, Bill (payment), bills, royalties (or other contractual payments), and child support. Payment in arrear is a payment made after a service has been provided, as distinct from in advance, which are payments made at the ''start'' of a period. For instance, rent is usually paid in advance, but mortgages in arrear (the interest for the period is due at the end of the period). Employees' salaries are usually paid in arrear. Payment at the end of a period is referred to by the singular arrear, to distinguish from past due payments. For example, a housing tenant who is obliged to pay rent at the end of each month, is said to pay rent ''in arrear,'' while a tenant who has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" comes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Renting

Renting, also known as hiring or letting, is an agreement where a payment is made for the temporary use of a good, service or property owned by another. A gross lease is when the tenant pays a flat rental amount and the landlord pays for all property charges regularly incurred by the ownership. An example of renting is equipment rental. Renting can be an example of the sharing economy. History Various types of rent are referenced in Roman law: rent (''canon'') under the long leasehold tenure of Emphyteusis; rent (''reditus'') of a farm; ground-rent (''solarium''); rent of state lands (''vectigal''); and the annual rent (''prensio'') payable for the ''jus superficiarum'' or right to the perpetual enjoyment of anything built on the surface of land. Reasons for renting There are many possible reasons for renting instead of buying, for example: *In many jurisdictions (including India, Spain, Australia, United Kingdom and the United States) rent paid in a trade or business is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill (payment)

An invoice, bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products, quantities, and agreed-upon prices for products or services the seller had provided the buyer. Payment terms are usually stated on the invoice. These may specify that the buyer has a maximum number of days to pay and is sometimes offered a discount if paid before the due date. The buyer could have already paid for the products or services listed on the invoice. To avoid confusion and consequent unnecessary communications from buyer to seller, some sellers clearly state in large and capital letters on an invoice whether it has already been paid. From a seller's point of view, an invoice is a ''sales invoice''. From a buyer's point of view, an invoice is a ''purchase invoice''. The document indicates the buyer and seller, but the term ''invoice'' indicates money is owed ''or'' owing. Within the European Union, an invoice is primarily legally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalties

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or a fixed price per unit sold of an item of such, but there are also other modes and metrics of compensation.Guidelines for Evaluation of Transfer of Technology Agreements, United Nations, New York, 1979 A royalty interest is the right to collect a stream of future royalty payments. A license agreement defines the terms under which a resource or property are licensed by one party to another, either without restriction or subject to a limitation on term, business or geographic territory, type of product, etc. License agreements can be regulated, particularly where a government is the resource owner, or they can be private contracts that follow a general structure. However, certain types of franchise agreements have comparable provisions. N ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to transfer any of those at a future date. In the event of a breach of contract, the injured party may seek judicial remedies such as damages or rescission. Contract law, the field of the law of obligations concerned with contracts, is based on the principle that agreements must be honoured. Contract law, like other areas of private law, varies between jurisdictions. The various systems of contract law can broadly be split between common law jurisdictions, civil law jurisdictions, and mixed law jurisdictions which combine elements of both common and civil law. Common law jurisdictions typically require contracts to include consideration in order to be valid, whereas civil and most mixed law jurisdictions solely require a meeting of the mind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Support

Child support (or child maintenance) is an ongoing, periodic payment made by a parent for the financial benefit of a child (or parent, caregiver, guardian) following the end of a marriage or other similar relationship. Child maintenance is paid directly or indirectly by an ''obligor'' to an ''obligee'' for the care and support of children of a relationship that has been terminated, or in some cases never existed. Often the obligor is a non-custodial parent. The obligee is typically a custodial parent, a caregiver, a Legal guardian, guardian. Depending on the jurisdiction, a custodial parent may pay child support to a non-custodial parent. Typically one has the same duty to pay child support irrespective of sex, so a mother is required to pay support to a father just as a father must pay a mother. In some jurisdictions where there is joint custody, the child is considered to have two custodial parents and no non-custodial parents, and a custodial parent with a higher income (obligo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Call Money

Call money is minimum short-term finance repayable on demand, with a maturity period of one to fourteen days or overnight to a fortnight. It is used for inter-bank transactions. The money that is lent for one day in this market is known as "call money" and, if it exceeds one day, is referred to as "notice money." Commercial banks have to maintain a minimum cash balance known as the cash reserve ratio. Call money is a method by which banks lend to each other to be able to maintain the cash reserve ratio. The interest rate paid on call money is known as the call rate. It is a highly volatile rate that varies from day to day and sometimes even from hour to hour. There is an inverse relationship between call rates and other short-term money market instruments such as certificates of deposit and commercial paper. A rise in call money rates makes other sources of finance, such as commercial paper and certificates of deposit, cheaper in comparison for banks to raise funds from these sour ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Preferred Stock

Preferred stock (also called preferred shares, preference shares, or simply preferreds) is a component of share capital that may have any combination of features not possessed by common stock, including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferred stocks are senior (i.e., higher ranking) to common stock but subordinate to bonds in terms of claim (or rights to their share of the assets of the company, given that such assets are payable to the returnee stock bond) and may have priority over common stock (ordinary shares) in the payment of dividends and upon liquidation. Terms of the preferred stock are described in the issuing company's articles of association or articles of incorporation. Like bonds, preferred stocks are rated by major credit rating agencies. Their ratings are generally lower than those of bonds, because preferred dividends do not carry the same guarantees as interest payments from bonds, and becaus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Annuity (finance Theory)

In investment, an annuity is a series of payments made at equal intervals.Kellison, Stephen G. (1970). ''The Theory of Interest''. Homewood, Illinois: Richard D. Irwin, Inc. p. 45 Examples of annuities are regular deposits to a savings account, monthly home mortgage payments, monthly insurance payments and pension payments. Annuities can be classified by the frequency of payment dates. The payments (deposits) may be made weekly, monthly, quarterly, yearly, or at any other regular interval of time. Annuities may be calculated by mathematical functions known as "annuity functions". An annuity which provides for payments for the remainder of a person's lifetime is a life annuity. Types Annuities may be classified in several ways. Timing of payments Payments of an ''annuity-immediate'' are made at the end of payment periods, so that interest accrues between the issue of the annuity and the first payment. Payments of an ''annuity-due'' are made at the beginning of payment periods ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Swap

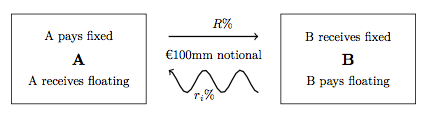

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs). In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion. Interest rate swaps can be traded as an index through the FTSE MTIRS Index. Interest rate swaps General description An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index. The most common IRS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reset (finance)

Reset also known as fixing is a generic concept in the EV financial markets, meaning the determination and recording of a reference rate, usually in order to calculate the settlement value of a periodic payment schedule between two parties. Resets are most commonly used in Interest rate swaps, to determine the value of the floating rate payment for each period. The parties will have agreed a source for the reference rate (usually a named screen on an information vendors system, though any public domain source will do, such as a newspaper or government publication). Fixing involves looking up the reference value on the agreed date, recording, then computing a payment based on the rate. Fixing can often change the value of a financial instrument, and can be difficult to encode in the software models used to price such instruments. Other examples of fixing are in asian option An Asian option (or ''average value'' option) is a special type of option contract. For Asian options the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Cap And Floor

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to receive a payment for each month the LIBOR rate exceeds 2.5%. Similarly an interest rate floor is a derivative contract in which the buyer receives payments at the end of each period in which the interest rate is below the agreed strike price. Caps and floors can be used to hedge against interest rate fluctuations. For example, a borrower who is paying the LIBOR rate on a loan can protect himself against a rise in rates by buying a cap at 2.5%. If the interest rate exceeds 2.5% in a given period the payment received from the derivative can be used to help make the interest payment for that period, thus the interest payments are effectively "capped" at 2.5% from the borrowers' point of view. Interest rate cap An interest rate cap is a derivative in which the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |