|

Auditors

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon.” Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, and evaluate the propositions in their auditing report. Audits provide third-party assurance to various stakeholders that the subject matter is free from material misstatement. The term is most frequently applied to audits of the financial information relating to a legal person. Other commonly audited areas include: secretarial and compliance, internal controls, quality management, project management, water management, and energy conservation. As a result of an audit, stakeholders may evaluate and improve the effectiveness of risk management, control, and governanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Audit

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes. Internal auditing might achieve this goal by providing insight and recommendations based on analyses and assessments of data and business processes. With commitment to integrity and accountability, internal auditing provides value to governing bodies and senior management as an objective source of independent advice. Professionals called internal auditors are employed by organizations to perform the internal auditing activity. The scope of internal auditing within an organization may be broad and may involve topics such as an organization's governance, risk management and management controls over: efficiency/effectiveness of operations (includin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Audit Cycle

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon.” Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, and evaluate the propositions in their auditing report. Audits provide third-party assurance to various stakeholder (corporate), stakeholders that the subject matter is free from Materiality (auditing) , material misstatement. The term is most frequently applied to audits of the financial information relating to a legal person. Other commonly audited areas include: secretarial and compliance, internal controls, quality management, project management, water management, and energy conservation. As a result of an audit, stakeholders may evaluate and improve the effecti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Audit

A financial audit is conducted to provide an opinion whether "financial statements" (the information is verified to the extent of reasonable assurance granted) are stated in accordance with specified criteria. Normally, the criteria are international accounting standards, although auditors may conduct audits of financial statements prepared using the cash basis or some other basis of accounting appropriate for the organization. In providing an opinion whether financial statements are fairly stated in accordance with accounting standards, the auditor gathers evidence to determine whether the statements contain material errors or other misstatements.Arens, Elder, Beasley; Auditing and Assurance Services; 14th Edition; Prentice Hall; 2012 Overview The audit opinion is intended to provide reasonable assurance, but not absolute assurance, that the financial statements are presented fairly, in all material respects, and/or give a true and fair view in accordance with the financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Audit

A financial audit is conducted to provide an opinion whether "financial statements" (the information is verified to the extent of reasonable assurance granted) are stated in accordance with specified criteria. Normally, the criteria are international accounting standards, although auditors may conduct audits of financial statements prepared using the cash basis or some other basis of accounting appropriate for the organization. In providing an opinion whether financial statements are fairly stated in accordance with accounting standards, the auditor gathers evidence to determine whether the statements contain material errors or other misstatements.Arens, Elder, Beasley; Auditing and Assurance Services; 14th Edition; Prentice Hall; 2012 Overview The audit opinion is intended to provide reasonable assurance, but not absolute assurance, that the financial statements are presented fairly, in all material respects, and/or give a true and fair view in accordance with the financial re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

External Auditor

An external auditor performs an audit, in accordance with specific laws or rules, of the financial statements of a company, government entity, other legal entity, or organization, and is independent of the entity being audited. Users of these entities' financial information, such as investors, government agencies, and the general public, rely on the external auditor to present an unbiased and independent audit report. The manner of appointment, the qualifications, and the format of reporting by an external auditor are defined by statute, which varies according to jurisdiction. External auditors must be members of one of the recognised professional accountancy bodies. External auditors normally address their reports to the shareholders of a corporation. In the United States, certified public accountants are the only authorized non-governmental external auditors who may perform audits and attestations on an entity's financial statements and provide reports on such audits for public r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sarbanes–Oxley Act

The Sarbanes–Oxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations. The act, (), also known as the "Public Company Accounting Reform and Investor Protection Act" (in the Senate) and "Corporate and Auditing Accountability, Responsibility, and Transparency Act" (in the House) and more commonly called Sarbanes–Oxley, SOX or Sarbox, contains eleven sections that place requirements on all U.S. public company boards of directors and management and public accounting firms. A number of provisions of the Act also apply to privately held companies, such as the willful destruction of evidence to impede a federal investigation. The law was enacted as a reaction to a number of major corporate and accounting scandals, including Enron and WorldCom. The sections of the bill cover responsibilities of a public corporation's board of directors, add criminal penalties for certain misconduct, and require t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company Accounting Oversight Board

The Public Company Accounting Oversight Board (PCAOB) is a nonprofit corporation created by the Sarbanes–Oxley Act of 2002 to oversee the audits of public companies and other issuers in order to protect the interests of investors and further the public interest in the preparation of informative, accurate and independent audit reports. The PCAOB also oversees the audits of broker-dealers, including compliance reports filed pursuant to federal securities laws, to promote investor protection. All PCAOB rules and standards must be approved by the U.S. Securities and Exchange Commission (SEC). Purpose In creating the Public Company Accounting Oversight Board (PCAOB), the Sarbanes-Oxley Act required that auditors of U.S. public companies be subject to external and independent oversight for the first time in history. Previously, the profession was self-regulated. Congress vested the PCAOB with expanded oversight authority over the audits of brokers and dealers registered with the SE ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-based Audit

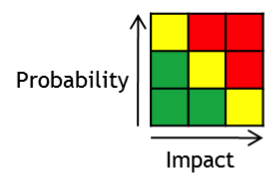

Risk-based auditing is a style of auditing which focuses upon the analysis and management of risk. In the UK, the 1999 Turnbull Report on corporate governance required directors to provide a statement to shareholders of the significant risks to the business. This then encouraged the audit activity of studying these risks rather than just checking compliance with existing controls. Standards for risk management have included the COSO guidelines and the first international standard, AS/NZS 4360. The latter is now the basis for a family of international standards for risk management — ISO 31000. A traditional audit would focus upon the transactions which would make up financial statements such as the balance sheet In financial accounting, a balance sheet (also known as statement of financial position or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a business .... A risk-base ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Control

Internal control, as defined by accounting and auditing, is a process for assuring of an organization's objectives in operational effectiveness and efficiency, reliable financial reporting, and compliance with laws, regulations and policies. A broad concept, internal control involves everything that controls risks to an organization. It is a means by which an organization's resources are directed, monitored, and measured. It plays an important role in detecting and preventing fraud and protecting the organization's resources, both physical (e.g., machinery and property) and intangible (e.g., reputation or intellectual property such as trademarks). At the organizational level, internal control objectives relate to the reliability of financial reporting, timely feedback on the achievement of operational or strategic goals, and compliance with laws and regulations. At the specific transaction level, internal controls refers to the actions taken to achieve a specific objective (e.g., ho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Information Technology

Information technology (IT) is the use of computers to create, process, store, retrieve, and exchange all kinds of data . and information. IT forms part of information and communications technology (ICT). An information technology system (IT system) is generally an information system, a communications system, or, more specifically speaking, a computer system — including all hardware, software, and peripheral equipment — operated by a limited group of IT users. Although humans have been storing, retrieving, manipulating, and communicating information since the earliest writing systems were developed, the term ''information technology'' in its modern sense first appeared in a 1958 article published in the ''Harvard Business Review''; authors Harold J. Leavitt and Thomas L. Whisler commented that "the new technology does not yet have a single established name. We shall call it information technology (IT)." Their definition consists of three categories: techniques for pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Numerical Data

Level of measurement or scale of measure is a classification that describes the nature of information within the values assigned to variables. Psychologist Stanley Smith Stevens developed the best-known classification with four levels, or scales, of measurement: nominal, ordinal, interval, and ratio. This framework of distinguishing levels of measurement originated in psychology and is widely criticized by scholars in other disciplines. Other classifications include those by Mosteller and Tukey, and by Chrisman. Stevens's typology Overview Stevens proposed his typology in a 1946 ''Science'' article titled "On the theory of scales of measurement". In that article, Stevens claimed that all measurement in science was conducted using four different types of scales that he called "nominal", "ordinal", "interval", and "ratio", unifying both " qualitative" (which are described by his "nominal" type) and "quantitative" (to a different degree, all the rest of his scales). The conc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governance

Governance is the process of interactions through the laws, social norm, norms, power (social and political), power or language of an organized society over a social system (family, tribe, formal organization, formal or informal organization, a territory or across territories). It is done by the government of a state (polity), state, by a market (economics), market, or by a social network, network. It is the decision-making among the actors involved in a collective problem that leads to the creation, reinforcement, or reproduction of social norms and institutions". In lay terms, it could be described as the political processes that exist in and between formal institutions. A variety of entities (known generically as governing bodies) can govern. The most formal is a government, a body whose sole responsibility and authority is to make binding decisions in a given geopolitical system (such as a sovereign state, state) by establishing laws. Other types of governing include an o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |