|

Anti-correlation

In statistics, there is a negative relationship or inverse relationship between two variables if higher values of one variable tend to be associated with lower values of the other. A negative relationship between two variables usually implies that the correlation between them is negative, or — what is in some contexts equivalent — that the slope in a corresponding graph is negative. A negative correlation between variables is also called inverse correlation. Negative correlation can be seen geometrically when two normalized random vectors are viewed as points on a sphere, and the correlation between them is the cosine of the circular arc of separation of the points on a great circle of the sphere. When this arc is more than a quarter-circle (θ > π/2), then the cosine is negative. Diametrically opposed points represent a correlation of –1 = cos(π), called anti-correlation. Any two points ''not'' in the same hemisphere have negative correlation. An example would be a negat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correlation

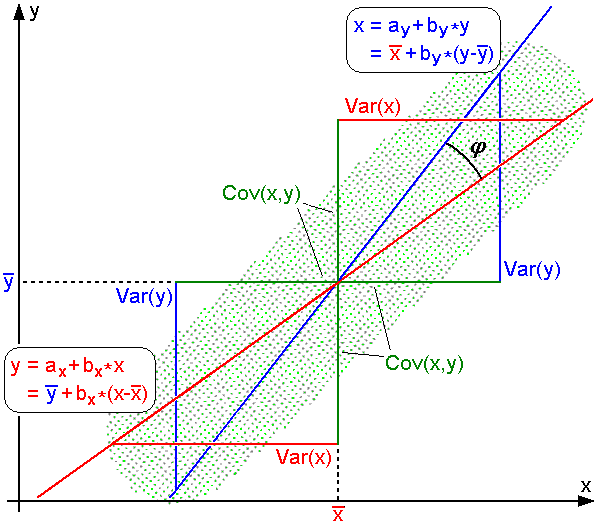

In statistics, correlation or dependence is any statistical relationship, whether causal or not, between two random variables or bivariate data. Although in the broadest sense, "correlation" may indicate any type of association, in statistics it usually refers to the degree to which a pair of variables are '' linearly'' related. Familiar examples of dependent phenomena include the correlation between the height of parents and their offspring, and the correlation between the price of a good and the quantity the consumers are willing to purchase, as it is depicted in the demand curve. Correlations are useful because they can indicate a predictive relationship that can be exploited in practice. For example, an electrical utility may produce less power on a mild day based on the correlation between electricity demand and weather. In this example, there is a causal relationship, because extreme weather causes people to use more electricity for heating or cooling. However, in g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pearson Correlation Coefficient

In statistics, the Pearson correlation coefficient (PCC) is a correlation coefficient that measures linear correlation between two sets of data. It is the ratio between the covariance of two variables and the product of their standard deviations; thus, it is essentially a normalized measurement of the covariance, such that the result always has a value between −1 and 1. As with covariance itself, the measure can only reflect a linear correlation of variables, and ignores many other types of relationships or correlations. As a simple example, one would expect the age and height of a sample of children from a school to have a Pearson correlation coefficient significantly greater than 0, but less than 1 (as 1 would represent an unrealistically perfect correlation). Naming and history It was developed by Karl Pearson from a related idea introduced by Francis Galton in the 1880s, and for which the mathematical formula was derived and published by Auguste Bravais in 1844. The nami ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cartesian Plane

In geometry, a Cartesian coordinate system (, ) in a plane is a coordinate system that specifies each point uniquely by a pair of real numbers called ''coordinates'', which are the signed distances to the point from two fixed perpendicular oriented lines, called '' coordinate lines'', ''coordinate axes'' or just ''axes'' (plural of ''axis'') of the system. The point where the axes meet is called the '' origin'' and has as coordinates. The axes directions represent an orthogonal basis. The combination of origin and basis forms a coordinate frame called the Cartesian frame. Similarly, the position of any point in three-dimensional space can be specified by three ''Cartesian coordinates'', which are the signed distances from the point to three mutually perpendicular planes. More generally, Cartesian coordinates specify the point in an -dimensional Euclidean space for any dimension . These coordinates are the signed distances from the point to mutually perpendicular fixed hyp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diminishing Returns

In economics, diminishing returns means the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal ('' ceteris paribus''). The law of diminishing returns (also known as the law of diminishing marginal productivity) states that in a productive process, if a factor of production continues to increase, while holding all other production factors constant, at some point a further incremental unit of input will return a lower amount of output. The law of diminishing returns does not imply a decrease in overall production capabilities; rather, it defines a point on a production curve at which producing an additional unit of output will result in a lower profit. Under diminishing returns, output remains positive, but productivity and efficiency decrease. The modern understanding of the law adds the dimension of holding other outputs equal, since a giv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diversification (finance)

In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. A common path towards diversification is to reduce financial risk, risk or volatility (finance), volatility by investment, investing in a variety of assets. If asset prices do not change in perfect synchrony, a diversified Portfolio (finance), portfolio will have less variance than the weighted mean, weighted average variance of its constituent assets, and often less volatility than the least volatile of its constituents. Diversification is one of two general techniques for reducing investment risk. The other is hedge (finance), hedging. Examples The simplest example of diversification is provided by the proverb "Don't put all your eggs in one basket". Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them. On the other h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Risk

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent. Modern portfolio theory initiated by Harry Markowitz in 1952 under his thesis titled "Portfolio Selection" is the discipline and study which pertains to managing market and financial risk. In modern portfolio theory, the variance (or standard deviation In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean ( ...) of a portfolio is used as the definition of risk. Types According to Bender and Panz (2021), financial risks can be sorted into five different categories. In their study, they apply an algorith ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Of Return

In finance, return is a profit on an investment. It comprises any change in value of the investment, and/or cash flows (or securities, or other investments) which the investor receives from that investment over a specified time period, such as interest payments, coupons, cash dividends and stock dividends. It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. The latter is also called the holding period return. A loss instead of a profit is described as a '' negative return'', assuming the amount invested is greater than zero. To compare returns over time periods of different lengths on an equal basis, it is useful to convert each return into a return over a period of time of a standard length. The result of the conversion is called the rate of return. Typically, the period of time is a year, in which case the rate of return is also called the annualized return, and the conversion process, described below, is called ''annualiz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Singular Point Of A Curve

In geometry, a singular point on a curve is one where the curve is not given by a smooth embedding of a parameter. The precise definition of a singular point depends on the type of curve being studied. Algebraic curves in the plane Algebraic curves in the plane may be defined as the set of points satisfying an equation of the form f(x,y) = 0, where is a polynomial function If is expanded as f = a_0 + b_0 x + b_1 y + c_0 x^2 + 2c_1 xy + c_2 y^2 + \cdots If the origin is on the curve then . If then the implicit function theorem guarantees there is a smooth function so that the curve has the form near the origin. Similarly, if then there is a smooth function so that the curve has the form near the origin. In either case, there is a smooth map from to the plane which defines the curve in the neighborhood of the origin. Note that at the origin b_0 = \frac, \; b_1 = \frac, so the curve is non-singular or ''regular'' at the origin if at least one of the partial derivatives o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Positive Real Numbers

In mathematics, the set of positive real numbers, \R_ = \left\, is the subset of those real numbers that are greater than zero. The non-negative real numbers, \R_ = \left\, also include zero. Although the symbols \R_ and \R^ are ambiguously used for either of these, the notation \R_ or \R^ for \left\ and \R_^ or \R^_ for \left\ has also been widely employed, is aligned with the practice in algebra of denoting the exclusion of the zero element with a star, and should be understandable to most practicing mathematicians. In a complex plane, \R_ is identified with the positive real axis, and is usually drawn as a horizontal ray. This ray is used as reference in the polar form of a complex number. The real positive axis corresponds to complex numbers z = , z, \mathrm^, with argument \varphi = 0. Properties The set \R_ is closed under addition, multiplication, and division. It inherits a topology from the real line and, thus, has the structure of a multiplicative topological group or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative

In mathematics, the derivative is a fundamental tool that quantifies the sensitivity to change of a function's output with respect to its input. The derivative of a function of a single variable at a chosen input value, when it exists, is the slope of the tangent line to the graph of the function at that point. The tangent line is the best linear approximation of the function near that input value. For this reason, the derivative is often described as the instantaneous rate of change, the ratio of the instantaneous change in the dependent variable to that of the independent variable. The process of finding a derivative is called differentiation. There are multiple different notations for differentiation. '' Leibniz notation'', named after Gottfried Wilhelm Leibniz, is represented as the ratio of two differentials, whereas ''prime notation'' is written by adding a prime mark. Higher order notations represent repeated differentiation, and they are usually denoted in Leib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |