|

Anti-competitive

Anti-competitive practices are business or government practices that prevent or reduce competition in a market. Antitrust laws differ among state and federal laws to ensure businesses do not engage in competitive practices that harm other, usually smaller, businesses or consumers. These laws are formed to promote healthy competition within a free market by limiting the abuse of monopoly power. Competition allows companies to compete in order for products and services to improve; promote innovation; and provide more choices for consumers. In order to obtain greater profits, some large enterprises take advantage of market power to hinder survival of new entrants. Anti-competitive behavior can undermine the efficiency and fairness of the market, leaving consumers with little choice to obtain a reasonable quality of service. Anti-competitive behaviour is used by business and governments to lessen competition within the markets so that monopolies and dominant firms can generate superno ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Fixing

Price fixing is an anticompetitive agreement between participants on the same side in a market to buy or sell a product, service, or commodity only at a fixed price, or maintain the market conditions such that the price is maintained at a given level by controlling supply and demand. The intent of price fixing may be to push the price of a product as high as possible, generally leading to profits for all sellers but may also have the goal to fix, peg, discount, or stabilize prices. The defining characteristic of price fixing is any agreement regarding price, whether expressed or implied. Price fixing requires a conspiracy between sellers or buyers. The purpose is to coordinate pricing for mutual benefit of the traders. For example, manufacturers and retailers may conspire to sell at a common "retail" price; set a common minimum sales price, where sellers agree not to discount the sales price below the agreed-to minimum price; buy the product from a supplier at a specified maxi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue.Syverson, C. (2019). Macroeconomics and Market Power. The Journal of Economic Perspectives, 33(3), 23-43. https://doi.org/10.1257/jep.33.3.23 This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. Such propensities contradict perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are consequently referred to as 'price takers', whereas market participants that exhibit market power are referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tying (commerce)

Tying (informally, product tying) is the practice of selling one product or service as a mandatory addition to the purchase of a different product or service. In legal terms, a ''tying sale'' makes the sale of one good (the ''tying good'') to the de facto customer (or de jure customer) conditional on the purchase of a second distinctive good (the ''tied good''). Tying is often illegal when the products are not naturally related. It is related to but distinct from freebie marketing, a common (and legal) method of giving away (or selling at a substantial discount) one item to ensure a continual flow of sales of another related item. Some kinds of tying, especially by contract, have historically been regarded as anti-competitive practices. The basic idea is that consumers are harmed by being forced to buy an undesired good (the tied good) in order to purchase a good they actually want (the tying good), and so would prefer that the goods be sold separately. The company doing this bund ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exclusive Dealing

In Economics and Law, exclusive dealing arises when a supplier entails the buyer by placing limitations on the rights of the buyer to choose what, who and where they deal. This is against the law in most countries which include the USA, Australia and Europe when it has a significant impact of substantially lessening the competition in an industry.Commission, Australian Competition and Consumer (2013-01-09). "Exclusive dealing". Australian Competition and Consumer Commission. Retrieved 2020-11-03. When the sales outlets are owned by the supplier, exclusive dealing is because of vertical integration, where the outlets are independent exclusive dealing is illegal (in the US) due to the Restrictive Trade Practices Act, however, if it is registered and approved it is allowed. While primarily those agreements imposed by sellers are concerned with the comprehensive literature on exclusive dealing, some exclusive dealing arrangements are imposed by buyers instead of sellers Exclusive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

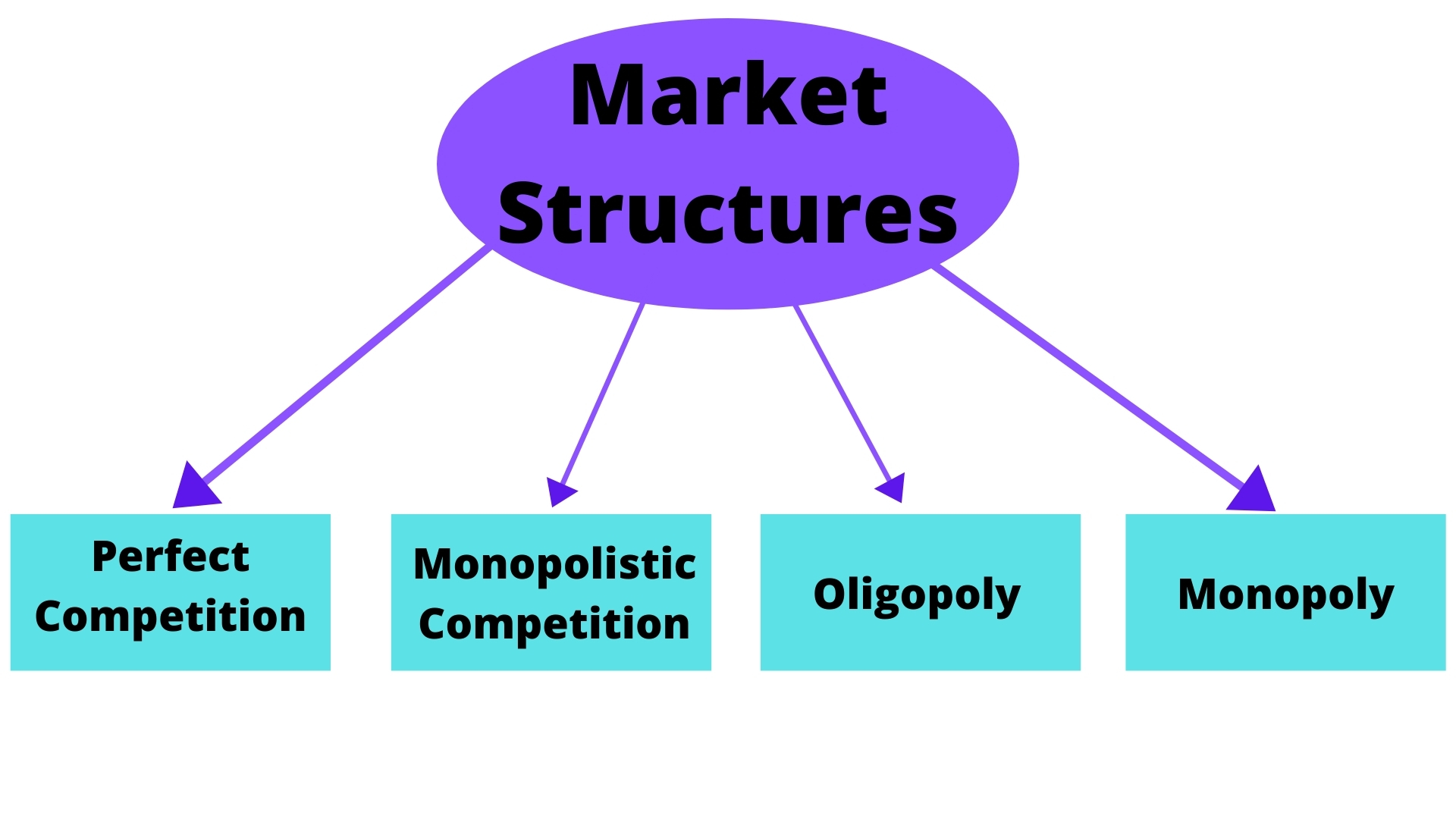

Competition (economics)

In economics, competition is a scenario where different Economic agent, economic firmsThis article follows the general economic convention of referring to all actors as firms; examples in include individuals and brands or divisions within the same (legal) firm. are in contention to obtain goods that are limited by varying the elements of the Marketing mix for product software, marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products. The greater the selection of a good is in the market, prices are typically lower for the products, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly). The level of competition that exists within the market is dependent on a variety of factors both on the firm/ seller side; the number of firms, barriers to entry, infor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Refusal To Deal

Though in general, each business may decide with whom they wish to transact, there are some situations when a refusal to deal may be considered an unlawful anti-competitive practice, if it prevents or reduces competition in a market. The unlawful behaviour may involve two or more companies refusing to use, buy from or otherwise deal with a person or business, such as a competitor, for the purpose of inflicting some economic loss on the target or otherwise force them out of the market. A refusal to deal (also known as a group boycott) is forbidden in some countries which have restricted market economies, though the actual acts or situations which may constitute such unacceptable behaviour may vary significantly between jurisdictions. Definitions Australian Competition & Consumer Commission defines the refusal to deal as: The Indian Competition Act 2002 defines the refusal to deal as: See also * ''ACCC v Cabcharge Australia Ltd'' * Commercial law * Competition law * Essential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividing Territories

Dividing territories (also market division) is an agreement by two companies to stay out of each other's way and reduce competition in the agreed-upon territories. The process known as geographic market allocation is one of several anti-competitive practices outlawed under United States antitrust laws. The term is generally understood to include dividing customers as well. For example, in 1984, FMC Corp. and Asahi Chemical agreed to divide territories for the sale of microcrystalline cellulose, and later FMC attempted to eliminate all vestiges of competition by inviting smaller rivals also to collude. See also *Horizontal territorial allocation *Regional lockout *Market allocation scheme Market allocation or market division schemes are agreements in which competitors divide markets among themselves. In such schemes, competing firms allocate specific customers or types of customers, products, or territories among themselves. For ex ... References Anti-competitive practices ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Marginalization

Double marginalization is a vertical externality that occurs when two firms with market power (i.e., not in a situation of perfect competition), at different vertical levels in the same supply chain, apply a mark-up to their prices. This is caused by the prospect of facing a steep demand curve slope, prompting the firm to mark-up the price beyond its marginal costs. Double marginalization is clearly negative from a welfare point of view, as the double markup induces a deadweight loss, because the retail price is higher than the optimal monopoly price a vertically integrated company would set, leading to underproduction. Thus all social groups are negatively affected because the overall profit for the company is lower, the consumer has to pay more and a smaller amount of units are consumed. Example Consider an industry with the following characteristics - \text\quad \mathrm=10-p \text\quad \mathrm= C'(\mathrm)=2 \text\quad \pi = p \cdot \mathrm - c \cdot \mathrm In a mono ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copyright Misuse

Copyright misuse is an equitable defence to copyright infringement in the United States based upon the doctrine of unclean hands. The misuse doctrine provides that the copyright holder engaged in abusive or improper conduct in exploiting or enforcing the copyright will be precluded from enforcing his rights against the infringer. Copyright misuse is often comparable to and draws from the older and more established doctrine of patent misuse, which bars a patentee from obtaining relief for infringement when he extends his patent rights beyond the limited monopoly conferred by the law. The doctrine forbids the copyright holder from attempting to extend the effect or operation of copyright beyond the scope of the statutory right. For example, by engaging in restrictive licensing practices that are contrary to the public policy underlying copyright law. In fact, the misuse doctrine is said to have evolved to tackle such aggressive licensing practices. Requirements Although the doctrine ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

I Like A Little Competition

I, or i, is the ninth letter and the third vowel letter of the Latin alphabet, used in the modern English alphabet, the alphabets of other western European languages and others worldwide. Its name in English is ''i'' (pronounced ), plural '' ies''. History In the Phoenician alphabet, the letter may have originated in a hieroglyph for an arm that represented a voiced pharyngeal fricative () in Egyptian, but was reassigned to (as in English "yes") by Semites, because their word for "arm" began with that sound. This letter could also be used to represent , the close front unrounded vowel, mainly in foreign words. The Greeks adopted a form of this Phoenician ''yodh'' as their letter ''iota'' () to represent , the same as in the Old Italic alphabet. In Latin (as in Modern Greek), it was also used to represent and this use persists in the languages that descended from Latin. The modern letter ' j' originated as a variation of 'i', and both were used interchangeably for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago School Of Economics

The Chicago school of economics is a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago, some of whom have constructed and popularized its principles. Milton Friedman and George Stigler are considered the leading scholars of the Chicago school. Chicago macroeconomic theory rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. The freshwater–saltwater distinction is largely antiquated today, as the two traditions have heavily incorporated ideas from each other. Specifically, new Keynesian economics was developed as a response to new classical economics, electing to incorporate the insight of rational expectations without giving up the traditional Keynesian focus on imperfect competition and sticky wages. Chicago economists have also left their intellectual influence in other fields, notably in pioneerin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |