|

Activity-based Costing

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more indirect costs ( overhead) into direct costs compared to conventional costing. CIMA, the Chartered Institute of Management Accountants, defines ABC as an approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs. Resources are assigned to activities, and activities to cost objects based on consumption estimates. The latter utilize cost drivers to attach activity costs to outputs. The Institute of Cost & Management Accountants of Bangladesh (ICMAB) defines activity-based costing as an accounting method which identifies the activities which a firm performs and then assigns indirect costs to cost objects. Objectives With ABC, a company can soundly estimate the cost elemen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Costing

Cost accounting is defined as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, classifying, allocating, aggregating and reporting such costs and comparing them with standard costs." (IMA) Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future. Cost accounting information is also commonly used in financial accounting, but its primary function is for use by managers to facilitate their decision-making. Origins of Cost Accounting All types of businesses, whether manufacturing, trading or producing services, require cost accounting to track their activities. Cost accounting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balanced Scorecard

A balanced scorecard is a strategy performance management tool – a well structured report, that can be used by managers to keep track of the execution of activities by the staff within their control and to monitor the consequences arising from these actions. The phrase 'balanced scorecard' primarily refers to a performance management report used by a management team, and typically this team is focused on managing the implementation of a strategy or operational activities – in a 2020 survey 88% of respondents reported using Balanced Scorecard for strategy implementation management, 63% for operational management. Balanced Scorecard is also used by individuals to track personal performance, but this is uncommon – only 17% of respondents in the survey using Balanced Scorecard in this way, however it is clear from the same survey that a larger proportion (about 30%) use corporate Balanced Scorecard elements to inform personal goal setting and incentive calculations. The cri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

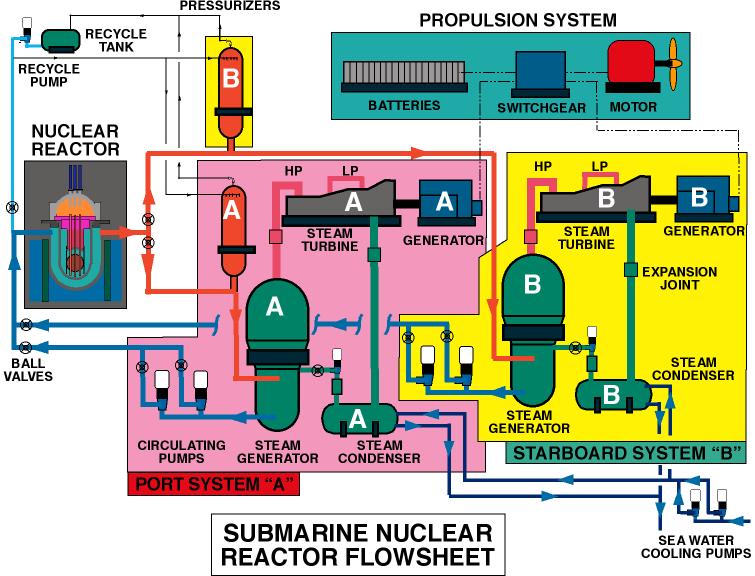

Flow Diagram

Flow diagram is a collective term for a diagram representing a flow or set of dynamic relationships in a system. The term flow diagram is also used as a synonym for flowchart, and sometimes as a counterpart of the flowchart.Harris. (1999, p. 156) Flow diagrams are used to structure and order a complex system, or to reveal the underlying structure of the elements and their interaction. Overview The term flow diagram is used in theory and practice in different meanings. Most commonly the flow chart and flow diagram are used in an interchangeable way in the meaning of a representation of a process. For example the ''Information Graphics: A Comprehensive Illustrated Reference'' by Harris (1999) gives two separate definitions: :''Flow chart or flow diagram... is a diagram that visually displays interrelated information such as events, steps in a process, functions, etc., in an organized fashion, such as sequentially or chronologically.'' :''Flow diagram sa graphic representa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Driver

According to the most simple definition, a cost driver is the unit of an activity that causes a change in the activity's cost: A different meaning is assigned to the term by Michael Porter: "cost drivers are the structural determinants of the cost of an activity, reflecting any linkages or interrelationships that affect it". This defines 'cost drivers' not just as a simple ''variable in a function'', but as something that ''changes the function'' itself. For example, the driver 'economy of scale' leads to different costs per unit for different scales of operation (a small cargo vessel is more expensive per unit than a large bulk carrier), and the driver 'capacity utilisation' leads to greater costs per unit if the capacity is uder-utilised and lower costs per unit is the utilisation is high. The Activity Based Costing (ABC) approach relates indirect cost to the activities that drive them to be incurred. Activity Based Costing is based on the belief that activities cause costs an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overhead Cost

In business, overhead or overhead expense refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit, unlike operating expenses such as raw material and labor. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. Such expenses are incurred for output generally and not for particular work order; e.g., wages paid to watch and ward staff, heating and lighting expenses of factory, etc. Overheads are also a very important cost element along with direct materials and direct labor. Overheads are often related to account ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variable Cost

Variable costs are costs that change as the quantity of the good or service that a business produces changes.Garrison, Noreen, Brewer. Ch 2 - Managerial Accounting and Costs Concepts, pp 48 Variable costs are the sum of marginal costs over all units produced. They can also be considered normal costs. Fixed costs and variable costs make up the two components of total cost. Direct costs are costs that can easily be associated with a particular cost object.Garrison, Noreen, Brewer. Ch 2 - Managerial Accounting and Costs Concepts, pp 51 However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs that are indirect costs, not direct costs. Variable costs are sometimes called unit-level costs as they vary with the number of units produced. Direct labor and overhead are often called conversion cost,Garrison, Noreen, Brewer. Ch 2 - Managerial Accounting and Costs Concepts, pp 39 while direct material and direct labor are oft ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Cost

In accounting and economics, 'fixed costs', also known as indirect costs or overhead costs, are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be recurring, such as interest or rents being paid per month. These costs also tend to be capital costs. This is in contrast to variable costs, which are volume-related (and are paid per quantity produced) and unknown at the beginning of the accounting year. Fixed costs have an effect on the nature of certain variable costs. For example, a retailer must pay rent and utility bills irrespective of sales. As another example, for a bakery the monthly rent and phone line are fixed costs, irrespective of how much bread is produced and sold; on the other hand, the wages are variable costs, as more workers would need to be hired for the production to increase. For any factory, the fix cost should be all the money paid on capitals and land. Such fixed costs as buying machines an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Allocation

Cost allocation is a process of providing relief to shared service organization's cost centers that provide a product or service. In turn, the associated expense is assigned to internal clients' cost centers that consume the products and services. For example, the CIO may provide all IT services within the company and assign the costs back to the business units that consume each offering. The core components of a cost allocation system consist of a way to track which organizations provides a product and/or service, the organizations that consume the products and/or services, and a list of portfolio offerings (e.g. service catalog). Depending on the operating structure within a company, the cost allocation data may generate an internal invoice or feed an ERP system's chargeback module. Accessing the data via an invoice or chargeback module are the typical methods that drive personnel behavior. In return, the consumption data becomes a great source of quantitative information ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lean Manufacturing

Lean manufacturing is a production method aimed primarily at reducing times within the production system as well as response times from suppliers and to customers. It is closely related to another concept called just-in-time manufacturing (JIT manufacturing in short). Just-in-time manufacturing tries to match production to demand by only supplying goods which have been ordered and focuses on efficiency, productivity (with a commitment to continuous improvement) and reduction of "wastes" for the producer and supplier of goods. Lean manufacturing adopts the just-in-time approach and additionally focuses on reducing cycle, flow and throughput times by further eliminating activities which do not add any value for the customer. Lean manufacturing also involves people who work outside of the manufacturing process, such as in marketing and customer service. Lean manufacturing is particularly related to the operational model implemented in the post-war 1950s and 1960s by the J ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lean Accounting

Lean, leaning or LEAN may refer to: Business practices * Lean thinking, a business methodology adopted in various fields ** Lean construction, an adaption of lean manufacturing principles to the design and construction process ** Lean government, application of lean thinking to government ** Lean higher education, application of lean manufacturing principles in Higher Education ** Lean integration, application of lean manufacturing principles to data and systems integration ** Lean IT, application of lean manufacturing principles to the development and management of information technology (IT) products and services ** Lean laboratory, application of lean manufacturing principles in a laboratory ** Lean manufacturing, a process improvement discipline ** Lean product development, lean thinking applied to product development ** Lean project management, application of lean concepts to project management ** Lean services, application of lean manufacturing principles in a servi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peter F

Peter may refer to: People * List of people named Peter, a list of people and fictional characters with the given name * Peter (given name) ** Saint Peter (died 60s), apostle of Jesus, leader of the early Christian Church * Peter (surname), a surname (including a list of people with the name) Culture * Peter (actor) (born 1952), stage name Shinnosuke Ikehata, Japanese dancer and actor * ''Peter'' (album), a 1993 EP by Canadian band Eric's Trip * ''Peter'' (1934 film), a 1934 film directed by Henry Koster * ''Peter'' (2021 film), Marathi language film * "Peter" (''Fringe'' episode), an episode of the television series ''Fringe'' * ''Peter'' (novel), a 1908 book by Francis Hopkinson Smith * "Peter" (short story), an 1892 short story by Willa Cather Animals * Peter, the Lord's cat, cat at Lord's Cricket Ground in London * Peter (chief mouser), Chief Mouser between 1929 and 1946 * Peter II (cat), Chief Mouser between 1946 and 1947 * Peter III (cat), Chief Mouser between ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |