|

ZB Bank Limited

ZB Bank Limited (ZBBL), also known as ZB Bank but commonly referred to as Zimbank, is a commercial bank in Zimbabwe. It is licensed by the Reserve Bank of Zimbabwe, the central bank and national banking regulator. Location The headquarters and main branch of ZB Bank Limited are in ZB House, at 21 Natal Road, in Avondale, Harare, Harare, the capital and largest city of Zimbabwe. The geographical coordinates of the bank's headquarters are: 17°47'59.0"S, 31°02'30.0"E (Latitude:-17.799722; Longitude:31.041667). ZB Life Assurance- Individual Life ZB Life Assurance products are designed and tailor-made to suit the needs of individuals and households and these products include the following: 1. MoreCover Funeral Plan 2. MoreCover Endowment Plan 3. MoreCover Life Plan 4. The Seed 5. Prime Plan 6. Growthplus Retirement Plan (With and Without Life Cover) ZB Life Assurance- Group Business ZB Life Assurance has comprehensive range of products and services that include; 1. Pension ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harare

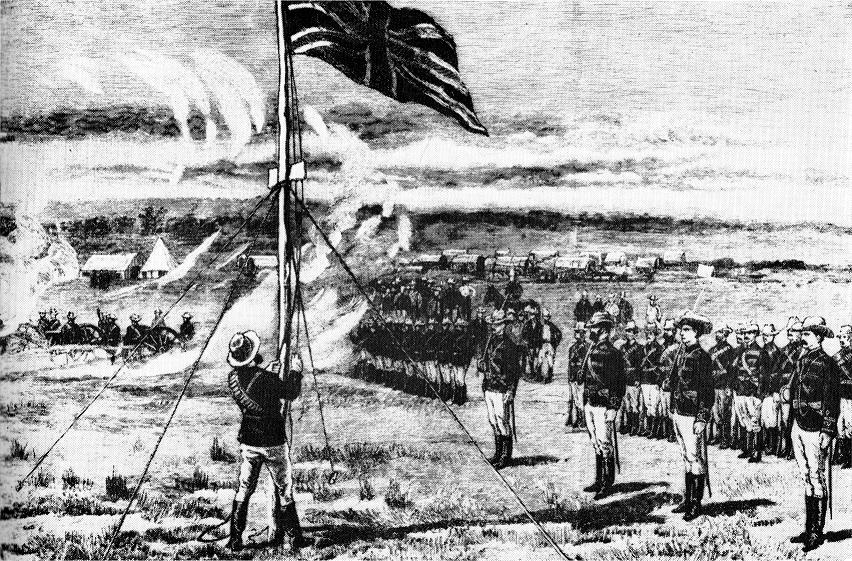

Harare (; formerly Salisbury ) is the capital and most populous city of Zimbabwe. The city proper has an area of 940 km2 (371 mi2) and a population of 2.12 million in the 2012 census and an estimated 3.12 million in its metropolitan area in 2019. Situated in north-eastern Zimbabwe in the country's Mashonaland region, Harare is a metropolitan province, which also incorporates the municipalities of Chitungwiza and Epworth. The city sits on a plateau at an elevation of above sea level and its climate falls into the subtropical highland category. The city was founded in 1890 by the Pioneer Column, a small military force of the British South Africa Company, and named Fort Salisbury after the UK Prime Minister Lord Salisbury. Company administrators demarcated the city and ran it until Southern Rhodesia achieved responsible government in 1923. Salisbury was thereafter the seat of the Southern Rhodesian (later Rhodesian) government and, between 1953 and 1963, th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1951

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Of Zimbabwe

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of Zimbabwe

The economy of Zimbabwe mainly relies on the tertiary sector of the economy, also known as the service sector of the economy, which makes up to 60% of total GDP as of 2017. Zimbabwe has the second biggest Informal economy in the world as a percentage of its economy, with a score of 60.6%.https://www.herald.co.zw/zim-has-worlds-second-largest-informal-economy-imf/ /ref> Agriculture and mining largely contribute to exports. After continuous negative growth between 1999 and 2008, the economy of Zimbabwe grew at a meteoric annual rate of 34% from 2008 to 2013, rendering it the fastest-growing economy in the world. Its economy then stagnated again through 2020, before seeing another extremely sharp increase (45%) in the most recent year. The country has reserves of metallurgical-grade Chromite. Other commercial mineral deposits include Coal, asbestos, copper, nickel, gold, platinum and Iron ore. Current economic conditions In 2000, Zimbabwe planned a land redistribution act to co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks In Zimbabwe

This is a list of "Operating Banking Institutions" in Zimbabwe. # Agricultural Development Bank of Zimbabwe # BancABC Zimbabwe # CABS # CBZ Bank Limited # First Capital Bank Limited # Ecobank Zimbabwe Limited # FBC Bank Limited # Nedbank Zimbabwe Limited # Metbank # NMB Bank Limited # Stanbic Bank Zimbabwe Limited # Standard Chartered Bank Zimbabwe Limited # Steward Bank # ZB Bank Limited # Tetrad Investment Bank Limited # FBC Building Society # National Building Society # ZB Building Society # People's Own Savings Bank # Infrastructure Development Bank of Zimbabwe # Small and Medium Enterprises Development Corporation. # Time Bank See also *Economy of Zimbabwe *List of banks in Africa *Reserve Bank of Zimbabwe References External linksZimbabwe Banking Banking Sector Profits Double {{Economy of Zimbabw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Mutual

Old Mutual Limited is a pan-African investment, savings, insurance, and banking group. It is listed on the Johannesburg Stock Exchange, the Zimbabwe Stock Exchange, the Namibian Stock Exchange and the Botswana Stock Exchange. It was founded in South Africa by John Fairbairn in 1845 and was demutualised and listed on the London Stock Exchange and other stock exchanges in 1999. It introduced a new strategy, called 'managed separation', that entailed the separation of its four businesses – Old Mutual Emerging Markets, Nedbank, UK-based Old Mutual Wealth and Boston-based Old Mutual Asset Management (OMAM) – into standalone entities in 2018. This led to the demerger of Quilter plc (formerly 'Old Mutual Wealth') and the unbundling of its shareholding in Nedbank. The business, which is now largely based in South Africa, provides sponsorship and supports bursaries at South African universities. History The company was founded in 1845 as a mutual insurance company by John Fairbai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chair

A chair is a type of seat, typically designed for one person and consisting of one or more legs, a flat or slightly angled seat and a back-rest. They may be made of wood, metal, or synthetic materials, and may be padded or upholstered in various colors and fabrics. Chairs vary in design. An armchair has armrests fixed to the seat; a recliner is upholstered and features a mechanism that lowers the chair's back and raises into place a footrest; a rocking chair has legs fixed to two long curved slats; and a wheelchair has wheels fixed to an axis under the seat. Etymology ''Chair'' comes from the early 13th-century English word ''chaere'', from Old French ''chaiere'' ("chair, seat, throne"), from Latin ''cathedra'' ("seat"). History The chair has been used since antiquity, although for many centuries it was a symbolic article of state and dignity rather than an article for ordinary use. "The chair" is still used as the emblem of authority in the House of Commons in the Unite ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NewsDay (Zimbabwean Newspaper)

''NewsDay'' is a Harare-based Zimbabwean independent daily newspaper published since 2010. It began publishing on 4 June 2010 and is based in Harare. It carries the slogan ''Everyday News for Everyday People '' on its logo. See also * Media of Zimbabwe The media of Zimbabwe has varying amounts of control by successive governments, coming under tight restriction in recent years by the government of Robert Mugabe, particularly during the growing economic and political crisis in the country. The Zimb ... References 2010 establishments in Zimbabwe Mass media in Harare Newspapers published in Zimbabwe Publications established in 2010 {{Zimbabwe-newspaper-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Society

A building society is a financial institution owned by its members as a mutual organization. Building societies offer banking and related financial services, especially savings and mortgage lending. Building societies exist in the United Kingdom, Australia and New Zealand, and used to exist in Ireland and several Commonwealth countries. They are similar to credit unions in organisation, though few enforce a common bond. However, rather than promoting thrift and offering unsecured and business loans, the purpose of a building society is to provide home mortgages to members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. The term "building society" first arose in the 19th century in Great Britain from cooperative savings groups. In the United Kingdom, building societies actively compete ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Company

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conglomerate (company)

A conglomerate () is a multi-industry company – i.e., a combination of multiple business entities operating in entirely different industries under one corporate group, usually involving a parent company and many subsidiaries. Conglomerates are often large and multinational. United States The conglomerate fad of the 1960s During the 1960s, the United States was caught up in a "conglomerate fad" which turned out to be a form of speculative mania. Due to a combination of low interest rates and a repeating bear-bull market, conglomerates were able to buy smaller companies in leveraged buyouts (sometimes at temporarily deflated values). Famous examples from the 1960s include Ling-Temco-Vought,. ITT Corporation, Litton Industries, Textron, and Teledyne. The trick was to look for acquisition targets with solid earnings and much lower price–earnings ratios than the acquirer. The conglomerate would make a tender offer to the target's shareholders at a princely premium to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |