|

Youi

Youi is an Australian insurance company. Its services cover vehicles, homes, product liability, and watercraft. Youi was founded in 2007 by its parent company OUTsurance and is headquartered in Queensland, Australia. Overview Youi was founded in 2007 by its parent company OUTsurance, making it the first African company to set up an insurance firm in Australia. OUTsurance is also a Rand Merchant Investment Holdings subsidiary, a South African investment holding company. In 2014, OUTsurance launched Youi New Zealand as the subsidiary of Youi Australia. As of 2022, the company is headquartered in Queensland, Australia. In September 2019, Youi sold its 34,000 New Zealand policies to Tower. Youi opened an office in Sydney Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountain ... in 2022. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OUTsurance Holdings

OUTsurance Holdings Limited, commonly referred to as OUTsurance, is a subsidiary of OUTsurance Group Limited (OUTsure, a JSE listed entity), a South African based financial services investment holding company. OUTsurance Holdings Limited was formed in 1998 and is an unlisted public company with headquarters in Centurion, South Africa. It is a financial services holding company based in South Africa, with subsidiaries in Australia and New Zealand. OUTsurance subsidiaries offer various short and long-term insurance as well as investment products to individual and corporate customers. History OUTsurance was launched on 28 February 1998 as a wholly owned subsidiary of RMB Holdings to provide short-term insurance to individuals. On 1 January 2000, OUTsurance acquired the First National Insurance group (FNI) from FirstRand in an all share deal that gave RMBH and FirstRand each an interest of 47.5% in the merged entity, with 5% being held by the staff trust. By virtue of its share ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rand Merchant Investment Holdings

Rand Merchant Investment Holdings, also referred to as RMI Holdings, is a listed financial services investment holding company that holds various insurance brands in South Africa, Australia, China, Mauritius, New Zealand, Republic of Ireland, Singapore, the United Kingdom and the United States of America. Overview RMI Holdings is listed on the JSE and insurance and investment products and services to retail, commercial, corporate and public sector customers. The group has its headquarters in Sandton, South Africa. History RMI Holdings was incorporated and registered in South Africa on 24 March 2010 as a wholly owned subsidiary of RMB Holdings. On 7 March 2011, RMB Holdings (RMBH)'','' ''''Remgro and FirstRand span off their insurance assets to RMI Holdings and separately listing it on the JSE. RMB Holdings Restructure The RMB Holdings restructure was announced on 10 December 2010. Its aim was to create separate focused insurance and banking entities. Prior to the restructu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Queensland

) , nickname = Sunshine State , image_map = Queensland in Australia.svg , map_caption = Location of Queensland in Australia , subdivision_type = Country , subdivision_name = Australia , established_title = Before federation , established_date = Colony of Queensland , established_title2 = Separation from New South Wales , established_date2 = 6 June 1859 , established_title3 = Federation , established_date3 = 1 January 1901 , named_for = Queen Victoria , demonym = , capital = Brisbane , largest_city = capital , coordinates = , admin_center_type = Administration , admin_center = 77 local government areas , leader_title1 = Monarch , leader_name1 = Charles III , leader_title2 = Governor , leader_name2 = Jeannette Young , leader_title3 = Premier , leader_name3 = Annastacia Palaszczuk ( ALP) , legislature = Parliament of Queensland , judiciary = Supreme Court of Queensland , national_representation = Parliament of Australia , national_representation_type ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Car Insurance

Vehicle insurance (also known as car insurance, motor insurance, or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region. History Widespread use of the motor car began after the First World War in urban areas. Cars were relatively fast and dangerous by that stage, yet there was still no compulsory form of car insurance anywhere in the world. This meant that injured victims would rarely get ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Insurance

Home insurance, also commonly called homeowner's insurance (often abbreviated in the US real estate industry as HOI), is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one's home, its contents, loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory. Additionally, homeowner's insurance provides financial protection against disasters. A standard home insurance policy insures the home itself along with the things kept inside. Overview Homeowner's policy is a multiple-line insurance policy, meaning that it includes both property insurance and liability coverage, with an indivisible premium, meaning that a single premium is paid for all risks. This means that it covers both da ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tower Insurance

Tower is a New Zealand-based insurance company which provides car, home, contents, business, boat, pet, travel and other general insurance. History In 1869 the New Zealand Government provided the capital for the creation of the New Zealand Government Life Insurance Department (better known simply as Government Life). It became Tower Corporation in 1987 at a time when several New Zealand government departments and organisations were being corporatized or converted into state owned enterprises. Three years later, ownership of Tower was transferred to policyholders as the business was mutualised. Being a mutual caused difficulties in raising capital and nine years later, in 1999, Tower demutualised and listed on the Australian and New Zealand stock exchanges. Seven years later, in November 2006, TOWER's Australian and New Zealand operations were separated with the approval of its shareholders and the high court. Today Tower is still shareholder owned and listed on the NZX.[1][3] ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

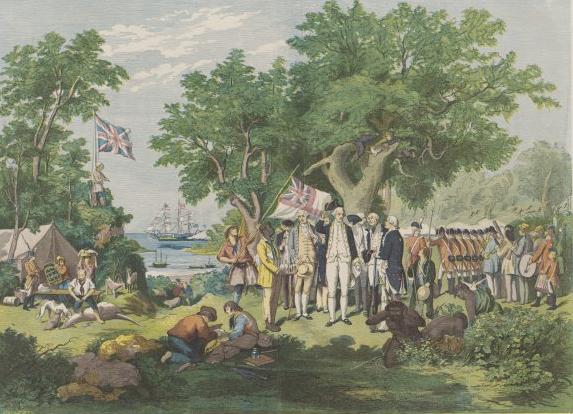

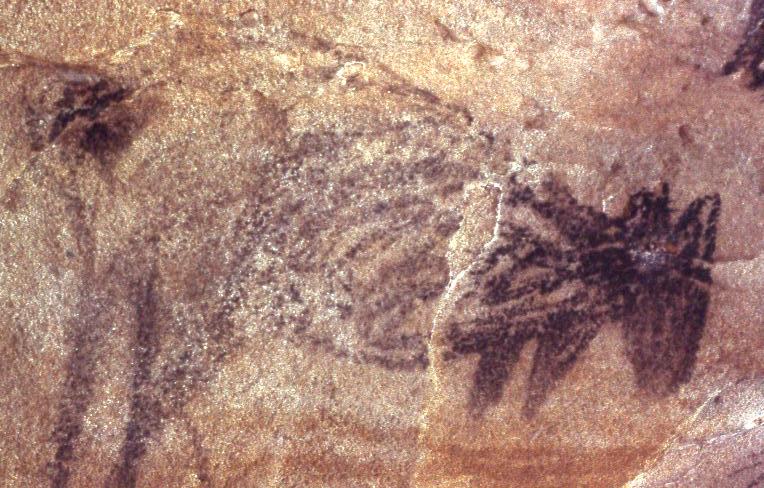

Sydney

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Companies Of Australia

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Companies Based In Queensland

A company, abbreviated as co., is a Legal personality, legal entity representing an association of people, whether Natural person, natural, Legal person, legal or a mixture of both, with a specific objective. Company members share a common purpose and unite to achieve specific, declared goals. Companies take various forms, such as: * voluntary associations, which may include nonprofit organizations * List of legal entity types by country, business entities, whose aim is generating profit * financial entities and banks * programs or Educational institution, educational institutions A company can be created as a legal person so that the company itself has limited liability as members perform or fail to discharge their duty according to the publicly declared Incorporation (business), incorporation, or published policy. When a company closes, it may need to be Liquidation, liquidated to avoid further legal obligations. Companies may associate and collectively register themselves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |