|

Wära

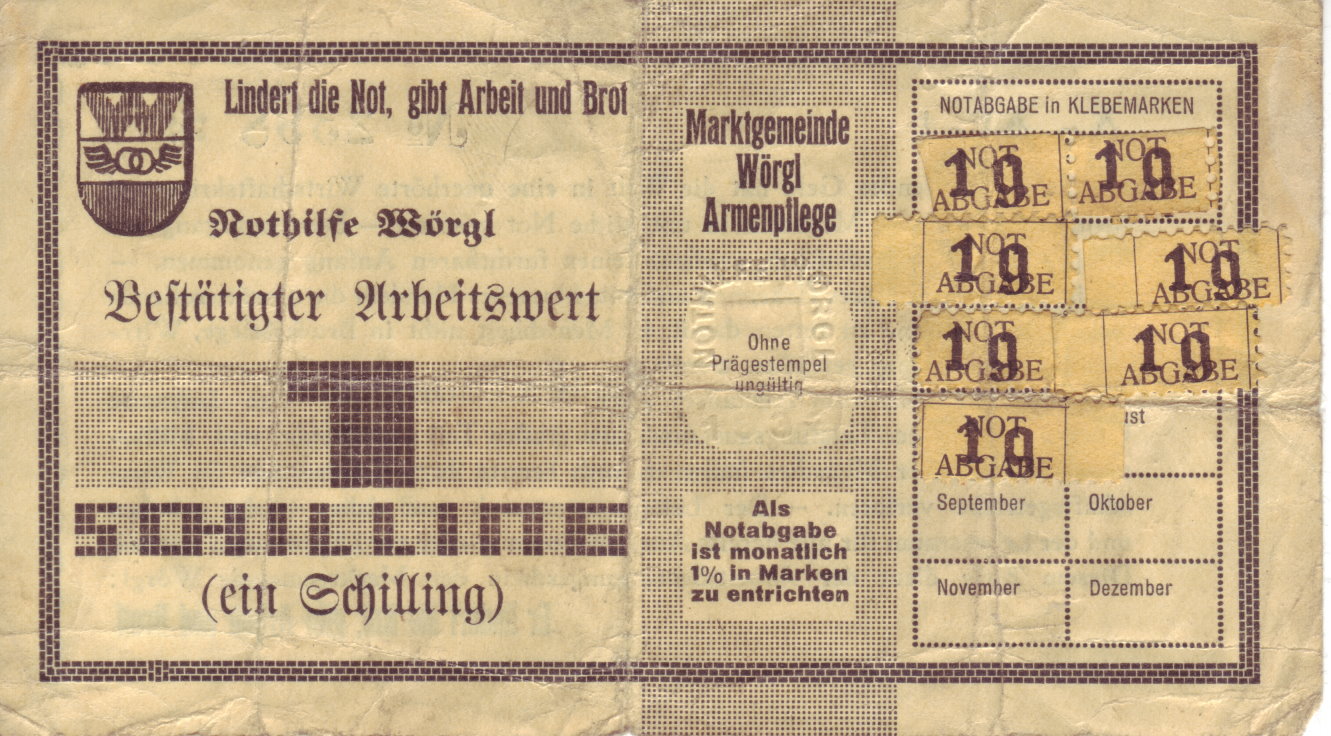

The Wära was a demurrage-charged currency used in Germany introduced in 1926 as a free economy experiment. It was introduced by Hans Timm and Helmut Rödiger, who were followers of Silvio Gesell. The Wära is comparable to current models of local currencies. Concept and function The word ''Wära'', invented by Timm and Rödiger, comes from the words ''Währung'' (currency) and ''währen'' ("to last"), in the sense of "lasting", "stable". One Wära corresponded to one Reichsmark. Wära banknotes were available in denominations of 1/2, 1, 2, 5, and 10 Wära. Each Wära banknote had a monthly demurrage fee of one percent of its nominal value. This fee could be balanced by the acquisition of demurrage stamps of 1/2, 1, 2, 5, and 10 Wära-cents (1 cent equalled 1 Reichspfennig). On the back of the Wära banknote was a series of printed fields, where the demurrage stamps could be glued onto. The idea of this measure was to place the currency under compulsory circulation. To avoid l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demurrage (currency)

Demurrage is the cost associated with owning or holding currency over a given period. It is sometimes referred to as a carrying cost of money. For commodity money such as gold, demurrage is the cost of storing and securing the gold. For paper currency, it can take the form of a periodic tax, such as a stamp tax, on currency holdings. Demurrage is sometimes cited as economically advantageous, usually in the context of complementary currency systems. Theory While demurrage is a natural feature of private commodity money, it has at various times been deliberately incorporated into currency systems as a disincentive to hoard money and to achieve more efficient allocation of capital in society. In particular, for long-term investment financing, it affects the dynamics of net present value (NPV) calculations. Demurrage in a currency system reduces discount rates, and thus increases the present value of a long-term investment, and thus gives an incentive for such investments.Bernard L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |