|

Winton Group

Winton Group, Ltd (which includes Winton Capital Management) is a British investment management firm founded by David Harding. In the United States, Winton is registered with the Securities and Exchange Commission as an investment advisor and with the Commodity Futures Trading Commission as a CTA, and is authorised by the Financial Conduct Authority in the UK. The company trades on more than 100 global futures markets in a wide variety of asset classes and on global equity markets. The firm was launched with $1.6 million in 1997, reached a peak of $28.5 billion in assets under advisement, before dropping to 7.3 billion by late 2020. Winton Group has seven offices around the world: London, New York, Hong Kong, Tokyo, Shanghai, Sydney, and Abu Dhabi. History Early years In 1996, physicist and investment manager David Harding left Man AHL (formerly Adam, Harding and Lueck), a systematic managed futures fund and created Winton. Using Harding's middle name, the firm began trading in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Company

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is offered, owned, traded, exchanged privately, or Over-the-counter (finance), over-the-counter. In the case of a closed corporation, there are a relatively small number of shareholders or company members. Related terms are closely-held corporation, unquoted company, and unlisted company. Though less visible than their public company, publicly traded counterparts, private companies have major importance in the world's economy. In 2008, the 441 list of largest private non-governmental companies by revenue, largest private companies in the United States accounted for ($1.8 trillion) in revenues and employed 6.2 million people, according to ''Forbes''. In 2005, using a substantially smaller pool size (22.7%) for comparison, the 339 companies on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

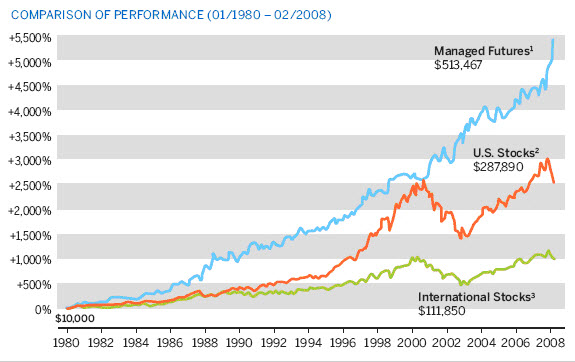

Managed Futures Account

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the futures markets is managed by another person or entity, rather than the fund's owner. Managed futures accounts include, but are not limited to, commodity pools. These funds are operated by commodity trading advisors (CTAs) or commodity pool operators (CPOs), who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. , the assets under management held by managed futures accounts totaled $340 billion. Characteristics Managed futures accounts are operated on behalf of an individual by professional money managers such as CTAs or CPOs, trading in futures or other derivative securities. The funds can take both long and short positions in futures contracts and options on futures contracts in the global commodity, interest rate, equity, and currency markets. Trading strategies Managed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation. In addition to the Securities Exchange Act of 1934, which created it, the SEC enforces the Securities Act of 1933, the Trust Indenture Act of 1939, the Investment Company Act of 1940, the Investment Advisers Act of 1940, the Sarbanes–Oxley Act of 2002, and other statutes. The SEC was created by Section 4 of the Securities Exchange Act of 1934 (now codified as and commonly referred to as the Exchange Act or the 1934 Act). Overview The SEC has a three-part mission: to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation. To achieve its mandate, the SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peer Review

Peer review is the evaluation of work by one or more people with similar competencies as the producers of the work (peers). It functions as a form of self-regulation by qualified members of a profession within the relevant field. Peer review methods are used to maintain quality standards, improve performance, and provide credibility. In academia, scholarly peer review is often used to determine an academic paper's suitability for publication. Peer review can be categorized by the type of activity and by the field or profession in which the activity occurs, e.g., medical peer review. It can also be used as a teaching tool to help students improve writing assignments. Henry Oldenburg (1619–1677) was a German-born British philosopher who is seen as the 'father' of modern scientific peer review. Professional Professional peer review focuses on the performance of professionals, with a view to improving quality, upholding standards, or providing certification. In academia, peer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published six days a week by Dow Jones & Company, a division of News Corp. The newspaper is published in the broadsheet format and online. The ''Journal'' has been printed continuously since its inception on July 8, 1889, by Charles Dow, Edward Jones, and Charles Bergstresser. The ''Journal'' is regarded as a newspaper of record, particularly in terms of business and financial news. The newspaper has won 38 Pulitzer Prizes, the most recent in 2019. ''The Wall Street Journal'' is one of the largest newspapers in the United States by circulation, with a circulation of about 2.834million copies (including nearly 1,829,000 digital sales) compared with ''USA Today''s 1.7million. The ''Journal'' publishes the luxury news and lifestyle magazine ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Affiliated Managers Group

Affiliated Managers Group, Inc. (NYSE: AMG) is a strategic partner to independent investment management firms globally, with equity stakes in a number of partner-owned traditional investment managers, hedge funds, and specialized private equity firms which it calls “Affiliates.” The company has principal offices in West Palm Beach, Florida; Prides Crossing, Massachusetts; Stamford, Connecticut; and London, United Kingdom. The company was founded in December 1993 by William J. Nutt in Boston, Massachusetts, as a privately owned company with initial backing from TA Associates; Its initial public offering on the New York Stock Exchange occurred in November 1997. Today, AMG’s Affiliates manage $651 billion in assets in aggregate. AMG’s strategy is to generate value by investing in an array of independent firms and supporting their long-term growth, through an approach in which significant equity ownership is retained by the management partners of each Affiliate, and each Aff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Sunday Times

''The Sunday Times'' is a British newspaper whose circulation makes it the largest in Britain's quality press market category. It was founded in 1821 as ''The New Observer''. It is published by Times Newspapers Ltd, a subsidiary of News UK, which is owned by News Corp. Times Newspapers also publishes ''The Times''. The two papers were founded independently and have been under common ownership since 1966. They were bought by News International in 1981. ''The Sunday Times'' has a circulation of just over 650,000, which exceeds that of its main rivals, including ''The'' ''Sunday Telegraph'' and ''The'' ''Observer'', combined. While some other national newspapers moved to a tabloid format in the early 2000s, ''The Sunday Times'' has retained the larger broadsheet format and has said that it would continue to do so. As of December 2019, it sells 75% more copies than its sister paper, ''The Times'', which is published from Monday to Saturday. The paper publishes ''The Sunday Ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial News

''Financial News'' is a financial newspaper and news website published in London. It is a weekly newspaper, published by eFinancial News Limited, covering the financial services sector through news, views and extensive people coverage. ''Financial News'' was founded in 1996. Financial News is owned by Dow Jones & Company, who acquired eFinancial News in 2007. It is part of the Dow Jones Media Group division, which also includes ''Barron's'', ''Factiva,'' ''MarketWatch'' and ''Mansion Global''. Financial News launched a revamped, mobile-first website and new weekly print edition in January 2017. Titles In addition to the publication of the Financial News, the company also operates ''FNLondon.com'', an updated daily website version of ''Financial News'', and ''The Private Equity News'', which provides daily news and analysis for Europe's private equity industry. ''The Private Equity News'' website is the counterpart to the weekly Private Equity News hard copy and was launched ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Undertakings For Collective Investment In Transferable Securities Directives

The Undertakings for Collective Investment in Transferable Securities Directive (UCITS2009/65/ECis a consolidated EU directive that allows collective investment schemes to operate freely throughout the EU on the basis of a single authorisation from one member state. EU member states are entitled to have additional regulatory requirements for the benefit of investors. Evolution The objective of Directive 85/611/EEC, adopted in 1985, was to allow for open-ended funds investing in transferable securities to be subject to the same regulation in every Member State. It was hoped that once such legislative uniformity was established throughout Europe, funds authorised in one Member State could be sold to the public in each Member State without further authorisation, thereby furthering the EU's goal of a single market for financial services in Europe. The reality differed somewhat from the expectation due primarily to individual marketing rules in each Member State that created obstacl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund Standards Board

The Standards Board for Alternative Investments (SBAI), formerly known as the Hedge Fund Standards Board, is an international standard-setting body for the alternative investment industry and sets the voluntary standard of best practices and practices endorsed by its members. Its primary role is to be the custodian of the Alternative Investment Standards (formerly known as "the Standards"), which are designed to create a "framework of transparency, integrity and good governance" in the way the hedge fund industry operates. History The SBAI originated in June 2007, when a group of leading alternative investment managers formed the Hedge Fund Working Group to develop industry standards in areas such as disclosure, valuation, risk management, governance, and shareholder conduct. Founding firms included Marshall Wace, Cheyne Capital Management, Man Group, and CQS. In January 2008, the working group was established as a nonprofit, called the Hedge Fund Standards Board (HFSB). Its p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Instruments

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form of currency (forex); debt ( bonds, loans); equity ( shares); or derivatives ( options, futures, forwards). International Accounting Standards IAS 32 and 39 define a financial instrument as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity". Financial instruments may be categorized by "asset class" depending on whether they are equity-based (reflecting ownership of the issuing entity) or debt-based (reflecting a loan the investor has made to the issuing entity). If the instrument is debt it can be further categorized into short-term (less than one year) or long-term. Foreign exchange instruments and transactions are neither debt- nor equity-based and belon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)