|

Wilmott Magazine

''Wilmott Magazine'' is a mathematical finance and risk management magazine, combining technical articles with humor pieces. Each copy of ''Wilmott'' is 11 inches square, runs about 100 pages, and is printed on glossy paper. The magazine has the highest subscription price of any magazine. ''Esquire''. 16 July 2007. Retrieved 4 March 2017. Content and contributors ''Wilmott'' has a section with technical articles on mathematical finance, but includes quantitative financial comic strips, and lighter articles. ''Wilmott'' magazine's regular contributors include[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wiley Publishing

John Wiley & Sons, Inc., commonly known as Wiley (), is an American multinational publishing company founded in 1807 that focuses on academic publishing and instructional materials. The company produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students. History The company was established in 1807 when Charles Wiley opened a print shop in Manhattan. The company was the publisher of 19th century American literary figures like James Fenimore Cooper, Washington Irving, Herman Melville, and Edgar Allan Poe, as well as of legal, religious, and other non-fiction titles. The firm took its current name in 1865. Wiley later shifted its focus to scientific, technical, and engineering subject areas, abandoning its literary interests. Wiley's son John (born in Flatbush, New York, October 4, 1808; died in East Orange, New Jers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

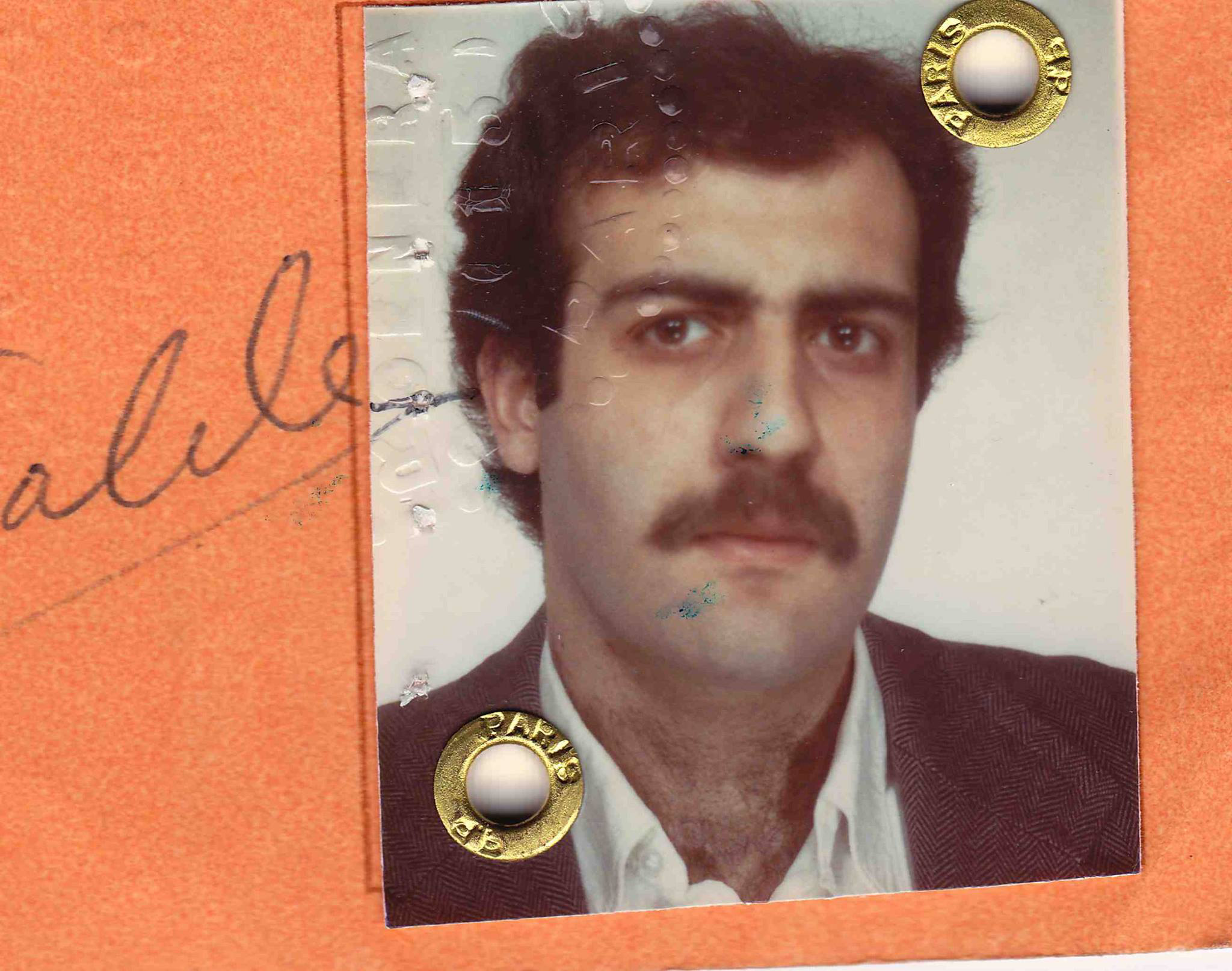

Paul Wilmott

Paul Wilmott (born 8 November 1959) is an English researcher, consultant and lecturer in quantitative finance.Financial gurus He is best known as the author of various academic and practitioner texts on risk and derivatives, for ''Wilmott'' magazine and Wilmott.com, a quantitative finance portal, and for his prescient warnings about the misuse of mathematics in finance. Early life One of two sons of an accountant and an entrepreneurial mother, Wilmott attended Wirral Grammar School for Boys in , and read mathematics at |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Glossy Paper

Coated paper (also known as enamel paper, gloss paper, and thin paper) is paper that has been coated by a mixture of materials or a polymer to impart certain qualities to the paper, including weight, surface gloss, smoothness, or reduced ink absorbency. Various materials, including kaolinite, calcium carbonate, bentonite, and talc, can be used to coat paper for high-quality printing used in the packaging industry and in magazines. The chalk or china clay is bound to the paper with synthetic s, such as styrene-butadiene latexes and natural organic binders such as starch. The coating formulation may also contain chemical additives as dispersants, resins, or polyethylene to give water resistance and wet strength to the paper, or to protect against ultraviolet radiation. Varieties Machine-finished coated paper ''Machine-finished coated paper'' (MFC) has a basis weight of 48–80 g/m2. They have good surface properties, high print gloss and adequate sheet stiffness. MF ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edward Thorp

Edward Oakley Thorp (born August 14, 1932) is an American mathematics professor, author, hedge fund manager, and blackjack researcher. He pioneered the modern applications of probability theory, including the harnessing of very small correlations for reliable financial gain. Thorp is the author of ''Beat the Dealer'', which mathematically proved that the house advantage in blackjack could be overcome by card counting. He also developed and applied effective hedge fund techniques in the financial markets, and collaborated with Claude Shannon in creating the first wearable computer. Thorp received his Ph.D. in mathematics from the University of California, Los Angeles in 1958, and worked at the Massachusetts Institute of Technology (MIT) from 1959 to 1961. He was a professor of mathematics from 1961 to 1965 at New Mexico State University, and then joined the University of California, Irvine where he was a professor of mathematics from 1965 to 1977 and a professor of mathematic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aaron Brown (financial Author)

Aaron C. Brown (born November 27, 1956) is an American finance practitioner, well known as an authorStephen Schurr, , Financial Times, March 20, 2006 on risk management and gambling-related issues. He also speaks frequently at professional and academic conferences. He was Chief Risk Manager at AQR Capital Management. He was one of the original developers of |

Nassim Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Satyajit Das

Satyajit Das (born 1957) is an Australian former banker and corporate treasurer, turned consultant, and author. Early life and education Satyajit Das was born in Calcutta, India in 1957. His family emigrated to Australia when he was 12. Das received bachelor's degrees in Commerce and Law from the University of New South Wales followed by an MBA from the Australian Graduate School of Management. Career From 1977 to 1987, Das worked in banking with the Commonwealth Bank, CitiGroup and Merrill Lynch. From 1988 to 1994, Das was Treasurer of the TNT Transport Group. Das is the author of ''Traders, Guns & Money'', ''Extreme Money'', and reference books on derivatives and risk management. He lives in Sydney. ''Extreme Money'' was long-listed for the Financial Times/Goldman Sachs Business Book of the Year Award. ''The Economist'' reviewed the book, stating that "Satyajit Das is well-placed to comment, having worked both for investment banks and as a consultant advising clients on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jean-Philippe Bouchaud

Jean-Philippe Bouchaud (born 1962) is a French physicist. He is co-founder and chairman of Capital Fund Management (CFM), adjunct professor at École Normale Supérieure and co-director of the CFM-Imperial Institute of Quantitative Finance at Imperial College London. He is a member of the French Academy of Sciences, and held the Bettencourt Innovation Chair at Collège de France in 2020. Biography Born in Paris in 1962, Jean-Philippe Bouchaud studied at the French Lycée in London. Graduating from École Normale Supérieure in 1985, he carried out his PhD at the Laboratory of Hertzian Spectroscopy, studying spin-polarized quantum gases with Claire Lhuillier. He then worked for the French National Center for Scientific Research, in particular on liquid Helium 3 and diffusion in random media. He spent a year at the Cavendish Laboratory, University of Cambridge in 1992 before joining the Laboratory of Condensed Matter Physics (SPEC) of the French Atomic Energy and Alternative En ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

A hedge fund is a pooled investment fund that trades in relatively liquid assets and is able to make extensive use of more complex trading, portfolio-construction, and risk management techniques in an attempt to improve performance, such as short selling, leverage, and derivatives. Financial regulators generally restrict hedge fund marketing to institutional investors, high net worth individuals, and accredited investors. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and ETFs. They are also considered distinct from private equity funds and other similar closed-end funds as hedge funds generally invest in relatively liquid assets and are usually open-ended. This means they typically allow investors to invest and withdraw capital periodically based on the fund's net asset value, whereas pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Banks

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services (fixed income instruments, currencies, and commodities) or research (macroeconomic, credit or equity research). Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)