|

Widowed Parent's Allowance

Widowed Parent's Allowance is a benefit under the United Kingdom Social Security system. Entitlement It replaced Widowed Mother's Allowance in 2001 as part of the process of removing sex discrimination from the Social Security system. It is available to anyone with a child whose husband, wife or civil partner has died. The claimant must get Child Benefit for at least one child and the late husband, wife or civil partner was their parent. It is not available if the partners were divorced at the time of death, if the claimant is in prison, if they remarry or are cohabitating with another person by means of living together as a married couple. Amount of benefit In 2013 the maximum payment is £108.30 a week. It is taxable, but it is not affected by the receipt of other income. It is counted in full for all means-tested benefits. The amount payable is dependent on the National Insurance contributions paid by the deceased. It could be affected by the benefit cap. It continues while ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The United Kingdom includes the island of Great Britain, the north-eastern part of the island of Ireland, and many smaller islands within the British Isles. Northern Ireland shares a land border with the Republic of Ireland; otherwise, the United Kingdom is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. The total area of the United Kingdom is , with an estimated 2020 population of more than 67 million people. The United Kingdom has evolved from a series of annexations, unions and separations of constituent countries over several hundred years. The Treaty of Union between the Kingdom of England (which included Wales, annexed in 1542) and the Kingdom of Scotland in 170 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare State In The United Kingdom

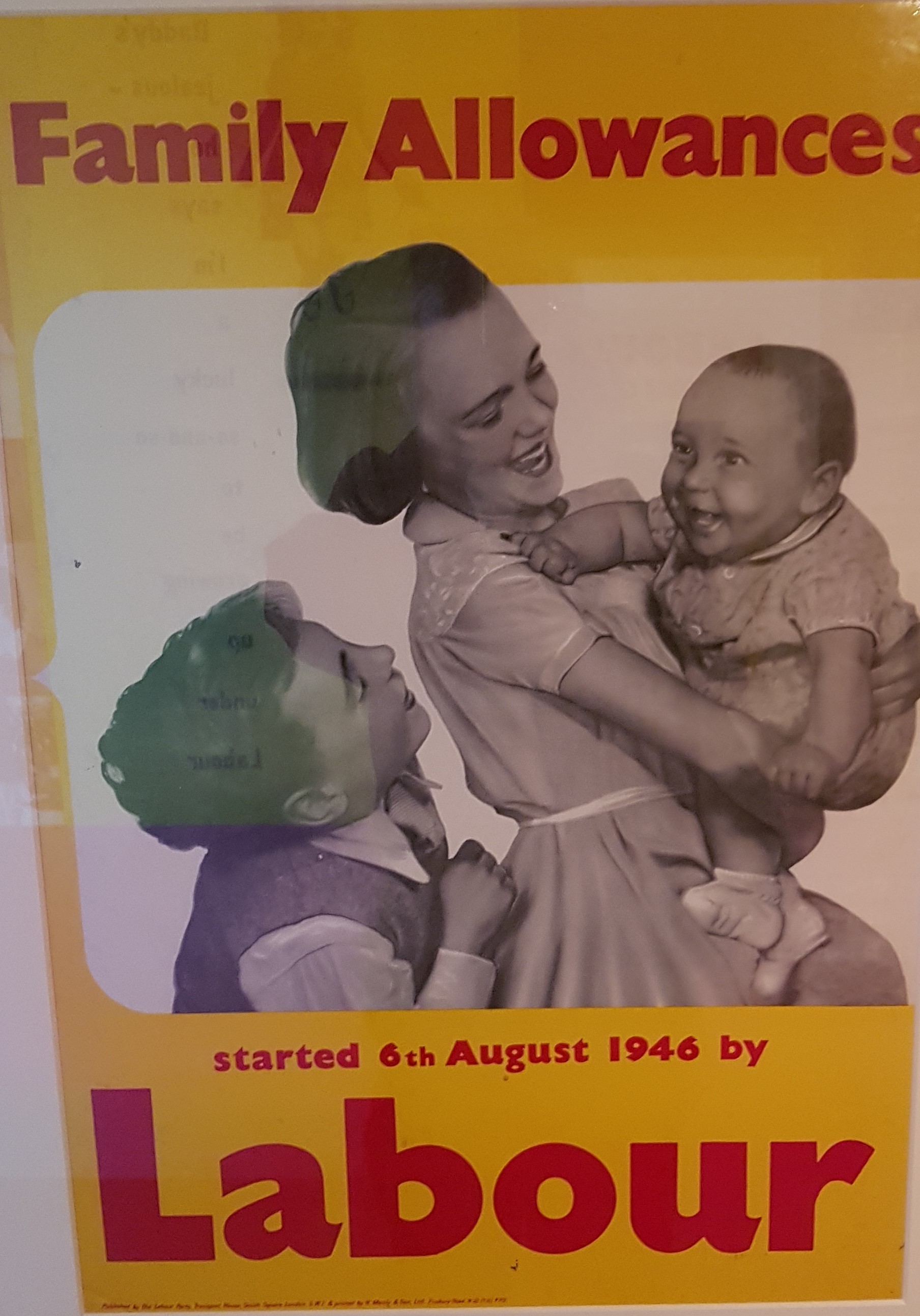

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system. https://books.google.com/books/about/?id=zW2ungEACAAJ History The welfare state in the modern sense was anticipated by the Royal Commission into the Operation of the Poor Laws 1832 which found that the old poor law (a part of the English Poor laws) was subject to widespread abuse and promoted squalor, idleness and criminality in its recipients, compared to those who received private charity. Accordingly, the qualifications for receiving aid were tightened up, forcing many recipients to either turn to private charity or accept employment. Opinions began to be changed late in the century by reports drawn up by men such as Seebohm Rowntree and Cha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Widowed Mother's Allowance

Widowed Mother's Allowance was part of the United Kingdom system of Social Security benefits. It was established under the National Insurance Act 1946 and abolished and replaced by Widowed Parent's Allowance in 2001. William Beveridge's view was: "There is no reason why a childless widow should get a pension for life; if she is able to work, she should work. On the other hand, provision much better than at present should be made for those who, because they have the care of children, cannot work for gain or cannot work regularly". Main conditions The widow had to be receiving Child Benefit for a child who was either hers and her late husband's, or a child the husband was entitled to Child Benefit for before his death, or a child of hers by an earlier marriage which ended by her being widowed, if she was living with her late husband when he died, or she was expecting a child of her late husband's (a child conceived by artificial insemination counts if she was living with her husband ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sexism

Sexism is prejudice or discrimination based on one's sex or gender. Sexism can affect anyone, but it primarily affects women and girls.There is a clear and broad consensus among academic scholars in multiple fields that sexism refers primarily to discrimination against women, and primarily affects women. See, for example: * Defines sexism as "prejudice, stereotyping, or discrimination, typically against women, on the basis of sex". * Defines sexism as "prejudice or discrimination based on sex or gender, especially against women and girls". Notes that "sexism in a society is most commonly applied against women and girls. It functions to maintain patriarchy, or male domination, through ideological and material practices of individuals, collectives, and institutions that oppress women and girls on the basis of sex or gender." * Notes that Sexism' refers to a historically and globally pervasive form of oppression against women." * Notes that "sexism usually refers to prejudice ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, Child benefit payments are currently called Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Australian Income tax system. It can be claimed as fortnightly payments or as an annual lump sum. It may be payable for dependant children from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cohabitation In The United Kingdom

Cohabitation in the United Kingdom, according to social security law would typically relate to a couple being treated as living together as a married couple even if not married or in a civil partnership. This has the effect that for means-tested benefits their resources are treated as held in common. There are also effects on benefits which depend on the claimant not having a partner. History The Victorian era of the late 19th century is famous for the Victorian standards of personal morality. Historians generally agree that the middle classes held high personal moral standards and rejected cohabitation. They have debated whether the working classes followed suit. Moralists in the late 19th century such as Henry Mayhew decried high levels of cohabitation without marriage and illegitimate births in London slums. However new research using computerized matching of data files shows that the rates of cohabitation were quite low—under 5% – for the working class and the urban poor. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Means-tested Benefit

A means test is a determination of whether an individual or family is eligible for government assistance or welfare, based upon whether the individual or family possesses the means to do without that help. Canada In Canada, means tests are used for student finance (for post-secondary education), legal aid, and "welfare" (direct transfer payments to individuals to combat poverty). They are not generally used for primary and secondary education which are tax-funded. Means tests for public health insurance were once common but are now illegal, as the Canada Health Act of 1984 requires that all the provinces provide universal healthcare coverage to be eligible for subsidies from the federal government. Means tests are also not used for pensions and seniors' benefits, but there is a clawback of Old Age Security payments for people making over $69,562 (in 2012). The Last Post Fund uses a means test on a deceased veteran's estate and surviving widow to determine whether they are eligi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is revi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benefit Cap

The benefit cap is a British Coalition government policy that limits the amount in state benefits that an individual household can claim per year. The benefit cap was introduced in 2013 at £26,000 per year (£500 per week) which was the average family income in the UK. For single people with no children it was set at £18,200 per year (£350 per week). The level of the benefit cap was subsequently lowered following an announcement in the July 2015 United Kingdom budget. From Autumn 2016 it was reduced to £20,000, except in London where it was reduced to £23,000. The benefit cap was announced in the October 2010 Spending Review by the Coalition Government and was made law by the Welfare Reform Act 2012, The Benefit Cap (Housing Benefit) Regulations 2012 and The Universal Credit Regulations 2013. It began roll out in April 2013 and was fully implemented by September 2013. By 2014 a total of 36,471 households were having their payments reduced by the benefit cap, of which 17,102 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions Bill 2012

A pension (, from Latin ''pensiō'', "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a " defined benefit plan", where a fixed sum is paid regularly to a person, or a " defined contribution plan", under which a fixed sum is invested that then becomes available at retirement age. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms "retirement plan" and "superannuation" tend to refer to a pension granted upon retirement of the individual. Retirement plans may be set up by employers, insurance companies, the government, or other institutions such as employer associations or trade unions. Called ''retirement plans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Department Of Work And Pensions

, type = Department , seal = , logo = Department for Work and Pensions logo.svg , logo_width = 166px , formed = , preceding1 = , jurisdiction = Government of the United Kingdom , headquarters = Caxton House7th Floor6–12 Tothill StreetLondonSW1H 9NA , employees = 96,011 (as of July 2021) , budget = £176.3 billion (Resource AME),£6.3 billion (Resource DEL),£0.3 billion (Capital DEL),£2.3 billion (Non-Budget Expenditure)Estimated for year ending 31 March 2017 , minister1_name = Mel Stride , minister1_pfo = Secretary of State for Work and Pensions , chief1_name = Peter Schofield , chief1_position = Permanent Secretary , chief2_name = , chief2_position = , chief3_name = , chief3_position = , chief4_name = , chief4_position = , chief5_name = , chief5_position = , chief6_name = , chief6_position = , chief7_name = , chief7_position = , chief8_name = , chief8_position = , chief9_name = , chief9_position = , parent_department = , we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bereavement Support Payment

In the United Kingdom, Bereavement Support Payments (also known as bereavement benefits) are paid to the husband/wife or partner of a person who has died in the previous 21 months. It replaced Bereavement Payment and Bereavement Allowance in April 2017, which had previously replaced Widow's benefit in April 2001. It is a social security benefit that is designed to support people who have recently lost their spouse, and need some financial support to help them get back on their feet. A similar benefit is provided in Malta in accordance to the ''Widows and Orphans Pension Act'' of 1927. The qualifying conditions are as follows: * the deceased partner must have paid National Insurance contributions for at least 25 weeks in one tax year since 6 April 1975. Bereavement Support Payment consists of 2 parts, firstly: *a bereavement payment of £3,500 which is a one off tax free lump sum, provided the claimant was receiving Child Benefit; otherwise the payment is £2,500 ::::(formerl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |