|

Welsh Fiscal Deficit

The Welsh fiscal balance is the difference between general government revenues and expenditures in Wales. From 1999 to 2022, Wales has carried a fiscal deficit as public spending in Wales exceeded tax revenue. For the 2018–19 fiscal year, the fiscal deficit is about 19.4 percent of Wales's estimated GDP, compared to 2 percent for the United Kingdom as a whole. All UK nations and regions except for East, South East England and London have a deficit. Wales' fiscal deficit per capita of £4,300 is the second highest of the economic regions, after the Northern Ireland fiscal deficit, which is nearly £5,000 per capita. Some state that the deficit is not a Welsh deficit as Wales does not have significant powers over taxation and does not set its own budget, in that the UK Government holds many of these fiscal powers. According to political scientist John Doyle of Dublin City University, the fiscal deficit in the "early days" of an independent Wales would be approximately £2.6bn. Thi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Fiscal Balance Of Wales And UK In Percent Of GDP

Net or net may refer to: Mathematics and physics * Net (mathematics), a filter-like topological generalization of a sequence * Net, a linear system of divisors of dimension 2 * Net (polyhedron), an arrangement of polygons that can be folded up to form a polyhedron * An incidence structure consisting of points and parallel classes of lines * Operator algebras in Local quantum field theory Others * Net (command), an operating system command * Net (device), a grid-like device or object such as that used in fishing or sports, commonly made from woven fibers * ''Net'' (film), 2021 Indian thriller drama film * Net (textile), a textile in which the warp and weft yarns are looped or knotted at their intersections * Net (economics) (nett), the sum or difference of two or more economic variables ** Net income (nett), an entity's income minus cost of goods sold, expenses and taxes for an accounting period * In electronic design, a connection in a netlist * In computing, the Internet * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cardiff University

, latin_name = , image_name = Shield of the University of Cardiff.svg , image_size = 150px , caption = Coat of arms of Cardiff University , motto = cy, Gwirionedd, Undod a Chytgord , mottoeng = Truth, Unity and Concord , established = 1883 (/)2005 (independent university status) , type = Public , endowment = £45.5 million (2021) , budget = £603.4 million (2020–21) , total_staff = 6,900 (2019/20) , academic_staff = 3,350 (2019/20) , chancellor = Jenny Randerson , vice_chancellor = Colin Riordan , students = () , undergrad = () , postgrad = () , other = , city = Cardiff , country = Wales, United Kingdom , coor = , campus = Urban , colours = , mascot = , affiliations = Russell Group EUAUniversities UK GW4 , website cardiff.ac.uk, logo = Cardiff University ( cy, Prifysgol Caerdydd) is a public research university in Cardiff, Wales, United Kingdom. It was established in 1883 as the University College of South Wales and Monmouthshire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending In The United Kingdom

Central government spending in the United Kingdom, also called public expenditure, is the responsibility of the UK Government, the Scottish Government, the Welsh Government and the Northern Ireland Executive. In the budget for financial year 2019–20, proposed total government spending was £842 billion. Spending per head is significantly higher in Northern Ireland, Wales and Scotland than it is in England. Scotland has historically collected more tax per person than has the rest of the UK, although following a decline in the oil price in 2014, Scotland produced slightly less revenue than England per capita in 2014–15. As of 2014 and the release of the GERS report, Scotland had a higher deficit relative to the UK deficit as a whole and received an increased net subsidy from UK Government borrowing, this deficit was attributed to declining oil revenues as the price of crude oil has fallen. This condition is predicted to only get worse should oil revenues fall further. Gove ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom National Debt

The United Kingdom national debt is the total quantity of money borrowed by the Government of the United Kingdom at any time through the issue of securities by the British Treasury and other government agencies. At the end of December 2021, UK General government gross debt was £2,382.8 billion, or 102.8% of Gross domestic product, the second lowest in the G7 while 14.6% above the average of the EU member states at that time. Approximately a third of the UK National Debt is owned by the British government due to the Bank of England's quantitative easing programme, so approximately a third of the cost of servicing the debt is paid by the government to itself. In 2018, this reduced the annual servicing cost to approximately £30 billion (approx 2% of GDP, approx 5% of UK government tax income). In 2017, due to the Government's budget deficit ( PSNCR), the national debt increased by £46 billion. The Cameron–Clegg coalition government in 2010 planned that they would eliminate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institute Of Welsh Affairs

The Institute of Welsh Affairs (IWA) () is an independent charity and membership-based think-tank based Cardiff, Wales, which specialises in public policy and debate around the economy, education, environment and health sectors in Wales. History The establishment of the IWA came amid, according to Schofield (2014), the launch and subsequent failure of the 1979 Welsh devolution referendum, and the resulting “tug-of-war between a desire for a measure of independence for Wales and concerns about the country's ability to function under such a system.” In 1986, controller of BBC Wales Geraint Talfan Davies and Cardiff lawyer Keith James (of Hugh James LLP) set out a paper which established their case for "a body that can provide a regular intellectual challenge to current practice in all those spheres of Welsh life and administration that impact on our industrial and economic performance." An initial £50,000 grant was provided by the Welsh Development Agency Chief Executive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tourist Tax

A tourist tax is any revenue-generating measure targeted at tourists. It is a means of combating overtourism and a form of tax exporting (partial shifting of tax burden to non-citizens or non-residents). The tourist industry typically campaigns against the taxes. It is separate from value-added tax and other taxes that tourists may pay, but are also paid by residents. Types Per diem tax As of 2019, Bhutan charges $200 to $250 per visitor per day, considered one of the highest tourist taxes at the time. Originally people from India, Bangladesh, and the Maldives were exempt from part of the fee, but the country plans to increase fees for these visitors beginning in 2020. Hotel tax Many countries in Europe charge a per-day tax on rooms in hotels and other temporary accommodation. In Germany, the tax is levied by cities in addition to VAT and is called () or "Bettensteuer" (bed tax). In many municipalities business travelers are exempt from paying it. Spanish municipalities also char ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Land Value Tax

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements. It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating. Land value taxes are generally favored by economists as they do not cause economic efficiency, economic inefficiency, and reduce economic inequality, inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity or discourage or subsidize development. LVT is associated with Henry George, whose ideology became known as Georgism. George ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Union

A currency union (also known as monetary union) is an intergovernmental agreement that involves two or more State (polity), states sharing the same currency. These states may not necessarily have any Economic integration#Stages, further integration (such as an economic and monetary union, which would have, in addition, a customs union and a single market). There are three types of currency unions: * ''Informal'' – unilateral adoption of a foreign currency. * ''Formal'' – adoption of foreign currency by virtue of bilateral or multilateral agreement with the monetary authority, sometimes supplemented by issue of local currency in currency peg regime. * ''Formal with common policy'' – establishment by multiple countries of a common monetary policy and monetary authority for their common currency. The theory of the optimal currency area addresses the question of how to determine what geographical regions should share a currency in order to maximize economic efficiency. Advantag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert A

The name Robert is an ancient Germanic given name, from Proto-Germanic "fame" and "bright" (''Hrōþiberhtaz''). Compare Old Dutch ''Robrecht'' and Old High German ''Hrodebert'' (a compound of '' Hruod'' ( non, Hróðr) "fame, glory, honour, praise, renown" and ''berht'' "bright, light, shining"). It is the second most frequently used given name of ancient Germanic origin. It is also in use as a surname. Another commonly used form of the name is Rupert. After becoming widely used in Continental Europe it entered England in its Old French form ''Robert'', where an Old English cognate form (''Hrēodbēorht'', ''Hrodberht'', ''Hrēodbēorð'', ''Hrœdbœrð'', ''Hrœdberð'', ''Hrōðberχtŕ'') had existed before the Norman Conquest. The feminine version is Roberta. The Italian, Portuguese, and Spanish form is Roberto. Robert is also a common name in many Germanic languages, including English, German, Dutch, Norwegian, Swedish, Scots, Danish, and Icelandic. It can be use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

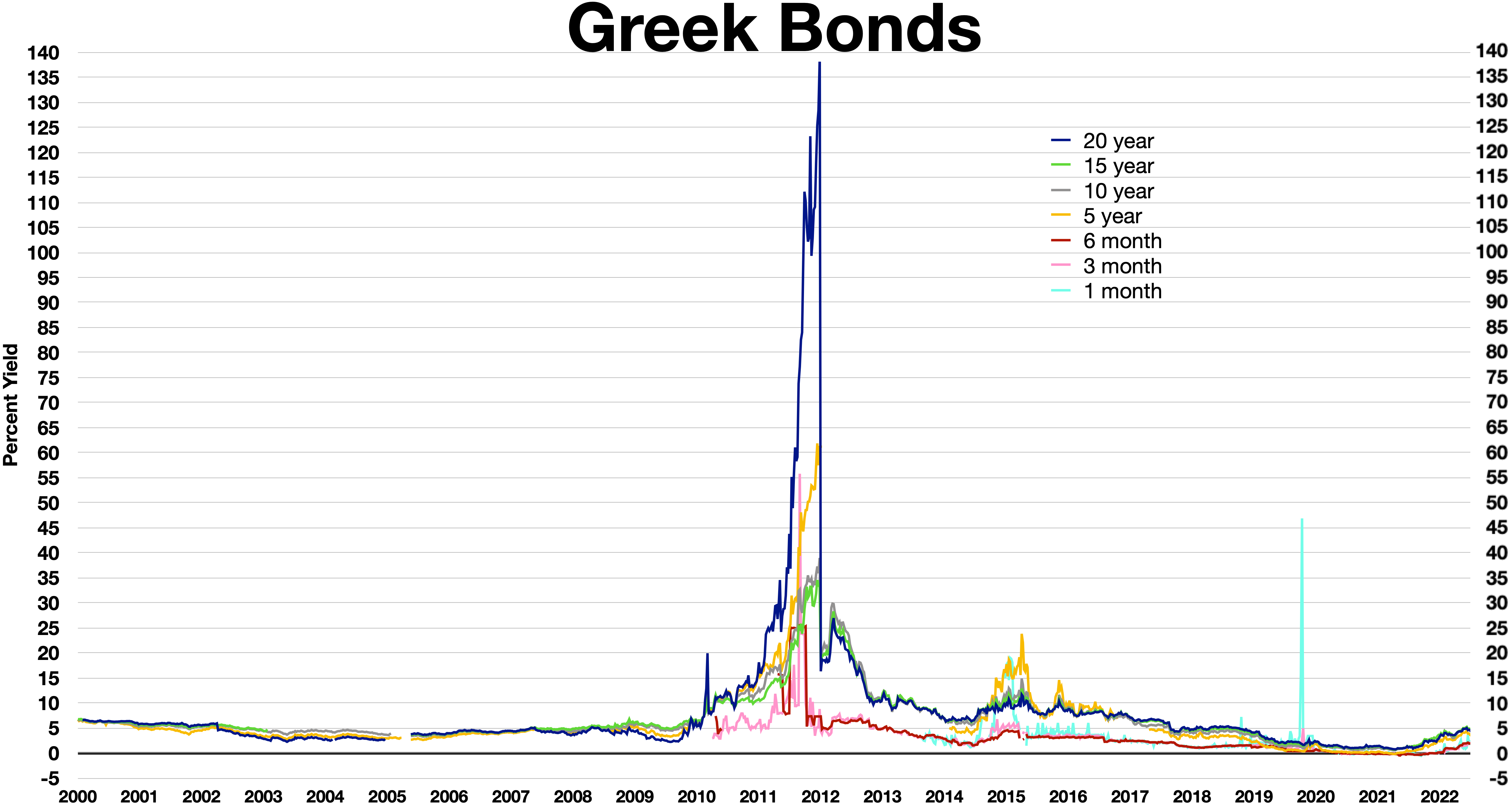

Greek Government-debt Crisis

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis ( Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country. The Greek crisis started in late 2009, triggered by the turmoil of the world-wide Great Recession, structural weaknesses in the Greek economy, and lack of monetary policy flexibility as a member of the Eurozone. The crisis included revelations that previous data on government debt levels and deficits had been underreported by the Greek government: the official forecast for the 2009 budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Finance (magazine)

''Public Finance'' comprises a bimonthly magazine, a UK news website and an international news website covering public policy and public sector The public sector, also called the state sector, is the part of the economy composed of both public services and public enterprises. Public sectors include the public goods and governmental services such as the military, law enforcement, inf ... finance. History and profile ''Public Finance'' was first published in 1896 under the name ''Financial Circular''. In 1935 the publication was renamed to ''Local Government Finance'', and in 1974 it became ''Public Finance and Accountancy''. Philip Windsor was appointed as the first professional journalist editor in 1978. The magazine's title was shortened to ''Public Finance'' in the 1980s. The current editor is Jon Watkins. Publicfinance.co.uk was launched in the late 1990s, and Publicfinanceinternational.org was launched in March 2012. It is published by Redactive Media Group on beh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wales Governance Centre

The Wales Governance Centre (WGC) () is a research centre and think-tank based Cardiff, Wales, which specialises in research into the law, politics, government and political economy of Wales, as well the wider territorial governance of the UK and Europe. It was established shortly after the 1997 Welsh devolution referendum, and was founded by Barry Jones in 1999. Its current director is Professor Richard Wyn Jones, and it is a part of Cardiff University. History The centre was established following the 1997 Welsh devolution referendum and during the debate about implementing the programme of devolution in Wales. The Centre produces the nationally reported coverage of Welsh politics of the Elections in Wales Etholiadau yng Nghymru blog written by Professor Roger Awan-Scully. In 2019 it established a new branch, the Wales Fiscal Analysis, to focus on "authoritative and independent research" into the public finances, taxation and public expenditures of Wales. Funding The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)