|

Walton V. Commissioner

''Walton v. Commissioner'', 115 T.C. 589 (2000), a decision of the United States Tax Court in favor of taxpayer Audrey J. Walton, "ruled that a grantor's right to receive a fixed amount for a term of years, if that right is a qualified interest within the meaning of Section 2702(b), is valued for gift tax purposes under Section 7520, without regard to the life expectancy of the transferor." More simply, a grantor's estate's contingent interest in a grantor-created annuity upon the grantor's death does not constitute a gift to anyone; but rather, is a retained interest of the grantor. Facts Audrey J. Walton created two grantor retained annuity trusts (GRATs). Each GRAT had a two-year duration during which Audrey retained the right to receive an annuity. If Audrey died within the two-year period, the annuity payments would be received by her estate. "The balance of the trust property would then be paid to the remainder beneficiaries." Audrey's daughter, Ann Walton Kroenke was th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Tax Court

The United States Tax Court (in case citations, T.C.) is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides (in part) that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service. Though taxpayers may choose to litigate tax matters in a variety of legal settings, outside of bankruptcy, the Tax Court is the only forum in which taxpayers may do so without having first paid the disputed tax in full. Parties who contest the imposition of a tax may also bring an action in any United States District Court, or in the United States Court of Federal Claims; however these venues require that the tax be paid first, and that the party then file a lawsuit to recover the contested amount paid (the "full payment rule" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid. The process of transferring assets and wealth to the upcoming generations is known as estate planning. It involves planning for transfers at death or during life. One such instrument is the right to transfer assets to another person known as gift-giving, or with the goal of reducing one's taxable wealth when the donor still lives. For fulfilling the crit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Taxation And Revenue Case Law

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wal-Mart

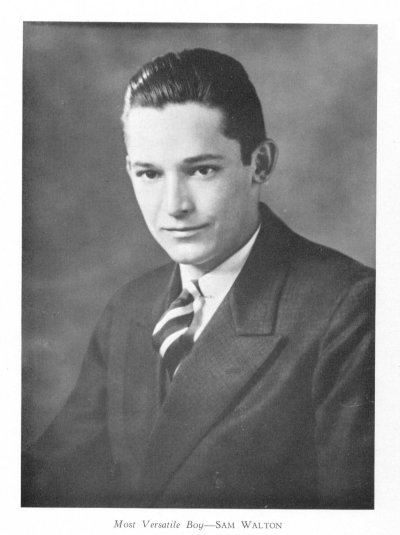

Walmart Inc. (; formerly Wal-Mart Stores, Inc.) is an American multinational retail corporation that operates a chain of hypermarkets (also called supercenters), discount department stores, and grocery stores from the United States, headquartered in Bentonville, Arkansas. The company was founded by Sam Walton in nearby Rogers, Arkansas in 1962 and incorporated under Delaware General Corporation Law on October 31, 1969. It also owns and operates Sam's Club retail warehouses. Walmart has 10,586 stores and clubs in 24 countries, operating under 46 different names. The company operates under the name Walmart in the United States and Canada, as Walmart de México y Centroamérica in Mexico and Central America, and as Flipkart Wholesale in India. It has wholly owned operations in Chile, Canada, and South Africa. Since August 2018, Walmart held only a minority stake in Walmart Brasil, which was renamed Grupo Big in August 2019, with 20 percent of the company's shares, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nancy Walton Laurie

Nancy Walton Laurie (born May 15, 1951) is an American heir to the Walmart fortune. She is also a businesswoman and a philanthropist. Early life Nancy Walton was born on May 15, 1951. She is the younger daughter of Bud Walton, the brother and business partner of Walmart founder Sam Walton. She grew up in Versailles, Missouri, where she met future husband Bill Laurie. At Bud's death, she and her sister Ann Walton Kroenke inherited a stake in Walmart now worth over $9 billion. Philanthropy With her husband, she donated US$25 million to the University of Missouri for the construction of a new sports arena for the Missouri Tigers in 2001, to be named after their daughter Paige Laurie, who did not attend the university.Stephanie SimonFuming at What Isn't in a Name: A University of Missouri sports complex is named after philanthropists' child, who goes to USC. ''The Los Angeles Times'', April 04, 2004Sarah DeShazo ''Inside Philanthropy'', July 31, 2013 However, it was reveale ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ann Walton Kroenke

Anne, alternatively spelled Ann, is a form of the Latin female given name Anna. This in turn is a representation of the Hebrew Hannah, which means 'favour' or 'grace'. Related names include Annie. Anne is sometimes used as a male name in the Netherlands, particularly in the Frisian speaking part (for example, author Anne de Vries). In this incarnation, it is related to Germanic arn-names and means 'eagle'.See entry on "Anne" in th''Behind the Name'' databaseand th"Anne"an"Ane"entries (in Dutch) in the Nederlandse Voornamenbank (Dutch First Names Database) of the Meertens Instituut (23 October 2018). It has also been used for males in France (Anne de Montmorency) and Scotland (Lord Anne Hamilton). Anne is a common name and the following lists represent a small selection. For a comprehensive list, see instead: . As a feminine name Anne * Saint Anne, Mother of the Virgin Mary * Anne, Queen of Great Britain (1665–1714), Queen of England, Scotland, and Ireland (1702–07) an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grantor Retained Annuity Trust

A grantor-retained annuity trust (commonly referred to by the acronym GRAT), is a financial instrument commonly used in the United States to make large financial gifts to family members without paying a U.S. gift tax. Basic mechanism A grantor transfers property into an irrevocable trust in exchange for the right to receive fixed payments at least annually, based on original fair market value of the property transferred. At the end of a specified time, any remaining value in the trust is passed on to a beneficiary of the trust as a gift. Beneficiaries are generally close family members of the grantor, such as children or grandchildren, who are prohibited from being named beneficiaries of another estate freeze technique, the grantor retained income trust. If a grantor dies before the trust period ends, the assets in the GRAT are included in the grantor's estate by operation of I.R.C. § 2036, eliminating any potential gift tax benefit; this is the GRAT's main weakness as a tax avo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax In The United States

A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the giver's life. The United States Internal Revenue Service says that a gift is "Any transfer to an individual, either directly or indirectly, where full compensation (measured in money or money's worth) is not received in return." When a taxable gift in the form of cash, stocks, real estate, gift cards, or other tangible or intangible property is made, the tax is usually imposed on the donor (the giver) unless there is a retention of an interest which delays completion of the gift. A transfer is "completely gratuitous" when the donor receives nothing of value in exchange for the given property. A transfer is "gratuitous in part" when the donor receives some value but the value of the property received by the donor is substantially less than the value of the property given by the donor. In this case, the amount of the gift is the difference. In the United States, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Walton Family

The Walton family is an American family whose collective fortune derived from Walmart makes them the richest family in the United States of America. Overview The three most prominent living members (Jim, Rob, and Alice Walton) have consistently been in the top twenty of the ''Forbes'' 400 list since 2001, as were John ( 2005) and Helen (d. 2007) prior to their deaths. Christy Walton took her husband John's place in the ranking after his death. The majority of the family's wealth derives from the heritage of Bud and Sam Walton, who were the co-founders of Walmart. Walmart is the world's largest retailer, one of the world's largest business enterprises in terms of annual revenue, and, with just over 2.2 million employees, the world's largest private employer. , the Waltons collectively owned 50.8 percent of Walmart. In 2018, the family sold some of their company's stock and now owns just under 50%. In January 19, the Walton family's net worth was around US$240.6 billion. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grantor Retained Annuity Trust

A grantor-retained annuity trust (commonly referred to by the acronym GRAT), is a financial instrument commonly used in the United States to make large financial gifts to family members without paying a U.S. gift tax. Basic mechanism A grantor transfers property into an irrevocable trust in exchange for the right to receive fixed payments at least annually, based on original fair market value of the property transferred. At the end of a specified time, any remaining value in the trust is passed on to a beneficiary of the trust as a gift. Beneficiaries are generally close family members of the grantor, such as children or grandchildren, who are prohibited from being named beneficiaries of another estate freeze technique, the grantor retained income trust. If a grantor dies before the trust period ends, the assets in the GRAT are included in the grantor's estate by operation of I.R.C. § 2036, eliminating any potential gift tax benefit; this is the GRAT's main weakness as a tax avo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joseph H

Joseph is a common male given name, derived from the Hebrew Yosef (יוֹסֵף). "Joseph" is used, along with "Josef", mostly in English, French and partially German languages. This spelling is also found as a variant in the languages of the modern-day Nordic countries. In Portuguese and Spanish, the name is "José". In Arabic, including in the Quran, the name is spelled '' Yūsuf''. In Persian, the name is "Yousef". The name has enjoyed significant popularity in its many forms in numerous countries, and ''Joseph'' was one of the two names, along with ''Robert'', to have remained in the top 10 boys' names list in the US from 1925 to 1972. It is especially common in contemporary Israel, as either "Yossi" or "Yossef", and in Italy, where the name "Giuseppe" was the most common male name in the 20th century. In the first century CE, Joseph was the second most popular male name for Palestine Jews. In the Book of Genesis Joseph is Jacob's eleventh son and Rachel's first son, and k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |