|

Windfall Tax

A windfall tax is a higher tax rate on profits that ensue from a sudden windfall gain to a particular company or industry. There have been windfall taxes in various countries across the world, including Mongolia, Australia, and on wind power in Turkey. Australia In Australia, windfall taxes include: * Commonwealth places windfall tax, imposed under the ''Commonwealth Places Windfall Tax (Collection) Act 1998'' (1998 No 25) and the ''Commonwealth Places Windfall Tax (Imposition) Act 1998'' (1998 No 26) * Franchise fees windfall tax, imposed under the ''Franchise Fees Windfall Tax (Collection) Act 1997'' (1997 No 132), ''Franchise Fees Windfall Tax (Imposition) Act 1997'' (1997 No 133), and ''Franchise Fees Windfall Tax (Consequential Amendments) Act 1997'' (1997 No 134) In both cases, windfall tax originates in High Court decisions that certain state taxes were unconstitutional. Thus, the States were required to repay to the taxpayers the amounts previously collected under these ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. * Let t be the total tax liability. * Let i be the total tax base. ::= \frac. In a proportional tax, the tax rate is fixed and the average tax rate equals this tax rate. In case of tax brackets, commonly used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherida ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Crude Oil Production And Imports

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Ameri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oil Price Chronology

An oil is any nonpolar chemical substance that is composed primarily of hydrocarbons and is hydrophobic (does not mix with water) & lipophilic (mixes with other oils). Oils are usually flammable and surface active. Most oils are unsaturated lipids that are liquid at room temperature. The general definition of oil includes classes of chemical compounds that may be otherwise unrelated in structure, properties, and uses. Oils may be animal, vegetable, or petrochemical in origin, and may be volatile or non-volatile. They are used for food (e.g., olive oil), fuel (e.g., heating oil), medical purposes (e.g., mineral oil), lubrication (e.g. motor oil), and the manufacture of many types of paints, plastics, and other materials. Specially prepared oils are used in some religious ceremonies and rituals as purifying agents. Etymology First attested in English 1176, the word ''oil'' comes from Old French ''oile'', from Latin ''oleum'', which in turn comes from the Greek (''elaio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Severance Tax

Severance taxes are taxes imposed on the removal of natural resources within a taxing jurisdiction. Severance taxes are most commonly imposed in oil producing states within the United States. Resources that typically incur severance taxes when extracted include oil, natural gas, coal, uranium, and timber. Some jurisdictions use other terms like gross production tax. Note that severance taxes are used in jurisdictions where most resource extraction occurs on privately owned land and/or where sub-surface minerals are privately owned (for example, the United States). Where the resources are publicly owned to begin with (for example, in most Commonwealth and European Union countries), it is not a tax but rather a resource royalty that is paid. In the case of the forestry industry, this royalty is called " stumpage". Oil and natural gas Severance taxes are set and collected at the state level. States usually calculate the tax based on the value and/or volume produced; sometimes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Of Oil

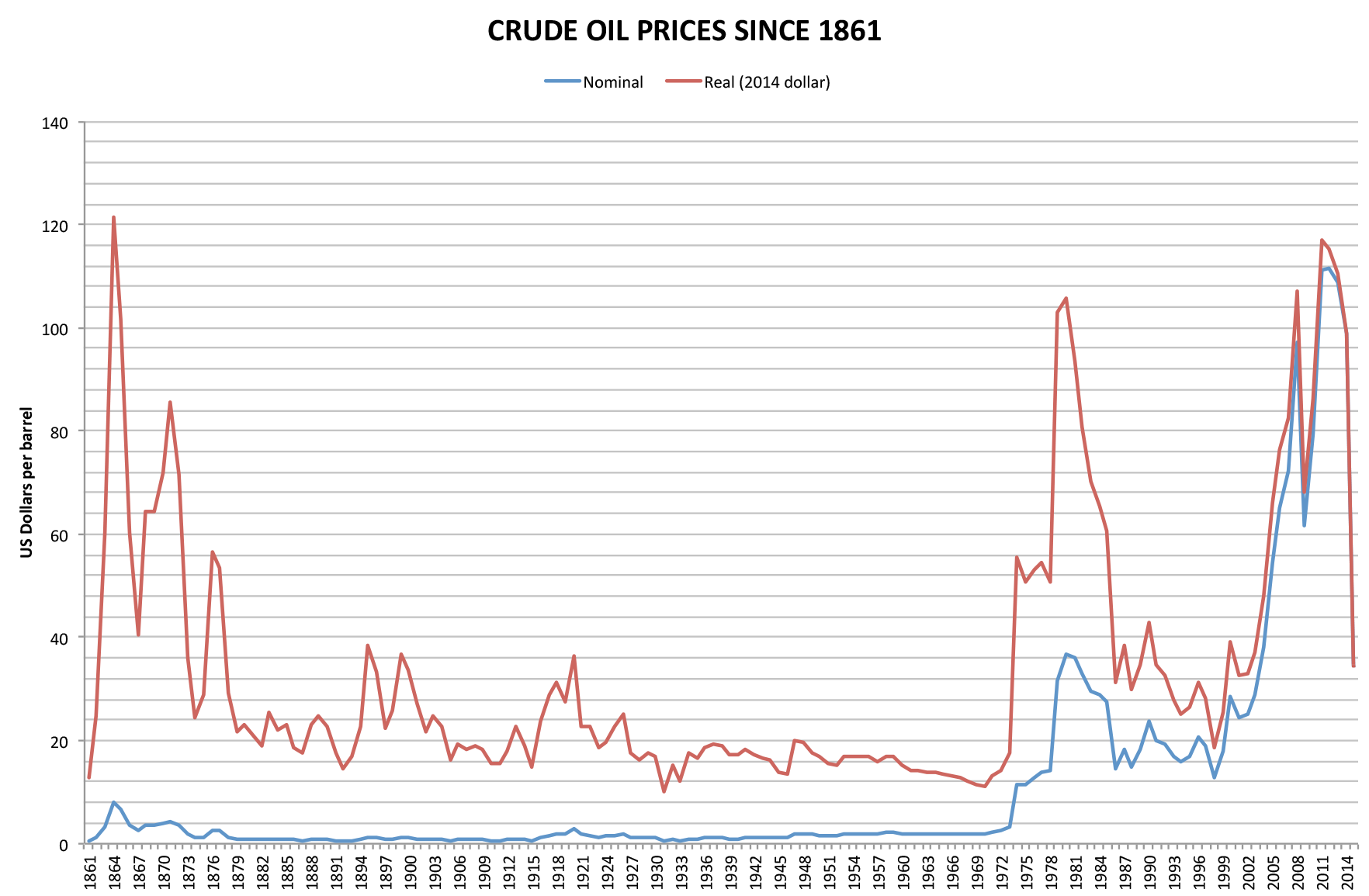

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level. The global price of crude oil was relatively consistent in the nineteenth century and early twentieth century. This changed in the 1970s, with a significant increase in the price of oil globally. There have been a number of structural drivers of global oil prices historically, including oil supply, demand, and storage shocks, and shocks to global economic growth affecting oil prices. Notable events driving significant price fluctuations include the 1973 OPEC oil embargo targeting nations that had supported Israel during the Yom Kippur War ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Misnomer

A misnomer is a name that is incorrectly or unsuitably applied. Misnomers often arise because something was named long before its correct nature was known, or because an earlier form of something has been replaced by a later form to which the name no longer suitably applies. A misnomer may also be simply a word that someone uses incorrectly or misleadingly. The word "misnomer" does not mean " misunderstanding" or " popular misconception", and a number of misnomers remain in common usage — which is to say that a word being a misnomer does not necessarily make usage of the word incorrect. Sources of misnomers Some of the sources of misnomers are: * An older name being retained after the thing named has changed (e.g., tin can, mince meat pie, steamroller, tin foil, clothes iron, digital darkroom). This is essentially a metaphorical extension with the older item standing for anything filling its role. * Transference of a well-known product brand name into a genericized tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a confidential, nonpartisan basis. CRS is sometimes known as Congress' think tank due to its broad mandate of providing research and analysis on all matters relevant to national policymaking. CRS has roughly 600 employees reflecting a wide variety of expertise and disciplines, including lawyers, economists, reference librarians, and scientists. In the 2016 fiscal year, it was appropriated a budget of roughly $106.9 million by Congress. CRS was founded during the height of the Progressive Era as part of a broader effort to professionalize the government by providing independent research and information to public officials. Its work was initially made available to the public, but between 1952 and 2018 was restricted only to members of Congr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1973 OPEC Oil Embargo

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supported Israel during the Yom Kippur War. The initial nations targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States, though the embargo also later extended to Portugal, Rhodesia and South Africa. By the end of the embargo in March 1974, the price of oil had risen nearly 300%, from US to nearly globally; US prices were significantly higher. The embargo caused an oil crisis, or "shock", with many short- and long-term effects on global politics and the global economy. It was later called the "first oil shock", followed by the 1979 oil crisis, termed the "second oil shock". Background Arab-Israeli conflict Ever since the recreation of the State of Israel in 1948 there has been Arab–Israeli conflict in th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Analysts

Tax Analysts is a nonprofit publisher offering the Tax Notes portfolio of products, including weekly magazines featuring commentary, daily online journals featuring news and analysis, and research tools, all focused on tax policy and administration. Tax Analysts also promotes transparency in tax policymaking and holds regular conferences on key tax issues. History Thomas F. Field founded Tax Analysts in 1970 as part of an effort to expose tax policymaking to the general public at a time when it was being heavily influenced by special interests. The organization provided analysis on prominent policy debates, offered congressional testimony on proposed legislation and published op-eds that could reach a broader audience. But within 10 years, the group had shifted focus and become the country's foremost provider of unbiased tax information with a style that has since come to be regarded by tax professionals as "the epitome of hard-nosed impartiality." The organization underwent a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crude Oil Prices

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level. The global price of crude oil was relatively consistent in the nineteenth century and early twentieth century. This changed in the 1970s, with a significant increase in the price of oil globally. There have been a number of structural drivers of global oil prices historically, including oil supply, demand, and storage shocks, and shocks to global economic growth affecting oil prices. Notable events driving significant price fluctuations include the 1973 OPEC oil embargo targeting nations that had supported Israel during the Yom Kippur War ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |