|

Widowed Mother's Allowance

Widowed Mother's Allowance was part of the United Kingdom system of Social Security benefits. It was established under the National Insurance Act 1946 and abolished and replaced by Widowed Parent's Allowance in 2001. William Beveridge's view was: "There is no reason why a childless widow should get a pension for life; if she is able to work, she should work. On the other hand, provision much better than at present should be made for those who, because they have the care of children, cannot work for gain or cannot work regularly". Main conditions The widow had to be receiving Child Benefit for a child who was either hers and her late husband's, or a child the husband was entitled to Child Benefit for before his death, or a child of hers by an earlier marriage which ended by her being widowed, if she was living with her late husband when he died, or she was expecting a child of her late husband's (a child conceived by artificial insemination counts if she was living with her husband ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

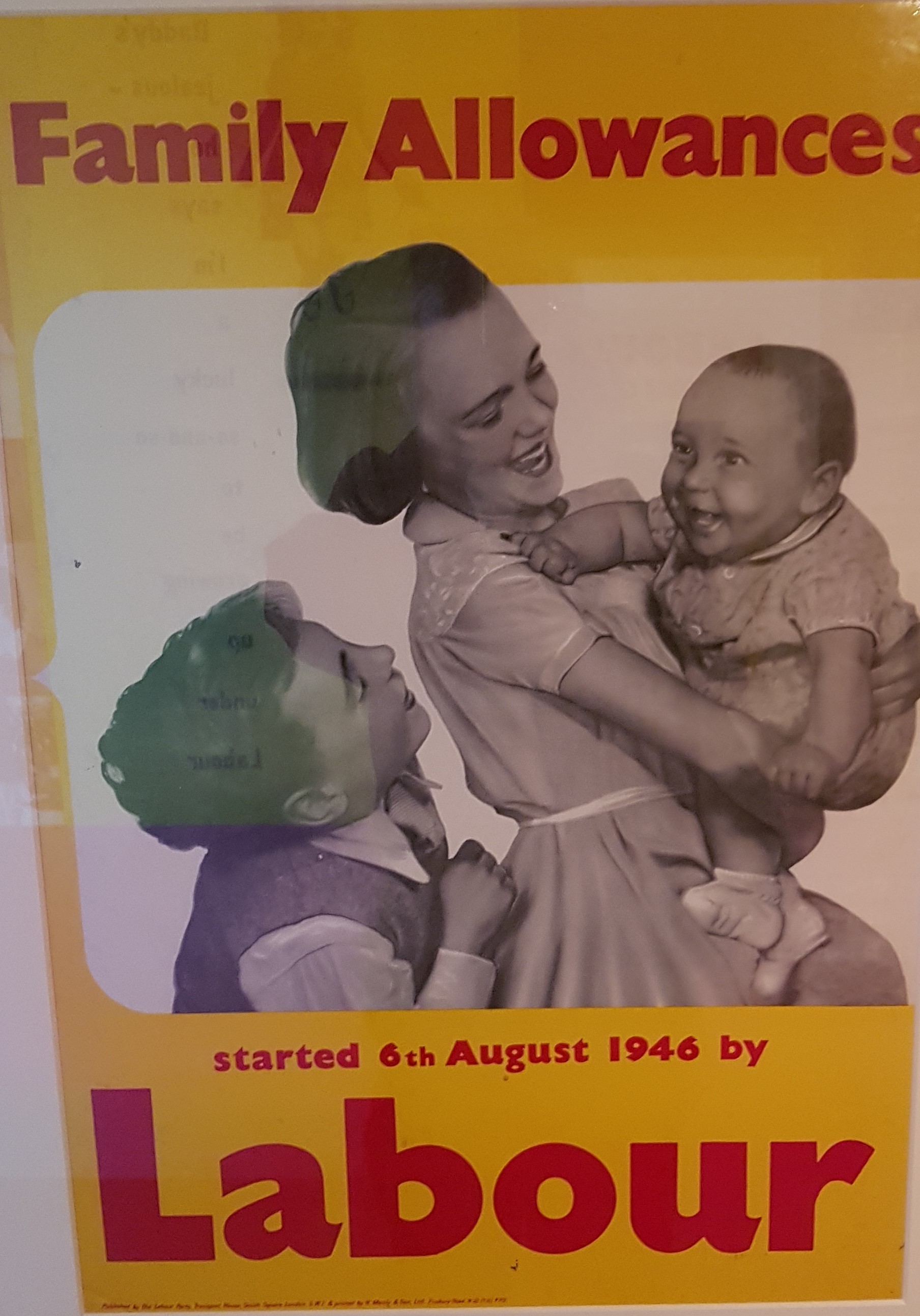

National Insurance Act 1946

The National Insurance Act 1946 (c 67) was a British Act of Parliament passed during the Attlee ministry which established a comprehensive system of social security throughout the United Kingdom. The act meant that all who were of working age were to pay a weekly contribution. If they had been paying National Insurance, mothers were to be entitled to an allowance (of 18 weeks) for each child as well as a lump sum when the child was born. The act however excluded married women. The weekly contributions meant that benefits including sickness benefit and unemployment benefits were able to be offered. Pensions were to offered to men and women at ages 60 and 65 respectively. Background Attlee had campaigned hard in his campaign leading up to the 1945 election for the creation of the welfare state. When elected, he and his administration and adopted Beveridge proposal from 1944 to keep to his manifesto promise. Significance According to the historian Kenneth O. Morgan, the Act cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Widowed Parent's Allowance

Widowed Parent's Allowance is a benefit under the United Kingdom Social Security system. Entitlement It replaced Widowed Mother's Allowance in 2001 as part of the process of removing sex discrimination from the Social Security system. It is available to anyone with a child whose husband, wife or civil partner has died. The claimant must get Child Benefit for at least one child and the late husband, wife or civil partner was their parent. It is not available if the partners were divorced at the time of death, if the claimant is in prison, if they remarry or are cohabitating with another person by means of living together as a married couple. Amount of benefit In 2013 the maximum payment is £108.30 a week. It is taxable, but it is not affected by the receipt of other income. It is counted in full for all means-tested benefits. The amount payable is dependent on the National Insurance contributions paid by the deceased. It could be affected by the benefit cap. It continues whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

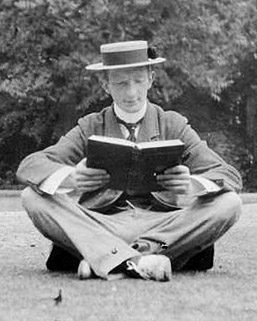

William Beveridge

William Henry Beveridge, 1st Baron Beveridge, (5 March 1879 – 16 March 1963) was a British economist and Liberal politician who was a progressive and social reformer who played a central role in designing the British welfare state. His 1942 report ''Social Insurance and Allied Services'' (known as the Beveridge Report) served as the basis for the welfare state put in place by the Labour government elected in 1945. He built his career as an expert on unemployment insurance. He served on the Board of Trade as Director of the newly created labour exchanges, and later as Permanent Secretary of the Ministry of Food. He was Director of the London School of Economics and Political Science from 1919 until 1937, when he was elected Master of University College, Oxford. Beveridge published widely on unemployment and social security, his most notable works being: ''Unemployment: A Problem of Industry'' (1909), ''Planning Under Socialism'' (1936), '' Full Employment in a Free S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, Child benefit payments are currently called Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Australian Income tax system. It can be claimed as fortnightly payments or as an annual lump sum. It may be payable for dependant children from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance Contributions

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Labour government in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of 16 years, until the age they become eligible for the State pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute partly through a fixed weekly or monthly payment and partly on a percentage of net profits above a threshold, which is revie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security In The United Kingdom

, type = Department , seal = , logo = Department for Work and Pensions logo.svg , logo_width = 166px , formed = , preceding1 = , jurisdiction = Government of the United Kingdom , headquarters = Caxton House7th Floor6–12 Tothill StreetLondonSW1H 9NA , employees = 96,011 (as of July 2021) , budget = £176.3 billion (Resource AME),£6.3 billion (Resource DEL),£0.3 billion (Capital DEL),£2.3 billion (Non-Budget Expenditure)Estimated for year ending 31 March 2017 , minister1_name = Mel Stride , minister1_pfo = Secretary of State for Work and Pensions , chief1_name = Peter Schofield , chief1_position = Permanent Secretary , chief2_name = , chief2_position = , chief3_name = , chief3_position = , chief4_name = , chief4_position = , chief5_name = , chief5_position = , chief6_name = , chief6_position = , chief7_name = , chief7_position = , chief8_name = , chief8_position = , chief9_name = , chief9_position = , parent_department = , we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |