|

Venezuelan Bolívar

The bolívar is the official currency of Venezuela. Named after the hero of Latin American independence Simón Bolívar, it was introduced following the monetary reform in 1879, before which the venezolano was circulating. Due to its decade-long reliance on silver and gold standards, and then on a peg to the United States dollar, it was considered among the most stable currencies and was internationally accepted until 1983, when the government decided to adopt a floating exchange rate instead. Since 1983, the currency has experienced a prolonged period of high inflation, losing value almost 500-fold against the US dollar in the process. The depreciation became manageable in mid-2000s, but it still stayed in double digits. It was then, on 1 January 2008, that the hard bolívar (''bolívar fuerte'' in Spanish, sign: Bs.F, code: VEF) replaced the original bolívar ( sign: Bs; code: VEB) at a rate of Bs.F 1 to Bs. 1,000 (the abbreviation Bs. is due to the first and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Céntimo

The céntimo (in Spanish-speaking countries) or cêntimo (in Portuguese-speaking countries) was a currency unit of Spain, Portugal and their former colonies. The word derived from the Latin meaning "hundredth part". The main Spanish currency, before the euro, was the peseta which was divided into 100 céntimos. In Portugal it was the real and later the escudo, until it was also replaced by the euro. In the European community ''cent'' is the official name for one hundredth of a euro. However, both ''céntimo'' (in Spanish) and ''cêntimo'' (in Portuguese) are commonly used to describe the euro cent. Current use Céntimo or cêntimo is one-hundredth of the following basic monetary units: Portuguese cêntimo * Angolan kwanza * São Tomé and Príncipe dobra Spanish céntimo * Costa Rican colón (but as centavo between 1917 and 1920) * Paraguayan guaraní * Peruvian sol * Philippine peso (as ''séntimo'' in Filipino, as centavo in English) * Venezuelan bolívar Obsolete Portug ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Substitution

Currency substitution is the use of a foreign currency in parallel to or instead of a domestic currency. The process is also known as dollarization or euroization when the foreign currency is the dollar or the euro, respectively. Currency substitution can be full or partial. Full currency substitution can occur after a major economic crisis, such as in Ecuador, El Salvador, and Zimbabwe. Some small economies, for whom it is impractical to maintain an independent currency, use the currencies of their larger neighbours; for example, Liechtenstein uses the Swiss franc. Partial currency substitution occurs when residents of a country choose to hold a significant share of their financial assets denominated in a foreign currency. It can also occur as a gradual conversion to full currency substitution; for example, Argentina and Peru were both in the process of converting to the U.S. dollar during the 1990s. Origins After the gold standard was abandoned at the outbreak of World W ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Black Market

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "currency ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Bolívar

''Sovereign'' is a title which can be applied to the highest leader in various categories. The word is borrowed from Old French , which is ultimately derived from the Latin , meaning 'above'. The roles of a sovereign vary from monarch, ruler or head of state to head of municipal government or head of a chivalric order. As a result, the word ''sovereignty'' has more recently also come to mean independence or autonomy. Head of state The word ''sovereign'' is frequently used synonymously with monarch. There are numerous titles in a monarchical rule which can belong to the sovereign. The sovereign is the autonomous head of the state. Examples of the various titles in modern sovereign leaders are: Chivalric orders The term ''sovereign'' is generally used in place of "grand master" for the supreme head of various orders of European nations. In the Sovereign Military Order of Malta, the Grand Master is styled "Sovereign", e.g. Sovereign Grand Master, due to its status as an intern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Flight

Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence or as the result of a political event such as regime change or economic globalization. Such events could be an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength. This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country—depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime. This fall is particularly damaging when the capital belongs to the people of the affected country because not only are the citizens now burdened by the loss in the economy and devaluation of their currency but their assets have lost much of their nominal valu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

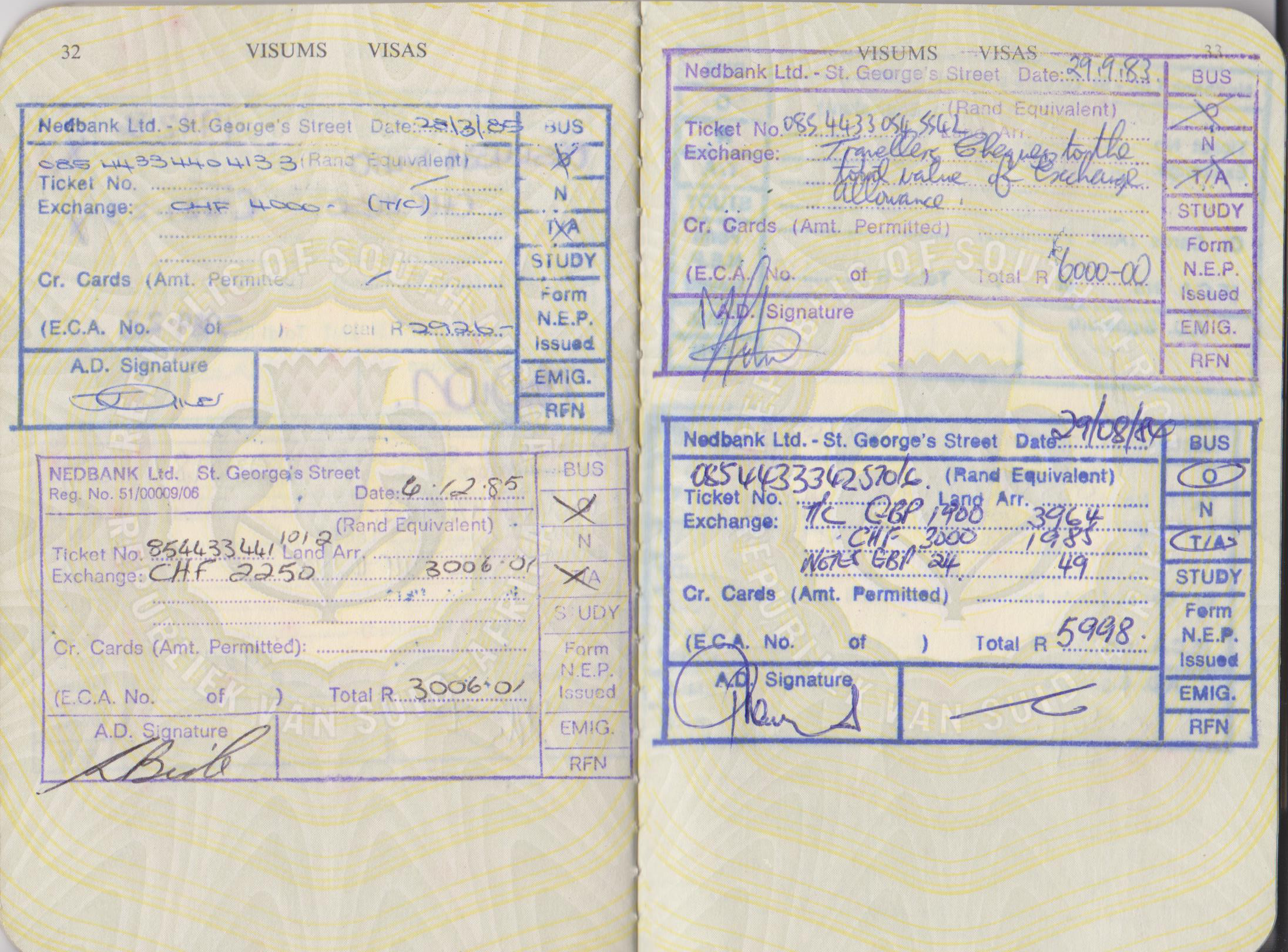

Exchange Control

Foreign exchange controls are various forms of controls imposed by a government on the purchase/sale of foreign currencies by residents, on the purchase/sale of local currency by nonresidents, or the transfers of any currency across national borders. These controls allow countries to better manage their economies by controlling the inflow and outflow of currency, which may otherwise create exchange rate volatility. Countries with weak and/or developing economies generally use foreign exchange controls to limit speculation against their currencies. They may also introduce capital controls, which limit foreign investment in the country. Rationale Common foreign exchange controls include: * banning the use of foreign currency within the country; * banning locals from possessing foreign currency; * restricting currency exchange to government-approved exchangers; * fixed exchange rates * restricting the amount of currency that may be imported or exported; Often, foreign exchange ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a ''revaluation''. A monetary authority (e.g., a central bank) maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate. However, under a floating exchange rate system (in which exchange rates are determined by market forces acting on the foreign exchange market, and not by government or central bank policy actions), a decrease in a currency's value relative to other major curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Dollar

The United States dollar (symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. Some jurisdictions allow contract law to overrule the status of legal tender, allowing (for example) merchants to specify that they will not accept cash payments. Coins and banknotes are usually defined as legal tender in many countries, but personal cheques, credit cards, and similar non-cash methods of payment are usually not. Some jurisdictions may include a specific foreign currency as legal tender, at times as its exclusive legal tender or concurrently with its domestic currency. Some jurisdictions may forbid or restrict payment made by other than legal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latin Monetary Union

The Latin Monetary Union (LMU) was a 19th-century system that unified several European currencies into a single currency that could be used in all member states when most national currencies were still made out of gold and silver. It was established in 1865 and disbanded in 1927. Many countries minted coins according to the LMU standard even though they did not formally accede to the LMU treaty. History Preliminary context The LMU adopted the specifications of the French gold franc, which had been introduced by Napoleon I in 1803 and was struck in denominations of 5, 10, 20, 40, 50 and 100 francs, with the 20 franc coin ( of .900 fine gold struck on a planchet) being the most common. In the French system the gold franc was interchangeable with the silver franc based on an exchange ratio of 1:15.5, which was the approximate relative value of the two metals at the time of the law of 1803. Initial treaty By treaty dated 23 December 1865, France, Belgium, Italy, and Switzerland fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

_(cropped)_(3-to-4_aspect_ratio).jpg)