|

Value Added Tax Identification Number

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. It confirms that the number is currently allocated and can provide the name or other identifying details of the entity to whom the identifier has been allocated. However, many national governments will not give out VAT identification numbers due to data protection laws. The full identifier starts with an ISO 3166-1 alpha-2 (2 letters) country code (except for Greece, which uses the ISO 639-1 language code ''EL'' for the Greek language, instead of its ISO 3166-1 alpha-2 country code ''GR'', and Northern Ireland, which uses the code ''XI'' when trading with the EU) and then has between 2 and 13 characters. The identifiers are composed of numeric digits in most countries, but in some countries th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Identifier

An identifier is a name that identifies (that is, labels the identity of) either a unique object or a unique ''class'' of objects, where the "object" or class may be an idea, physical countable object (or class thereof), or physical noncountable substance (or class thereof). The abbreviation ID often refers to identity, identification (the process of identifying), or an identifier (that is, an instance of identification). An identifier may be a word, number, letter, symbol, or any combination of those. The words, numbers, letters, or symbols may follow an encoding system (wherein letters, digits, words, or symbols ''stand for'' epresentideas or longer names) or they may simply be arbitrary. When an identifier follows an encoding system, it is often referred to as a code or ID code. For instance the ISO/IEC 11179 metadata registry standard defines a code as ''system of valid symbols that substitute for longer values'' in contrast to identifiers without symbolic meaning. Ide ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

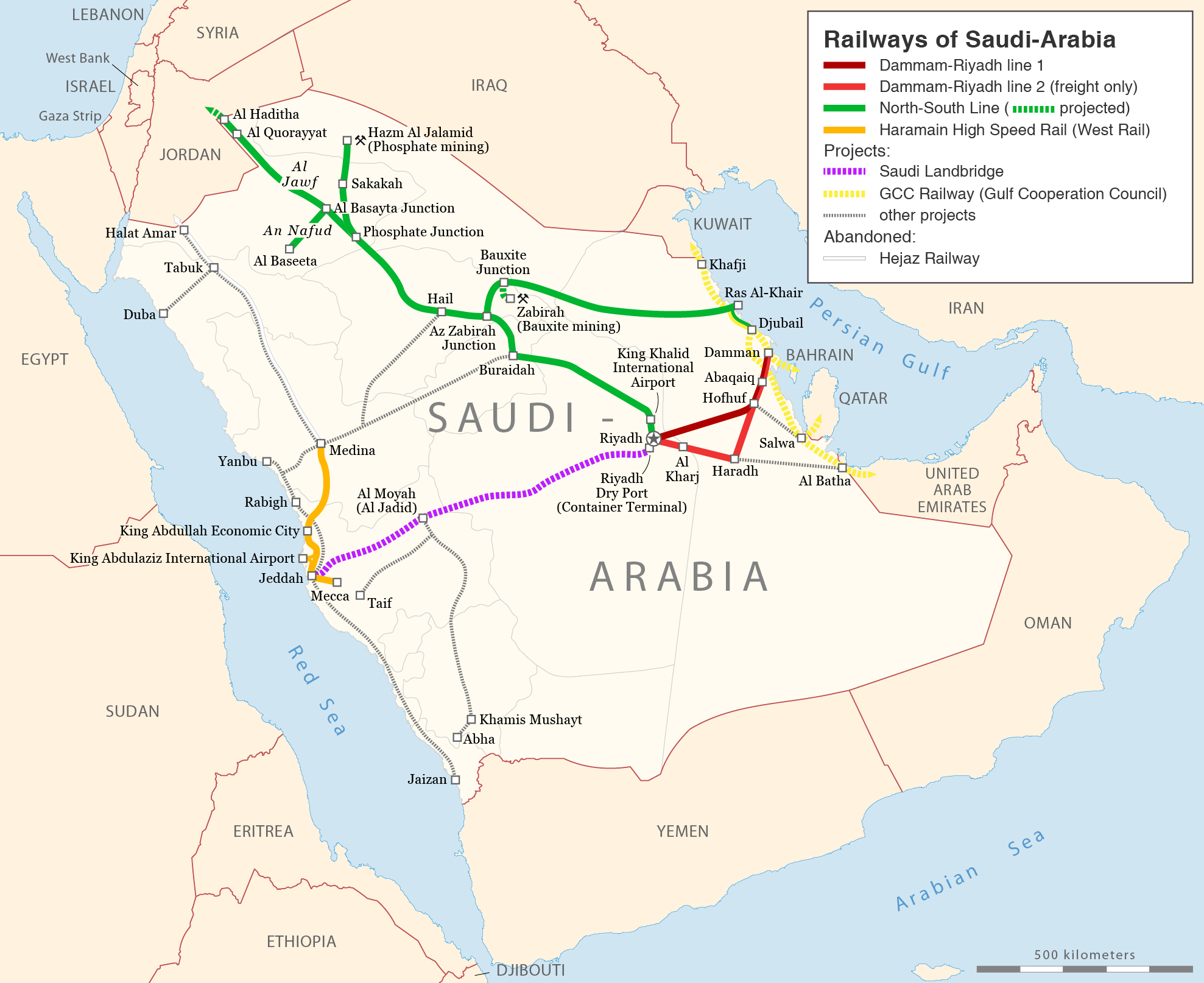

Gulf Cooperation Council

The Cooperation Council for the Arab States of the Gulf ( ar, مجلس التعاون لدول العربية الخليج ), also known as the Gulf Cooperation Council (GCC; ar, مجلس التعاون الخليجي), is a regional, intergovernmental, political, and economic union comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. The council's main headquarters is located in Riyadh, the capital of Saudi Arabia. The Charter of the GCC was signed on 25 May 1981, formally establishing the institution. All current member states are monarchies, including three constitutional monarchies (Qatar, Kuwait, and Bahrain), two absolute monarchies (Saudi Arabia and Oman), and one federal monarchy (the United Arab Emirates, which is composed of seven member states, each of which is an absolute monarchy with its own emir). There have been discussions regarding the future membership of Jordan, Morocco, and Yemen. During the Arab Spring in 2011, Saudi Arab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

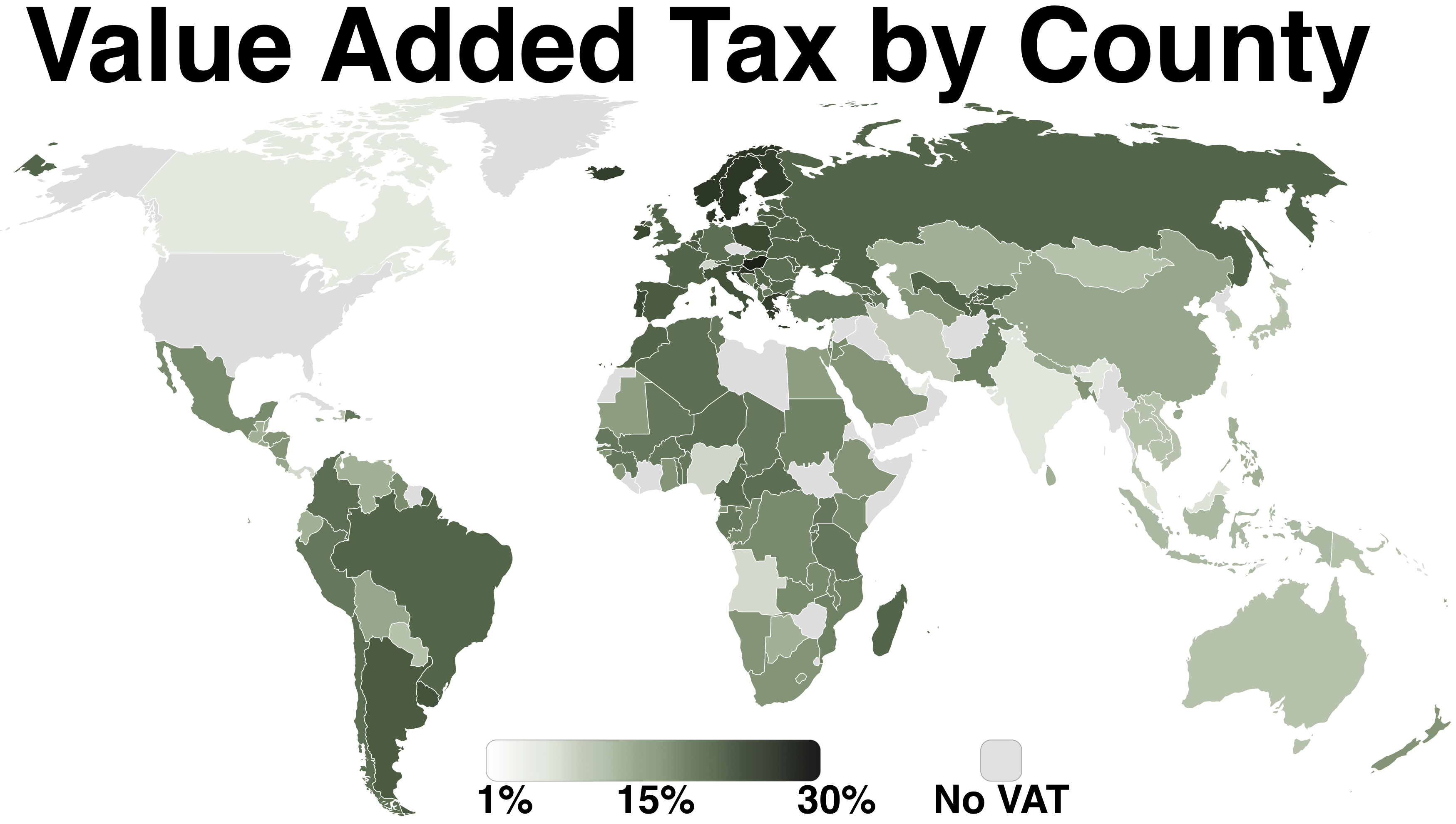

Value Added Taxes

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Identification Number

A national identification number, national identity number, or national insurance number or JMBG/EMBG is used by the governments of many countries as a means of tracking their citizens, permanent residents, and temporary residents for the purposes of work, taxation, government benefits, health care, and other governmentally-related functions. The ways in which such a system is implemented vary among countries, but in most cases citizens are issued an identification number upon reaching legal age, or when they are born. Non-citizens may be issued such numbers when they enter the country, or when granted a temporary or permanent residence permit. Many countries issued such numbers for a singular purpose, but over time, they become a ''de facto'' national identification number. For example, the United States developed its Social Security number (SSN) system as a means of organizing disbursing of Social Security benefits. However, due to function creep, the number has become used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EORI Number

An Economic Operators Registration and Identification number (EORI number) is a European Union registration and identification number for businesses which undertake the import or export of goods into or out of the EU. Any business or individual established in the EU (an economic operator) needs to obtain an EORI number from their national customs authority before commencing customs activities in the EU. EORI is an abbreviation for Economic Operators Registration and Identification. An economic operator established outside the EU needs to be assigned an EORI number if it intends to lodge a customs declaration, an Entry or an Exit Summary Declaration. Authorized economic operators in particular need to have an EORI number. EORI numbers can be validated online. The EORI system was established in order to implement the security measures introduced by Regulation (EEC) No 2913/92, as amended by Regulation (EC) No 648/2005 of the European Parliament and of the council. The European Commiss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cadastro De Pessoa Física

The CPF number (', ; Portuguese for "''Natural Persons Register''") is the Brazilian individual taxpayer registry, since its creation in 1965. This number is attributed by the Brazilian Federal Revenue to Brazilians and resident aliens who, directly or indirectly, pay taxes in Brazil. It's an 11-digit number in the format 000.000.000-00, where the last 2 numbers are check digits, generated through an arithmetic operation on the first nine digits. In May 2020, a digital version of the document was promoted for Android and iOS. In June 2020, an audit from the Tribunal de Contas da União (''Federal Court of Accounts'', often referred to as TCU) revealed that there was at least 12.5 million CPFs more than the total population. During COVID-19 pandemic the Revenue reported 223.8 million active CPFs, the problem is that, according to the Brazilian Institute of Geography and Statistics (IBGE), the Brazilian population at the time of the survey was around 211.4 million people, up ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cadastro Nacional De Pessoa Jurídica

The Brazilian National Registry of Legal Entities (Portuguese: ''Cadastro Nacional de Pessoas Jurídicas'', “CNPJ”) is a nationwide registry of corporations, partnerships, foundations, investment funds, and other legal entities, created and maintained by the Brazilian Federal Revenue Service (''Receita Federal do Brasil'', “RFB”). Currently, all companies are automatically enrolled in the system upon incorporation. The system uses a fourteen-digit number, which is made up of an eight-digit unique identifier, a four-digit branch identifier, and two check digits. The first number (even though it does not belong to the first company to be enrolled), 00.000.000/0001-91, has been assigned to Banco do Brasil, the country's largest public bank. The CNPJ has become the most important number for commercial transactions between companies due to its ubiquity and official status. The RFB maintains a publicly accessible website where any CNPJ number can be checked; thus, for many pur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Isle Of Man

) , anthem = "O Land of Our Birth" , image = Isle of Man by Sentinel-2.jpg , image_map = Europe-Isle_of_Man.svg , mapsize = , map_alt = Location of the Isle of Man in Europe , map_caption = Location of the Isle of Man (green) in Europe (dark grey) , subdivision_type = Sovereign state , subdivision_name = United Kingdom , established_title = Norse control , established_date = 9th century , established_title2 = Scottish control , established_date2 = 2 July 1266 , established_title3 = English control , established_date3 = 1399 , established_title4 = Revested into British Crown , established_date4 = 10 May 1765 , official_languages = , capital = Douglas , coordinates = , demonym = Manx; Manxman (plural, Manxmen); Manxwoman (plural, Manxwomen) , ethnic_groups = , ethnic_groups_year = 2021 , ethnic_groups_ref = Official census statistics provided by Statistics Isle of Man, Isle of Man Government: * * , religion = , religion_year = 2021 , relig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |