|

Value Added

In business, total value added is calculated by tabulating the unit value added (measured by summing unit profit sale price and production cost">Price.html" ;"title="he difference between Price">sale price and production cost], unit depreciation cost, and unit Direct labor cost, labor cost) per each unit of product sold. Thus, total value added is equivalent to revenue minus intermediate consumption. Value added is a higher portion of revenue for integrated companies (e.g. manufacturing companies) and a lower portion of revenue for less integrated companies (e.g. retail companies); total value added is very closely approximated by compensation of employees, which represents a return to labor, plus earnings before taxes, representative of a return to capital. In economics, specifically macroeconomics, the term value added refers to the contribution of the factors of production (i.e. capital and labor) to raise the value of the product and increase the income of those who own the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marxism

Marxism is a left-wing to far-left method of socioeconomic analysis that uses a materialist interpretation of historical development, better known as historical materialism, to understand class relations and social conflict and a dialectical perspective to view social transformation. It originates from the works of 19th-century German philosophers Karl Marx and Friedrich Engels. As Marxism has developed over time into various branches and schools of thought, no single, definitive Marxist theory exists. In addition to the schools of thought which emphasize or modify elements of classical Marxism, various Marxian concepts have been incorporated and adapted into a diverse array of social theories leading to widely varying conclusions. Alongside Marx's critique of political economy, the defining characteristics of Marxism have often been described using the terms dialectical materialism and historical materialism, though these terms were coined after Marx's death and their tenet ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Value Added

In economics, gross value added (GVA) is the measure of the value of goods and services produced in an area, industry or sector of an economy. "Gross value added is the value of output minus the value of intermediate consumption; it is a measure of the contribution to GDP made by an individual producer, industry or sector; gross value added is the source from which the primary incomes of the System of National Accounts (SNA) are generated and is therefore carried forward into the primary distribution of income account." Relationship to gross domestic product GVA is a very important measure, because it is used to determine gross domestic product (GDP). GDP is an indicator of the health of a national economy and economic growth. It represents the monetary value of all products and services produced in the country within a defined period of time. "In comparing GVA and GDP, we can say that GVA is a better measure for the economic welfare of the population, because it includes all pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Measures Of National Income And Output

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income (NNI adjusted for natural resource depletion – also called as NNI at factor cost). All are specially concerned with counting the total amount of goods and services produced within the economy and by various sectors. The boundary is usually defined by geography or citizenship, and it is also defined as the total income of the nation and also restrict the goods and services that are counted. For instance, some measures count only goods & services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by ''imputing'' monetary values to them. National accounts Arriving at a figure for the total production of goods and services in a large region like a country entails ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bang For The Buck

"Bang for the buck" is an idiom meaning the worth of one's money or exertion. The phrase originated from the slang usage of the words "bang" which means "excitement" and "buck" which means "money". Variations of the term include "bang for your buck," "bang for one's buck," "more bang for the buck," "bigger bang for the buck," and mixings of these. "More bang for the buck" was preceded by "more bounce to the ounce", an advertising slogan used in 1950 to market the carbonated soft drink Pepsi. The phrase "bigger bang for the buck" was notably used by U.S. President Dwight D. Eisenhower's Secretary of Defense, Charles Erwin Wilson, in 1954. He used it to describe the New Look policy of depending on nuclear weapons, rather than a large regular army, to keep the Soviet Union in check. Today, the phrase is used to mean a greater worth for the money used. !4$ is sometimes used as a shorthand version. History and usage William Safire discussed "bang for the buck" in his 1968 book, '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Added Value

{{One source, date=June 2010 Added value in financial analysis of shares is to be distinguished from value added. It is used as a measure of shareholder value, calculated using the formula: :Added Value = The selling price of a product - the cost of bought-in materials and components Added Value can also be defined as the difference between a particular product's final selling price and the direct and indirect input used in making that particular product. Also it can be said to be the process of increasing the perceived value of the product in the eyes of the consumers (formally known as the value proposition). The difference is profit for the firm and its shareholders after all the costs and taxes owed by the business have been paid for that financial year. Value added or any related measure may help investors decide if this is a business that is worthwhile investing on, or that there are other and better opportunities ( fixed deposits, debentures). Example A jewelry busin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Household Final Consumption Expenditure

Household final consumption expenditure (POES) is a transaction of the national account's use of income account representing consumer spending. It consists of the expenditure incurred bresident households on individual consumption goods and services, including those sold at prices that are not economically significant. It also includes various kinds of imputed expenditure of which the imputed rent for services of owner-occupied housing (imputed rents) is generally the most important one. The household sector covers not only those living in traditional households, but also those people living in communal establishments, such as retirement homes, boarding houses and prisons. The above given definition of HFCE includes expenditure by resident households on the domestic territory and expenditure by resident households abroad (outbound tourists), but excludes any non-resident households' expenditure on the domestic territory (inbound tourists). From this national definition of consu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

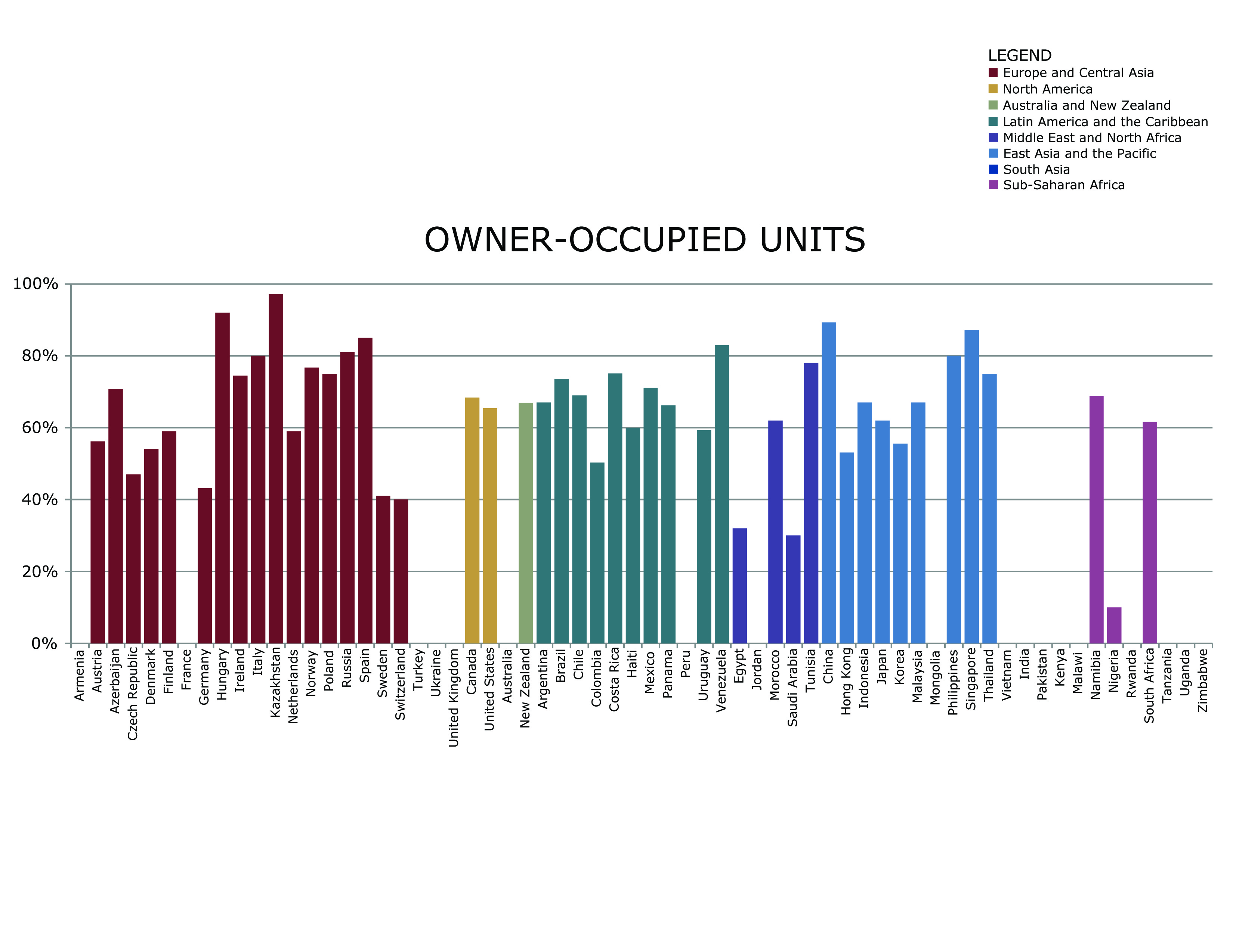

Owner-occupier

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased, as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes, and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the home owner ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when comparing living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the per capita GDP (also called the Mean Standard of Living). GDP definitions are maintained by a number of national and international economic organizations. The Org ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Indirect Taxes

An indirect tax (such as sales tax, per unit tax, value added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or nat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wages

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as ''minimum wage'', '' prevailing wage'', and ''yearly bonuses,'' and remunerative payments such as ''prizes'' and ''tip payouts.'' Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company. Payment by wage contrasts with salaried work, in which the employer pays an arranged amount at steady intervals (such as a week or month) regardless of hours worked, with commission which conditions pay on individual performance, and with compensation based on the performance of the company as a whole. Waged employees may also receive tips or gratuity paid directly by clients and employee benefits which are non-monetary forms of compensation. Since wage labour is the predominant form of work, the term "wage" sometimes refers to al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |