|

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

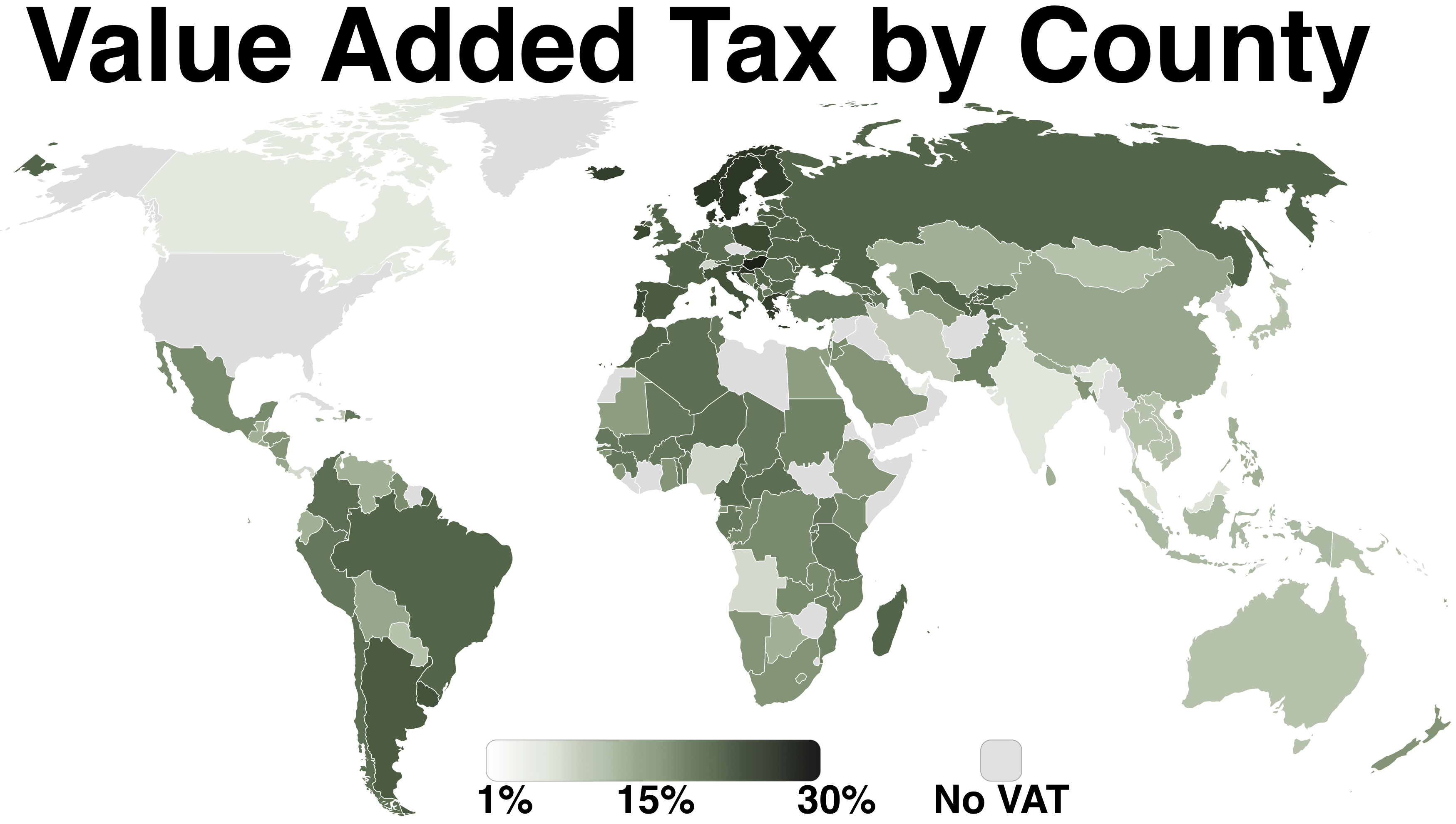

VAT By County

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Widget (economics)

Placeholder names are words that can refer to things or people whose names do not exist, are temporarily forgotten, are not relevant to the salient point at hand, are to avoid stigmatization, are unknowable/unpredictable in the context in which they are being discussed, or are otherwise de-emphasized whenever the speaker or writer is unable to, or chooses not to, specify precisely. Placeholder names for people are often terms referring to an average person or a predicted persona of a typical user. Linguistic role These placeholders typically function grammatically as nouns and can be used for people (e.g. '' John Doe, Jane Doe''), objects (e.g. '' widget''), locations ("Main Street"), or places (e.g. ''Anytown, USA''). They share a property with pronouns, because their referents must be supplied by context; but, unlike a pronoun, they may be used with no referent—the important part of the communication is not the thing nominally referred to by the placeholder, but t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Surplus

In mainstream economics, economic surplus, also known as total welfare or total social welfare or Marshallian surplus (after Alfred Marshall), is either of two related quantities: * Consumer surplus, or consumers' surplus, is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest price that they would be willing to pay. * Producer surplus, or producers' surplus, is the amount that producers benefit by selling at a market price that is higher than the least that they would be willing to sell for; this is roughly equal to profit (since producers are not normally willing to sell at a loss and are normally indifferent to selling at a break-even price). Overview In the mid-19th century, engineer Jules Dupuit first propounded the concept of economic surplus, but it was the economist Alfred Marshall who gave the concept its fame in the field of economics. On a standard supply and demand diagram, consumer su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deadweight Loss

In economics, deadweight loss is the difference in production and consumption of any given product or service including government tax. The presence of deadweight loss is most commonly identified when the quantity produced ''relative'' to the amount consumed differs in regards to the optimal concentration of surplus. This difference in the amount reflects the quantity that is not being utilized or consumed and thus resulting in a ''loss''. This "deadweight loss" is therefore attributed to both, producers and consumers because neither one of them benefits from the surplus of the overall production. Deadweight loss can also be a measure of lost economic efficiency when the socially optimal quantity of a good or a service is not produced. Non-optimal production can be caused by monopoly pricing in the case of artificial scarcity, a positive or negative externality, a tax or subsidy, or a binding price ceiling or price floor such as a minimum wage. Examples Assume a market for na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply Curve

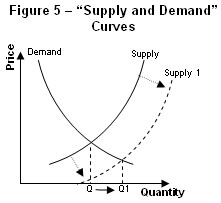

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention. The supply curve can be either for an individual seller or for the market as a whole, adding up the quantity supplied by all sellers. The quantity supplied is for a particular time period (e.g., the tons of steel a firm would supply in a year), but the units and time are often omitted in theoretical presentations. In the goods market, supply is the amount of a product per un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand Curve

In economics, a demand curve is a graph depicting the relationship between the price of a certain commodity (the ''y''-axis) and the quantity of that commodity that is demanded at that price (the ''x''-axis). Demand curves can be used either for the price-quantity relationship for an individual consumer (an individual demand curve), or for all consumers in a particular market (a market demand curve). It is generally assumed that demand curves slope down, as shown in the adjacent image. This is because of the law of demand: for most goods, the quantity demanded falls if the price rises. Certain unusual situations do not follow this law. These include Veblen goods, Giffen goods, and speculative bubbles where buyers are attracted to a commodity if its price rises. Demand curves are used to estimate behaviour in competitive markets and are often combined with supply curves to find the equilibrium price (the price at which sellers together are willing to sell the same amount as bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Model

In economics, a model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world. Overview In general terms, economic models have two functions: first as a simplification of and abstraction from observed data, and second as a means of selection of data based on a paradigm of econometric study. ''Simplification'' is particularly important for economics given the enormous complexity of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply And Demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a particular Good (economics), good, or other traded item such as Labour supply, labor or Market liquidity, liquid financial assets, will vary until it settles at a point where the quantity demanded (at the current price) will equal the quantity supplied (at the current price), resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics. In macroeconomics, as well, the AD–AS model, aggregate demand-aggregate supply model has been used to depict how the quantity of real GDP, total output and the aggregate price level may be determined in equilibrium. Graphical representations Supply schedule A supply schedule, depicted graphically as a supply cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Use Tax

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then converted it for its own use, without having paid tax when it was initially purchased. Use taxes are functionally equivalent to sales taxes. They are typically levied upon the use, storage, enjoyment, or other consumption in the state of tangible personal property that has not been subjected to a sales tax. Introduction Use tax is assessed upon tangible personal property and taxable services purchased by a resident or entity doing business in the taxing state upon the use, storage, enjoyment or consumption of the good or service, regardless of origin of the purchase. Use taxes are designed to discourage the purchase of products that are not subject to the sales tax within a taxing jurisdiction. Use tax may be applied to purchases from out-of-s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Income Tax

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income (though it will be phased out by 2027). Forty-seven states and many localities impose a tax on the income of corporations. State income tax is imposed at a fixed or graduated rate on taxable income of individuals, corporations, and certain estates and trusts. These tax rates vary by state and by entity type. Taxable income conforms closely to federal taxable income in most states with limited modifications. States are prohibited from taxing income from federal bonds or other federal obligations. Most states do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |