|

Use Tax

A use tax is a type of tax levied in the United States by numerous state governments. It is essentially the same as a sales tax but is applied not where a product or service was sold but where a merchant bought a product or service and then converted it for its own use, without having paid tax when it was initially purchased. Use taxes are functionally equivalent to sales taxes. They are typically levied upon the use, storage, enjoyment, or other consumption in the state of tangible personal property that has not been subjected to a sales tax. Introduction Use tax is assessed upon tangible personal property and taxable services purchased by a resident or entity doing business in the taxing state upon the use, storage, enjoyment or consumption of the good or service, regardless of origin of the purchase. Use taxes are designed to discourage the purchase of products that are not subject to the sales tax within a taxing jurisdiction. Use tax may be applied to purchases from out-of-s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

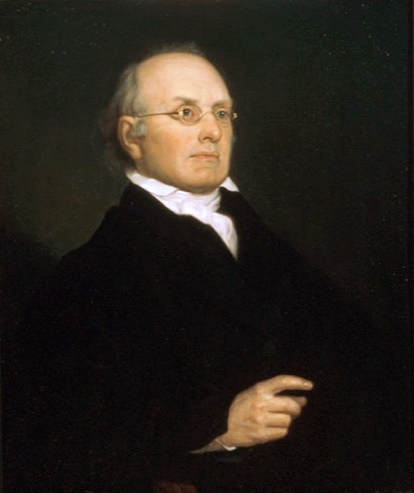

Interstate Commerce Clause

The Commerce Clause describes an enumerated power listed in the United States Constitution ( Article I, Section 8, Clause 3). The clause states that the United States Congress shall have power "to regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes". Courts and commentators have tended to discuss each of these three areas of commerce as a separate power granted to Congress. It is common to see the individual components of the Commerce Clause referred to under specific terms: the Foreign Commerce Clause, the Interstate Commerce Clause, and the Indian Commerce Clause. Dispute exists within the courts as to the range of powers granted to Congress by the Commerce Clause. As noted below, it is often paired with the Necessary and Proper Clause, and the combination used to take a more broad, expansive perspective of these powers. During the Marshall Court era (1801–1835), interpretation of the Commerce Clause gave Congress jurisdiction over ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Taxation In The United States

State may refer to: Arts, entertainment, and media Literature * ''State Magazine'', a monthly magazine published by the U.S. Department of State * ''The State'' (newspaper), a daily newspaper in Columbia, South Carolina, United States * ''Our State'', a monthly magazine published in North Carolina and formerly called ''The State'' * The State (Larry Niven), a fictional future government in three novels by Larry Niven Music Groups and labels * States Records, an American record label * The State (band), Australian band previously known as the Cutters Albums * ''State'' (album), a 2013 album by Todd Rundgren * ''States'' (album), a 2013 album by the Paper Kites * ''States'', a 1991 album by Klinik * ''The State'' (album), a 1999 album by Nickelback Television * ''The State'' (American TV series), 1993 * ''The State'' (British TV series), 2017 Other * The State (comedy troupe), an American comedy troupe Law and politics * State (polity), a centralized political organizatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Local Taxation

A comparison of tax rates by countries is difficult and somewhat subjective, as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. The list focuses on the main types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance tax. Some other taxes (for instance property tax, substantial in many countries, such as the United States) and payroll tax are not shown here. The table is not exhaustive in representing the true tax burden to either the corporation or the individual in the listed country. The tax rates displayed are marginal and do not account for deductions, exemptions or rebates. The effective rate is usually lower than the marginal rate. The tax rates given for federations (such as the United States and Canada) are averages and vary depending on the state or province. Territories th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quill Corp

Quill Corporation is an American office supply retailer, founded in 1956, and headquartered in Lincolnshire, Illinois. It services more than one million small and mid-sized U.S. business customers, with access to over one million assorted products. While over 70% of sales are conducted online, it also employs mail-order and direct sales models. It is considered to be among the largest business-to-business direct markets of office supplies in the United States, but it also sells products in other categories such as technology, cleaning & breakroom supplies, furniture, safety products and professional medical equipment through its Quill Healthcare unit. Quill is owned by Staples, Inc., and is recognized as their most profitable division, accounting for about 25% of the company's net income. Between 1998 and 2009, Quill grew from $500 million in revenues to over $1 billion. It employs approximately 500 people and has twelve distribution centers. The president of the Staples subsid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxing And Spending Clause

The Taxing and Spending Clause (which contains provisions known as the General Welfare Clause and the Uniformity Clause), Article I, Section 8, Clause 1 of the United States Constitution, grants the federal government of the United States its power of taxation. While authorizing Congress to levy taxes, this clause permits the levying of taxes for two purposes only: to pay the debts of the United States, and to provide for the common defense and general welfare of the United States. Taken together, these purposes have traditionally been held to imply and to constitute the federal government's taxing and spending power. The text of the constitution reads thus: Background One of the most often claimed defects of the Articles of Confederation was its lack of a grant to the central government of the power to lay and collect taxes. Under the Articles, Congress was forced to rely on requisitions upon the governments of its member states. Without the power to independently raise i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax-free Shopping

Tax-free shopping (TFS) is the buying of goods in another country or state and obtaining a refund of the sales tax which has been collected by the retailer on those goods. The sales tax may be variously described as a sales tax, value added tax, goods and services tax (GST), value added tax (VAT), or consumption tax. Promoting tax-free shopping and making it easier for tourists to claim the refund back has helped to attract travellers to many countries. TFS is subject to national regulations, such as minimum spend and restrictions on the types of products on which it can be claimed. Refunds can only be claimed on goods which are exported. Buying goods tax free does not mean travellers are exempt from paying applicable taxes on their purchases when they get home; however, they will generally be able to benefit from an allowance of a certain amount on import. Tax-free shopping countries Fifty-four of the 130 countries that levy VAT/GST allow foreign visitors to have their taxes rei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Holiday

A tax holiday is a temporary reduction or elimination of a tax. It is synonymous with tax abatement, tax subsidy or tax reduction. Governments usually create tax holidays as incentives for business investment. Tax relief can be provided in the form of property tax concessions to assure the investment of new businesses or the retention of existing ones. Tax holidays have been granted by governments at national, sub-national, and local levels, and have included income, property, sales, VAT, and other taxes. Some tax holidays are extra-statutory concessions, where governing bodies grant a reduction in tax that is not necessarily authorized within the law. In developing countries, governments sometimes reduce or eliminate corporate taxes for the purpose of attracting foreign direct investment or stimulating growth in selected industries. A tax holiday may be granted to particular activities, in particular to develop a given area of business, or to particular taxpayers. Researchers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. Tax exemption generally refers to a statutory exception to a general rule rather than the mere absence of taxation in particular circumstances, otherwise known as an exclusion. Tax exemption also refers to removal from taxation of a particular item rather than a deduction. International duty free shopping may be termed "tax-free shopping". In tax-free shopping, the goods are permanently taken outside the jurisdiction, thus paying taxes is not necessary. Tax-free shopping is also found in ships, airplanes and other vessels traveling ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Streamlined Sales Tax Project

The Streamlined Sales Tax Project (SSTP), first organized in March 2000, is intended to simplify and modernize sales and use tax collection and administration in the United States. It arose in response to efforts by Congress to permanently prohibit states from collecting sales tax on online commerce. Because such a ban would have serious financial consequences for states, the SSTP began as an effort to try to minimize the many differences between the states' sales tax policies and practices. The SSTP was dissolved once the Streamlined Sales and Use Tax Agreement (SSUTA) became effective on October 1, 2005. Mission In prior decisions regarding mail-order sales, the U.S. Supreme Court ruled in 1992 (in the case of Quill Corp. v. North Dakota, 504 U.S. 298) that mail-order retailers were not compelled to collect use tax and remit the tax to states, in part because of the complexities of doing so. With computers, however, the difficulties of doing so are much smaller today, so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchase, al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Best Buy

Best Buy Co. Inc. is an American multinational consumer electronics retailer headquartered in Richfield, Minnesota. Originally founded by Richard M. Schulze and James Wheeler in 1966 as an audio specialty store called Sound of Music, it was rebranded under its current name with an emphasis on consumer electronics in 1983. Best Buy operates internationally in Canada, and formerly operated in China until February 2011 (when the faction was merged with Five Star) and in Mexico until December 2020 (due to the effects of the COVID-19 pandemic). The company also operated in Europe until 2012. Its subsidiaries include Geek Squad, Magnolia Audio Video, and Pacific Sales. Best Buy also operates the Best Buy Mobile and Insignia brands in North America, plus Five Star in China. Best Buy sells cellular phones from Verizon Wireless, AT&T Mobility, T-Mobile, Boost Mobile and Ting Mobile in the United States. In Canada, carriers include Bell Mobility, Rogers Wireless, Telus Mobility, their fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |