|

Underwriter

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a insurance premium, premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyd's Of London

Lloyd's of London, generally known simply as Lloyd's, is an insurance and reinsurance market located in London, England. Unlike most of its competitors in the industry, it is not an insurance company; rather, Lloyd's is a corporate body governed by the Lloyd's Act 1871 and subsequent Acts of Parliament. It operates as a partially-mutualised marketplace within which multiple financial backers, grouped in syndicates, come together to pool and spread risk. These underwriters, or "members", are a collection of both corporations and private individuals, the latter being traditionally known as "Names". The business underwritten at Lloyd's is predominantly general insurance and reinsurance, although a small number of syndicates write term life insurance. The market has its roots in marine insurance and was founded by Edward Lloyd at his coffee house on Tower Street in 1688. Today, it has a dedicated building on Lime Street which is Grade I listed. Traditionally business is tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Special-purpose Acquisition Company

A special purpose acquisition company (SPAC; ), also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making it public without going through the traditional initial public offering process and the associated regulations thereof. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition opportunity within a set timeframe; these opportunities usually have yet to be identified while raising funds. In the United States, SPACs are registered with the SEC and considered publicly-traded companies; the general public may buy their shares on stock exchanges before any merger or acquisition takes place. For this reason they have at times been referred to as the "poor man's private equity funds". The majority of companies pursuing SPACs do so on the Nasdaq or New York Stock Exchange in the United States, althoug ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Underwriting

Mortgage underwriting is the process a lender uses to determine if the risk (especially the risk that the borrower will default ) of offering a mortgage loan to a particular borrower is acceptable and is a part of the larger mortgage origination process. Most of the risks and terms that underwriters consider fall under the five C’s of underwriting: credit, capacity, cashflow, collateral, and character. (This is also known in the UK as the three canons of credit - capacity, collateral, and character.) To help the underwriter assess the quality of the loan, banks and lenders create guidelines and even computer models that analyze the various aspects of the mortgage and provide recommendations regarding the risks involved. However, it is always up to the underwriter to make the final decision on whether to approve or decline a loan. Risks for the lender Risks for the lender are of three forms: interest rate risk, default risk, and prepayment risk. There is a risk to the lende ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Premium

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prospectus (finance)

{{unreferenced, date=October 2015 A prospectus, in finance, is a disclosure document that describes a financial security for potential buyers. It commonly provides investors with material information about mutual funds, stocks, bonds and other investments, such as a description of the company's business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties and any other material information. In the context of an individual securities offering, such as an initial public offering, a prospectus is distributed by underwriters or brokerages to potential investors. Today, prospectuses are most widely distributed through websites such as EDGAR and its equivalents in other countries. United States In a securities offering in the United States, a prospectus is required to be filed with the Securities and Exchange Commission (SEC) as part of a registration statement. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwriting Spread

The underwriting spread is the difference between the amount paid by the underwriting group in a new issue of securities and the price at which securities are offered for sale to the public. It is the underwriter's gross profit margin, usually expressed in points per unit of sale (bond or stock). Spreads may vary widely and are influenced by the underwriter's expectation of market demand for the securities offered for sale, interest rates An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ..., and so on. Components of an underwriting spread in an initial public offering (IPO) typically include the following (on a per share basis): Manager's fee, Underwriting fee—earned by members of the syndicate, and the Concession—earned by the broker-dealer selling the shares. The Manager would b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Institution

Financial institutions, sometimes called banking institutions, are business entities that provide services as intermediaries for different types of financial monetary transactions. Broadly speaking, there are three major types of financial institutions: # Depository institutions – deposit-taking institutions that accept and manage deposits and make loans, including banks, building societies, credit unions, trust companies, and mortgage loan companies; # Contractual institutions – insurance companies and pension funds # Investment institutions – investment banks, underwriters, and other different types of financial entities managing investments. Financial institutions can be distinguished broadly into two categories according to ownership structure: * Commercial banks * Cooperative banks Some experts see a trend toward homogenisation of financial institutions, meaning a tendency to invest in similar areas and have similar business strategies. A consequence of this might ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Market

:''"Primary market" may also refer to a market in art valuation.'' The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, as distinguished from the secondary market, where previously issued securities are bought and sold. "A market is primary if the proceeds of sales go to the issuer of the securities sold." Buyers buy securities that were not previously traded. Concept In a primary market, companies, governments, or public sector institutions can raise funds through bond issues, and corporations can raise capital through the sale of new stock through an initial public offering (IPO). This is often done through an investment bank or underwriter or finance syndicate of securities dealers. The process of selling new shares to buyers is called underwriting. Dealers earn a commission that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

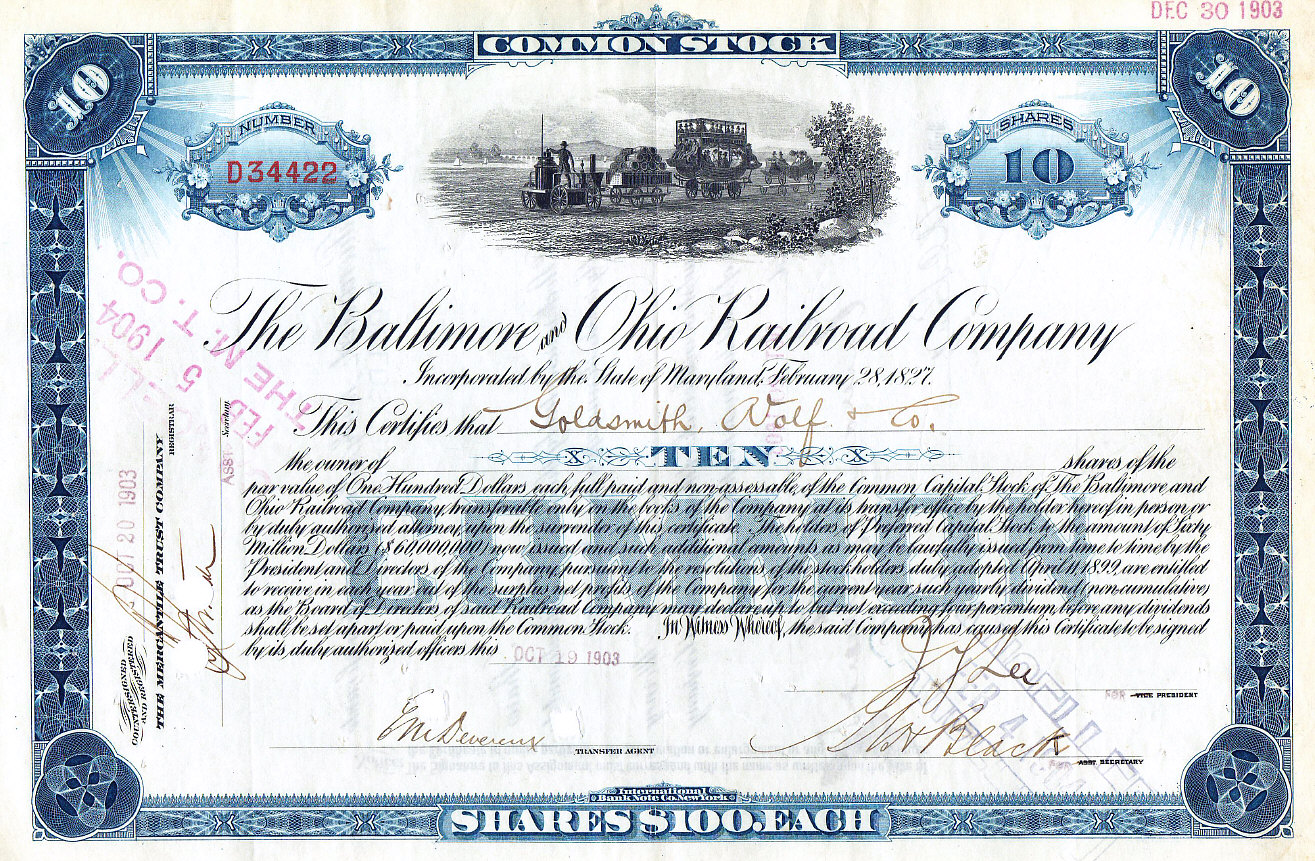

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)