|

Transit Check

A transit check or not on-us check is a negotiable item (check) which is drawn on another bank than that at which it is presented for payment. For example, a check drawn on Bank of America, presented for deposit at Wells Fargo Bank, would be considered a transit item by Wells Fargo, while the same item presented for cash or deposit at Bank of America would be an on-us check. Routing numbers, as well as the bank name printed on the check, help to determine an item's classification. References See also * On-us check * Clearing * Clearing house Clearing house or Clearinghouse may refer to: Banking and finance * Clearing house (finance) * Automated clearing house * ACH Network, an electronic network for financial transactions in the U.S. * Bankers' clearing house * Cheque clearing * Cl ... * Routing number Cheques {{Bank-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

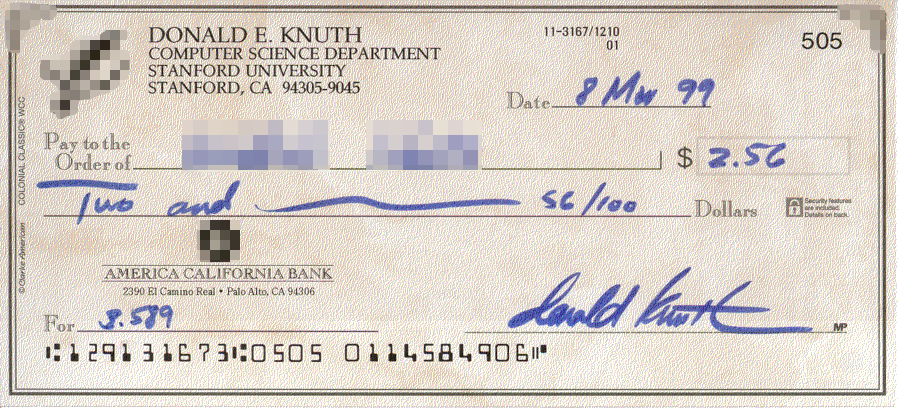

Cheque

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots in the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of America

The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina. The bank was founded in San Francisco. It is the second-largest banking institution in the United States, after JPMorgan Chase, and the second largest bank in the world by market capitalization. Bank of America is one of the Big Four banking institutions of the United States. It serves approximately 10.73% of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial services revolve around commercial banking, wealth management, and investment banking. One branch of its history stretches back to the U.S.-based Bank of Italy, founded by Amadeo Pietro Giannini in 1904, which provided various banking options to Italian immigrants who faced service discrimination. Originally headquartered ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below. Transactions on deposit accounts are recorded in a bank's books, and the resulting balance is recorded as a liability of the bank and represents an amount owed by the bank to the customer. In other words, the banker-customer (depositor) relationship is one of debtor-creditor. Some banks charge fees for transactions on a customer's account. Additionally, some banks pay customers interest on their account balances. Types of accounts * How banking works In banking, the verbs "deposit" and "withdraw" mean a customer paying money into, and taking money out of, an account, respectively. From a legal and financial accounting standpoint, the noun "deposit" is used by the banking industry in financial statements to describe the liability owed b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wells Fargo Bank

Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California; operational headquarters in Manhattan; and managerial offices throughout the United States and internationally. The company has operations in 35 countries with over 70 million customers globally. It is considered a systemically important financial institution by the Financial Stability Board. The firm's primary subsidiary is Wells Fargo Bank, N.A., a national bank which designates its Sioux Falls, South Dakota site as its main office. It is the fourth largest bank in the United States by total assets and is also one of the largest as ranked by bank deposits and market capitalization. Along with JPMorgan Chase, Bank of America and Citigroup. Wells Fargo is one of the "Big Four Banks" of the United States. It has 8,050 branches and 13,000 ATMs. It is one of the most valuable bank brands. Wells Fargo, in its present form, is a result o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

On-us Check

An on-us check is a negotiable item (check) which is drawn on the same bank that it is presented to for payment. For example, a check drawn on Bank of America, presented for deposit at another branch of Bank of America, would be considered an on-us check. The same item presented for deposit at Wells Fargo Bank would be considered a transit check. Routing numbers, as well as the bank name printed on the check, help to determine an item's classification. References See also * Transit check * Clearing * Clearing house Clearing house or Clearinghouse may refer to: Banking and finance * Clearing house (finance) * Automated clearing house * ACH Network, an electronic network for financial transactions in the U.S. * Bankers' clearing house * Cheque clearing * Cl ... * Routing number Cheques {{bank-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ABA Routing Transit Number

In the United States, an ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's (check writer's) bank for debit to the drawer's account. Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution. The Federal Reserve Bank uses ABA RTNs in processing Fedwire funds transfers. The ACH Network also uses ABA RTNs in processing direct deposits, bill payments, and other automated money transfers. Management Since 1911, the American Bankers Association has partnered with a series of registrars, currently Accuity, to manage the ABA routing number system. Accuity is the Official Routing Number Registrar and is responsible for assigning ABA RTNs and managing the ABA RTN system. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

On-us Check

An on-us check is a negotiable item (check) which is drawn on the same bank that it is presented to for payment. For example, a check drawn on Bank of America, presented for deposit at another branch of Bank of America, would be considered an on-us check. The same item presented for deposit at Wells Fargo Bank would be considered a transit check. Routing numbers, as well as the bank name printed on the check, help to determine an item's classification. References See also * Transit check * Clearing * Clearing house Clearing house or Clearinghouse may refer to: Banking and finance * Clearing house (finance) * Automated clearing house * ACH Network, an electronic network for financial transactions in the U.S. * Bankers' clearing house * Cheque clearing * Cl ... * Routing number Cheques {{bank-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing (finance)

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment (for example, in the form of a cheque or electronic payment request) into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks. Description In trading, clearing is necessary because the speed of trades is much faster than the cycle time for completing the underlying transaction. It involves the management of post-trading, pre-settlement credit exposures to ensure that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement. Processes included in clearing are reporting/monitoring, risk margining, netting of trades to single positions, tax handling, and failure handling. Systemically important payment systems (SIPS) are payment systems which have the characteristic th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing House (finance)

A clearing house is a financial institution formed to facilitate the exchange (i.e., '' clearance'') of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms (also known as member firms or participants). Its purpose is to reduce the risk of a member firm failing to honor its trade settlement obligations. Description After the legally binding agreement (i.e., ''execution'') of a trade between a buyer and a seller, the role of the clearing house is to centralize and standardize all of the steps leading up to the payment (i.e. ''settlement'') of the transaction. The purpose is to reduce the cost, settlement risk and operational risk of clearing and settling multiple transactions among multiple parties. In addition to the above services, central counterparty clearing (CCP) takes on counterparty risk by stepping in between the original buyer and seller of a financial contract, such as a derivative. The role of the CCP is to perform t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)