|

Transfer Payments Multiplier

In Keynesian economics, the transfer payments multiplier (or transfer payment multiplier) is the multiplier by which aggregate demand will increase when there is an increase in transfer payments (e.g., welfare spending, unemployment payments). Transfer payments are not in the same theoretical category as government spending on goods and services because such payments are not directly injected into a goods market. Instead, the spendable funds are transferred to a member of the public, who then may spend some or all of them. For this reason, transfer payments are analyzed as negative taxes, and their multiplier is usually considered to be equal in magnitude but opposite in sign (specifically positive rather than negative) from that of taxes. One dollar of transfer payments results in up to one dollar of spending by the recipient. In turn, the recipient of that spending has experienced an increase in income and spends a portion of it on more goods, giving the next person income some ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It specifies the amount of goods and services that will be purchased at all possible price levels. Consumer spending, investment, corporate and government expenditure, and net exports make up the aggregate demand. The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Payments

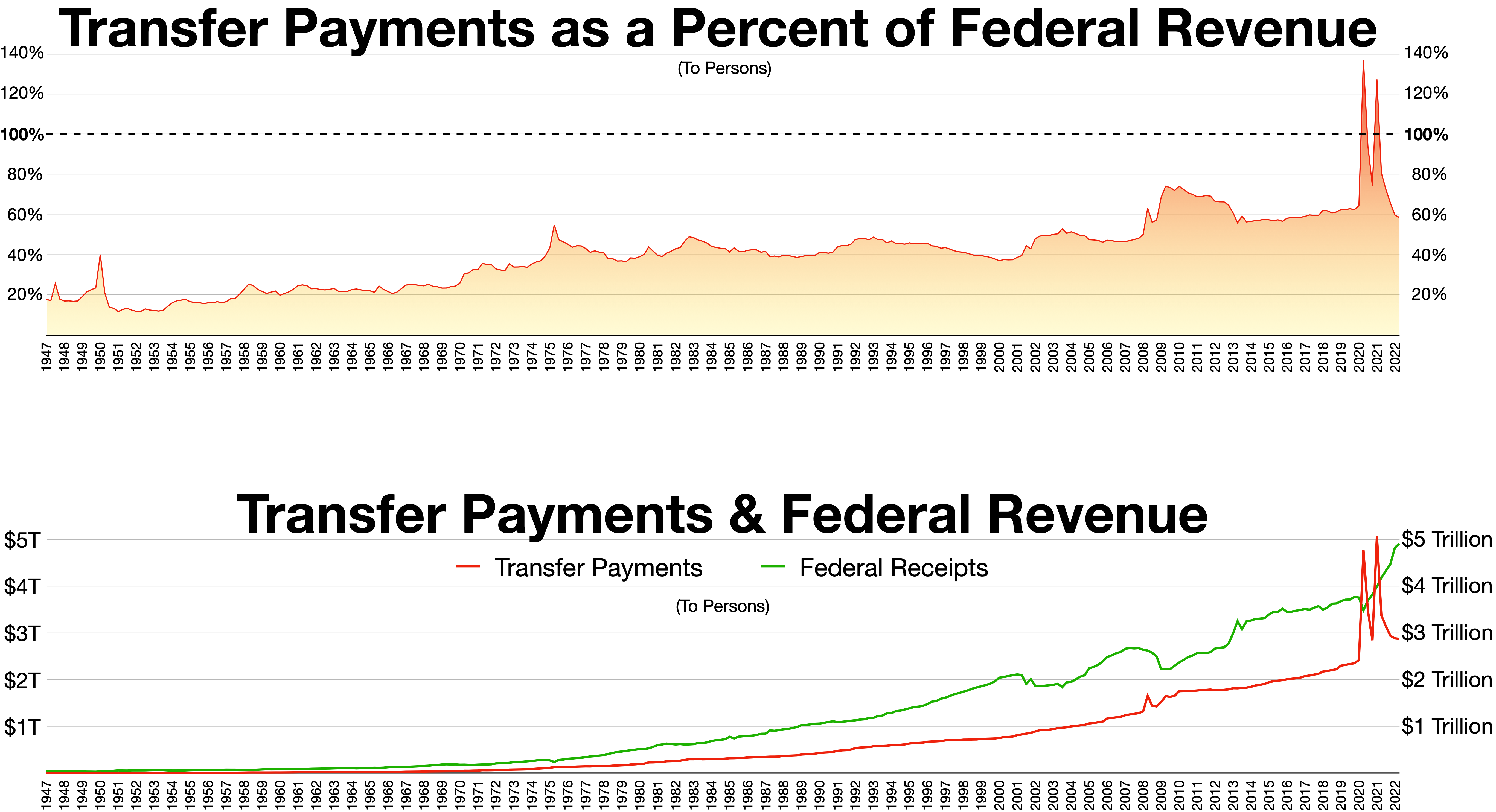

In macroeconomics and finance, a transfer payment (also called a government transfer or simply transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses. Unlike the exchange transaction which mutually benefits all the parties involved in it, the transfer payment consists of a donor and a recipient, with the donor giving up something of value without receiving anything in return. Transfers can be made both between individuals and entities, such as private companies or governmental bodies. These transactions can be both voluntary or involuntary and are generally motivated either by the altruism of the donor or the malevolence of the recipient. For the p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxes

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier may v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physical Capital

Physical capital represents in economics one of the three primary factors of production. Physical capital is the apparatus used to produce a good and services. Physical capital represents the tangible man-made goods that help and support the production. Inventory, cash, equipment or real estate are all examples of physical capital. Definition N.G. Mankiw definition from the book Economics: '' Capital is the equipment and structures used to produce goods and services. Physical capital consists of man-made goods (or input into the process of production) that assist in the production process. Cash, real estate, equipment, and inventory are examples of physical capital.'' Capital goods represents one of the key factors of corporation function. Generally, capital allows a company to preserve liquidity while growing operations, it refers to physical assets in business and the way a company have reached their physical capital. While referring how companies have obtained their capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Durables

In economics, a durable good or a hard good or consumer durable is a good that does not quickly wear out or, more specifically, one that yields utility over time rather than being completely consumed in one use. Items like bricks could be considered perfectly durable goods because they should theoretically never wear out. Highly durable goods such as refrigerators or cars usually continue to be useful for several years of use, so durable goods are typically characterized by long periods between successive purchases. Durable goods are known to form an imperative part of economic production. This can be exemplified from the fact that personal expenditures on durables exceeded the total value of $800 billion in 2000. In the year 2000 itself, durable goods production composed of approximately 60 percent of aggregate production within the manufacturing sector in the United States. Examples of consumer durable goods include bicycles, books, household goods (home appliances, consumer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Multiplier

In economics, the fiscal multiplier (not to be confused with the money multiplier) is the ratio of change in national income arising from a change in government spending. More generally, the exogenous spending multiplier is the ratio of change in national income arising from any autonomous change in spending (including private investment spending, consumer spending, government spending, or spending by foreigners on the country's exports). When this multiplier exceeds one, the enhanced effect on national income may be called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased income and hence increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complex Multiplier

:''This article deals with the concept in economics. For the multiplication of complex numbers, see Complex number#Multiplication.'' The complex multiplier is the multiplier principle in Keynesian economics (formulated by John Maynard Keynes). The simplistic multiplier that is the reciprocal of the marginal propensity to save is a special case used for illustrative purposes only. The multiplier applies to any change in autonomous expenditure, in other words, an externally induced change in consumption, investment, government expenditure or net exports. Each of these operates to increase or reduce the equilibrium level of income in the economy. * any increase to an injection will be multiplied to result in a higher level of aggregate expenditure. * Any decrease in an injection will be multiplied to result in a lower level of aggregate expenditure. * Any increase in a withdrawal will be multiplied to result in a lower level of aggregate expenditure. and... *Any decrease in a with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics Effects

Economics () is the social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on these elements. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating "what ought to be"; between economic theory and applied economics; between rational and beh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |