|

Taxpayer Bill Of Rights 2

The Taxpayer Bill of Rights 2 () is an Act of Congress. Among other things, it created the Office of the Taxpayer Advocate. The Office of the Taxpayer Advocate The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service (TAS), is an office within the Internal Revenue Service (IRS) of the U.S. Department of the Treasury, reporting directly to the Commissioner of Internal Revenue. The ... was run by the Taxpayer Advocate. The function of the advocate was to do the following: * Assist taxpayers in resolving problems with the Internal Revenue Service * Identify areas in which taxpayers have problems in dealings with the Internal Revenue Service * To the extent possible, propose changes in the administrative practices of the Internal Revenue Service to mitigate problems identified under the clause above * Identify potential legislative changes which may be appropriate to mitigate such problems. The Taxpayer Advocate also had to do yearly reports no later than De ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code Of 1986

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nancy Johnson

Nancy Elizabeth Lee Johnson (born January 5, 1935) is an American lobbyist and politician from the state of Connecticut. Johnson was a Republican member of the United States House of Representatives from 1983 to 2007, representing the 6th district and later the 5th District after reapportionment. In September 2007, Johnson began lobbying for Baker, Donelson, Bearman, Caldwell & Berkowitz, PC in Washington, D.C. Early life, education, and early career Nancy Johnson was born in Chicago. She graduated from the University of Chicago Laboratory School (high school) in 1953, and from Radcliffe College of Harvard University in 1957. She attended the University of London's Courtauld Institute of Art in 1957 and 1958. She later moved to New Britain, Connecticut, where she lives today. She was an active volunteer in the schools and social service agencies of her community, before serving in the Connecticut Senate from 1977 to 1983. House of Representatives Elections Johnso ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Committee On Ways And Means

The Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other programs including Social Security, unemployment benefits, Medicare, the enforcement of child support laws, Temporary Assistance for Needy Families, foster care, and adoption programs. Members of the Ways and Means Committee are not allowed to serve on any other House Committee unless they are granted a waiver from their party's congressional leadership. It has long been regarded as the most prestigious committee of the House of Representatives. The United States Constitution requires that all bills regarding taxation must originate in the U.S. House of Representatives, and House rules dictate that all bills regarding taxation must pass through Ways and Means. This system imparts upon the committee and its members a significant degree of influe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill Clinton

William Jefferson Clinton ( né Blythe III; born August 19, 1946) is an American politician who served as the 42nd president of the United States from 1993 to 2001. He previously served as governor of Arkansas from 1979 to 1981 and again from 1983 to 1992, and as attorney general of Arkansas from 1977 to 1979. A member of the Democratic Party, Clinton became known as a New Democrat, as many of his policies reflected a centrist "Third Way" political philosophy. He is the husband of Hillary Clinton, who was a senator from New York from 2001 to 2009, secretary of state from 2009 to 2013 and the Democratic nominee for president in the 2016 presidential election. Clinton was born and raised in Arkansas and attended Georgetown University. He received a Rhodes Scholarship to study at University College, Oxford and later graduated from Yale Law School. He met Hillary Rodham at Yale; they married in 1975. After graduating from law school, Clinton returned to Arkansas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

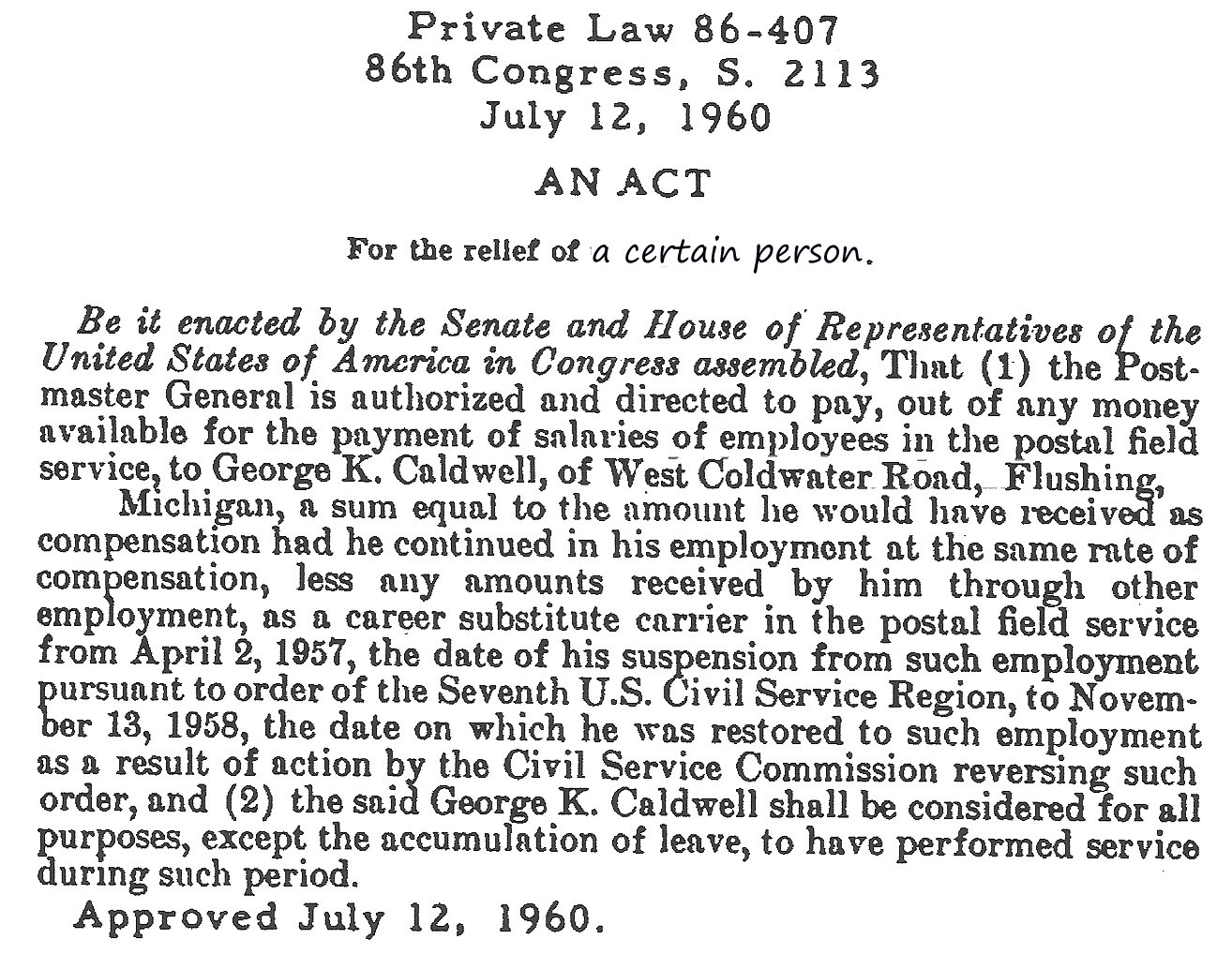

Act Of Congress

An Act of Congress is a statute enacted by the United States Congress. Acts may apply only to individual entities (called Public and private bills, private laws), or to the general public (Public and private bills, public laws). For a Bill (law), bill to become an act, the text must pass through both houses with a majority, then be either signed into law by the president of the United States, be left unsigned for ten days (excluding Sundays) while Congress remains in session, or, if vetoed by the president, receive a congressional override from of both houses. Public law, private law, designation In the United States, Acts of Congress are designated as either public laws, relating to the general public, or private laws, relating to specific institutions or individuals. Since 1957, all Acts of Congress have been designated as "Public Law X–Y" or "Private Law X–Y", where X is the number of the Congress and Y refers to the sequential order of the bill (when it was enacted). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of The Taxpayer Advocate

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service (TAS), is an office within the Internal Revenue Service (IRS) of the U.S. Department of the Treasury, reporting directly to the Commissioner of Internal Revenue. The office is under the supervision and direction of the National Taxpayer Advocate who is appointed by the Secretary of Treasury. History Established in 1996, the Office of the Taxpayer Advocate has its origins in other Internal Revenue Service programs, such as the Taxpayer Service Program (formalized in 1963) and Problem Resolution Program (established in 1977). On the recommendation of the House Government Operations Committee, the Taxpayer Ombudsman was established within the Office of the IRS Commissioner in 1979, reporting directly to the Commissioner of Internal Revenue. In 1984, the problem resolution offices (PRO) consisted of 80 full time employees and was headed by George A. O'Hanlon, the IRS ombudsman at the time. Commentators ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxpayer Bill Of Rights III

The Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III (), resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986. The bill was passed in the Senate unanimously, and was seen as a major reform of the Internal Revenue Service. Provisions Individuals The Act provides that individuals who fail to provide their taxpayer identification numbers are not allowed to take the earned income credit for the year in which the failure occurs. Individuals are allowed to deduct interest expense paid on certain student loans. The exclusion, from income, of gain on the sale of a principal residence (up to $250,000 for individuals or $500,000 on a joint return) is pro-rated for certain taxpayers. The use of a continuous levy—a levy attaching to both property held on the date of levy and to property acquired after that date—must be specifically app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Acts Of The 104th United States Congress

The Acts of the Apostles ( grc-koi, Πράξεις Ἀποστόλων, ''Práxeis Apostólōn''; la, Actūs Apostolōrum) is the fifth book of the New Testament; it tells of the founding of the Christian Church and the spread of its message to the Roman Empire. It gives an account of the ministry and activity of Christ's apostles in Jerusalem and other regions, after Christ's death, resurrection, and ascension. Acts and the Gospel of Luke make up a two-part work, Luke–Acts, by the same anonymous author. It is usually dated to around 80–90 AD, although some scholars suggest 90–110. The first part, the Gospel of Luke, tells how God fulfilled his plan for the world's salvation through the life, death, and resurrection of Jesus of Nazareth. Acts continues the story of Christianity in the 1st century, beginning with the ascension of Jesus to Heaven. The early chapters, set in Jerusalem, describe the Day of Pentecost (the coming of the Holy Spirit) and the growth of the chur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.png)

.jpg)