|

Taxation In Sri Lanka

Taxation in Sri Lanka mainly includes excise duties, value added tax, income tax and tariffs. Tax revenue is a primary constituent of the government's fiscal policy. The Government of Sri Lanka imposes taxes mainly of two types in the forms of direct taxes and indirect taxes. As of 2018 CBSL report, taxes are the most important revenue source for the government, contributing 89% of the revenue. The tax revenue to GDP ratio is just about 11.6 percent as of 2018, which is one of the lowest rates among the upper-middle income earning countries. At present, the government of Sri Lanka also face major challenges regarding the continuous budget deficits where government expenditures have exceeded the government tax revenue. Indirect taxes in the forms of excise duties, VAT and tariffs are the key contributors to the government tax revenue with 74% while direct taxes including income tax, Pay-as-you-earn tax and Economic Service Charge contribute only around 9%. However the tax regi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Duties

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

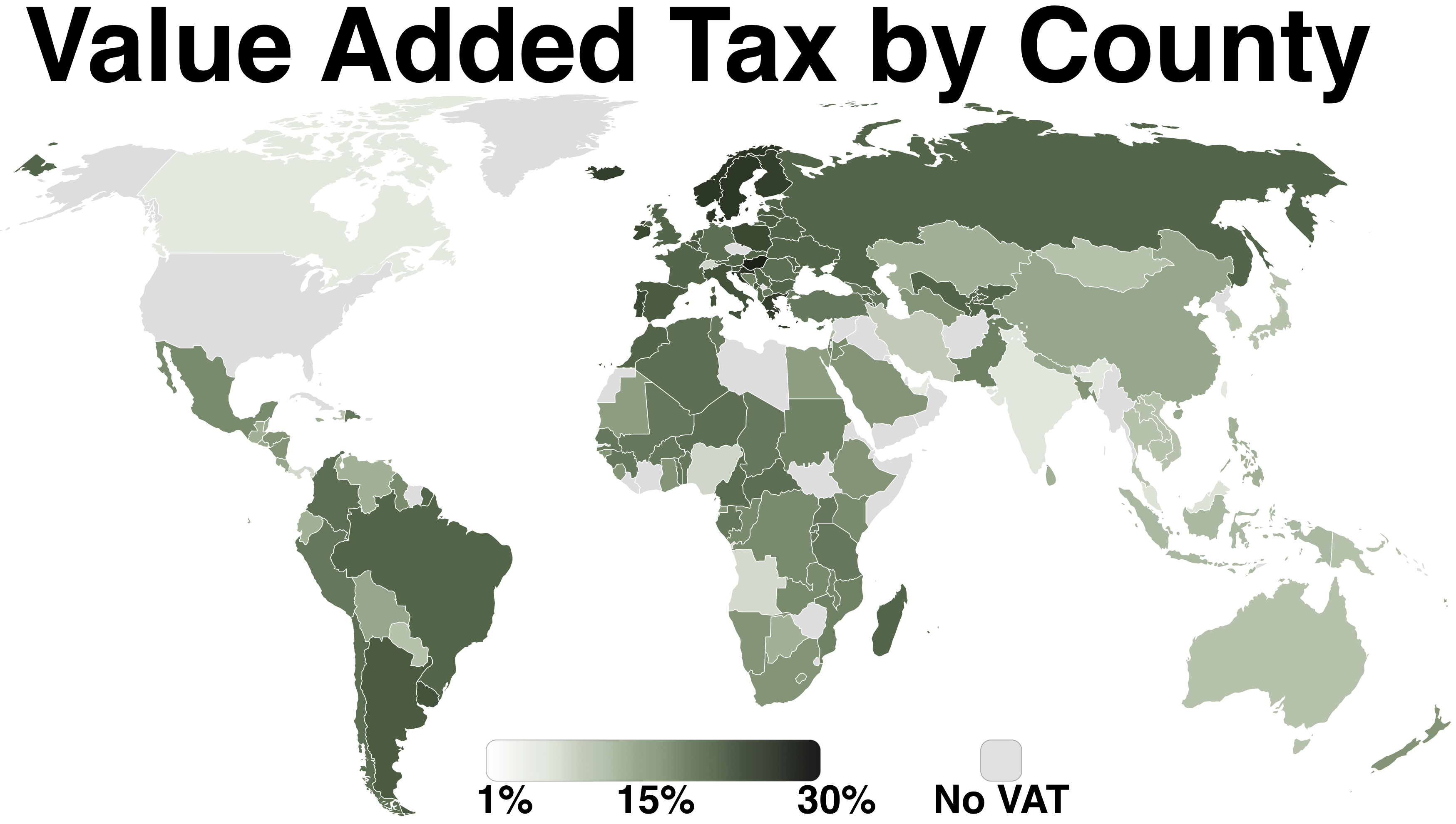

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariffs

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation (which is considered "healthy" at the level in the range 2%–3%) and to increase employment. Additionally, it is designed to try to k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Sri Lanka

The Government of Sri Lanka (GoSL) ( si, ශ්රී ලංකා රජය, Śrī Lankā Rajaya; ta, இலங்கை அரசாங்கம்) is a parliamentary system determined by the Sri Lankan Constitution. It administers the island from both its commercial capital of Colombo and the administrative capital of Sri Jayawardenepura Kotte. Constitution The Constitution of Sri Lanka has been the constitution of the island nation of Sri Lanka since its original promulgation by the National State Assembly on 7 September 1978. It is Sri Lanka's second republican constitution and its third constitution since the country's independence (as Ceylon) in 1948. As of October 2020, it has been formally amended 21 times. Executive branch The President, directly elected for a five-year term, is head of state, chief executive, and commander-in-chief of the armed forces. The election occurs under the Sri Lankan form of the contingent vote. Responsible to Parliament for the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank Of Sri Lanka

The Central Bank of Sri Lanka ( CBSL; si, ශ්රී ලංකා මහ බැංකුව, Sri Lanka Maha Bankuwa) is the monetary authority of Sri Lanka. It was established in 1950 under the Monetary Law Act No.58 of 1949 (MLA), it is a semi-autonomous body, and following the amendments to the MLA in December 2002, is governed by a five-member Monetary Board, comprising the Governor as chairman, the Secretary to the Ministry of Finance and Planning, and three members appointed by the President of Sri Lanka, on the recommendation of the Minister of Finance, with the concurrence of the Constitutional Council. History The Central Bank of Sri Lanka was established in 1950, two years after independence. The founder governor of the Central Bank of Sri Lanka was John Exter, while the minister of finance at the time was J. R. Jayewardene. Under the former name of Central Bank of Ceylon, it replaced the Currency Board that until then had been responsible for issuing the country's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pay-as-you-earn Tax

A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding tax, withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax. United Kingdom Origins Devised by Sir Paul Chambers, PAYE was introduced into the UK in 1944, following trials in 1940–1941. As with many of the United Kingdom's institutional arrangements, the way in which the state collects income tax through PAYE owes much of its form and structure to the peculiarities of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2019 Sri Lankan Presidential Election

Nineteen or 19 may refer to: * 19 (number), the natural number following 18 and preceding 20 * one of the years 19 BC, AD 19, 1919, 2019 Films * ''19'' (film), a 2001 Japanese film * ''Nineteen'' (film), a 1987 science fiction film Music * 19 (band), a Japanese pop music duo Albums * ''19'' (Adele album), 2008 * ''19'', a 2003 album by Alsou * ''19'', a 2006 album by Evan Yo * ''19'', a 2018 album by MHD * ''19'', one half of the double album ''63/19'' by Kool A.D. * ''Number Nineteen'', a 1971 album by American jazz pianist Mal Waldron * ''XIX'' (EP), a 2019 EP by 1the9 Songs * "19" (song), a 1985 song by British musician Paul Hardcastle. * "Nineteen", a song by Bad4Good from the 1992 album '' Refugee'' * "Nineteen", a song by Karma to Burn from the 2001 album ''Almost Heathen''. * "Nineteen" (song), a 2007 song by American singer Billy Ray Cyrus. * "Nineteen", a song by Tegan and Sara from the 2007 album '' The Con''. * "XIX" (song), a 2014 song by Slipk ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carbon Tax

A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Carbon taxes are intended to make visible the "hidden" social costs of carbon emissions, which are otherwise felt only in indirect ways like more severe weather events. In this way, they are designed to reduce carbon dioxide ( ) emissions by increasing prices of the fossil fuels that emit them when burned. This both decreases demand for goods and services that produce high emissions and incentivizes making them less carbon-intensive. In its simplest form, a carbon tax covers only CO2 emissions; however, it could also cover other greenhouse gases, such as methane or nitrous oxide, by taxing such emissions based on their CO2-equivalent global warming potential. When a hydrocarbon fuel such as coal, petroleum, or natural gas is burned, most or all of its carbon is converted to . Greenhouse gas emissions cause climate change, which damages the environment and human health. This negative ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gotabaya Rajapaksa

Lieutenant Colonel Nandasena Gotabaya Rajapaksa ( si, නන්දසේන ගෝඨාභය රාජපක්ෂ; ta, நந்தசேன கோட்டாபய ராஜபக்ஷ; born 20 June 1949) is a former Sri Lankan military officer and politician, who served as the eighth President of Sri Lanka from 18 November 2019 until his resignation on 14 July 2022. He previously served as Secretary to the Ministry of Defence and Urban Development from 2005 to 2015 under the administration of his elder brother former President Mahinda Rajapaksa, during the final phase of the Sri Lankan Civil War. Born to a political family from the Southern Province, Rajapaksa was educated at Ananda College, Colombo and joined the Ceylon Army in April 1971. Following basic training at the Army Training Centre, Diyatalawa, he was commissioned as signals officer and later transferred to several infantry regiments. He saw active service in the early stages of the Sri Lankan Civil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other. If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance. As of 2016, about 60 out of 200 countries have a trade surplus. The notion that bilateral trade deficits are bad in and of themselves is overwhelmingly rejected by trade experts and economists. Explanation The balance of trade forms part of the current account, which includes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)