|

Tax-Sharing Reform Of China In 1994

China's Tax-Sharing Reform in 1994 was a fiscal and taxation system reform initiated by the Chinese government in 1992, prepared and promulgated in 1993, and finally implemented in 1994. The reform was a large-scale adjustment of the tax distribution system and tax structure between the central and local governments, which was regarded as a milestone in the transition of China's fiscal system from planned economy to market economy. The main purpose of the tax-sharing reform is to alleviate the budget deficit since the end of the 1980s. As the reform achieved indeed remarkable results, it yet evoked problems like heavier financial burden of local governments. In order to make ends meet, governments started to let lands (also known as land finance) which eventually pushed up the land and housing price. Therefore, the tax-sharing reform is considered to be the reason of China's severe land finance. History In 1978, since China implemented the reform and opening up policy, China gra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation System

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but mos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1994 In China

The following lists events from 1994 in China. Incumbents *General Secretary of the Communist Party: Jiang Zemin *President: Jiang Zemin * Premier: Li Peng *Vice President: Rong Yiren * Vice Premier: Zhu Rongji Governors * Governor of Anhui Province – Fu Xishou then Hui Liangyu * Governor of Fujian Province – Jia Qinglin then Chen Mingyi * Governor of Gansu Province – Zhang Wule then Sun Ying * Governor of Guangdong Province – Zhu Senlin then Lu Ruihua * Governor of Guizhou Province – Chen Shineng then Wu Yixia * Governor of Hainan Province – Ruan Chongwu * Governor of Hebei Province – Ye Liansong * Governor of Heilongjiang Province – Shao Qihui then Tian Fengshan * Governor of Henan Province – Ma Zhongchen * Governor of Hubei Province – Jia Zhijie then Jiang Zhuping * Governor of Hunan Province – Chen Bangzhu then Yang Zhengwu * Governor of Jiangsu Province – Chen Huanyou th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross National Product

The gross national income (GNI), previously known as gross national product (GNP), is the total domestic and foreign output claimed by residents of a country, consisting of gross domestic product (GDP), plus factor incomes earned by foreign residents, minus income earned in the domestic economy by nonresidents. Comparing GNI to GDP shows the degree to which a nation's GDP represents domestic or international activity. GNI has gradually replaced GNP in international statistics. While being conceptually identical, it is calculated differently. GNI is the basis of calculation of the largest part of contributions to the budget of the European Union. In February 2017, Ireland's GDP became so distorted from the base erosion and profit shifting ("BEPS") tax planning tools of U.S. multinationals, that the Central Bank of Ireland replaced Irish GDP with a new metric, Irish Modified GNI (or "GNI*"). In 2017, Irish GDP was 162% of Irish Modified GNI. Comparison of GNI and GDP \mat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

People's Bank Of China

The People's Bank of China (officially PBC or informally PBOC; ) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in mainland China, as determined by the People's Bank Law and the Commercial Bank Law. It is a cabinet-level executive department of the State Council. History The bank was established on December 1, 1948, based on the consolidation of the Huabei Bank, the Beihai Bank and the Xibei Farmer Bank. The headquarters was first located in Shijiazhuang, Hebei, and then moved to Beijing in 1949. Between 1950 and 1978 the PBC was the only bank in the People's Republic of China and was responsible for both central banking and commercial banking operations. All other banks within Mainland China such as the Bank of China were either organized as divisions of the PBC or were non-deposit taking agencies. From 1952 to 1955 government shares were added to private banks to make state-p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Tax

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid. The process of transferring assets and wealth to the upcoming generations is known as estate planning. It involves planning for transfers at death or during life. One such instrument is the right to transfer assets to another person known as gift-giving, or with the goal of reducing one's taxable wealth when the donor still lives. For fulfilling the crit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deed Sale

A tax sale is the forced sale of property (usually real estate) by a governmental entity for unpaid taxes by the property's owner. The sale, depending on the jurisdiction, may be a tax deed sale (whereby the actual property is sold) or a tax lien sale (whereby a lien on the property is sold) Under the tax lien sale process, depending on the jurisdiction, after a specified period of time if the lien is not redeemed, the lienholder may seek legal action which will result in the lienholder either automatically obtaining the property, or forcing a future tax deed sale of the property and possibly obtaining the property as a result. General The governmental entity can be any level of government that can assess and collect property taxes or other governmental debt, such as counties (parishes, in the case of Louisiana), cities, townships (in New England and other jurisdictions), and school districts (in places where they are independent of other governmental jurisdictions, such as in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stamp Duty Land Tax

Stamp duty in the United Kingdom is a form of tax charged on legal instruments (written documents), and historically required a physical stamp to be attached to or impressed upon the document in question. The more modern versions of the tax no longer require a physical stamp. History of UK stamp duties Stamp duty was first introduced in England on 28 June 1694, during the reign of William III and Mary II, under "An act for granting to their Majesties several duties upon vellum, parchment and paper, for four years, towards carrying on the war against France". Dagnall, H. (1994) ''Creating a Good Impression: three hundred years of The Stamp Office and stamp duties.'' London: HMSO, p. 3. In the 1702/03 financial year 3,932,933 stamps were embossed in England for a total value of £91,206.10s.4d. Stamp duty was so successful that it continues to this day through a series of Stamp Acts. Similar duties have been levied in the Netherlands, France and elsewhere. During the 18th an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheritance or gift and taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or geographical region or a municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted to a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy on the value of land, excluding the value of buildings and other improvements. Under a p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption Tax

A consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on Consumption (economics), consumption. Consumption taxes are usually indirect, such as a sales tax or a value-added tax. However, a consumption tax can also be structured as a form of direct, personal taxation, such as the Hall–Rabushka flat tax. Types Value-added tax A value-added tax applies to the market value added to a product or material at each stage of its manufacture or distribution. For example, if a retailer buys a shirt for twenty dollars and sells it for thirty dollars, this tax would apply to the ten dollar difference between the two amounts. A simple value-added tax is proportional tax, proportional to consumption but is regressive tax, regressive on income at higher income levels, as consumption tends to fall as a percentage of income as income rises. Savings and investment are tax-deferred until they become consumption. A value-added t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation (which is considered "healthy" at the level in the range 2%–3%) and to increase employment. Additionally, it is designed to try to k ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value-added Tax

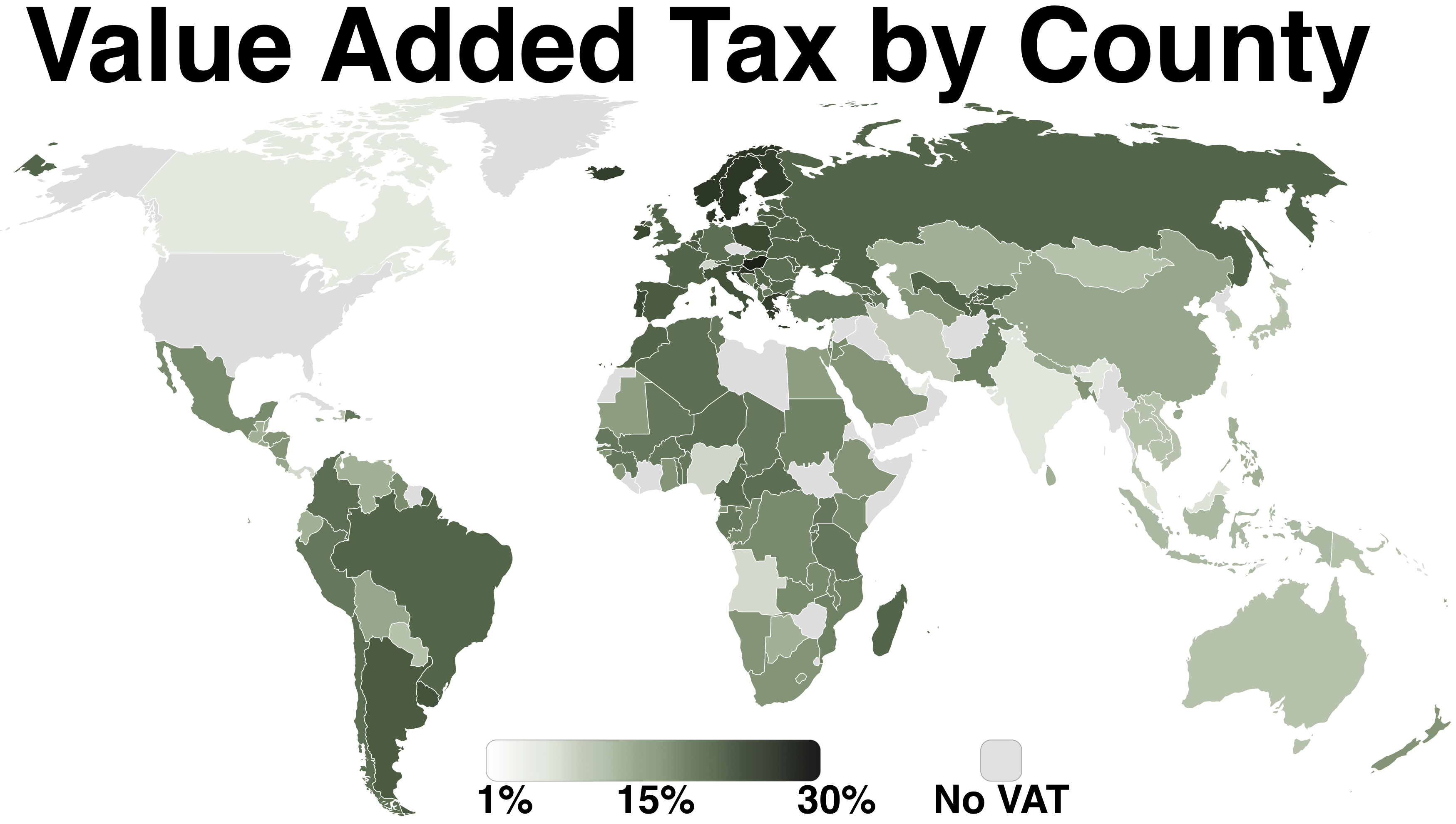

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)