|

TFSA

A tax-free savings account (TFSA, french: links=no, Compte d'épargne libre d'impôt, CELI) is an account available in Canada that provides tax benefits for saving. Investment income, including capital gains and dividends, earned in a TFSA is not taxed in most cases, even when withdrawn. Contributions to a TFSA are not deductible for income tax purposes, unlike contributions to a registered retirement savings plan (RRSP). Despite the name, a TFSA does not have to be a cash savings account. Like an RRSP, a TFSA may contain cash and/or other investments such as mutual funds, segregated funds, certain stocks, bonds, or guaranteed investment certificates (GICs). The cash on hand in a TFSA collects interest just like a regular savings account, except that the interest is tax free. History The first tax-free savings account was introduced by Jim Flaherty, then Canadian federal Minister of Finance, in the 2008 federal budget. It came into effect on January 1, 2009. This measure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jim Flaherty

James Michael Flaherty (December 30, 1949 – April 10, 2014) was a Canadian politician who served as the federal minister of finance from 2006 to 2014 under Conservative Prime Minister Stephen Harper. First elected to the Legislative Assembly of Ontario in 1995 under the Progressive Conservative (PC) banner, Flaherty would sit as a member of Provincial Parliament (MPP) until 2006, also serving in a number of Cabinet positions from 1997 to 2002 during Premier Mike Harris' government. He unsuccessfully ran for the PC leadership twice. Flaherty entered federal politics and ran for the Conservative Party in the 2006 election. With his party forming government, Prime Minister Harper named Flaherty as finance minister. As finance minister, Flaherty cut the goods and services tax from 7 percent to 5 percent, introduced the tax-free savings account, and combatted the 2008 financial crisis; the $55.6 billion deficit from the crisis was eliminated in 2014 as a result of major spe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Canadian Federal Budget

The Canadian federal budget for the 2008-2009 fiscal year was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on February 26, 2008. The budget included a surplus of $10.2 billion to be applied to pay down federal debt, and the introduction of the Tax-Free Savings Account (TFSA). The government announced there would be little to no new tax breaks as major tax cuts took place in the economic update during the fall of 2007 in anticipation of economic slowdowns in 2008. It was to be the last budget of the Conservative government's first term in office. The budget was deemed ordinary and uncontroversial by the press. The Liberal party had pledged not to push for an election in the spring of 2008, and so guaranteed their support for the budget. The Bloc Québécois had submitted a long list of budgetary demands to be met, which effectively eliminated them from budget negotiations. They voted against the budget. Highlights The 2008 budget was tabled on Febru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Segregated Fund

A segregated fund or seg fund is a type of investment fund administered by Canadian insurance companies in the form of individual, variable life insurance contracts offering certain guarantees to the policyholder such as reimbursement of capital upon death. As required by law, these funds are fully segregated from the company's general investment funds, hence the name. A segregated fund is analogous to the U.S. insurance industry "separate account" and related insurance and annuity products. Usage A segregated fund is an investment fund that combines the growth potential of a mutual fund with the security of a life insurance policy. Segregated funds are often referred to as "mutual funds with an insurance policy wrapper". Like mutual funds, segregated funds consist of a pool of investments in securities such as bonds, debentures, and stocks. The value of the segregated fund fluctuates according to the market value of the underlying securities. Segregated funds do not issue units ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2015 Canadian Federal Budget

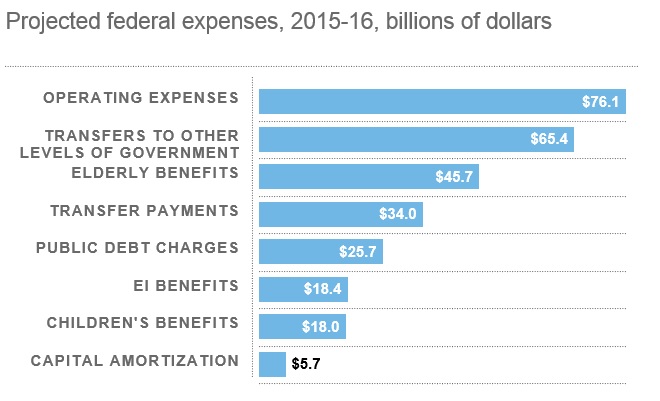

The Canadian federal budget for fiscal year 2015–2016 was presented to the House of Commons of Canada by Joe Oliver (politician), Joe Oliver on 21 April 2015. This was the last budget before the 2015 Canadian federal election, 2015 federal election. The budget was supposed to be presented in February or March before the fiscal year began on April 1, but was delayed because of the steep drop in oil prices in the winter of 2014–15. A surplus of $1.4 billion was projected for the fiscal year 2015-2016, however this was adjusted by the new government to a deficit of $1.0 billion by end of March 2016. This was later adjusted to $2.9 billion after reflecting a change requested by the Auditor General dating back 10 years' worth of federal budgets, specifically with regards to the discount rate methodology used to determine the present value of the Government's unfunded pension obligations. Programs Child care The Universal Child Care Benefit will be increased to $1,920 per year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return, however its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisition a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. Overview A CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically. Sub-indices and sub-sub-indices can be computed for different categories and sub-categories of goods and services, being combined to produce the overall index with weights reflecting their shares in the total of the consumer expenditures covered by the index. It is one of several price indices calculated by most national statistical agencies. The annual percentage change in a CPI is used as a measure of inflation. A CPI can be used to index (i.e. adjust for the effect of inflation) the real value of wages, salaries, and pensions; to regulate prices; and to deflate monetary magnitudes to show changes in real values. In most c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Globe And Mail

''The Globe and Mail'' is a Canadian newspaper printed in five cities in western and central Canada. With a weekly readership of approximately 2 million in 2015, it is Canada's most widely read newspaper on weekdays and Saturdays, although it falls slightly behind the ''Toronto Star'' in overall weekly circulation because the ''Star'' publishes a Sunday edition, whereas the ''Globe'' does not. ''The Globe and Mail'' is regarded by some as Canada's " newspaper of record". ''The Globe and Mail''s predecessors, '' The Globe'' and ''The Mail and Empire'' were both established in the 19th century. The former was established in 1844, while the latter was established in 1895 through a merger of ''The Toronto Mail'' and the ''Toronto Empire''. In 1936, ''The Globe'' and ''The Mail and Empire'' merged to form ''The Globe and Mail''. The newspaper was acquired by FP Publications in 1965, who later sold the paper to the Thomson Corporation in 1980. In 2001, the paper merged with broadcast ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Year

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner ( non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Taxpayers Federation

The Canadian Taxpayers Federation (CTF; french: Fédération canadienne des contribuables, link=no) is a federally incorporated, non-profit organization in Canada. It claimed 30,517 donors and 215,009 supporters in 2018–19. Voting membership, however, is restricted to the board of directors. According to its by-laws, the board "can have as few as three and as many as 20" members. In 2017, it reportedly had a voting membership of six board members, and in 2020 it had four.https://www.taxpayer.com/about/board/ It describes itself as a taxpayers advocacy group, and the organization advocates lower taxes, less waste, and an increase in government accountability. It was founded in Saskatchewan in 1990 through a merger of the Association of Saskatchewan Taxpayers and the Resolution One Association of Alberta. The CTF maintains a federal office in Ottawa, and has staff based in Calgary, Vancouver, Victoria, Edmonton, Regina, Toronto, Montreal and Halifax. Provincial offices conduct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral treaties are also in place. For example, European Union (EU) countries are parties to a multilateral agreement with respect to value added taxes under auspices of the EU, while a joint treaty on mutual administrative assistance of the Council of Europe and the Organisation for Economic Co-operation and Development (OECD) is open to all countries. Tax treaties tend to reduce taxes of one treaty country for residents of the other treaty country to reduce double taxation of the same income. The provisions and goals vary significantly, with very few tax treaties being alike. Most treaties: * define which taxes are covered and who is a resident and eligible for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |