|

Treasury Regulations

Treasury Regulations are the tax regulations issued by the United States Internal Revenue Service (IRS), a bureau of the United States Department of the Treasury. These regulations are the Treasury Department's official interpretations of the Internal Revenue Code and are one source of U.S. federal income tax law. Authority and citations Section 7805 of the Internal Revenue Code gives the United States Secretary of the Treasury the power to create the necessary rules and regulations for enforcing the Internal Revenue Code. These regulations, including but not limited to the "Income Tax Regulations," are located in Title 26 of the Code of Federal Regulations, or "C.F.R." Each regulation is generally organized to correspond to the Internal Revenue Code section interpreted by that regulation. Citations to the Treasury Regulations may appear in different formats. For instance, the definition of gross income in the regulations may be cited to as "26 C.F.R. 1.61-1" or as "Treas. Reg. 1.6 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitutio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of The Treasury

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes. The depart ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code (USC). It is organized topically, into subtitles and sections, covering income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not separately organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

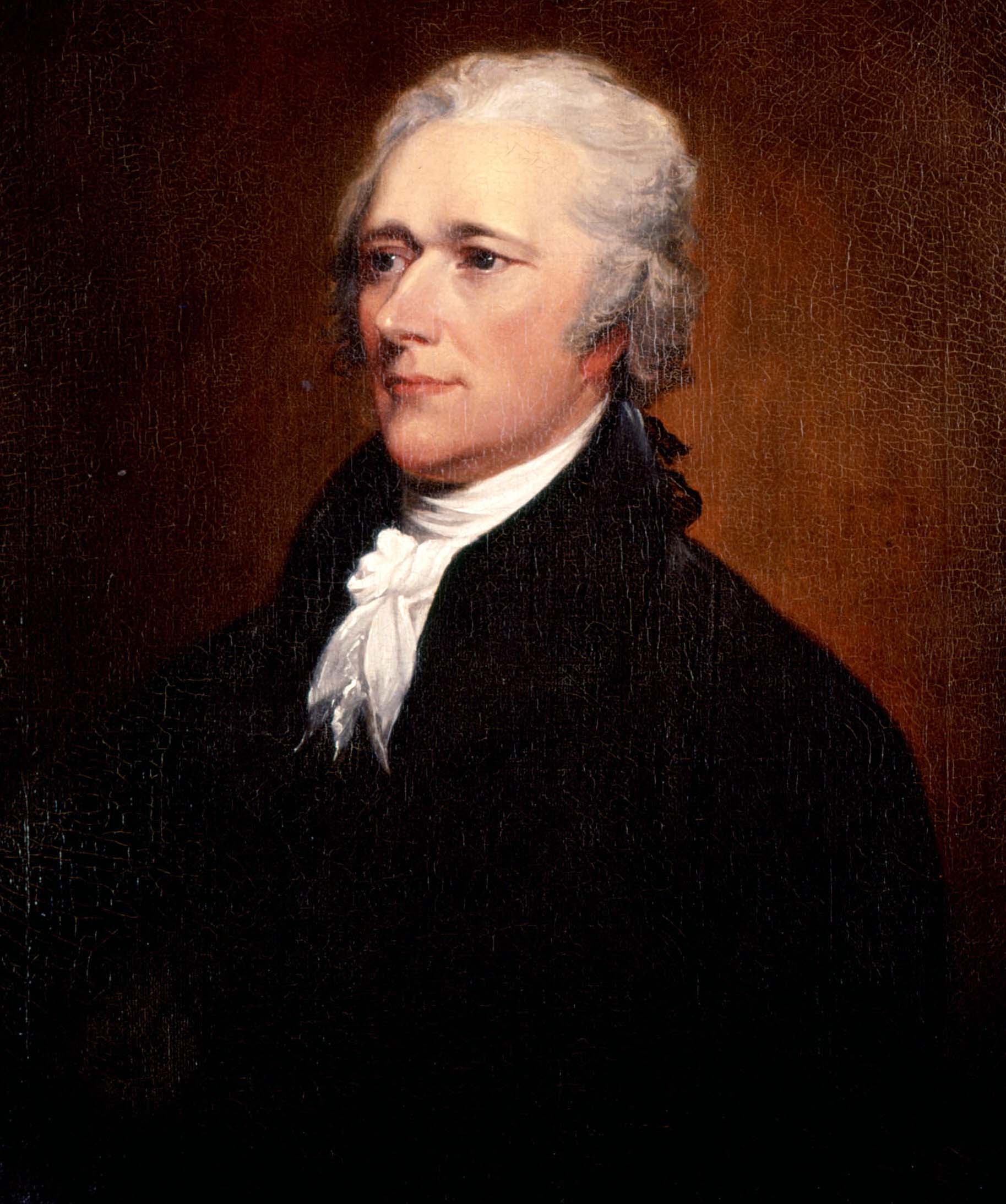

United States Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the United States presidential line of succession, presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the United States Senate Committee on Finance, Senate Committee on Finance, is confirmed by the United States Senate. The United States Secretary of State, secretary of state, the secretary of the treasury, the United States Secretary of Defense, secretary of defense, and the United States Att ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Code Of Federal Regulations

In the law of the United States, the ''Code of Federal Regulations'' (''CFR'') is the codification of the general and permanent regulations promulgated by the executive departments and agencies of the federal government of the United States. The CFR is divided into 50 titles that represent broad areas subject to federal regulation. The CFR annual edition is published as a special issue of the '' Federal Register'' by the Office of the Federal Register (part of the National Archives and Records Administration) and the Government Publishing Office. In addition to this annual edition, the CFR is published online on the Electronic CFR (eCFR) website, which is updated daily. Background Congress frequently delegates authority to an executive branch agency to issue regulations to govern some sphere. These statutes are called "enabling legislation." Enabling legislation typically has two parts: a substantive scope (typically using language such as "The Secretary shall promulgate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Zachman

John A. Zachman (born December 16, 1934) is an American business and IT consultant,Elizabeth N. Fong and Alan H. Goldfine (1989) ''Information Management Directions: The Integration Challenge''. National Institute of Standards and Technology (NIST) Special Publication 500-167, September 1989. p.63 early pioneer of enterprise architecture, chief executive officer of Zachman InternationalZachman.com, and originator of the Zachman Framework. Biography Zachman holds a degree in Chemistry from Northwestern University. He served for a number of years as a line officer in the United States Navy, and is a retired Commander in the U.S. Naval Reserve.John A. Zachman Biographical Sketch Accessed 15 Dec 2008. He joined IBM Corporation in 1964 an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supreme Court Of The United States

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point of federal law. It also has original jurisdiction over a narrow range of cases, specifically "all Cases affecting Ambassadors, other public Ministers and Consuls, and those in which a State shall be Party." The court holds the power of judicial review, the ability to invalidate a statute for violating a provision of the Constitution. It is also able to strike down presidential directives for violating either the Constitution or statutory law. However, it may act only within the context of a case in an area of law over which it has jurisdiction. The court may decide cases having political overtones, but has ruled that it does not have power to decide non-justiciable political questions. Established by Article Three of the United States ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mayo Foundation V

Mayo often refers to: * Mayonnaise, often shortened to "mayo" * Mayo Clinic, a medical center in Rochester, Minnesota, United States Mayo may also refer to: Places Antarctica * Mayo Peak, Marie Byrd Land Australia * Division of Mayo, an Australian Electoral Division in South Australia Canada * Mayo, Quebec, a municipality * Mayo, Yukon, a village ** Mayo (electoral district), Yukon, a former electoral district Cape Verde * Maio, Cape Verde (also formerly known as Mayo Island) Republic of Ireland * County Mayo * Mayo (Dáil constituency) * Mayo (Parliament of Ireland constituency) * Mayo (UK Parliament constituency) * Mayo, County Mayo, a village Ivory Coast * Mayo, Ivory Coast, a town and commune Thailand * Mayo District, Pattani Province United Kingdom * Mayo, a townland in County Down, Northern Ireland * Mayo (UK Parliament constituency), a former constituency encompassing the whole of County Mayo United States * Mayo, Florida, a town * Mayo, Kentucky, an unincorpo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chevron U

Chevron (often relating to V-shaped patterns) may refer to: Science and technology * Chevron (aerospace), sawtooth patterns on some jet engines * Chevron (anatomy), a bone * '' Eulithis testata'', a moth * Chevron (geology), a fold in rock layers * Chevron (land form), a sediment deposit across the earth's surface * Chevron nail, a rare transient fingernail ridge pattern seen in children * Chevron plot, a way of representing data Organisations * ''The Chevron'', former newspaper at the University of Waterloo, Ontario, Canada * Chevron Corporation, an American multinational energy corporation ** ''Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc.'', 467 U.S. 837 (1984), a United States Supreme Court case dealing with administrative law * Chevron Cars Ltd, a British racing car constructor * Chevron Engineering Ltd, a New Zealand car maker People * Philip Chevron (1957–2013), Irish singer/songwriter * The Chevrons, an American pop group Places * Chevron, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Register

The ''Federal Register'' (FR or sometimes Fed. Reg.) is the official journal of the federal government of the United States that contains government agency rules, proposed rules, and public notices. It is published every weekday, except on federal holidays. The final rules promulgated by a federal agency and published in the ''Federal Register'' are ultimately reorganized by topic or subject matter and codified in the '' Code of Federal Regulations'' (CFR), which is updated annually. The ''Federal Register'' is compiled by the Office of the Federal Register (within the National Archives and Records Administration) and is printed by the Government Publishing Office. There are no copyright restrictions on the ''Federal Register''; as a work of the U.S. government, it is in the public domain. Contents The ''Federal Register'' provides a means for the government to announce to the public changes to government requirements, policies, and guidance. * Proposed new rules and regulat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Research

Legal research is "the process of identifying and retrieving information necessary to support legal decision-making. In its broadest sense, legal research includes each step of a course of action that begins with an analysis of the facts of a problem and concludes with the application and communication of the results of the investigation." The processes of legal research vary according to the country and the legal system involved. Legal research involves tasks such as: # Finding primary sources of law, or primary authority, in a given jurisdiction ( cases, statutes, regulations, etc.). # Searching secondary authority, for background information about a legal topics. Secondary authorities can come in many forms (for example, law reviews, legal dictionaries, legal treatises, and legal encyclopedias such as American Jurisprudence and Corpus Juris Secundum). # Searching non-legal sources for investigative or supporting information. Legal research is performed by anyone with a need fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)