|

Transfer Payment

In macroeconomics and finance, a transfer payment (also called a government transfer or simply transfer) is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses. Unlike the exchange transaction which mutually benefits all the parties involved in it, the transfer payment consists of a donor and a recipient, with the donor giving up something of value without receiving anything in return. Transfers can be made both between individuals and entities, such as private companies or governmental bodies. These transactions can be both voluntary or involuntary and are generally motivated either by the altruism of the donor or the malevolence of the recipient. Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

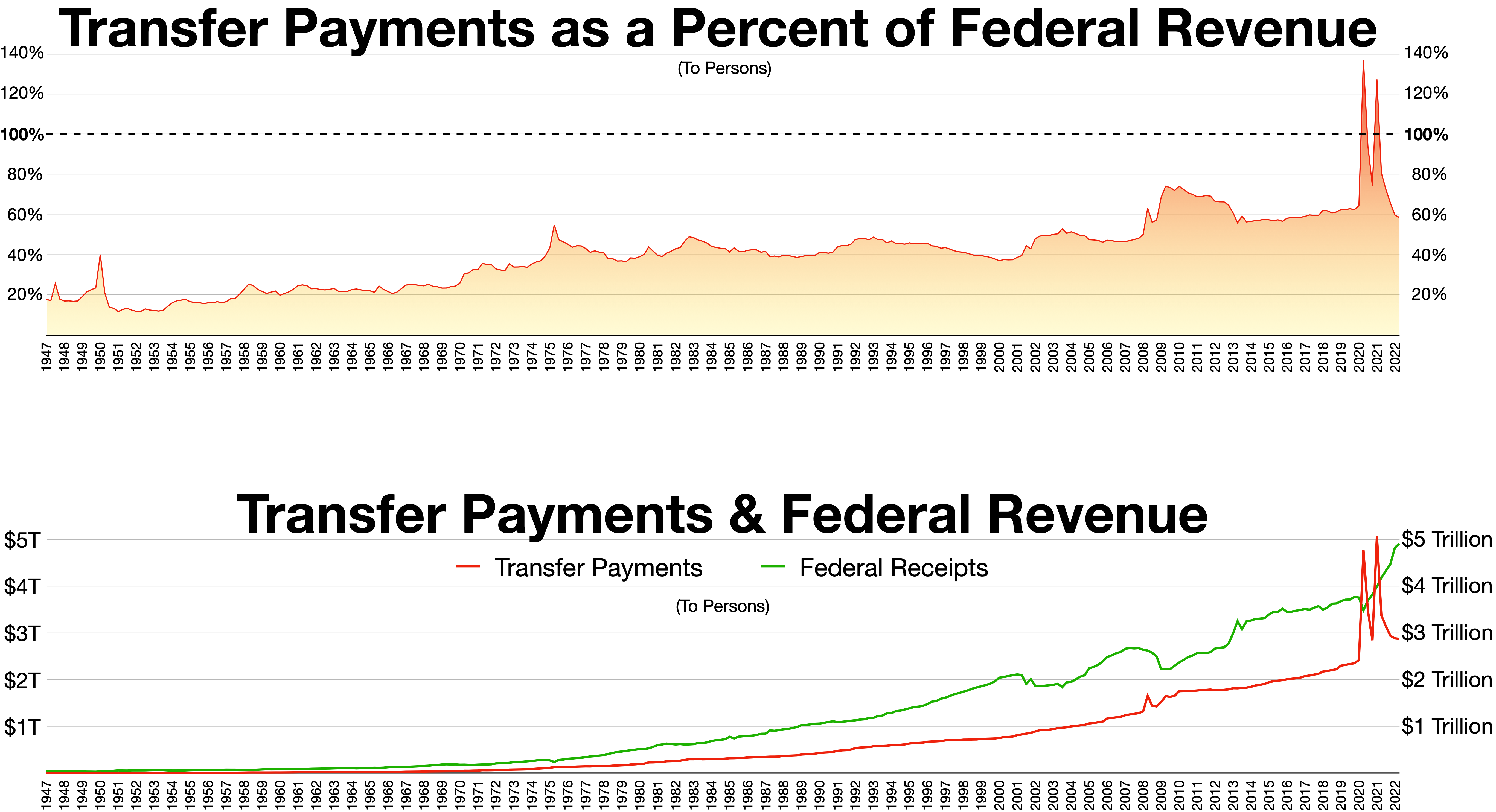

Transfer Payments As A Percent Of Federal Revenue

Transfer may refer to: Arts and media * ''Transfer'' (2010 film), a German science-fiction movie directed by Damir Lukacevic and starring Zana Marjanović * ''Transfer'' (1966 film), a short film * ''Transfer'' (journal), in management studies * "The Transfer" (''Smash''), a television episode *''The Transfer'', a novel by Silvano Ceccherini Finance * Transfer payment, a redistribution of income and wealth by means of the government making a payment * Balance transfer, transfer of the balance (either of money or credit) in an account to another account * Money transfer (other) ** Wire transfer, an international expedited bank-to-bank funds transfer Science and technology Learning and psychology * Transfer (propaganda), a method of psychological manipulation * Knowledge transfer, within organizations * Language transfer, in which native-language grammar and pronunciation influence the learning and use of a second language * Transfer of learning, in education Mathematic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. List of countries by GDP (nominal) per capita, GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation, inflation rates of the countries; therefore, using a basis of List of countries by GDP (PPP) per capita, GDP per capita at purchasing power parity (PPP) may be more useful when comparing standard of living, living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the GDP per capita, p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equalization Payments

Equalization payments are cash payments made in some federal systems of government from the federal government to subnational governments with the objective of offsetting differences in available revenue or in the cost of providing services. Many federations use fiscal equalisation to reduce the inequalities in the fiscal capacities of sub-national governments arising from the differences in their geography, demography, natural endowments and economies. The level of equalisation sought can vary, however. The payments are generally calculated based on the magnitude of the subnational "fiscal gap": essentially the difference between fiscal need and fiscal capacity. Fiscal capacity and fiscal need are not equivalent to measures of fiscal revenue and expenditure, as making them so would induce perverse incentives to subnational governments to reduce fiscal effort. Australia Australia introduced a formal system of horizontal fiscal equalisation (HFE) in 1933 to compensate states/terr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Provinces And Territories Of Canada

Within the geographical areas of Canada, the ten provinces and three territories are sub-national administrative divisions under the jurisdiction of the Canadian Constitution. In the 1867 Canadian Confederation, three provinces of British North America—New Brunswick, Nova Scotia, and the Province of Canada (which upon Confederation was divided into Ontario and Quebec)—united to form a federation, becoming a fully independent country over the next century. Over its history, Canada's international borders have changed several times as it has added territories and provinces, making it the world's second-largest country by area. The major difference between a Canadian province and a territory is that provinces receive their power and authority from the '' Constitution Act, 1867'' (formerly called the '' British North America Act, 1867''), whereas territorial governments are creatures of statute with powers delegated to them by the Parliament of Canada. The powers flowing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commonwealth Grants Commission

The Commonwealth Grants Commission is an Australian independent statutory body that advises the Australian Government on financial assistance to the states and territories of Australia under section 96 of the Australian Constitution. The Commission was established in July 1933 by the Lyons Government during the Great Depression to provide impartial advice on the distribution of federal government grants to the states. The Commission operates under the ''Commonwealth Grants Commission Act 1973'', and is responsible for measuring the relative fiscal capacity of each state and territory. The Commission recommends how the revenues raised from the goods and services tax (GST) should be distributed to each state and territory to achieve horizontal fiscal equalisation (HFE), a central feature of the Australian federation. References to Commission The Commission responds to a reference from the Australian Treasurer, which are generally requests for calculating appropriate ratios of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Imbalance In Australia

The fiscal imbalance in Australia is the disparity between the revenue generation ability of the three levels of governments in Australia relative to their spending obligations; but in Australia the term is commonly used to refer more specifically to the vertical fiscal imbalance, the discrepancy between the federal government's extensive capacity to raise revenue and the responsibility of the States to provide most public services, such as physical infrastructure, health care, education etc., despite having only limited capacity to raise their own revenue. In Australia, vertical fiscal imbalance is addressed by the transfer of funds as grants from the federal government to the states and territories. Vertical fiscal imbalance Vertical fiscal imbalance in Australia is largely the product of the Commonwealth's takeover of income taxes in 1942, during World War II, and rulings of the High Court of Australia that made various state taxes unconstitutional under the Australian Const ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

In-kind

The term in kind (or in-kind) generally refers to goods, services, and transactions not involving money or not measured in monetary terms. It is a part of many spheres, mainly economics, finance, but also politics, work career, food, health and others. There are many different types of in kind actions throughout the mentioned branches, which can be identified and distinguished. In-kind contributions An in-kind contribution is a non-cash contribution of goods or a service. Those are either offered free or at less than usual charge for them. Similarly, when a person or entity pays for services on the committee’s behalf, the payment is also considered as an in-kind contribution. In-kind services and contributions are valued at their fair market value or at their actual cost. In other words, they are valued at what you would pay for them if they were not donated. There are two types of receivers of in-kind contributions: individuals and companies. For individuals, the provider of i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dependency Theory

Dependency theory is the notion that resources flow from a " periphery" of poor and underdeveloped states to a " core" of wealthy states, enriching the latter at the expense of the former. A central contention of dependency theory is that poor states are impoverished and rich ones enriched by the way poor states are integrated into the "world system". This theory was officially developed in the late 1960s following World War II, as scholars searched for the root issue in the lack of development in Latin America. The theory arose as a reaction to modernization theory, an earlier theory of development which held that all societies progress through similar stages of development, that today's underdeveloped areas are thus in a similar situation to that of today's developed areas at some time in the past, and that, therefore, the task of helping the underdeveloped areas out of poverty is to accelerate them along this supposed common path of development, by various means such as in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Global South

The concept of Global North and Global South (or North–South divide in a global context) is used to describe a grouping of countries along socio-economic and political characteristics. The Global South is a term often used to identify regions within Latin America, Asia, Africa, and Oceania. It is one of a family of terms, including "Third World" and "Periphery", that denote regions outside Europe and North America. Most, though not all, of these countries are low-income and often politically or culturally marginalized on one side of the divide, while on the other side are the countries of the Global North (often equated with developed countries). As such, the term does not inherently refer to a geographical south; for example, most of the Global South is geographically within the Northern Hemisphere. The term as used by governmental and developmental organizations was first introduced as a more open and value-free alternative to "Third World" and similarly potentially "val ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Welfare Program

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts. Employees and employers An employee contributes labour and expertise to an e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |