|

Too Big To Fail

"Too big to fail" (TBTF) and "too big to jail" is a theory in banking and finance that asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. The colloquial term "too big to fail" was popularized by U.S. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The term had previously been used occasionally in the press, and similar thinking had motivated earlier bank bailouts. The term emerged as prominent in public discourse following the global financial crisis of 2007–2008. Critics see the policy as counterproductive and that large banks or other institutions should be left to fail if their risk management is not effective. Some critics, such as economist Ala ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

AIG Headquarters

American International Group, Inc. (AIG) is an American multinational finance and insurance corporation with operations in more than 80 countries and jurisdictions. , AIG companies employed 49,600 people.https://www.aig.com/content/dam/aig/america-canada/us/documents/investor-relations/2019/aig-2018-annual-report.pdf page 7 The company operates through three core businesses: General Insurance, Life & Retirement, and a standalone technology-enabled subsidiary. General Insurance includes Commercial, Personal Insurance, U.S. and International field operations. Life & Retirement includes Group Retirement, Individual Retirement, Life, and Institutional Markets. AIG is a sponsor of the AIG Women's Open golf tournament. AIG's corporate headquarters are in New York City and the company also has offices around the world. AIG serves 87% of the Fortune Global 500 and 83% of the Forbes 2000. AIG was ranked 60th on the 2018 Fortune 500 list. According to the 2016 Forbes Global 2000 list, A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

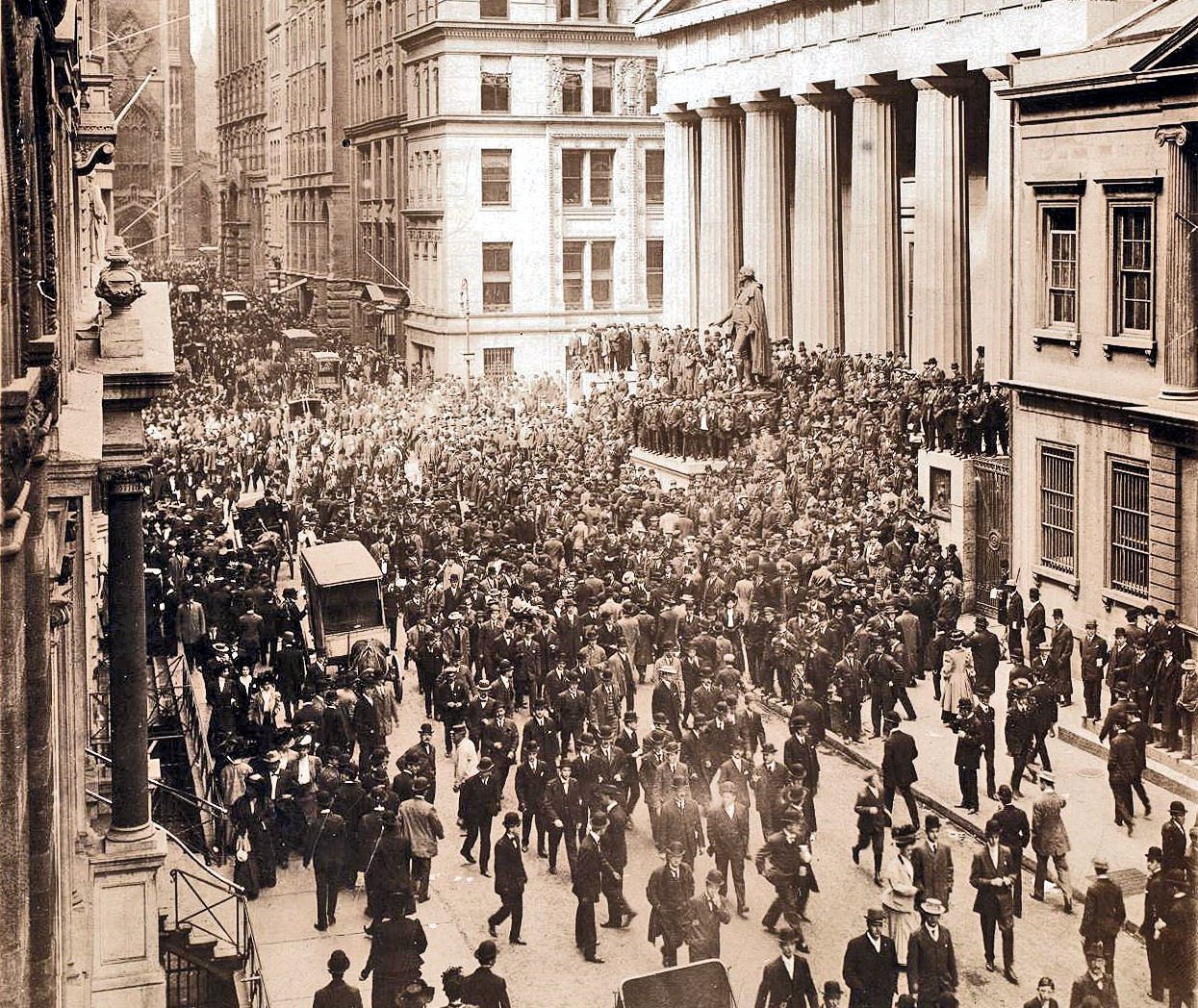

Panic Of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs on banks and on trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When that bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Troubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George Bush. It was a component of the government's measures in 2009 to address the subprime mortgage crisis. The TARP originally authorized expenditures of $700 billion. The Emergency Economic Stabilization Act of 2008 created the TARP. The Dodd–Frank Wall Street Reform and Consumer Protection Act, signed into law in 2010, reduced the amount authorized to $475 billion. By October 11, 2012, the Congressional Budget Office (CBO) stated that total disbursements would be $431 billion, and estimated the total cost, including grants for mortgage programs that have not yet been made, would be $24 billion. On December 19, 2014, the U.S. Treasury sold its remaining holdings of Ally Financial, essentially ending the program. Purpose TARP al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shadow Banking System

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that provide services similar to traditional commercial banks but outside normal banking regulations. Examples of NBFIs include hedge funds, insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. The phrase "shadow banking" is regarded by some as pejorative, and the term "market-based finance" has been proposed as an alternative. Former US Federal Reserve Chair Ben Bernanke provided the following definition in November 2013: Shadow banking has grown in importance to rival traditional depository banking, and was a factor in the subprime mortgage crisis of 2007–2008 and the global recession that followed. Overview Paul McCulley of investment management firm PIMCO coined the term "shadow banking". Shadow banking is sometimes said to include entities such as hedge funds, money market f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Glass–Steagall Legislation

The Glass–Steagall legislation describes four provisions of the United States Banking Act of 1933 separating commercial and investment banking.. Wilmarth 1990, p. 1161. The article 1933 Banking Act describes the entire law, including the legislative history of the provisions covered herein. As with the Glass–Steagall Act of 1932, the common name comes from the names of the Congressional sponsors, Senator Carter Glass and Representative Henry B. Steagall. The separation of commercial and investment banking prevented securities firms and investment banks from taking deposits, and commercial Federal Reserve member banks from: * dealing in non-governmental securities for customers, * investing in non-investment grade securities for themselves, * underwriting or distributing non-governmental securities, * affiliating (or sharing employees) with companies involved in such activities. Starting in the early 1960s, federal banking regulators' interpretations of the Act permitted ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1933 Banking Act

The Banking Act of 1933 () was a statute enacted by the United States Congress that established the Federal Deposit Insurance Corporation (FDIC) and imposed various other banking reforms. The entire law is often referred to as the Glass–Steagall Act, after its Congressional sponsors, Senator Carter Glass ( D) of Virginia, and Representative Henry B. Steagall (D) of Alabama. The term "Glass–Steagall Act," however, is most often used to refer to four provisions of the Banking Act of 1933 that limited commercial bank securities activities and affiliations between commercial banks and securities firms. That limited meaning of the term is described in the article on Glass–Steagall Legislation. The Banking Act of 1933 (the 1933 Banking Act) joined together two long-standing Congressional projects: #A federal system of bank deposit insurance championed by Representative Steagall #The regulation (or prohibition) of the combination of commercial and investment banking and othe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent; they keep the cash or transfer it into other assets, such as government bonds, precious metals or gemstones. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading (especially U.S. Treasury securities), research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008. On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy protection following the exodus of most of its clients, drastic declines in its stock price, and the devaluation of assets by credit rating agencies. The collapse was largely due to Lehman's involvement in the subprime mortgage crisis and its exposure to less liquid assets. Lehman's bankruptcy filing was the largest in US his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent problem, where one party, called an agent, acts on behalf of another party, called the principal. If the agent has more information about his or her actions or intentions than the princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Mortgage Crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than government securities, along with attractive risk ratings from rating agencies. While elements of the crisis first became more vis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |