|

Tobit Model

In statistics, a tobit model is any of a class of regression models in which the observed range of the dependent variable is censored in some way. The term was coined by Arthur Goldberger in reference to James Tobin, who developed the model in 1958 to mitigate the problem of zero-inflated data for observations of household expenditure on durable goods. Because Tobin's method can be easily extended to handle truncated and other non-randomly selected samples, some authors adopt a broader definition of the tobit model that includes these cases. Tobin's idea was to modify the likelihood function so that it reflects the unequal sampling probability for each observation depending on whether the latent dependent variable fell above or below the determined threshold. For a sample that, as in Tobin's original case, was censored from below at zero, the sampling probability for each non-limit observation is simply the height of the appropriate density function. For any limit observation, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regression Analysis

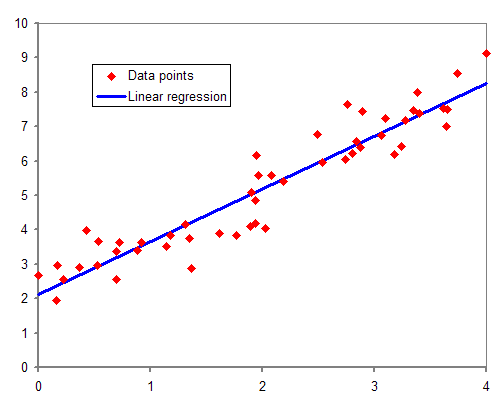

In statistical modeling, regression analysis is a set of statistical processes for estimating the relationships between a dependent variable (often called the 'outcome' or 'response' variable, or a 'label' in machine learning parlance) and one or more independent variables (often called 'predictors', 'covariates', 'explanatory variables' or 'features'). The most common form of regression analysis is linear regression, in which one finds the line (or a more complex linear combination) that most closely fits the data according to a specific mathematical criterion. For example, the method of ordinary least squares computes the unique line (or hyperplane) that minimizes the sum of squared differences between the true data and that line (or hyperplane). For specific mathematical reasons (see linear regression), this allows the researcher to estimate the conditional expectation (or population average value) of the dependent variable when the independent variables take on a given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Density Function

In probability theory, a probability density function (PDF), or density of a continuous random variable, is a function whose value at any given sample (or point) in the sample space (the set of possible values taken by the random variable) can be interpreted as providing a ''relative likelihood'' that the value of the random variable would be close to that sample. Probability density is the probability per unit length, in other words, while the ''absolute likelihood'' for a continuous random variable to take on any particular value is 0 (since there is an infinite set of possible values to begin with), the value of the PDF at two different samples can be used to infer, in any particular draw of the random variable, how much more likely it is that the random variable would be close to one sample compared to the other sample. In a more precise sense, the PDF is used to specify the probability of the random variable falling ''within a particular range of values'', as opposed to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Censored Regression Model

Censored regression models are a class of models in which the dependent variable is censored above or below a certain threshold. A commonly used likelihood-based model to accommodate to a censored sample is the Tobit model, but quantile and nonparametric estimators have also been developed. These and other censored regression models are often confused with truncated regression models. Truncated regression models are used for data where whole observations are missing so that the values for the dependent and the independent variables are unknown. Censored regression models are used for data where only the value for the dependent variable is unknown while the values of the independent variables are still available. Censored dependent variables frequently arise in econometrics. A common example is labor supply. Data are frequently available on the hours worked by employees, and a labor supply model estimates the relationship between hours worked and characteristics of employees such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Review Of Economics And Statistics

''The'' ''Review of Economics and Statistics'' is a peer-reviewed 103-year-old general journal that focuses on applied economics, with specific relevance to the scope of quantitative economics. The ''Review'', edited at the Harvard University’s Kennedy School of Government The Harvard Kennedy School (HKS), officially the John F. Kennedy School of Government, is the school of public policy and government of Harvard University in Cambridge, Massachusetts. The school offers master's degrees in public policy, public ... (JSTOR), has the long-term aim of publishing influential articles in mainly theoretical and empirical economics that will contribute to the broader readership in economics in both the present and the continual future. Over the time, the journal has published several of the most significant articles in empirical economics (JSTOR) based on its recognizable history which includes works from “Kenneth Arrow, Milton Friedman, Robert Merton, Paul Samuelson, Robert Sol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Linear Regression Model

In statistics, linear regression is a linear approach for modelling the relationship between a scalar response and one or more explanatory variables (also known as dependent and independent variables). The case of one explanatory variable is called ''simple linear regression''; for more than one, the process is called multiple linear regression. This term is distinct from multivariate linear regression, where multiple correlated dependent variables are predicted, rather than a single scalar variable. In linear regression, the relationships are modeled using linear predictor functions whose unknown model parameters are estimated from the data. Such models are called linear models. Most commonly, the conditional mean of the response given the values of the explanatory variables (or predictors) is assumed to be an affine function of those values; less commonly, the conditional median or some other quantile is used. Like all forms of regression analysis, linear regression focuses on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maximum Likelihood Estimator

In statistics, maximum likelihood estimation (MLE) is a method of estimating the parameters of an assumed probability distribution, given some observed data. This is achieved by maximizing a likelihood function so that, under the assumed statistical model, the observed data is most probable. The point in the parameter space that maximizes the likelihood function is called the maximum likelihood estimate. The logic of maximum likelihood is both intuitive and flexible, and as such the method has become a dominant means of statistical inference. If the likelihood function is differentiable, the derivative test for finding maxima can be applied. In some cases, the first-order conditions of the likelihood function can be solved analytically; for instance, the ordinary least squares estimator for a linear regression model maximizes the likelihood when all observed outcomes are assumed to have Normal distributions with the same variance. From the perspective of Bayesian inference, MLE ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Takeshi Amemiya

is an economist specializing in econometrics and the economy of ancient Greece. Amemiya is the Edward Ames Edmonds Professor of Economics (emeritus) and a Professor of Classics at Stanford University. He is a Fellow of the Econometric Society, the American Statistical Association and the American Academy of Arts and Sciences (1985). Education *B.A., 1958, Social Science, International Christian University, Tokyo, Japan *M.A., 1961, Economics, American University, Washington, DC *Ph.D., 1964, Economics, Johns Hopkins University, Baltimore, Maryland Honors and awards * U.S. Scientist Award, Alexander von Humboldt Foundation The Alexander von Humboldt Foundation (german: Alexander von Humboldt-Stiftung) is a foundation established by the government of the Federal Republic of Germany and funded by the Federal Foreign Office, the Federal Ministry of Education and Resear ..., 1988 * Fellowship, Japan Society for Promotion of Science, 1989 * Fellowship, John Simon Guggenheim F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consistent Estimator

In statistics, a consistent estimator or asymptotically consistent estimator is an estimator—a rule for computing estimates of a parameter ''θ''0—having the property that as the number of data points used increases indefinitely, the resulting sequence of estimates converges in probability to ''θ''0. This means that the distributions of the estimates become more and more concentrated near the true value of the parameter being estimated, so that the probability of the estimator being arbitrarily close to ''θ''0 converges to one. In practice one constructs an estimator as a function of an available sample of size ''n'', and then imagines being able to keep collecting data and expanding the sample ''ad infinitum''. In this way one would obtain a sequence of estimates indexed by ''n'', and consistency is a property of what occurs as the sample size “grows to infinity”. If the sequence of estimates can be mathematically shown to converge in probability to the true value ''� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Least Squares

The method of least squares is a standard approach in regression analysis to approximate the solution of overdetermined systems (sets of equations in which there are more equations than unknowns) by minimizing the sum of the squares of the residuals (a residual being the difference between an observed value and the fitted value provided by a model) made in the results of each individual equation. The most important application is in data fitting. When the problem has substantial uncertainties in the independent variable (the ''x'' variable), then simple regression and least-squares methods have problems; in such cases, the methodology required for fitting errors-in-variables models may be considered instead of that for least squares. Least squares problems fall into two categories: linear or ordinary least squares and nonlinear least squares, depending on whether or not the residuals are linear in all unknowns. The linear least-squares problem occurs in statistical regressio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stationary Point

In mathematics, particularly in calculus, a stationary point of a differentiable function of one variable is a point on the graph of the function where the function's derivative is zero. Informally, it is a point where the function "stops" increasing or decreasing (hence the name). For a differentiable function of several real variables, a stationary point is a point on the surface of the graph where all its partial derivatives are zero (equivalently, the gradient is zero). Stationary points are easy to visualize on the graph of a function of one variable: they correspond to the points on the graph where the tangent is horizontal (i.e., parallel to the -axis). For a function of two variables, they correspond to the points on the graph where the tangent plane is parallel to the plane. Turning points A turning point is a point at which the derivative changes sign. A turning point may be either a relative maximum or a relative minimum (also known as local minimum and maximum). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrica

''Econometrica'' is a peer-reviewed academic journal of economics, publishing articles in many areas of economics, especially econometrics. It is published by Wiley-Blackwell on behalf of the Econometric Society. The current editor-in-chief is Guido Imbens. History ''Econometrica'' was established in 1933. Its first editor was Ragnar Frisch, recipient of the first Nobel Memorial Prize in Economic Sciences in 1969, who served as an editor from 1933 to 1954. Although ''Econometrica'' is currently published entirely in English, the first few issues also contained scientific articles written in French. Indexing and abstracting ''Econometrica'' is abstracted and indexed in: * Scopus * EconLit * Social Science Citation Index According to the ''Journal Citation Reports'', the journal has a 2020 impact factor of 5.844, ranking it 22/557 in the category "Economics". Awards issued The Econometric Society aims to attract high-quality applied work in economics for publication in ''Eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maximum Likelihood Estimation

In statistics, maximum likelihood estimation (MLE) is a method of estimating the parameters of an assumed probability distribution, given some observed data. This is achieved by maximizing a likelihood function so that, under the assumed statistical model, the observed data is most probable. The point in the parameter space that maximizes the likelihood function is called the maximum likelihood estimate. The logic of maximum likelihood is both intuitive and flexible, and as such the method has become a dominant means of statistical inference. If the likelihood function is differentiable, the derivative test for finding maxima can be applied. In some cases, the first-order conditions of the likelihood function can be solved analytically; for instance, the ordinary least squares estimator for a linear regression model maximizes the likelihood when all observed outcomes are assumed to have Normal distributions with the same variance. From the perspective of Bayesian inference, M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |