|

The Path To Prosperity

''The Path to Prosperity: Restoring America's Promise'' was the Republican Party (United States), Republican Party's budget proposal for the federal government of the United States in the fiscal year 2012. It was succeeded in March 2012 by "The Path to Prosperity: A Blueprint for American Renewal", the Republican budget proposal for 2013. Representative Paul Ryan, Chairman of the House Budget Committee, played a prominent public role in drafting and promoting both The Path to Prosperity proposals, and they are therefore often referred to as the Ryan budget, Ryan plan or Ryan proposal. The plans stand in contrast to the 2012 United States federal budget, 2012 and 2013 United States federal budget, 2013 budget proposals, outlined by President Barack Obama and the Congressional Progressive Caucus. The 2012 Republican proposal was formalized and passed by the United States House of Representatives, House of Representatives on Friday, April 15, 2011 by a vote of 235 to 193, largely a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Republican Party (United States)

The Republican Party, also known as the Grand Old Party (GOP), is a Right-wing politics, right-wing political parties in the United States, political party in the United States. One of the Two-party system, two major parties, it emerged as the main rival of the then-dominant Democratic Party (United States), Democratic Party in the 1850s, and the two parties have dominated American politics since then. The Republican Party was founded in 1854 by anti-slavery activists opposing the Kansas–Nebraska Act and the expansion of slavery in the United States, slavery into U.S. territories. It rapidly gained support in the Northern United States, North, drawing in former Whig Party (United States), Whigs and Free Soil Party, Free Soilers. Abraham Lincoln's 1860 United States presidential election, election in 1860 led to the secession of Southern states and the outbreak of the American Civil War. Under Lincoln and a Republican-controlled Congress, the party led efforts to preserve th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States House Committee On Ways And Means

The Committee on Ways and Means is the chief tax-writing committee of the United States House of Representatives. The committee has jurisdiction over all taxation, tariffs, and other revenue-raising measures, as well as a number of other programs including Social Security, unemployment benefits, Medicare, the enforcement of child support laws, Temporary Assistance for Needy Families, foster care, and adoption programs. Members of the Ways and Means Committee are not allowed to serve on any other House Committee unless they are granted a waiver from their party's congressional leadership. It has long been regarded as the most prestigious committee of the House of Representatives. The United States Constitution requires that all bills regarding taxation must originate in the U.S. House of Representatives, and House rules dictate that all bills regarding taxation must pass through Ways and Means. This system imparts upon the committee and its members a significant degree of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inheri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Tax

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned within ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return; however, its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisition a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

The United States federal government and most State governments in the United States, state governments impose an income tax. They are determined by applying a tax rate, which Progressive tax, may increase as income increases, to taxable income, which is the total income less allowable tax deduction, deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnership taxation in the United States, Partnerships are not taxed (with some exceptions in the case of federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of tax credit, credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mort ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cuts

A tax cut typically represents a decrease in the amount of money taken from taxpayers to go towards government revenue. This decreases the revenue of the government and increases the disposable income of taxpayers. Tax rate cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes. However, sometimes a tax cut can increase tax revenue, as economist Thomas Sowell explains: :"What actually followed the cuts in tax rates in the 1920s were rising output, rising employment to produce that output, rising incomes as a result and rising tax revenues for the government because of the rising incomes, even though the tax rates had been lowered." How a tax cut affects the economy depends on which tax is cut. Policies that increase disposable inco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Library Of Congress

The Library of Congress (LOC) is a research library in Washington, D.C., serving as the library and research service for the United States Congress and the ''de facto'' national library of the United States. It also administers Copyright law of the United States, copyright law through the United States Copyright Office, and it houses the Congressional Research Service. Founded in 1800, the Library of Congress is the oldest Cultural policy of the United States, federal cultural institution in the United States. It is housed in three buildings on Capitol Hill, adjacent to the United States Capitol, along with the National Audio-Visual Conservation Center in Culpeper, Virginia, and additional storage facilities at Fort Meade, Fort George G. Meade and Cabin Branch in Hyattsville, Maryland. The library's functions are overseen by the librarian of Congress, and its buildings are maintained by the architect of the Capitol. The LOC is one of the List of largest libraries, largest libra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a confidential, nonpartisan basis. CRS is sometimes known as Congress' think tank due to its broad mandate of providing research and analysis on all matters relevant to national policymaking. CRS has roughly 600 employees, who have a wide variety of expertise and disciplines, including lawyers, economists, historians, political scientists, reference librarians, and scientists. In the 2023 fiscal year, it was appropriated a budget of roughly $133.6 million by Congress. Modeled after the Wisconsin Legislative Reference Bureau, CRS was founded during the height of the Progressive Era as part of a broader effort to professionalize the government by providing independent research and information to public officials. Its work was initially ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yahoo! News

Yahoo News (stylized as Yahoo! News) is a news website that originated as an internet-based news aggregator by Yahoo. The site was created by Yahoo software engineer Brad Clawsie in August 1996. Articles originally came from news services such as the Associated Press, Reuters, Fox News, Al Jazeera, ABC News, ''USA Today'', CNN and BBC News. In 2000, Yahoo News launched pages tracking the content on the site that was most viewed and most shared by email. The "most emailed" page in particular was noted as an innovation in online news aggregation. Yahoo News allows users to comment on articles. Between late 2006 and early 2010, comments were disabled in part due to moderation challenges. By 2011, Yahoo had expanded its focus to include original content, as part of its plans to become a major media organization. Veteran journalists (including Walter Shapiro and Virginia Heffernan) were hired, while the website had a correspondent in the White House press corps for the first ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New Yorker

''The New Yorker'' is an American magazine featuring journalism, commentary, criticism, essays, fiction, satire, cartoons, and poetry. It was founded on February 21, 1925, by Harold Ross and his wife Jane Grant, a reporter for ''The New York Times''. Together with entrepreneur Raoul H. Fleischmann, they established the F-R Publishing Company and set up the magazine's first office in Manhattan. Ross remained the editor until his death in 1951, shaping the magazine's editorial tone and standards. ''The New Yorker''s fact-checking operation is widely recognized among journalists as one of its strengths. Although its reviews and events listings often focused on the Culture of New York City, cultural life of New York City, ''The New Yorker'' gained a reputation for publishing serious essays, long-form journalism, well-regarded fiction, and humor for a national and international audience, including work by writers such as Truman Capote, Vladimir Nabokov, and Alice Munro. In the late ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

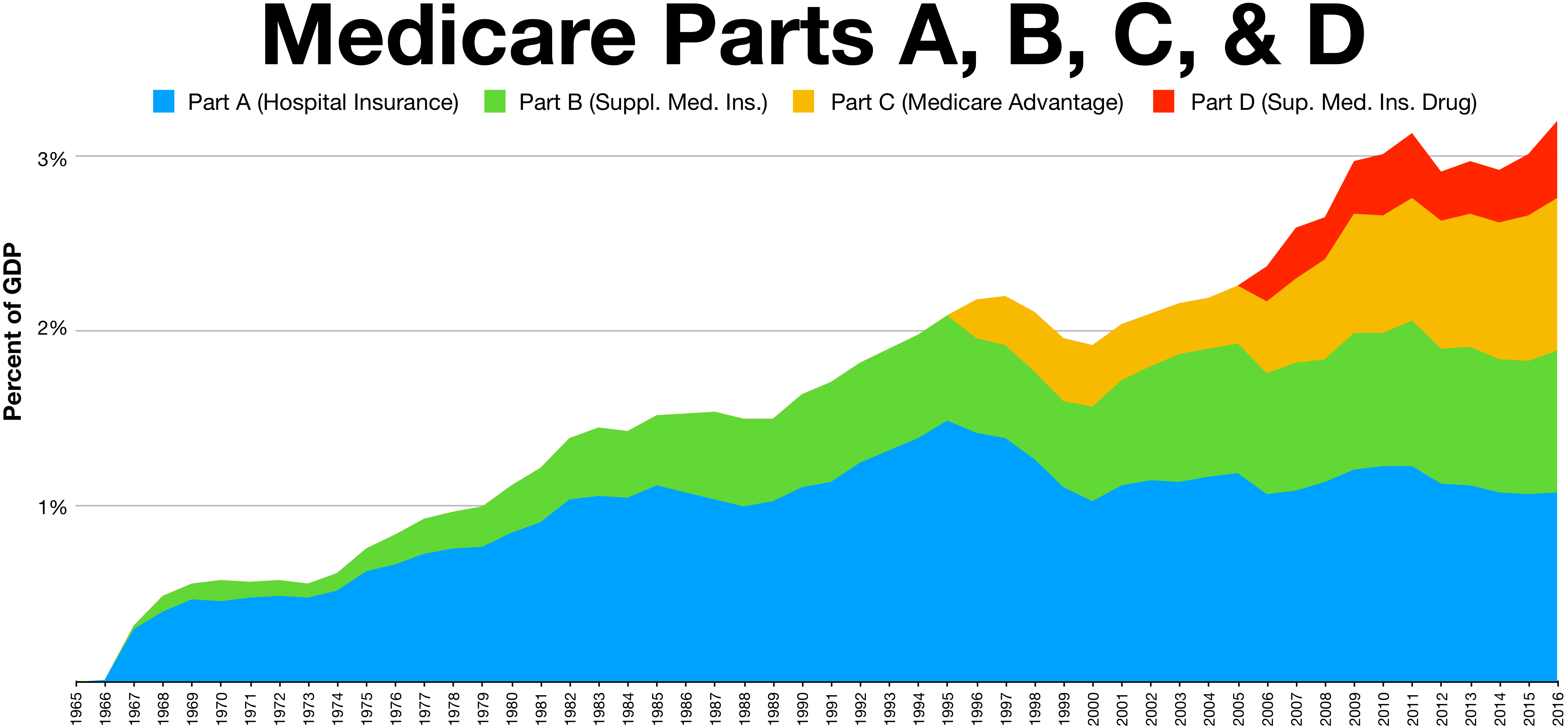

Medicare (United States)

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). It started in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS). Medicare is divided into four parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice services. Part B covers outpatient services. Part D covers self-administered prescription drugs. Part C is an alternative that allows patients to choose private plans with different benefit structures that provide the same services as Parts A and B, usually with additional benefits. In 2022, Medicare provided health insurance for 65.0 million individuals—more than 57 million people aged 65 and older and about 8 million younger people. According to annual Medicare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |