|

Tax Shelter

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities, including state and federal governments. The methodology can vary depending on local and international tax laws. Types of tax shelters Some tax shelters are questionable or even illegal: *Offshore companies. Due to differing tax rates and legislation in each country, tax benefits can be exploited. Example: If Import Co. buys $1 of goods from India and sells for $3, Import Co. will pay tax on $2 of taxable income. However, tax benefits can be exploited if Import Co. is to set up an offshore subsidiary in the British Virgin Islands to buy the same goods for $1, sell the goods to Import Co. for $3 and sell it again in the domestic market for $3. This allows Import Co. to report taxable income of $0 (because it was purchased for $3 and sold for $3), thus paying no tax. While the subsidiary will have to pay tax on $2, the tax is payable to the tax authority of Brit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Methodology

In its most common sense, methodology is the study of research methods. However, the term can also refer to the methods themselves or to the philosophical discussion of associated background assumptions. A method is a structured procedure for bringing about a certain goal. In the context of research, this goal is usually to discover new knowledge or to verify pre-existing knowledge claims. This normally involves various steps, like choosing a sample, collecting data from this sample, and interpreting this data. The study of methods involves a detailed description and analysis of these processes. It includes evaluative aspects by comparing different methods to assess their advantages and disadvantages relative to different research goals and situations. This way, a methodology can help make the research process efficient and reliable by guiding researchers on which method to employ at each step. These descriptions and evaluations of methods often depend on philosophical background ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Savings Account

An individual savings account (ISA; ) is a class of retail investment arrangement available to residents of the United Kingdom. First introduced in 1999, the accounts have favourable tax status. Payments into the account are made from after-tax income, then the account is exempt from income tax and capital gains tax on the investment returns, and no tax is payable on money withdrawn from the scheme. Cash and a broad range of investments can be held within the arrangement, and there is no restriction on when or how much money can be withdrawn. Since 2017, there have been four types of account: cash ISA, stocks & shares ISA, innovative finance ISA (IFISA) and lifetime ISA (LISA). Each taxpayer has an annual investment limit (£20,000 since ) which can be split among the four types as desired. Additionally, children under 18 may hold a junior ISA, with a different annual limit. Until the lifetime ISA was introduced in 2017, ISAs were not a specific retirement investment, but any type ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Port

Free economic zones (FEZ), free economic territories (FETs) or free zones (FZ) are a class of special economic zone (SEZ) designated by the trade and commerce administrations of various countries. The term is used to designate areas in which companies are taxed very lightly or not at all to encourage economic activity. The taxation rules and duties are determined by each country. The World Trade Organization (WTO) Agreement on Subsidies and Countervailing Measures (SCM) has content on the conditions and benefits of free zones. Some special economic zones are called free ports. Sometimes they have historically been endowed with favorable customs regulations, such as the free port of Trieste. As the United Kingdom was proposing the creation of ten free ports after leaving the European Union in early 2020, the EU was clamping down on 82 free zones after finding that their special status had aided the financing of terrorism, money laundering and organised crime. Definition The def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. The majority of the less than 100 material tax inversions recorded since 1993 have been of US corporations (85 inversions), seeking to pay less to the US corporate tax system. The only other jurisdiction to experience a material outflow of tax inversions was the United Kingdom from 2007 to 2010 (22 inversions); however, UK inversions largely ceased post the reform of the UK corporate tax code from 2009 to 2012. The first inversion was McDermott International in 1983. Reforms by US Congress in 2004 hal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Haven

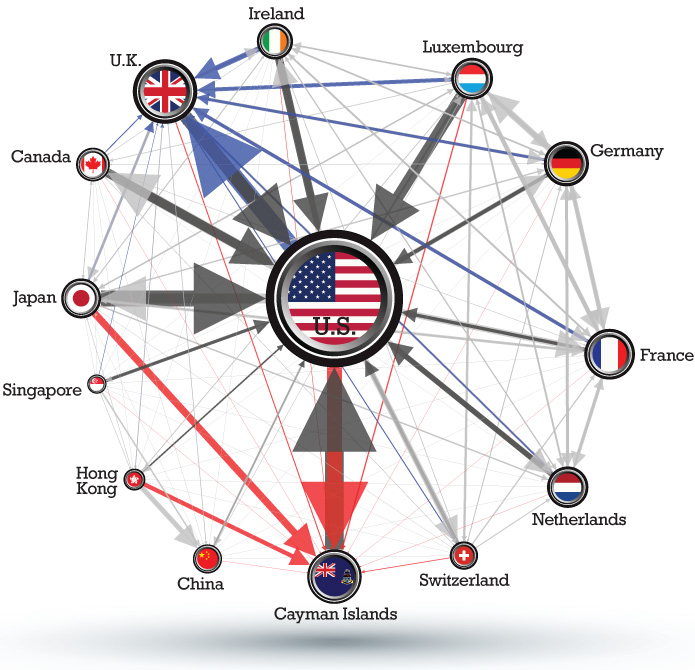

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties which accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the dutch sandwich, and single malt). Corporate tax ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underground Economy

A black market, underground economy, or shadow economy is a clandestine market or series of transactions that has some aspect of illegality or is characterized by noncompliance with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution is prohibited by law, non-compliance with the rule constitutes a black market trade since the transaction itself is illegal. Parties engaging in the production or distribution of prohibited goods and services are members of the . Examples include the illegal drug trade, prostitution (where prohibited), illegal currency transactions, and human trafficking. Violations of the tax code involving income tax evasion in the . Because tax evasion or participation in a black market activity is illegal, participants attempt to hide their behavior from the government or regulatory authority. Cash is the preferred medium of exchange in illegal transactions since cash transactions are less-easi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ATTAC

The Association pour la Taxation des Transactions financières et pour l'Action Citoyenne (''Association for the Taxation of financial Transactions and Citizen's Action'', ATTAC) is an activist organisation originally created to promote the establishment of a tax on foreign exchange transactions. Background Originally called "Action for a Tobin Tax to Assist the Citizen", ATTAC was a single-issue movement demanding the introduction of the so-called Tobin tax on currency speculation. n the ATTAC: A new European alternative to globalisation, David Moberg, These Times magazine, May 2001/ref> ATTAC has enlarged its scope to a wide range of issues related to globalisation, and monitoring the decisions of the World Trade Organization (WTO), the Organisation for Economic Co-operation and Development (OECD,) and the International Monetary Fund (IMF). ATTAC representatives attend the meetings of the G8 with the goal of influencing policymakers' decisions. Attac spokesmen recently crit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Protection

Asset protection (sometimes also referred to as ''debtor-creditor law'') is a set of legal techniques and a body of statutory and common law dealing with protecting assets of individuals and business entities from civil money judgments. The goal of asset protection planning is to insulate assets from claims of creditors without perjury or tax evasion. Asset protection consists of methods available to protect assets from liabilities arising elsewhere. It should not be confused with ''limiting liability'', which concerns the ability to stop or constrain liability to the asset or activity from which it arises. Assets that are shielded from creditors by law are few: common examples include some home equity, certain retirement plans and interests in LLCs and limited partnerships (and even these are not always unreachable). Assets that are almost always unreachable are those to which one does not hold legal title. In many cases it is possible to vest legal title to personal assets in a tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Substance

Economic substance is a doctrine in the tax law of the United States under which a transaction must have both a substantial purpose aside from reduction of tax liability and an economic effect aside from the tax effect in order to qualify for any tax benefits. This doctrine is used by the Internal Revenue Service to determine whether tax shelters, or strategies used to reduce tax liability, are considered "abusive." Under the doctrine, for a transaction to be respected, the transaction must change the taxpayer's economic position in a "meaningful way" apart from the Federal income tax effects, and the taxpayer must have had a "substantial purpose" for entering into the transaction, apart from the Federal income tax effects. The economic substance doctrine was originally a common law doctrine. The doctrine was codified in subsection (o) of section 7701 of the Internal Revenue Code by the Health Care and Education Reconciliation Act of 2010.Sec. 1409, Pub. L. No. 111-152, 124 Stat. 10 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Knetsch V

''Knetsch v. United States'', 364 U.S. 361 (1960), was a decision by the United States Supreme Court concerning taxation law. The taxpayer was a saver who was convinced to buy a deferred annuity because the inside buildup on such policies is tax-deferred. However, he wanted to claim a deduction on the money he borrowed that he used to buy the annuity. The IRS won and the taxpayer was denied the deduction. An understanding of the economics would immediately reveal that the only reason the transaction had any chance of making sense for the taxpayer was the asymmetric way the-then current tax code allowed a current deduction on the loan liability at the same time allowed tax deferral on the purchased asset. Success would have legitimated tax arbitrage. See also *List of United States Supreme Court cases, volume 364 This is a list of all the Supreme Court of the United States, United States Supreme Court cases from volume 364 of the ''United States Reports'': External links {{SC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Step Transaction Doctrine

The step transaction doctrine is a judicial doctrine in the United States that combines a series of formally separate steps, resulting in tax treatment as a single integrated event. The doctrine is often used in combination with other doctrines, such as substance over form. The doctrine is applied to prevent tax abuse, such as tax shelters or bailing assets out of a corporation. The step transaction doctrine originated from a common law principle in ''Gregory v. Helvering'', 293 U.S. 465 (1935), which allowed the court to recharacterize a tax-motivated transaction. Application The doctrine states: There are three tests for applying the step transaction doctrine: (1) a binding commitment, (2) a mutual interdependence of steps, or (3) the intent of particular result. Binding commitment test The binding commitment test was established in ''Commissioner v. Gordon''.. Under this strict test, a court will combine a series of separate steps if the parties had a formal obligation to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Substance Over Form Doctrine

Substance over form is an accounting principle used "to ensure that financial statements give a complete, relevant, and accurate picture of transactions and events". If an entity practices the 'substance over form' concept, then the financial statements will convey the overall financial reality of the entity (economic substance), rather than simply reporting the legal record of transactions (form). In accounting for business transactions and other events, the measurement and reporting is for the economic impact of an event, instead of its legal form. Substance over form is critical for reliable financial reporting. It is particularly relevant in cases of revenue recognition, sale and purchase agreements, etc. The key point of the concept is that a transaction should not be recorded in such a manner as to hide the true intent of the transaction, which would mislead the readers of a company's financial statements. Examples There is widespread use of substance over form concept in a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)