|

Tax Shelter

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities, including state and federal governments. The methodology can vary depending on local and international tax laws. Types of tax shelters Some tax shelters are questionable or even illegal: *Offshore companies. Due to differing tax rates and legislation in each country, tax benefits can be exploited. For example, if Import Co. buys $1 of goods from India and sells for $3, Import Co. will pay tax on $2 of taxable income. However, tax benefits can be exploited if Import Co. sets up an offshore subsidiary in the British Virgin Islands to buy the same goods for $1, sell the goods to Import Co. for $3 and sell it again in the domestic market for $3. This allows Import Co. to report taxable income of $0 (because it was purchased for $3 and sold for $3), thus paying no tax. While the subsidiary will have to pay tax on $2, the tax is payable to the tax authority of Brit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Methodology

In its most common sense, methodology is the study of research methods. However, the term can also refer to the methods themselves or to the philosophical discussion of associated background assumptions. A method is a structured procedure for bringing about a certain goal, like acquiring knowledge or verifying knowledge claims. This normally involves various steps, like choosing a Sample (statistics), sample, Data collection, collecting data from this sample, and interpreting the data. The study of methods concerns a detailed description and analysis of these processes. It includes evaluative aspects by comparing different methods. This way, it is assessed what advantages and disadvantages they have and for what research goals they may be used. These descriptions and evaluations depend on philosophical background assumptions. Examples are how to conceptualize the studied phenomena and what constitutes evidence for or against them. When understood in the widest sense, methodology al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

International Business Corporation

An international business company or international business corporation (IBC) is an offshore company formed under the laws of some jurisdictions as a tax neutral company which is usually limited in terms of the activities it may conduct in, but not necessarily from, the jurisdiction in which it is incorporated. While not taxable in the country of incorporation, an IBC or its owners, if resident in a country having “ controlled foreign corporation” rules for instance, can be taxable in other jurisdictions. Features Characteristics of an IBC vary by jurisdiction, but will usually include: * exemption from local corporate taxation and stamp duty, provided that the company engages in no local business (annual agent's fees and company registration taxes are still payable, which are normally a few hundred U.S. dollars per year) * preservation of confidentiality of the beneficial owner of the company * wide corporate powers to engage in different businesses and activities * abr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Free Economic Zone

A free-trade zone (FTZ) is a class of special economic zone. It is a geographic area where goods may be imported, stored, handled, manufactured, or reconfigured and re- exported under specific customs regulation and generally not subject to customs duty. Free trade zones are generally organized around major seaports, international airports, and national frontiers—areas with many geographic advantages for trade. Definition The World Bank defines free trade zones as "small, fenced-in, duty-free areas, offering warehousing, storage, and distribution facilities for trade, transshipment, and re-export operations". Free-trade zones can also be defined as labor-intensive manufacturing centers that involve the import of raw materials or components and the export of factory products, but this is a dated definition as more and more free-trade zones focus on service industries such as software, back-office operations, research, and financial services. Synonyms Free-t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Free Port

A free-trade zone (FTZ) is a class of special economic zone. It is a geographic area where goods may be imported, stored, handled, manufactured, or reconfigured and re-exported under specific customs regulation and generally not subject to customs duty. Free trade zones are generally organized around major seaports, international airports, and national frontiers—areas with many geographic advantages for trade. Definition The World Bank defines free trade zones as "small, fenced-in, duty-free areas, offering warehousing, storage, and distribution facilities for trade, transshipment, and re-export operations". Free-trade zones can also be defined as labor-intensive manufacturing centers that involve the import of raw materials or components and the export of factory products, but this is a dated definition as more and more free-trade zones focus on service industries such as software, back-office operations, research, and financial services. Synonyms Free-trade zones ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Corporate Inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. In US federal legislation a company which has been restructured in this manner is referred to as an inverted domestic corporation, and the term "corporate expatriate" is also used, for example in the Homeland Security Act of 2002. The majority of the less than 100 material tax inversions recorded since 1993 have been of US corporations (85 inversions), seeking to pay less to the US corporate tax system. The only other jurisdiction to experience a material outflow of tax inversions was the United Kingdom fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Corporate Haven

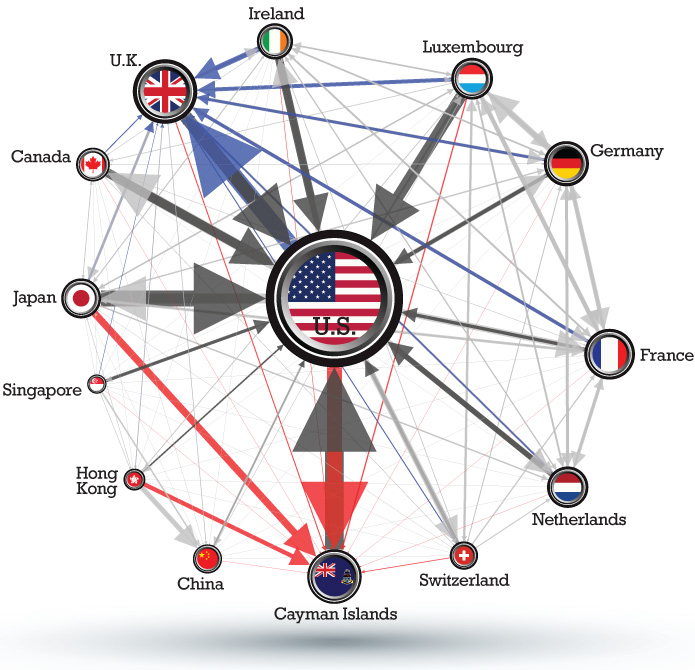

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or Incorporation (business), incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero Corporation tax in the Republic of Ireland#Effective tax rate (ETR), effective tax rates, due to their need to encourage jurisdictions to enter into bilateral Tax treaty, tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Underground Economy

A black market is a clandestine market or series of transactions that has some aspect of illegality, or is not compliant with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution are prohibited or restricted by law, non-compliance with the rule constitutes a black-market trade since the transaction itself is illegal. Such transactions include the illegal drug trade, prostitution (where prohibited), illegal currency transactions, and human trafficking. Participants try to hide their illegal behavior from the government or regulatory authority. Cash is the preferred medium of exchange in illegal transactions, since cash transactions are less easily traced. Common motives for operating in black markets are to trade contraband, avoid taxes and regulations, or evade price controls or rationing. Typically, the totality of such activity is referred to with the definite article, e.g., "''the'' black market in bush meat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Asset Protection

Asset protection (sometimes also referred to as ''debtor-creditor law'') is a set of legal techniques and a body of statutory and common law dealing with protecting assets of individuals and business entities from civil money judgments. The goal of asset protection planning is to insulate assets from claims of creditors without perjury or tax evasion. Asset protection consists of methods available to protect assets from liabilities arising elsewhere. It should not be confused with ''limiting liability'', which concerns the ability to stop or constrain liability to the asset or activity from which it arises. Assets that are shielded from creditors by law are few: common examples include some home equity, certain retirement plans and interests in LLCs and limited partnerships (and even these are not always unreachable). Assets that are almost always unreachable are those to which one does not hold legal title. In many cases it is possible to vest legal title to personal assets in a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Economic Substance

Economic substance is a doctrine in the tax law of the United States under which a transaction must have both a substantial purpose aside from reduction of tax liability and an economic effect aside from the tax effect in order to qualify for any tax benefits. This doctrine is used by the Internal Revenue Service to determine whether tax shelters, or strategies used to reduce tax liability, are considered "abusive". Under the doctrine, for a transaction to be respected, the transaction must change the taxpayer's economic position in a "meaningful way" apart from the Federal income tax effects, and the taxpayer must have had a "substantial purpose" for entering into the transaction, apart from the Federal income tax effects. The economic substance doctrine was originally a common law doctrine. The doctrine was codified in subsection (o) of section 7701 of the Internal Revenue Code by the Health Care and Education Reconciliation Act of 2010.Sec. 1409, Pub. L. No. 111-152, 124 Stat. 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |