|

Tax Revenue

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resources and/or foreign aid. An inefficient collection of taxes is greater in countries characterized by poverty, a large agricultural sector and large amounts of foreign aid. Just as there are different types of tax, the form in which tax revenue is collected also differs; furthermore, the agency that collects the tax may not be part of central government, but may be a third party licensed to collect tax which they themselves will use. For example, in the UK, the Driver and Vehicle Licensing Agency (DVLA) collects vehicle excise duty, which is then passed on to HM Treasury. Tax revenues on purchases come in two forms: "tax" itself is a percentage of the price added to the purchase (such as sales tax in U.S. states, or VAT in the UK), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For example, a person's income in an economic sense may be different from their income as defined by law. An extremely important definition of income is Haig–Simons income, which defines income as ''Consumption + Change in net worth'' and is widely used in economics. For households and individuals in the United States, income is defined by tax law as a sum that includes any wage, salary, profit, interest payment, rent, or other form of earnings received in a calendar year.Case, K. & Fair, R. (2007). ''Principles of Economics''. Upper Saddle River, NJ: Pearson Education. p. 54. Discretionary income is often defined as gross income minus taxes and other deductions (such as mandatory pension contributions), and is widely used as a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developed Country

A developed country, or advanced country, is a sovereign state that has a high quality of life, developed economy, and advanced technological infrastructure relative to other less industrialized nations. Most commonly, the criteria for evaluating the degree of economic development are the gross domestic product (GDP), gross national product (GNP), the per capita income, level of industrialization, amount of widespread infrastructure and general standard of living. Which criteria are to be used and which countries can be classified as being developed are subjects of debate. Different definitions of developed countries are provided by the International Monetary Fund and the World Bank; moreover, HDI ranking is used to reflect the composite index of life expectancy, education, and income per capita. In 2025, 40 countries fit all three criteria, while an additional 21 countries fit two out of three. Developed countries have generally more advanced post-industrial economies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Management

Risk management is the identification, evaluation, and prioritization of risks, followed by the minimization, monitoring, and control of the impact or probability of those risks occurring. Risks can come from various sources (i.e, Threat (security), threats) including uncertainty in Market environment, international markets, political instability, dangers of project failures (at any phase in design, development, production, or sustaining of life-cycles), legal liabilities, credit risk, accidents, Natural disaster, natural causes and disasters, deliberate attack from an adversary, or events of uncertain or unpredictable root cause analysis, root-cause. Retail traders also apply risk management by using fixed percentage position sizing and risk-to-reward frameworks to avoid large drawdowns and support consistent decision-making under pressure. There are two types of events viz. Risks and Opportunities. Negative events can be classified as risks while positive events are classifi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Capacity

Fiscal capacity is the ability of the state to extract revenues to provide public goods and carry out other functions of the state, given an administrative, fiscal accounting structure. In economics and political science, fiscal capacity may be referred to as tax capacity, extractive capacity or the power to tax, as taxes are a main source of public revenues. Nonetheless, though tax revenue is essential to fiscal capacity, taxes may not be the government's only source of revenue. Other sources of revenue include foreign aid and natural resources. In addition to the amount of public revenue the state extracts, fiscal capacity is the state's investment in "state structures—including monitoring, administration, and compliance through such things as training tax inspectors and running the revenue service efficiently". When investment in these administrative or bureaucratic fiscal structures are specific to the state's power to extract resources, fiscal capacity is moreover related to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Per Capita Income

Per capita income (PCI) or average income measures the average income earned per person in a given area (city, region, country, etc.) in a specified year. In many countries, per capita income is determined using regular population surveys, such as the American Community Survey. This allows the calculation of per capita income for both the country as a whole and specific regions or demographic groups. However, comparing per capita income across different countries is often difficult, since methodologies, definitions and data quality can vary greatly. Since the 1990s, the OECD has conducted regular surveys among its 38 member countries using a standardized methodology and set of questions. Per capita income is often used to measure a sector's average income and compare the wealth of different populations. Per capita income is also often used to measure a country's standard of living. When used to compare income levels of different countries, it is usually expressed using a commonly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a mandatory financial charge or levy imposed on an individual or legal person, legal entity by a governmental organization to support government spending and public expenditures collectively or to Pigouvian tax, regulate and reduce negative Externality, externalities. Tax compliance refers to policy actions and individual behavior aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax relief. The first known taxation occurred in Ancient Egypt around 3000–2800 BC. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as labor equivalent. All countries have a tax system in place to pay for public, common societal, or agreed national needs and for the functions of government. Some countries levy a flat tax, flat percentage rate of taxation on personal annual income, but most progressive tax, scale taxes are progressive based on brackets of yearly income amounts. Most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He was a columnist for ''The New York Times'' from 2000 to 2024. In 2008, Krugman was the sole winner of the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory, new trade theory and New Economic Geography, new economic geography. The Prize Committee cited Krugman's work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of Economy of scale, economies of scale and of consumer preferences for diverse goods and services. Krugman was previously a professor of economics at MIT, and, later, at Princeton University which he retired from in June 2015, holding the title of Emeritus, professor emeritus there ever since. He also holds the title o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Market

A black market is a Secrecy, clandestine Market (economics), market or series of transactions that has some aspect of illegality, or is not compliant with an institutional set of rules. If the rule defines the set of goods and services whose production and distribution are prohibited or restricted by law, non-compliance with the rule constitutes a black-market trade since the transaction itself is illegal. Such transactions include the illegal drug trade, prostitution (where prohibited), illegal currency transactions, and human trafficking. Participants try to hide their illegal behavior from the government or regulatory authority. Cash is the preferred medium of exchange in illegal transactions, since cash transactions are less easily traced. Common motives for operating in black markets are to trade contraband, avoid taxes and regulations, or evade price controls or rationing. Typically, the totality of such activity is referred to with the definite article, e.g., "''the' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, bribing authorities and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that the tax authority requests be reported and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that intend to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Evening Independent

The ''Evening Independent'' was St. Petersburg, Florida's first daily newspaper. The sister evening newspaper of the '' St. Petersburg Times'', it was launched as a weekly newspaper in March 1906 under the ownership of Willis B. Powell. In November 1907, it became a daily paper as the ''St. Petersburg Evening Independent''. The newspaper was known for its "Sunshine Offer", which was first enacted in 1910 by Lew Brown as a way to publicize St. Petersburg as "The Sunshine City". The paper offered copies free following days without sunshine in St. Petersburg. From 1910 until the paper folded in 1986, the ''Evening Independent'' made good on its offer 296 times. The ''Evening Independent'' was acquired by the ''Times'' in 1962, when its previous owner, the Thomson newspaper chain, threatened to close it down. Roy Thomson had originally bought the ''Independent'' so he would have a place to moor his yacht. The ''Evening Independent'' was merged into the ''Times'' in November 1986 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

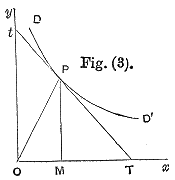

Price Elasticity Of Demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good ( law of demand), but it falls more for some than for others. The price elasticity gives the percentage change in quantity demanded when there is a one percent increase in price, holding everything else constant. If the elasticity is −2, that means a one percent price rise leads to a two percent decline in quantity demanded. Other elasticities measure how the quantity demanded changes with other variables (e.g. the income elasticity of demand for consumer income changes). Price elasticities are negative except in special cases. If a good is said to have an elasticity of 2, it almost always means that the good has an elasticity of −2 according to the formal definition. The phrase "more elastic" means that a good's elasticity has greater magnitude, ignoring the sign. Veblen and Giffen goods are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |