|

System Open Market Account

The System Open Market Account (SOMA) is a securities portfolio managed by the Federal Reserve Bank of New York, that holds the assets it has purchased through open market operations (OMOs) in the course of carrying out monetary policy. Through SOMA transactions, the Federal Reserve System influences interest rates and the amount of reserves in the US banking system. Income from SOMA assets also provides funding for the Federal Reserve's activities, which are not funded by Congress. The Federal Open Market Committee (FOMC) instructs the Reserve Bank of New York as to how it should use the SOMA to support monetary policy. Purpose SOMA's primary purpose is to assist the New York Fed in carrying out open market operations (OMOs) and foreign exchange interventions (the U.S. Treasury, in consultation with the Federal Reserve System, is responsible for setting U.S. exchange rate policy). The U.S. monetary authorities—the Treasury and the Fed—may intervene in the foreign exchange marke ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liability (financial Accounting)

In financial accounting, a liability is defined as the future sacrifices of economic benefits that the entity is ''obliged'' to make to other entities as a result of past transactions or other ''past'' events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future. Characteristics A liability is defined by the following characteristics: * Any type of borrowing from persons or banks for improving a business or personal income that is payable during short or long time; * A duty or responsibility to others that entails settlement by future transfer or use of assets, provision of services, or other transaction yielding an economic benefit, at a specified or determinable date, on occurrence of a specified event, or on demand; * A duty or responsibility that obligates the entity to another, leaving it little or no discretion to avoid settlement; and, * A transaction or event obligating the entity t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microsoft Excel

Microsoft Excel is a spreadsheet developed by Microsoft for Microsoft Windows, Windows, macOS, Android (operating system), Android and iOS. It features calculation or computation capabilities, graphing tools, pivot tables, and a macro (computer science), macro programming language called Visual Basic for Applications (VBA). Excel forms part of the Microsoft Office suite of software. Features Basic operation Microsoft Excel has the basic features of all spreadsheets, using a grid of ''cells'' arranged in numbered ''rows'' and letter-named ''columns'' to organize data manipulations like arithmetic operations. It has a battery of supplied functions to answer statistical, engineering, and financial needs. In addition, it can display data as line graphs, histograms and charts, and with a very limited three-dimensional graphical display. It allows sectioning of data to view its dependencies on various factors for different perspectives (using ''pivot tables'' and the ''sce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Open Data

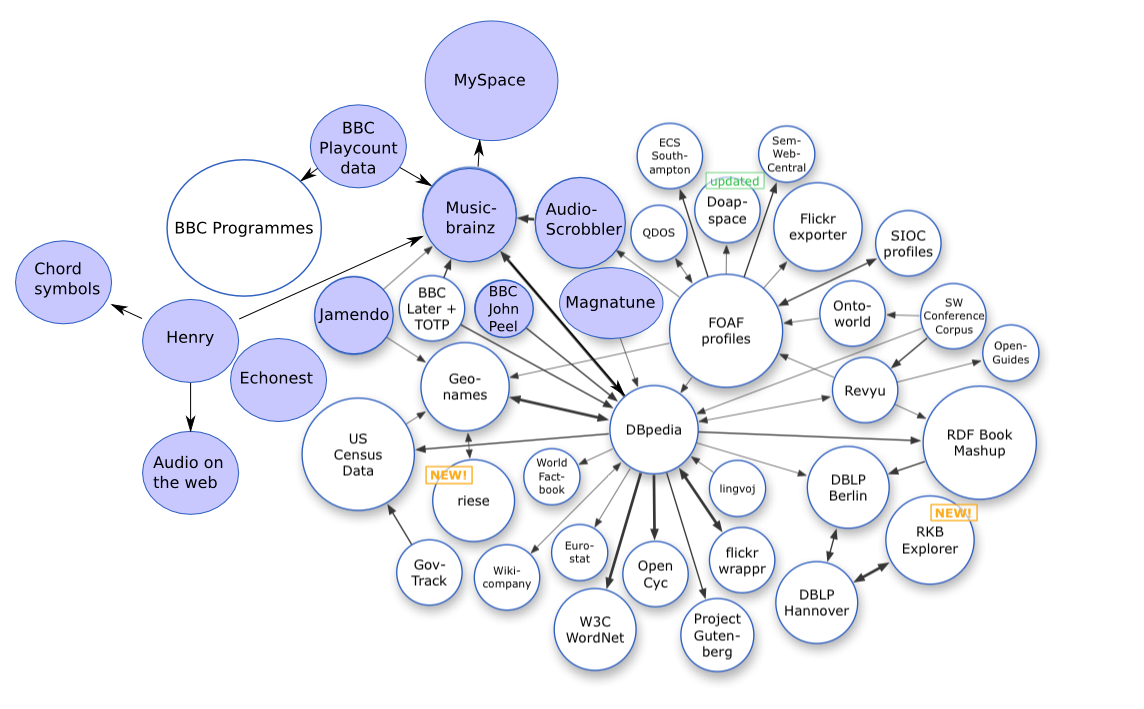

Open data is data that is openly accessible, exploitable, editable and shared by anyone for any purpose. Open data is licensed under an open license. The goals of the open data movement are similar to those of other "open(-source)" movements such as open-source software, hardware, open content, open specifications, open education, open educational resources, open government, open knowledge, open access, open science, and the open web. The growth of the open data movement is paralleled by a rise in intellectual property rights. The philosophy behind open data has been long established (for example in the Mertonian tradition of science), but the term "open data" itself is recent, gaining popularity with the rise of the Internet and World Wide Web and, especially, with the launch of open-data government initiatives such as Data.gov, Data.gov.uk and Data.gov.in. Open data can be linked data - referred to as linked open data. One of the most important forms of open data is o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Note

Federal Reserve Notes, also United States banknotes, are the currently issued banknotes of the United States dollar. The United States Bureau of Engraving and Printing produces the notes under the authority of the Federal Reserve Act of 1913 and issues them to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The Reserve Banks then circulate the notes to their member banks, at which point they become liabilities of the Reserve Banks and obligations of the United States. Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. The notes are backed by financial assets that the Federal Reserve Banks pledge as collateral, which are mainly Treasury securities and mortgage agency securities that they purchase on the open market by fiat payment. History Prior to centralized banking, each commercial bank issued its own notes. The first institution ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold Certificate (United States)

Gold certificates were issued by the United States Treasury as a form of representative money from 1865 to 1933. While the United States observed a gold standard, the certificates offered a more convenient way to pay in gold than the use of coins. General public ownership of gold certificates was outlawed in 1933 and since then they have been available only to the Federal Reserve Banks, with book-entry certificates replacing the paper form. Overview Gold certificates were first authorized under the Legal Tender Act of 1863, but unlike the United States Notes also authorized, they apparently were not printed until 1865. The need for them arose from the limitations of the United States Notes. To promote the flow of gold into the Treasury and maintain the credit of the government, the notes could not be used to pay customs duties or interest on the federal debt. Gold certificates, representing coins held physically in the Treasury, were instead provided for those purposes. The notes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Bank Liquidity Swap

Central bank liquidity swap is a type of currency swap used by a country's central bank to provide liquidity of its currency to another country's central bank. In a liquidity swap, the lending central bank uses its currency to buy the currency of another borrowing central bank at the market exchange rate, and agrees to sell the borrower's currency back at a rate that reflects the interest accrued on the loan. The borrower's currency serves as collateral. Swap line prehistory Avatars of the later currency swap lines first appeared in the period 1880–1920, when central banks exchanged gold reserves at need; but the first actual currency swap lines (between eight central banks) were set up in the 1960s: they were activated and used by three jurisdictions, the Bank of England, the Bank of Canada, and the US. The swap lines were briefly re-established in the wake of 9/11, but only became of global importance with the onset of the financial crisis of 2007–2008. Reason for liquidity s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Euro

The euro ( symbol: €; code: EUR) is the official currency of 19 out of the member states of the European Union (EU). This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens . The euro is divided into 100 cents. The currency is also used officially by the institutions of the European Union, by four European microstates that are not EU members, the British Overseas Territory of Akrotiri and Dhekelia, as well as unilaterally by Montenegro and Kosovo. Outside Europe, a number of special territories of EU members also use the euro as their currency. Additionally, over 200 million people worldwide use currencies pegged to the euro. As of 2013, the euro is the second-largest reserve currency as well as the second-most traded currency in the world after the United States dollar. , with more than €1.3 trillion in circulation, the euro has one of the highest combined values of banknotes and coins in c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repurchase Agreement

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price. The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, either in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets. In 2007–2008, a run on the repo market, in which funding for investment banks was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Treasury Security

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt. There are four types of marketable Treasury securities: Treasury bills, Treasury notes, Treasury bonds, and Treasury Inflation Protected Securities (TIPS). The government sells these securities in auctions conducted by the Federal Reserve Bank of New York, after which they can be traded in secondary markets. Non-marketable securities include savings bonds, issued to the public and transferable only as gifts; the State and Local Government Series (SLGS), purchaseable only with the proceeds of state and municipal bond sales; and the Government Account Series, purchased by units of the federal government. Treasury securities are b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetary Policy Of The United States

Monetary policy of The United States concerns those policies related to the minting & printing of money, policies governing the legal exchange of currency, demand deposits, the money supply, etc. In the United States, the central bank, The Federal Reserve System, colloquially known as "The Fed" is the monetary authority. It is significant to point out that the United States uses a fiat currency as of 1933, whereas from 1873 - 1933 a precious metal standard or gold standard was in use. The Federal Reserve's board of governors, along with the Open Market Committee are the principle arbiters of monetary policy in the United States, though the U.S. is unique in that the monetary policy role is ultimately shared along with the United States Treasury ( US Treasury Securities). The Treasury is the penultimate agency on fiscal policy, though it is directly involved in monetary policy through printing & minting federal reserve notes and treasurys. The Fed is largely concerned with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Reserves

Bank reserves are a commercial bank's cash holdings physically held by the bank, and deposits held in the bank's account with the central bank. Under the fractional-reserve banking system used in most countries, central banks typically set minimum reserve requirements that require commercial banks under its purview to hold cash or deposits at the central bank equivalent to at least a prescribed percentage of their liabilities, such as customer deposits. Such sums are usually termed required reserves, and any funds above the required amount are called excess reserves. These reserves are prescribed to ensure that, in the normal events, there is sufficient liquidity in the banking system to provide funds to bank customers wishing to withdraw cash. Even when there are no reserve requirements, banks often as a matter of prudent management hold reserves in case of unexpected events, such as unusually large net withdrawals by customers (such as before Christmas) or bank runs. In general ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)