|

Swiss Market Index

The Swiss Market Index (SMI) is Switzerland's blue-chip stock market index, which makes it the most followed in the country. It is made up of 20 of the largest and most liquid Swiss Performance Index (SPI) stocks. As a price index, the SMI is not adjusted for dividends. The SMI was introduced on 30 June 1988 at a baseline value of 1,500 points. It closed above the symbolic level of 10,000 points for the first time on 2 July 2019. It reached the 12,000 point milestone on 17 June 2021. It is currently in a bear market, which it entered on 22 September 2022 after losing more than 20%. This ended the bull market that had reached an all-time record closing price short of 13,000 on 28 December 2021. Its composition is examined once a year. As of September 2022, it contains 18 large-caps and two mid-caps. Calculation takes place in real-time. As soon as a new transaction occurs in a security contained in the SMI, an updated index level is calculated and displayed. However, the index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Market Index

The Swiss Market Index (SMI) is Switzerland's blue-chip stock market index, which makes it the most followed in the country. It is made up of 20 of the largest and most liquid Swiss Performance Index (SPI) stocks. As a price index, the SMI is not adjusted for dividends. The SMI was introduced on 30 June 1988 at a baseline value of 1,500 points. It closed above the symbolic level of 10,000 points for the first time on 2 July 2019. It reached the 12,000 point milestone on 17 June 2021. It is currently in a bear market, which it entered on 22 September 2022 after losing more than 20%. This ended the bull market that had reached an all-time record closing price short of 13,000 on 28 December 2021. Its composition is examined once a year. As of September 2022, it contains 18 large-caps and two mid-caps. Calculation takes place in real-time. As soon as a new transaction occurs in a security contained in the SMI, an updated index level is calculated and displayed. However, the index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Confederation

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel, St. Gallen a.o.). , coordinates = , largest_city = Zürich , official_languages = , englishmotto = "One for all, all for one" , religion_year = 2020 , religion_ref = , religion = , demonym = , german: Schweizer/Schweizerin, french: Suisse/Suissesse, it, svizzero/svizzera or , rm, Svizzer/Svizra , government_type = Federal assembly-independent directorial republic with elements of a direct democracy , leader_title1 = Federal Council , leader_name1 = , leader_title2 = , leader_name2 = Walter Thurnherr , legislature = Federal Assembly , upper_house = Council of Stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hoffmann-La Roche

F. Hoffmann-La Roche AG, commonly known as Roche, is a Swiss multinational healthcare company that operates worldwide under two divisions: Pharmaceuticals and Diagnostics. Its holding company, Roche Holding AG, has shares listed on the SIX Swiss Exchange. The company headquarters are located in Basel. Roche is the fifth largest pharmaceutical company in the world by revenue, and the leading provider of cancer treatments globally. The company controls the American biotechnology company Genentech, which is a wholly owned affiliate, and the Japanese biotechnology company Chugai Pharmaceuticals, as well as the United States-based companies Ventana and Foundation Medicine. Roche's revenues during fiscal year 2020 were 58.32 billion Swiss francs. Descendants of the founding Hoffmann and Oeri families own slightly over half of the bearer shares with voting rights (a pool of family shareholders 45%, and Maja Oeri a further 5% apart), with Swiss pharma firm Novartis owning a furth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nestlé

Nestlé S.A. (; ; ) is a Switzerland, Swiss multinational food and drink processing conglomerate corporation headquartered in Vevey, Vaud, Switzerland. It is the largest publicly held food company in the world, measured by revenue and other metrics, since 2014."Nestlé's Brabeck: We have a "huge advantage" over big pharma in creating medical foods" , ''CNN Money'', 1 April 2011 It ranked No. 64 on the Fortune Global 500, ''Fortune'' Global 500 in 2017 and No. 33 in the 2016 edition of the ''Forbes'' Global 2000 list of largest public companies. Nestlé's products include baby food (some including human milk oligosaccharides), medical food, bottled water, breakfast cereals, coffee and tea, confectionery, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Significance

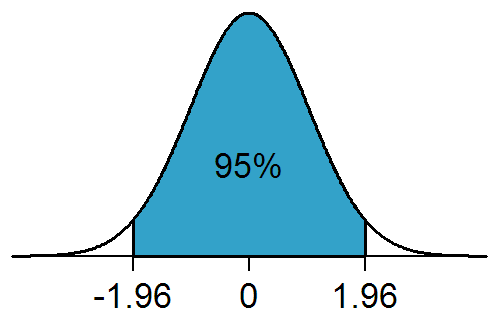

In statistical hypothesis testing, a result has statistical significance when it is very unlikely to have occurred given the null hypothesis (simply by chance alone). More precisely, a study's defined significance level, denoted by \alpha, is the probability of the study rejecting the null hypothesis, given that the null hypothesis is true; and the ''p''-value of a result, ''p'', is the probability of obtaining a result at least as extreme, given that the null hypothesis is true. The result is statistically significant, by the standards of the study, when p \le \alpha. The significance level for a study is chosen before data collection, and is typically set to 5% or much lower—depending on the field of study. In any experiment or observation that involves drawing a sample from a population, there is always the possibility that an observed effect would have occurred due to sampling error alone. But if the ''p''-value of an observed effect is less than (or equal to) the significanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sample Size Determination

Sample size determination is the act of choosing the number of observations or replicates to include in a statistical sample. The sample size is an important feature of any empirical study in which the goal is to make inferences about a population from a sample. In practice, the sample size used in a study is usually determined based on the cost, time, or convenience of collecting the data, and the need for it to offer sufficient statistical power. In complicated studies there may be several different sample sizes: for example, in a stratified survey there would be different sizes for each stratum. In a census, data is sought for an entire population, hence the intended sample size is equal to the population. In experimental design, where a study may be divided into different treatment groups, there may be different sample sizes for each group. Sample sizes may be chosen in several ways: *using experience – small samples, though sometimes unavoidable, can result in wide confiden ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Securities And Markets Authority

The European Securities and Markets Authority (ESMA) is an independent European Union Authority located in Paris. ESMA replaced the Committee of European Securities Regulators (CESR) on 1 January 2011. It is one of the three new European Supervisory Authorities set up within the European System of Financial Supervisors. __TOC__ Overview ESMA works in the field of securities legislation and regulation to improve the functioning of financial markets in Europe, strengthening investor protection and co-operation between national competent authorities. The idea behind ESMA is to establish an "EU-wide financial markets watchdog". One of its main tasks is to regulate credit rating agencies. In 2010 credit rating agencies were criticized for the lack of transparency in their assessments and for a possible conflict of interest. At the same time, the impact of the assigned ratings became significant for companies and banks but also states. In October 2017, ESMA organised its first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prague Interbank Offered Rate

The Prague Inter Bank Offered Rate (PRIBOR) is the average rate at which banks are willing to lend liquidity on the Czech interbank money market and as such, reflects the price of money on the market. PRIBOR belongs to the family of IBORs (InterBank Offered Rates) together with other financial benchmarks, e.g. LIBOR in London or EURIBOR in continental Europe. History of PRIBOR PRIBOR was created in Czechoslovakia in 1992 when a need for a financial benchmark was recognized and was modeled in the image of major benchmarks that already existed since the '80s. It was created by the Central Bank of Czechoslovakia, who started collection quotes from reference banks in order to determine PRIBOR. After the split of Czechoslovakia in 1993, the process of calculating PRIBOR was taken over by the newly created Czech National Bank (CNB). CNB was responsible for calculating the rate up to the point, where they handed over the role of calculation agent to Telerate (who was acquired by Reuter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Structured Products

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized "structurer" to design and manage its structured-product offering. Formal definitions U.S. Securities and Exchange Commission (SEC) Rule 434 (regarding certain prospectus deliveries) defines structured securities as "securities whose cash flow characteristics depend upon one or more indices or that have embedded forwards or options or securities where an investor's investment return and the issuer's payment obligations are contingent on, or highly sensitive to, changes in the value of underly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract that ''derives'' its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying". Derivatives can be used for a number of purposes, including insuring against price movements ( hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets. Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (off-exchange) or on an exchange such as the Chicago Mercantile Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financial crisis of 2007–2009, there has been increased pressure to move derivatives to trade on exchanges. Derivatives are one of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |