|

Swiss Bond Index

The Swiss Bond Index (SBI) is a bond index which tracks fixed-rate, investment-grade Bond (finance), obligations emitted in Swiss Francs, the currency of the Swiss Confederation. The index is calculated by SIX Swiss Exchange. It includes all the bonds emitted in CHF that meet inclusion criteria on Maturity (finance), maturity, issue size and rating. The SBI and its subindices are notably used in investment portfolios such as exchange-traded funds (ETFs) that track the CHF bond market. The SBI was introduced on 1 January 2007, with a baseline value of 100 points as of this date. It peaked above 146 in the Summer of 2019, before breaking its previous drawdown record, having lost more than 16% in June 2022 during the 2021–2022 inflation surge. In 2020, four SBI sub-indices, along with other SIX indices, were endorsed under the Prague interbank offered rate#European Benchmark Regulation (BMR), EU Benchmarks Regulation and are registered in ESMA, which means that they can be used as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SIX Swiss Exchange

SIX Swiss Exchange (formerly SWX Swiss Exchange), based in Zurich, is Switzerland's principal stock exchange (the other being Berne eXchange). SIX Swiss Exchange also trades other security (finance), securities such as Swiss government bonds and derivative (finance), derivatives such as stock options. SIX Swiss Exchange is completely owned by SIX Group, an unlisted public limited company itself controlled by 122 banks or financial institutions. The exchange in its current state was founded in 1993 by merging the Geneva Stock Exchange, the Basel Stock Exchange and the Zürich stock exchange into the (German for "Swiss Securities Exchanges Association"), publicly known in English as ''Swiss Exchange''.SIX Swiss Exchange Interactive brokers. Retrieved 15 April 2020. The newly created association took over trading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Franc

The Swiss franc is the currency and legal tender of Switzerland and Liechtenstein. It is also legal tender in the Italian exclave of Campione d'Italia which is surrounded by Swiss territory. The Swiss National Bank (SNB) issues banknotes and the federal mint Swissmint issues coins. In its polyglot environment, it is often simply referred as german: Franken, french: franc, it, franco and rm, franc. It is also designated through signes: ''Fr'' Some fonts render the currency sign character "₣" (unicodebr>U+20A3 as ligatured Fr, following the German language convention for the Swiss Franc. However, most fonts render the character as F with a strikethrough on the lower left, which is the unofficial sign of French Franc. (in German language), ''fr.'' (in French, Italian, Romansh languages), as well as in any other language, or internationally as ''CHF'' which stands for ''.'' This acronym also serves as eponymous ISO 4217 code of the currency, CHF being used by banks and financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalization-weighted Index

A capitalization-weighted (or cap-weighted) index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value (the share price multiplied by the number of outstanding shares), in a capitalization-weighted index. In other types of indices, different ratios are used. For example, the AMEX Composite Index (XAX) had more than 800 component stocks. The weighting of each stock constantly shifted with changes in the stock's price and the number of shares outstanding. The index fluctuates in line with the price move of the stocks. Stock market indices are a type of economic index. Free-float weighting A common version of capitalization weighting is the ''free-float'' weighting. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Market Index

The Swiss Market Index (SMI) is Switzerland's blue-chip stock market index, which makes it the most followed in the country. It is made up of 20 of the largest and most liquid Swiss Performance Index (SPI) stocks. As a price index, the SMI is not adjusted for dividends. The SMI was introduced on 30 June 1988 at a baseline value of 1,500 points. It closed above the symbolic level of 10,000 points for the first time on 2 July 2019. It reached the 12,000 point milestone on 17 June 2021. It is currently in a bear market, which it entered on 22 September 2022 after losing more than 20%. This ended the bull market that had reached an all-time record closing price short of 13,000 on 28 December 2021. Its composition is examined once a year. As of September 2022, it contains 18 large-caps and two mid-caps. Calculation takes place in real-time. As soon as a new transaction occurs in a security contained in the SMI, an updated index level is calculated and displayed. However, the index ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Performance Index

The Swiss Performance Index (SPI) is a wide total-return index that tracks equity primarily listed on SIX Swiss Exchange with a free-float of at least 20%, and excluding investment companies. The index covers large, mid and small caps and is weighted by market capitalization. Most constituents, although not all, are domiciled in Switzerland or the Principality of Liechtenstein. The SPI is Switzerland's most closely followed performance index. It is used as a benchmark for mutual funds, index funds and ETFs, and as an underlying index for derivative financial instruments such as options, futures and structured products. In 2020, the SPI, along with other SIX indices, was endorsed under the EU Benchmarks Regulation and is registered with the European Securities and Markets Authority, which means that it can be used as an underlying for financial products sold in the EU. SPI Universe The underlying share universe of the SPI is the Swiss All Share Index and includes approxima ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond Index

A bond index or bond market index is a method of measuring the investment performance and characteristics of the bond market. There are numerous indices of differing construction that are designed to measure the aggregate bond market and its various sectors (government, municipal, corporate, etc.) A bond index is computed from the change in market prices and, in the case of a total return index, the interest payments, associated with selected bonds over a specified period of time. Bond indices are used by investors and portfolio managers as a benchmark against which to measure the performance of actively managed bond portfolios, which attempt to outperform the index, and passively managed bond portfolios, that are designed to match the performance of the index. Bond indices are also used in determining the compensation of those who manage bond portfolios on a performance-fee basis. An index is a mathematical construct, so it may not be invested in directly. But many mutual funds ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Francs

The Swiss franc is the currency and legal tender of Switzerland and Liechtenstein. It is also legal tender in the Italian exclave of Campione d'Italia which is surrounded by Swiss territory. The Swiss National Bank (SNB) issues banknotes and the federal mint Swissmint issues coins. In its polyglot environment, it is often simply referred as german: Franken, french: franc, it, franco and rm, franc. It is also designated through signes: ''Fr'' Some fonts render the currency sign character "₣" (unicodebr>U+20A3 as ligatured Fr, following the German language convention for the Swiss Franc. However, most fonts render the character as F with a strikethrough on the lower left, which is the unofficial sign of French Franc. (in German language), ''fr.'' (in French, Italian, Romansh languages), as well as in any other language, or internationally as ''CHF'' which stands for ''.'' This acronym also serves as eponymous ISO 4217 code of the currency, CHF being used by banks and financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swiss Confederation

). Swiss law does not designate a ''capital'' as such, but the federal parliament and government are installed in Bern, while other federal institutions, such as the federal courts, are in other cities (Bellinzona, Lausanne, Luzern, Neuchâtel, St. Gallen a.o.). , coordinates = , largest_city = Zürich , official_languages = , englishmotto = "One for all, all for one" , religion_year = 2020 , religion_ref = , religion = , demonym = , german: Schweizer/Schweizerin, french: Suisse/Suissesse, it, svizzero/svizzera or , rm, Svizzer/Svizra , government_type = Federal assembly-independent directorial republic with elements of a direct democracy , leader_title1 = Federal Council , leader_name1 = , leader_title2 = , leader_name2 = Walter Thurnherr , legislature = Federal Assembly , upper_house = Council of Stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maturity (finance)

In finance, maturity or maturity date is the date on which the final payment is due on a loan or other financial instrument, such as a Bond (finance), bond or term deposit, at which point the Bond (finance)#Principal, principal (and all remaining interest) is due to be paid. Most instruments have a ''fixed maturity date'' which is a specific date on which the instrument matures. Such instruments include fixed interest and variable rate loans or debt instruments, however called, and other forms of security such as redeemable preference shares, provided their terms of issue specify a maturity date. It is similar in meaning to "redemption date". Some instruments have ''no fixed maturity date'' which continue indefinitely (unless repayment is agreed between the borrower and the lenders at some point) and may be known as "perpetual stocks". Some instruments have a range of possible maturity dates, and such stocks can usually be repaid at any time within that range, as chosen by the bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology companies. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

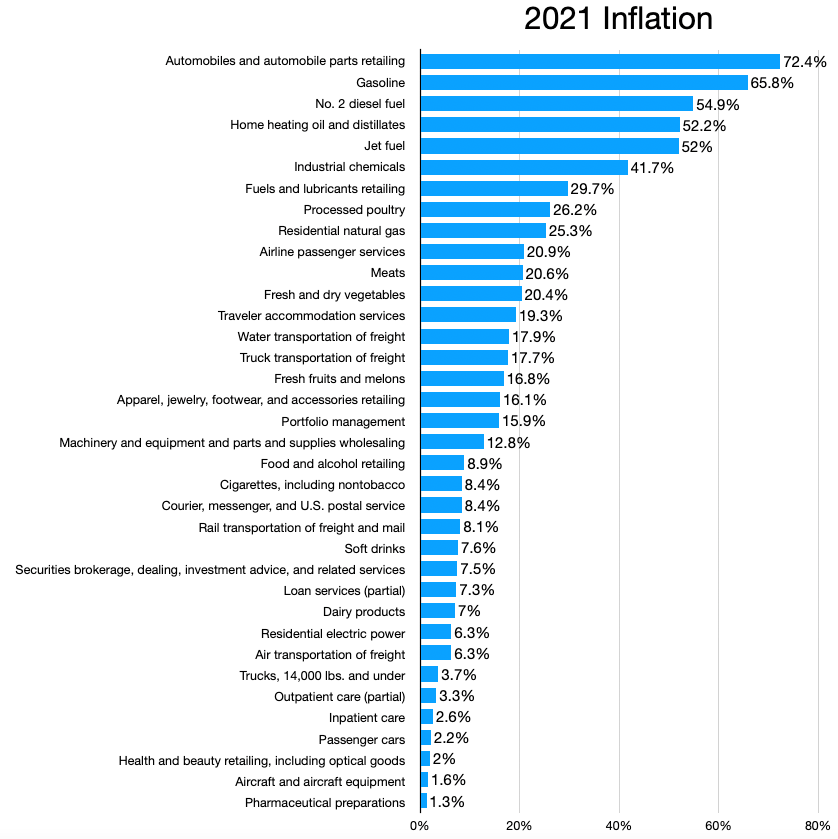

2021–2022 Inflation Surge

The 2021–2022 inflation surge is the higher-than-average economic inflation throughout much of the world that began in early 2021. It has been attributed to the 2021 global supply chain crisis caused by the COVID-19 pandemic, and unexpected demands for certain goods. As a result, many countries have seen their highest rates of inflation in decades. Background and causes While there is no unanimous agreement by economists as to the exact cause of the inflation surge, there are several theories. Most attribute it to product shortages resulting from global supply-chain problems, largely caused by the COVID-19 pandemic. Other causes cited include strong consumer demand; turmoil in the labor market; and the fact that 2021 prices are being compared to 2020 prices, which were depressed due to pandemic-related shutdowns. Additionally, many economists cite the unprecedented level of spending from the passage of COVID-19 relief programs by the Biden Administration as a key factor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)