|

Superdollar (economics)

The term superdollar is sometimes used to refer to a period of extreme strength of the United States dollar, relative to other currencies, particularly in the 1980s. This period ended when the G7 countries, concerned about the American trade deficit and the resulting protectionism, agreed to cooperate in the devaluation of the dollar in the Plaza Accord. References Foreign exchange market {{economics-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Dollar Index DXY

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strong Dollar Policy

The strong dollar policy is the United States economic policy based on the assumption that a strong exchange rate of the United States dollar (where a smaller dollar amount is needed to buy the same amount of other currency than would otherwise be the case) is in the interests of the United States and the whole world. It is said to be also driven by a desire to encourage foreign bondholders to buy more Treasury securities. The United States Secretary of the Treasury occasionally states that the U.S. supports a strong dollar. Despite this, the policy keeps inflation low, encourages foreign investment, and maintains the currency's role in the global financial system. Background Exchange rate weapon The term "exchange rate weapon" was introduced by Professor of International Economic Relations at the School of International Service at American University Randall Henning to describe the threat of manipulating the exchange rate of a strong country's currency with that of a weak co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BusinessWeek

''Bloomberg Businessweek'', previously known as ''BusinessWeek'', is an American weekly business magazine published fifty times a year. Since 2009, the magazine is owned by New York City-based Bloomberg L.P. The magazine debuted in New York City in September 1929. Bloomberg Businessweek business magazines are located in the Bloomberg Tower, 731 Lexington Avenue, Manhattan in New York City and market magazines are located in the Citigroup Center, 153 East 53rd Street between Lexington and Third Avenue, Manhattan in New York City. History ''Businessweek'' was first published based in New York City in September 1929, weeks before the stock market crash of 1929. The magazine provided information and opinions on what was happening in the business world at the time. Early sections of the magazine included marketing, labor, finance, management and Washington Outlook, which made ''Businessweek'' one of the first publications to cover national political issues that directly impacted the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trade Deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other. If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance. As of 2016, about 60 out of 200 countries have a trade surplus. The notion that bilateral trade deficits are bad in and of themselves is overwhelmingly rejected by trade experts and economists. Explanation The balance of trade forms part of the current account, which includes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

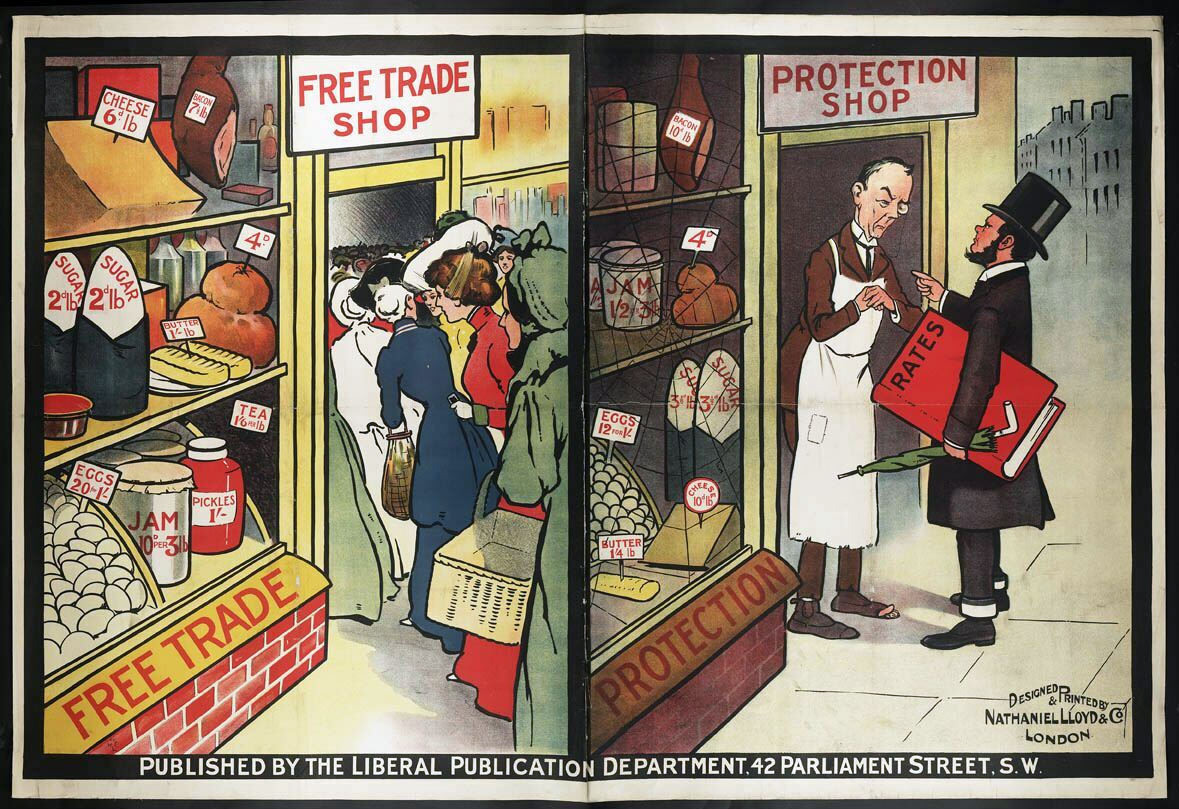

Protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulations. Proponents argue that protectionist policies shield the producers, businesses, and workers of the Import substitution industrialization, import-competing sector in the country from foreign competitors. Opponents argue that protectionist policies reduce trade and adversely affect consumers in general (by raising the cost of imported goods) as well as the producers and workers in export sectors, both in the country implementing protectionist policies and in the countries protected against. Protectionism is advocated mainly by parties that hold Economic nationalism, economic nationalist or left-wing positions, while economically right-wing political parties generally support free trade. There is a consensus among economists that protectioni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a ''revaluation''. A monetary authority (e.g., a central bank) maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate. However, under a floating exchange rate system (in which exchange rates are determined by market forces acting on the foreign exchange market, and not by government or central bank policy actions), a decrease in a currency's value relative to other major curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Plaza Accord

The Plaza Accord was a joint–agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British Pound sterling by intervening in currency markets. The U.S. dollar depreciated significantly from the time of the agreement until it was replaced by the Louvre Accord in 1987. Some commentators believe the Plaza Accord contributed to the Japanese asset price bubble of the late 1980s. Background The tight monetary policy of Federal Reserve's Chairman Paul Volcker and the expansionary fiscal policy of President Ronald Reagan's first term in 1981-84 pushed up long-term interest rates and attracted capital inflow, appreciating the dollar. The French government was strongly in favor of currency intervention to reduce it, but US administration officials such as Treasury Secretar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |