|

SunTrust

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered. As of September 2016, SunTrust Bank operated 1,400 bank branches and 2,160 ATMs across 11 southeastern states and Washington, D.C. The bank's primary businesses included deposits, lending, credit cards, and trust and investment services. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees. In 2013, it was ordered to pay $1.5 billion "to resolve claims of shoddy mortgage lending, servicing and foreclosure practices," and it reached a preliminary $968 Million settlement with the US government in 2014. In February 2019, SunTrust Banks announced its pending purchase by BB&T for $28 billion i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SunTrust Logo

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered. As of September 2016, SunTrust Bank operated 1,400 bank branches and 2,160 ATMs across 11 southeastern states and Washington, D.C. The bank's primary businesses included deposits, lending, credit cards, and trust and investment services. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees. In 2013, it was ordered to pay $1.5 billion "to resolve claims of shoddy mortgage lending, servicing and foreclosure practices," and it reached a preliminary $968 Million settlement with the US government in 2014. In February 2019, SunTrust Banks announced its pending purchase by BB&T for $28 billion i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

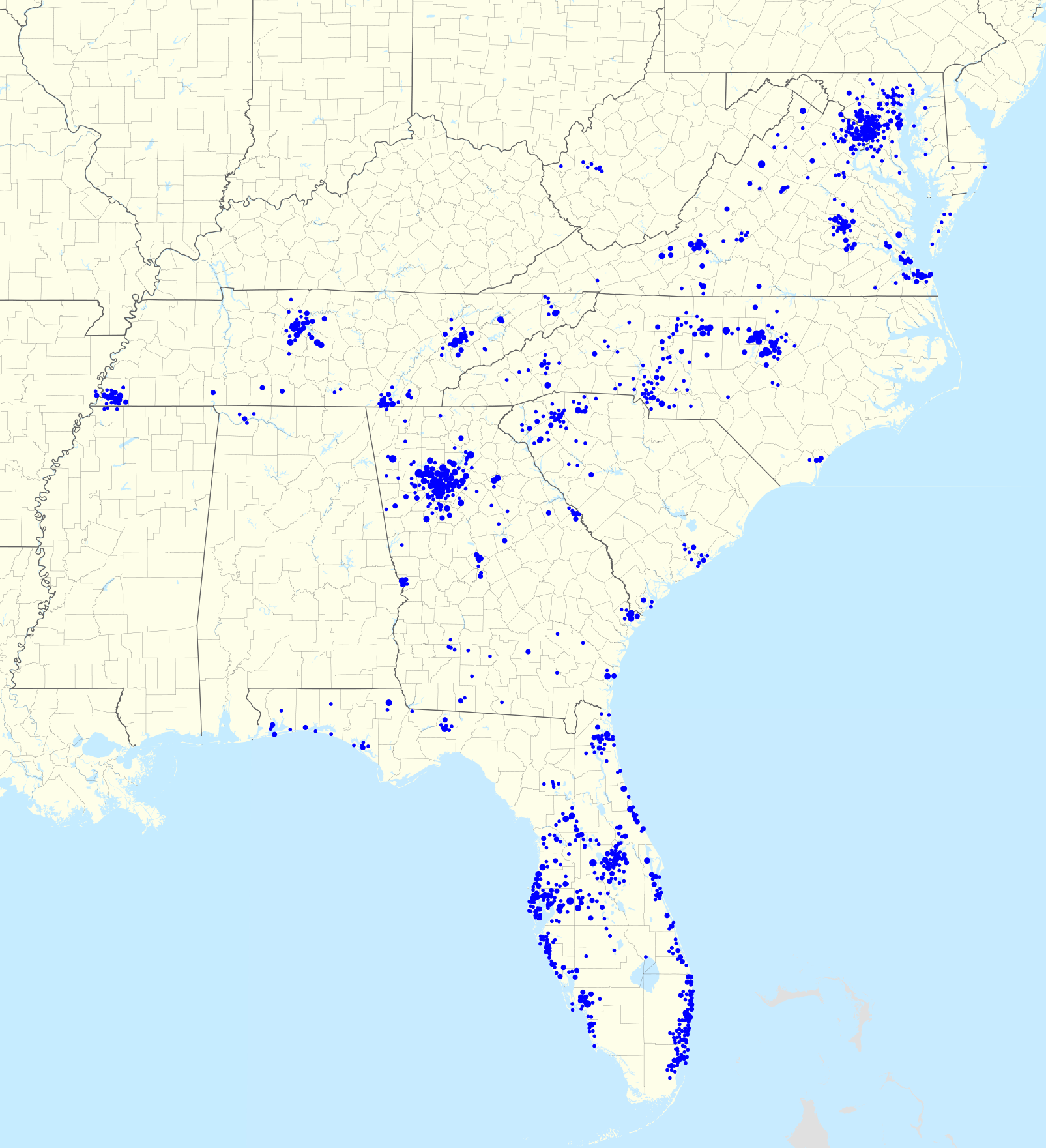

SunTrust Footprint 2010-08

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered. As of September 2016, SunTrust Bank operated 1,400 bank branches and 2,160 ATMs across 11 southeastern states and Washington, D.C. The bank's primary businesses included deposits, lending, credit cards, and trust and investment services. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees. In 2013, it was ordered to pay $1.5 billion "to resolve claims of shoddy mortgage lending, servicing and foreclosure practices," and it reached a preliminary $968 Million settlement with the US government in 2014. In February 2019, SunTrust Banks announced its pending purchase by BB&T for $28 billion i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Truist Financial

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T (Branch Banking and Trust Company) and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., and offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of June 2021, it is the 10th largest bank with $509 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world with $2.27 billion in annual revenue. History History of BB&T In 1872, Alpheus Branch and Thomas Jefferson Hadley founded the Branch and Hadley merchant bank in their hometown of Wilson, North Carolina. After many transactions, mostly with local farmers, Branch bought out Hadley's shares in 1887 and renamed the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Carolina Bank And Trust

Central Carolina Bank and Trust (CCB) was a bank headquartered in Durham, North Carolina. It began in 1961 with the merger of Durham Bank & Trust and University National Bank of Chapel Hill, North Carolina. Central Carolina Bank and Trust merged with SunTrust Banks of Atlanta, Georgia in 2005, which in turn merged with BB&T to form Truist Financial. Its headquarters was the historic 17-story Hill Building in North Carolina. History In 1899, attorney John Sprunt Hill married Annie Louise Watts, daughter of George Washington Watts, co-founder of the American Tobacco Company. Watts and Hill started Durham Loan & Trust Company and Home Savings Bank. Hill served as president and chairman of both banks. In 1931, Durham Loan & Trust became Durham Bank & Trust. Home Savings Bank and Durham Bank & Trust merged in 1950. In 1961, Durham Bank & Trust became Central Carolina Bank and Trust Company. In 1964, architect Frank DePasquale wanted to put a tobacco leaf on the new CCB sign to go atop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

BB&T

BB&T Corporation (previously known as the Branch Banking and Trust Company) was one of the largest banking and financial services firms in the United States, based in Winston-Salem, North Carolina. In 2019, BB&T announced its intentions to merge with Atlanta-based SunTrust Banks to form Truist Financial. History In 1872, Alpheus Branch and Thomas Jefferson Hadley founded the Branch and Hadley merchant bank in their hometown of Wilson, North Carolina. After many transactions, mostly with local farmers, Branch bought out Hadley's shares in 1887 and renamed the company Branch and Company, Bankers. During that same year, the bank also moved to its new headquarters on Nash Street in downtown Wilson, North Carolina. Two years later, Branch, his father-in-law Gen. Joshua Barnes, Hadley, and three other men secured a charter from the North Carolina General Assembly to operate the Wilson Banking and Trust Company. After many more name changes, the company finally settled on the name Branc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SunTrust Plaza

Truist Plaza is a 60 story skyscraper in downtown Atlanta. It was designed by John C. Portman, Jr. of John Portman & Associates and built from 1989 to 1992. In the mid-1990s, Portman sold half of his interest in the building to SunTrust Banks, which then moved its headquarters to the building and prompted a name change from One Peachtree Center to SunTrust Plaza. In 2021 the building changed its name to Truist Plaza, following a merger between SunTrust Banks and BB&T. The building is also known as 303 Peachtree. The building has a roof height of 871 feet (265 m) and stands a total of 902 feet (275 m) tall, including its antenna. When completed, Truist Plaza stood as the world's 28th tallest building and 21st tallest building in the United States. It is currently the 55th tallest building in the United States and 2nd tallest building in Atlanta. History Architect and developer John C. Portman, Jr. originally conceived this building in the 1980s commercial real-estate frenzy as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Commerce Financial

National Bank of Commerce was a bank headquartered in Memphis, Tennessee until it was taken over by SunTrust Banks in 2005. History Bank of Commerce & Trust began in 1873. Its limestone Neoclassicism, Classical Revival building was built in 1929. The 31-story One Commerce Square was completed in 1973 and has also been called the NBC Building and the SunTrust Building. In 1982, when Thomas M. Garrott became president of National Bank of Commerce and its parent company National Commerce Bancorporation (NCBC), NBC had 24 branches in Memphis. In 1985, NCBC made an arrangement with Kroger, which resulted in NBC branches being located inside grocery stores in Tennessee, Kentucky, Missouri, Arkansas, Mississippi and Alabama. The first in-store branch opened in Germantown, Tennessee later that year. During 1985 and 1986, NBC entered the Nashville, Tennessee and Knoxville, Tennessee markets under the names "Nashville Bank of Commerce" and "NBC Knoxville Bank". By 1988, NBC had 48 branches ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crestar Bank

Crestar Bank was a bank headquartered in Richmond, Virginia with branches in Virginia and Maryland. It was the leading subsidiary of Crestar Financial Corporation. In 1998, it was acquired by SunTrust Banks. At that time, it was the largest independent bank in Virginia. History The bank was originally chartered as State Planters Bank of Commerce and Trusts on December 8, 1865 in Richmond. In 1926, State Planters Bank of Commerce and Trusts merged with State & City Bank and Trust Co. and was renamed State Planters Bank and Trust Co. In 1969, it was renamed United Virginia Bank/State Planters. It reorganized as a holding company, United Virginia Bankshares, in 1971, which changed its name to Crestar Financial Corporation in 1987. In 1991, the bank acquired $527 million in deposits of Heritage Savings Bank for $2.35 million after it was seized by the Resolution Trust Corporation during the savings and loan crisis. In 1992, the bank acquired Perpetual Savings Bank for $7.8 million ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Atlanta

Atlanta ( ) is the capital and most populous city of the U.S. state of Georgia. It is the seat of Fulton County, the most populous county in Georgia, but its territory falls in both Fulton and DeKalb counties. With a population of 498,715 living within the city limits, it is the eighth most populous city in the Southeast and 38th most populous city in the United States according to the 2020 U.S. census. It is the core of the much larger Atlanta metropolitan area, which is home to more than 6.1 million people, making it the eighth-largest metropolitan area in the United States. Situated among the foothills of the Appalachian Mountains at an elevation of just over above sea level, it features unique topography that includes rolling hills, lush greenery, and the most dense urban tree coverage of any major city in the United States. Atlanta was originally founded as the terminus of a major state-sponsored railroad, but it soon became the convergence point among several rai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Atlanta, Georgia

Atlanta ( ) is the capital and most populous city of the U.S. state of Georgia. It is the seat of Fulton County, the most populous county in Georgia, but its territory falls in both Fulton and DeKalb counties. With a population of 498,715 living within the city limits, it is the eighth most populous city in the Southeast and 38th most populous city in the United States according to the 2020 U.S. census. It is the core of the much larger Atlanta metropolitan area, which is home to more than 6.1 million people, making it the eighth-largest metropolitan area in the United States. Situated among the foothills of the Appalachian Mountains at an elevation of just over above sea level, it features unique topography that includes rolling hills, lush greenery, and the most dense urban tree coverage of any major city in the United States. Atlanta was originally founded as the terminus of a major state-sponsored railroad, but it soon became the convergence point among several rai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richmond, Virginia

(Thus do we reach the stars) , image_map = , mapsize = 250 px , map_caption = Location within Virginia , pushpin_map = Virginia#USA , pushpin_label = Richmond , pushpin_map_caption = Location within Virginia##Location within the contiguous United States , pushpin_relief = yes , coordinates = , subdivision_type = Country , subdivision_name = , subdivision_type1 = U.S. state, State , subdivision_name1 = , established_date = 1742 , , named_for = Richmond, London, Richmond, United Kingdom , government_type = , leader_title = List of mayors of Richmond, Virginia, Mayor , leader_name = Levar Stoney (Democratic Party (United States), D) , total_type = City , area_magnitude = 1 E8 , area_total_sq_mi = 62.57 , area_land_sq_mi = 59.92 , area_ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Orlando, Florida

Orlando () is a city in the U.S. state of Florida and is the county seat of Orange County, Florida, Orange County. In Central Florida, it is the center of the Greater Orlando, Orlando metropolitan area, which had a population of 2,509,831, according to United States Census Bureau, U.S. Census Bureau figures released in July 2017, making it the List of Metropolitan Statistical Areas, 23rd-largest metropolitan area in the United States, the sixth-largest metropolitan area in the Southern United States, and the third-largest metropolitan area in Florida behind Miami and Tampa, Florida, Tampa. Orlando had a population of 307,573 in the 2020 census, making it the List of United States cities by population, 67th-largest city in the United States, the fourth-largest city in Florida, and the state's largest inland city. Orlando is one of the most-visited cities in the world primarily due to tourism, major events, and convention traffic; in 2018, the city drew more than 75 million v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |