|

Student Loan Deferment

Student loan deferment is an agreement between the student and lender that the student may reduce or postpone repayment of a student loan for a designated period. Deferment or forbearance will prevent the loan from going into default, but may increase the overall cost of the loan. Students may be eligible for deferment while experiencing financial hardship or unemployment. The lender may require valid proof of financial hardship and other financial information when the student applies. See also * Forbearance Forbearance, in the context of a mortgage process, is a special agreement between the lender and the borrower to delay a foreclosure. The literal meaning of forbearance is "holding back". This is also referred to as mortgage moratorium. Applica ... References {{reflist Education finance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lender

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed. The first party, in general, has provided some property or service to the second party under the assumption (usually enforced by contract) that the second party will return an equivalent property and service. The second party is frequently called a debtor or borrower. The first party is called the creditor, which is the lender of property, service, or money. Creditors can be broadly divided into two categories: secured and unsecured. *A secured creditor has a security or charge over some or all of the debtor's assets, to provide reassurance (thus to ''secure'' him) of ultimate repayment of the debt owed to him. This could be by way of, for example, a mortgage, where the property represents the security. *An unsecured creditor does not have a charge over the debtor's assets. The term creditor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Student Loan

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to citi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Default (finance)

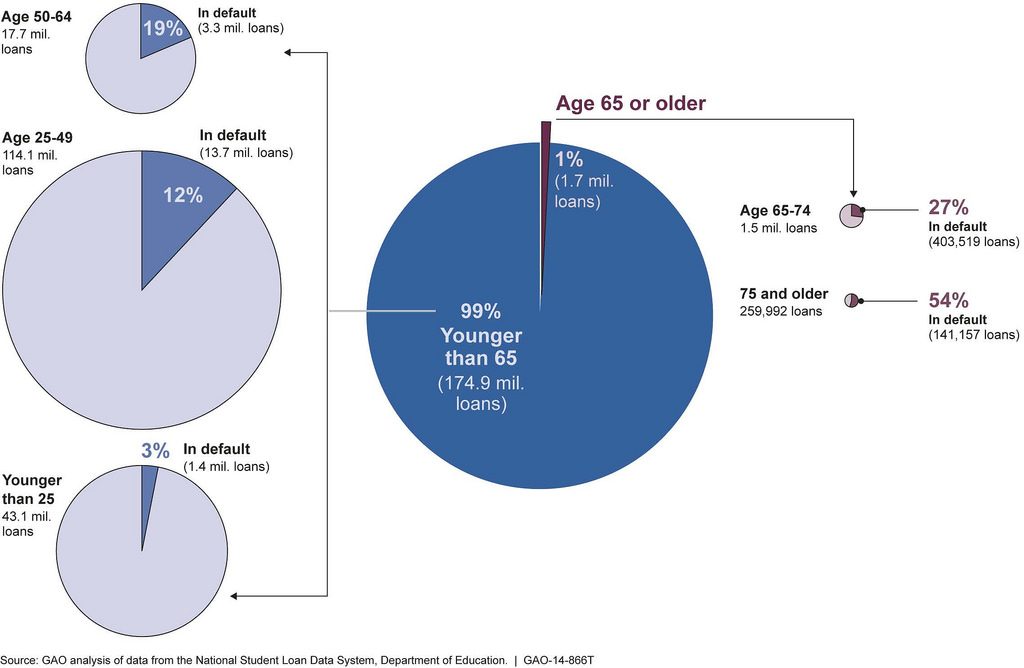

In finance, default is failure to meet the legal obligations (or conditions) of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt. The biggest private default in history is Lehman Brothers, with over $600 billion when it filed for bankruptcy in 2008. The biggest sovereign default is Greece, with $138 billion in March 2012. Distinction from insolvency, illiquidity and bankruptcy The term "default" should be distinguished from the terms "insolvency", illiquidity and " bankruptcy": * Default: Debtors have been passed behind the payment deadline on a debt whose payment was due. * Illiquidity: Debtors have insufficient cash (or other "liquefiable" assets) to pay debts. * Insolvency: A legal term meaning debtors are unable to pay their debts. * Bankruptcy: A legal finding tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forbearance

Forbearance, in the context of a mortgage process, is a special agreement between the lender and the borrower to delay a foreclosure. The literal meaning of forbearance is "holding back". This is also referred to as mortgage moratorium. Application and use When mortgage borrowers are unable to meet their repayment terms, lenders may opt to foreclose. To avoid foreclosure, the lender and the borrower can make an agreement called "forbearance." According to this agreement, the lender delays its right to exercise foreclosure if the borrower can catch up to its payment schedule by a certain time. This period and the payment plan depend on the details of the agreement that is accepted by both parties. COVID-19 pandemic Historically, forbearance has been granted for customers in temporary or short-term financial difficulty. If the borrower has more serious problems, e. g. the return to full mortgage payments in the long term does not appear sustainable, then forbearance is usually ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |