|

Stewardship Code 2010

The Stewardship Code is a part of UK company law concerning principles that institutional investors are expected to follow. It was first released in 2010 by the Financial Reporting Council ('FRC'), and in 2019 the FRC released an updated edition of the Stewardship Code. The UK Stewardship Code (“Code”) is a voluntary code for asset managers (investment managers), asset owners, and service providers (such as proxy advisers, investment consultants, and data providers). Its stated aim is to encourage active and engaged monitoring of corporate governance in the interests of beneficiaries. Specifically, the Code aims to promote the responsible allocation, management, and oversight of capital to create long-term value for clients and beneficiaries leading to sustainable benefits for the economy, the environment, and society. In late 2019, the FRC substantially updated the original 2010 Code introducing new principles for different signatory groups as well as introducing new themati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Company Law

The United Kingdom company law regulates corporations formed under the Companies Act 2006. Also governed by the Insolvency Act 1986, the UK Corporate Governance Code, European Union Directives and court cases, the company is the primary legal vehicle to organise and run business. Tracing their modern history to the late Industrial Revolution, public companies now employ more people and generate more of wealth in the United Kingdom economy than any other form of organisation. The United Kingdom was the first country to draft modern corporation statutes, where through a simple registration procedure any investors could incorporate, limit liability to their commercial creditors in the event of business insolvency, and where management was delegated to a centralised board of directors. An influential model within Europe, the Commonwealth and as an international standard setter, UK law has always given people broad freedom to design the internal company rules, so long as the mandato ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Reporting Council

The Financial Reporting Council (FRC) is an independent regulator in the UK and Ireland based in London Wall in the City of London, responsible for regulating auditors, accountants and actuaries, and setting the UK's Corporate Governance and Stewardship Codes. The FRC seeks to promote transparency and integrity in business by aiming its work at investors and others who rely on company reports, audits and high-quality risk management. In December 2018, an independent review of the FRC, led by Sir John Kingman, recommended its replacement by a new Audit, Reporting and Governance Authority, a recommendation followed by the government in March 2019. Ireland adopted the FRC's auditing framework in 2017. Structure The FRC is a company limited by guarantee, and is funded by the audit profession, who are required to contribute under the provisions of the Companies Act 2006 and by other groups subject to, or benefitting from FRC regulation. Its board of directors is appointed by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Governance

Corporate governance is defined, described or delineated in diverse ways, depending on the writer's purpose. Writers focused on a disciplinary interest or context (such as accounting, finance, law, or management) often adopt narrow definitions that appear purpose-specific. Writers concerned with regulatory policy in relation to corporate governance practices often use broader structural descriptions. A broad (meta) definition that encompasses many adopted definitions is "Corporate governance” describes the processes, structures, and mechanisms that influence the control and direction of corporations." This meta definition accommodates both the narrow definitions used in specific contexts and the broader descriptions that are often presented as authoritative. The latter include: the structural definition from the Cadbury Report, which identifies corporate governance as "the system by which companies are directed and controlled" (Cadbury 1992, p. 15); and the relational-structura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs. The term asset management is often used to refer to the management of investment funds, while the more generic term fund management may refer to all forms of institutional investment, as well as investment management for private investors. Investment managers who specialize in ''advisory'' or ''discretionary'' management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management within the context of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services And Markets Act 2000

The Financial Services and Markets Act 2000c 8 is an Act of the Parliament of the United Kingdom that created the Financial Services Authority (FSA) as a regulator for insurance, investment business and banking, and the Financial Ombudsman Service to resolve disputes as a free alternative to the courts. The Act was considerably amended by the Financial Services Act 2012 and the Bank of England and Financial Services Act 2016. Contents Some of the key sections of this act are: ;Part I The Regulator * Section 1A outlines the regulatory objectives of the Financial Conduct Authority: (a) market confidence; (b) financial stability (c) public awareness; (d) the protection of consumers; and (e) the reduction of financial crime. * Section 2A establishes the Prudential Regulation Authority ;Part II Regulated And Prohibited Activities * Section 19 requires firms to be authorised to conduct regulated activities. * Section 21 makes it a criminal offence to issue a financial promotion ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Listing Rules

The Listing Rules (LR) are a set of regulations applicable to any company listed on a United Kingdom stock exchange, subject to the oversight of the Financial Conduct Authority (FCA). The Listing Rules set out mandatory standards for any company wishing to list its shares or securities for sale to the public, including principles on executive pay and the requirement to comply or explain noncompliance with the UK Corporate Governance Code, the requirements of information in a prospectus before an initial public offering of shares, new share offers, rights issues, disclosure of price sensitive information, or takeover bids for companies. Overview *LR 1, Preliminary: All securities *LR 2, Requirements for listing: All securities *LR 3, Listing applications: All securities *LR 4, Listing particulars for professional securities market and certain other securities: All securities *LR 5, Suspending, cancelling and restoring listing: All securities *LR 6, Additional requirements for premiu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Corporate Governance Code

The UK Corporate Governance code, formerly known as the Combined Code (from here on referred to as "the Code") is a part of UK company law with a set of principles of good corporate governance aimed at companies listed on the London Stock Exchange. It is overseen by the Financial Reporting Council and its importance derives from the Financial Conduct Authority's Listing Rules. The Listing Rules themselves are given statutory authority under the Financial Services and Markets Act 2000 and require that public listed companies disclose how they have complied with the code, and explain where they have not applied the code in what the code refers to as 'comply or explain'. Private companies are also encouraged to conform; however there is no requirement for disclosure of compliance in private company accounts. The Code adopts a principles-based approach in the sense that it provides general guidelines of best practice. This contrasts with a rules-based approach which rigidly defines exa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Say On Pay

Say on pay is a term used for a role in corporate law whereby a firm's shareholders have the right to vote on the remuneration of executives. Often described in corporate governance or management theory as an agency problem, a corporation's managers are likely to overpay themselves because, directly or indirectly, they are allowed to pay themselves as a matter of general management power. Directors are elected to a board that has a fiduciary duty to protect the interests of the corporation. In large listed companies, executive compensation will usually be determined by a compensation committee composed of board members. Proponents argue that “say on pay” reforms strengthen the relationship between the board of directors and shareholders, ensuring that board members fulfill their fiduciary dutyCritics of the policy believe that “say on pay” does not effectively or comprehensibly monitor compensation, and consider it to be reactionary policy rather than proactive policy, bec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

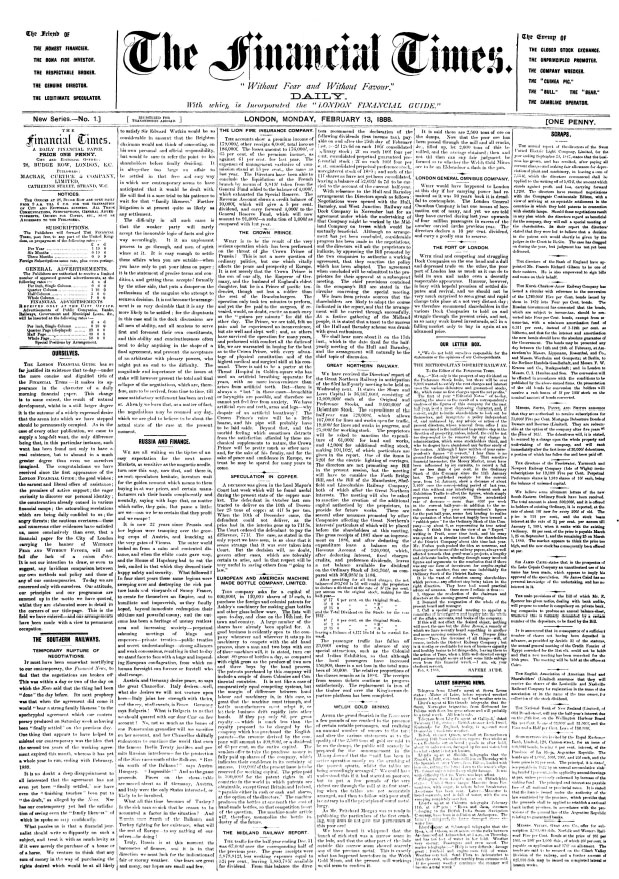

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Myners Report

''Institutional Investment in the UK: A Review'' (the ''Myners Report'') was a report to HM Treasury in March 2001 on institutional investors. It was delivered by Paul Myners. Government was concerned that institutional investor An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked co ...s were giving insufficient attention and resources to their holdings in non-listed companies. The report addressed this, in particular concerning pension fund trustees and fund managers. Though some anticipated creation of public interest duties, the Report took the approach of asking whether institutional investors were acting in the best interests of their beneficiaries. Summary The report questions whether institutional investors in the UK are too risk averse and considers if there are any factors dist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |