|

Soft Landing (economics)

A soft landing in the business cycle is the process of an economy shifting from growth to slow-growth to potentially flat, as it approaches but avoids a recession. It is usually caused by government attempts to slow down inflation. The criteria for distinguishing between a ''hard'' and ''soft'' landing are numerous and subjective. The term was adapted to economics from its origins in the early days of flight, when it historically was the method of the landing of hot air balloons, by gradually reducing their buoyancy. It later also applied to aviation, gliders and spacecraft, as in the Lunar lander. In the United States, modern recessions and hard and soft landings follow from Federal Reserve tightening cycles, in which the Federal funds rate is increased over several consecutive moves. In modern times, the most notable, and possibly the only true soft landing in the most recent 16 business cycles occurred in the soft landing of 1994, engineered by Federal Reserve Chairman Alan Gr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

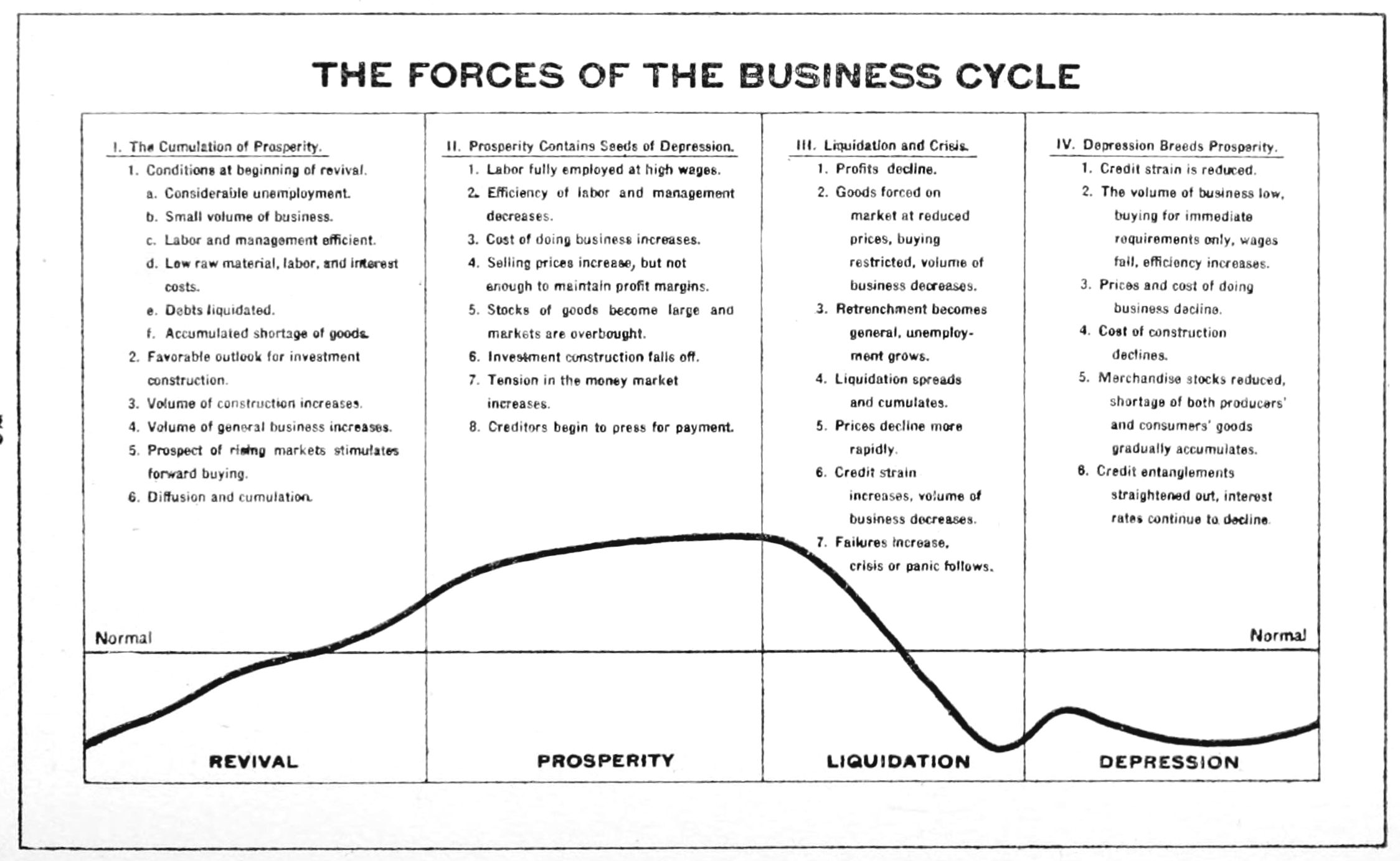

Economic Cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in arvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics'' such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numerous sources of business ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and regulating banks, maintaining the stabili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Cycle

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production. Business cycle fluctuations are usually characterized by general upswings and downturns in a span of macroeconomic variables. The individual episodes of expansion/recession occur with changing duration and intensity over time. Typically their periodicity has a wide range from around 2 to 10 years (the technical phrase "stochastic cycle" is often used in statistics to describe this kind of process.) As in [Harvey, Trimbur, and van Dijk, 2007, ''Journal of Econometrics''], such flexible knowledge about the frequency of business cycles can actually be included in their mathematical study, using a Bayesian statistical paradigm. There are numer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as monetary policy, incr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

South Africa

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. It is bounded to the south by of coastline that stretch along the South Atlantic and Indian Oceans; to the north by the neighbouring countries of Namibia, Botswana, and Zimbabwe; and to the east and northeast by Mozambique and Eswatini. It also completely enclaves the country Lesotho. It is the southernmost country on the mainland of the Old World, and the second-most populous country located entirely south of the equator, after Tanzania. South Africa is a biodiversity hotspot, with unique biomes, plant and animal life. With over 60 million people, the country is the world's 24th-most populous nation and covers an area of . South Africa has three capital cities, with the executive, judicial and legislative branches of government based in Pretoria, Bloemfontein, and Cape Town respectively. The largest city is Johannesburg. About 80% of the population are Black South Afri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Industry Sector

Industry classification or industry taxonomy is a type of economic taxonomy that classifies companies, organizations and traders into industrial groupings based on similar production processes, similar products, or similar behavior in financial markets. National and international statistical agencies use various industry-classification schemes to summarize economic conditions. Securities analysts use such groupings to track common forces acting on groups of companies, to compare companies' performance to that of their peers, and to construct either specialized or diversified portfolios. Sectors and industries Economic activities can be classified in a variety of ways. At the top level, they are often classified according to the three-sector theory into sectors: primary (extraction and agriculture), secondary (manufacturing), and tertiary (services). Some authors add quaternary (knowledge) or even quinary (culture and research) sectors. Over time, the fraction of a society's ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Segment

In marketing, market segmentation is the process of dividing a broad consumer or business market, normally consisting of existing and potential customers, into sub-groups of consumers (known as ''segments'') based on some type of shared characteristics. In dividing or segmenting markets, researchers typically look for common characteristics such as shared needs, common interests, similar lifestyles, or even similar demographic profiles. The overall aim of segmentation is to identify ''high yield segments'' – that is, those segments that are likely to be the most profitable or that have growth potential – so that these can be selected for special attention (i.e. become target markets). Many different ways to segment a market have been identified. Business-to-business (B2B) sellers might segment the market into different types of businesses or countries, while business-to-consumer (B2C) sellers might segment the market into demographic segments, such as lifestyle, behavior, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (currency), currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). The central bank of a country may use a definition of what constitutes legal tender for its purposes. Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public sector, Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of Security (finance), securities, inflation, the exchange rates, and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. First nominated to the Federal Reserve by President Ronald Reagan in August 1987, he was reappointed at successive four-year intervals until retiring on January 31, 2006, after the second-longest tenure in the position, behind only William McChesney Martin. President George W. Bush appointed Ben Bernanke as his successor. Greenspan came to the Federal Reserve Board from a consulting career. Although he was subdued in his public appearances, favorable media coverage raised his profile to a point that several observers likened him to a "rock star". Democratic leaders of Congress criticized him for politicizing his office because of his support for Social Security privatization and tax cuts. Many have argued that the "easy-money" policies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Funds Rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions' reserve requirements. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets. The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open Market Committee (FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Apollo Lunar Module

The Apollo Lunar Module (LM ), originally designated the Lunar Excursion Module (LEM), was the lunar lander spacecraft that was flown between lunar orbit and the Moon's surface during the United States' Apollo program. It was the first crewed spacecraft to operate exclusively in the airless vacuum of space, and remains the only crewed vehicle to land anywhere beyond Earth. Structurally and aerodynamically incapable of flight through Earth's atmosphere, the two-stage lunar module was ferried to lunar orbit attached to the Apollo command and service module (CSM), about twice its mass. Its crew of two flew the complete lunar module from lunar orbit to the Moon's surface. During takeoff, the spent descent stage was used as a launch pad for the ascent stage which then flew back to the command module, after which it was also discarded. Overseen by Grumman, the LM's development was plagued with problems that delayed its first uncrewed flight by about ten months and its first crewed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |