|

Social Security Act

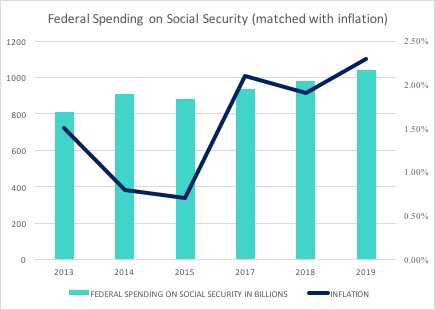

The Social Security Act of 1935 is a law enacted by the 74th United States Congress and signed into law by US President Franklin D. Roosevelt. The law created the Social Security program as well as insurance against unemployment. The law was part of Roosevelt's New Deal domestic program. By the 1930s, the United States was the only modern industrial country without any national system of social security. In the midst of the Great Depression, the physician Francis Townsend galvanized support behind a proposal to issue direct payments to the elderly. Responding to that movement, Roosevelt organized a committee led by Secretary of Labor Frances Perkins to develop a major social welfare program proposal. Roosevelt presented the plan in early 1935 and signed the Social Security Act into law on August 14, 1935. The act was upheld by the Supreme Court in two major cases decided in 1937. The law established the Social Security program. The old-age program is funded by payroll taxes, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin D

Franklin may refer to: People * Franklin (given name) * Franklin (surname) * Franklin (class), a member of a historical English social class Places Australia * Franklin, Tasmania, a township * Division of Franklin, federal electoral division in Tasmania * Division of Franklin (state), state electoral division in Tasmania * Franklin, Australian Capital Territory, a suburb in the Canberra district of Gungahlin * Franklin River, river of Tasmania * Franklin Sound, waterway of Tasmania Canada * District of Franklin, a former district of the Northwest Territories * Franklin, Quebec, a municipality in the Montérégie region * Rural Municipality of Franklin, Manitoba * Franklin, Manitoba, an unincorporated community in the Rural Municipality of Rosedale, Manitoba * Franklin Glacier Complex, a volcano in southwestern British Columbia * Franklin Range, a mountain range on Vancouver Island, British Columbia * Franklin River (Vancouver Island), British Columbia * Franklin Strai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aid To Families With Dependent Children

Aid to Families with Dependent Children (AFDC) was a federal assistance program in the United States in effect from 1935 to 1997, created by the Social Security Act (SSA) and administered by the United States Department of Health and Human Services that provided financial assistance to children whose families had low or no income. The program grew from a minor part of the social security system to a significant system of welfare administered by the states with federal funding. However, it was criticized for offering incentives for women to have children, and for providing disincentives for women to join the workforce. In July 1997, AFDC was replaced by the more restrictive Temporary Assistance for Needy Families (TANF) program. History The program was created under the name Aid to Dependent Children (ADC) by the Social Security Act of 1935 as part of the New Deal. It was created as a means tested entitlement which subsidized the income of families where fathers were "dec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social Security Amendments of 1972 and is incorporated in Title 16 of the Social Security Act. The program is administered by the Social Security Administration (SSA) and began operations in 1974. Individuals or their helpers may start the application for SSI benefits by completing a short form on SSA's website. SSA staff will schedule an appointment for the individual or helper within 1–2 weeks and complete the process. SSI was created to replace federal-state adult assistance programs that served the same purpose, but were administered by the state agencies and received criticism for lacking consistent eligibility criteria. The restructuring of these programs was intended to standardize the eligibility requirements and level of benefits. Alth ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge University Press

Cambridge University Press is the university press of the University of Cambridge. Granted letters patent by Henry VIII of England, King Henry VIII in 1534, it is the oldest university press A university press is an academic publishing house specializing in monographs and scholarly journals. Most are nonprofit organizations and an integral component of a large research university. They publish work that has been reviewed by schola ... in the world. It is also the King's Printer. Cambridge University Press is a department of the University of Cambridge and is both an academic and educational publisher. It became part of Cambridge University Press & Assessment, following a merger with Cambridge Assessment in 2021. With a global sales presence, publishing hubs, and offices in more than 40 Country, countries, it publishes over 50,000 titles by authors from over 100 countries. Its publishing includes more than 380 academic journals, monographs, reference works, school and uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically imp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regressive Tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA In terms of individual income and wealth, a regressive tax imposes a greater burden (relative to resources) on the poor than on the rich: there is an inverse relationship between the tax rate and the taxpayer's ability to pay, as measured by assets, consumption, or income. These taxes tend to reduce the tax burden of the people with a higher ability to pay, as they shift the relative burden increasingly to those with a lower ability to pay. The regressivity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court rule ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oxford University Press

Oxford University Press (OUP) is the university press of the University of Oxford. It is the largest university press in the world, and its printing history dates back to the 1480s. Having been officially granted the legal right to print books by decree in 1586, it is the second oldest university press after Cambridge University Press. It is a department of the University of Oxford and is governed by a group of 15 academics known as the Delegates of the Press, who are appointed by the vice-chancellor of the University of Oxford. The Delegates of the Press are led by the Secretary to the Delegates, who serves as OUP's chief executive and as its major representative on other university bodies. Oxford University Press has had a similar governance structure since the 17th century. The press is located on Walton Street, Oxford, opposite Somerville College, in the inner suburb of Jericho. For the last 500 years, OUP has primarily focused on the publication of pedagogical texts and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Health Insurance

National health insurance (NHI), sometimes called statutory health insurance (SHI), is a system of health insurance that insures a national population against the costs of health care. It may be administered by the public sector, the private sector, or a combination of both. Funding mechanisms vary with the particular program and country. National or statutory health insurance does not equate to government-run or government-financed health care, but is usually established by national legislation. In some countries, such as Australia's Medicare system, the UK's National Health Service and South Korea’s National Health Insurance Service, contributions to the system are made via general taxation and therefore are not optional even though use of the health system it finances is. In practice, most people paying for NHI will join it. Where an NHI involves a choice of multiple insurance funds, the rates of contributions may vary and the person has to choose which insurance fund to belon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement

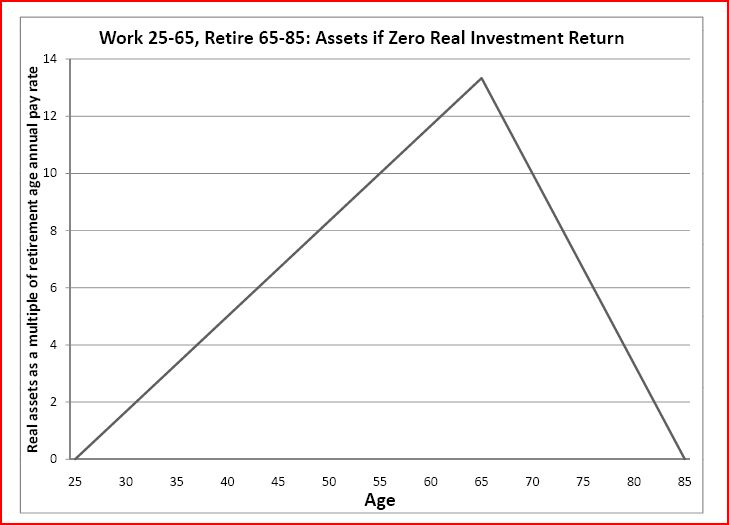

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retirement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Insurance

Social insurance is a form of Social protection, social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of Welfare, social assistance, individuals' claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the individuals are then paid benefits in the future. Types of social insurance include: * Universal health care, Public health insurance * Social Security (United States), Social Security * Unemployment Insurance, Public Unemployment Insurance * Public auto insurance * Parental leave, Universal parental leave Features * The contributions of individuals is nominal and never goes beyond what they can afford * the Social welfare, benefits, eligibility requirements and other aspects of the program are defined by statute; * explicit provision is made to account for the income and exp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)

.jpg)