|

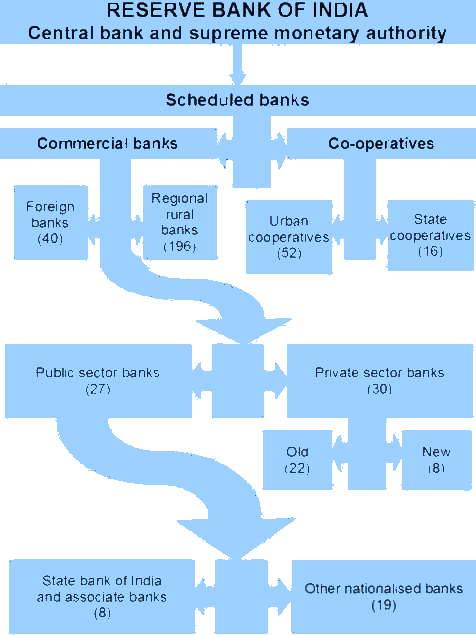

Scheduled Banks

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934. Reserve Bank of India (RBI) in turn includes only those banks in this Schedule which satisfy the criteria laid down vide section 42(6)(a) of the said Act. Banks not under this Schedule are called Non-Scheduled Banks Facilities Every Scheduled bank enjoys two types of principal facilities: it becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of clearing house. Types of banks There are two main categories of commercial banks in India namely - * Scheduled Commercial banks * Scheduled Co-operative banks Scheduled commercial Banks are further divided into 5 types as below - # Nationalised Banks # Development Banks # Regional urban Banks # Foreign Banks # Private sector Banks #Payment bank (currently five banks NSDL Payments Bank, Airtel Payments Bank, Fino Payments Bank, India Post Payments Ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scheduled Banking Structure In India

A schedule or a timetable, as a basic time-management tool, consists of a list of times at which possible task (project management), tasks, events, or actions are intended to take place, or of a sequence of events in the chronological order in which such things are intended to take place. The process of creating a schedule — deciding how to order these tasks and how to commit resources between the variety of possible tasks — is called scheduling,Ofer Zwikael, John Smyrk, ''Project Management for the Creation of Organisational Value'' (2011), p. 196: "The process is called scheduling, the output from which is a timetable of some form". and a person responsible for making a particular schedule may be called a scheduler. Making and following schedules is an ancient human activity. Some scenarios associate this kind of planning with learning life skills. Schedules are necessary, or at least useful, in situations where individuals need to know what time they must be at a spec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India Act, 1934

Reserve Bank of India Act, 1934 is the legislative act under which the Reserve Bank of India was formed. This act along with the Companies Act, which was amended in 1936, were meant to provide a framework for the supervision of banking firms in India. Summary The Act contains the definition of the so-called scheduled banks, as they are mentioned in the 2nd Schedule of the Act. These are banks which were to have paid up capital and reserves above 5 lakh. There are various section in the RBI Act but the most controversial and confusing section is Section 7. Although this section has been used only once by the central govt, it puts a restriction on the autonomy of the RBI. Section 7 states that central government can legislate the functioning of the RBI through the RBI board, and the RBI is not an autonomous body. Section 17 of the Act defines the manner in which the RBI (the central bank of India) can conduct business. The RBI can accept deposits from the central and state gover ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Nashik (Western India) and Dewas (Central India). RBI established the National Payments Corporation of India as one of its specialised division to regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialised division for the purpose of providing insurance of deposits and guaranteeing of credit facilit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Rate

Bank rate, also known as discount rate in American English, is the rate of interest which a central bank charges on its loans and advances to a commercial bank. The bank rate is known by a number of different terms depending on the country, and has changed over time in some countries as the mechanisms used to manage the rate have changed. Whenever a bank has a shortage of funds, they can typically borrow from the central bank based on the monetary policy of the country. The borrowing is commonly done via repos: the repo rate is the rate at which the central bank lends short-term money to the banks against securities. It is more applicable when there is a liquidity crunch in the market. In contrast, the reverse repo rate is the rate at which banks can park surplus funds with the reserve bank, which is mostly done when there is surplus liquidity. Determining the rate The interest rate that is charged by a country's central or federal bank on loans and advances controls the money ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing House (finance)

A clearing house is a financial institution formed to facilitate the exchange (i.e., '' clearance'') of payments, securities, or derivatives transactions. The clearing house stands between two clearing firms (also known as member firms or participants). Its purpose is to reduce the risk of a member firm failing to honor its trade settlement obligations. Description After the legally binding agreement (i.e., ''execution'') of a trade between a buyer and a seller, the role of the clearing house is to centralize and standardize all of the steps leading up to the payment (i.e. ''settlement'') of the transaction. The purpose is to reduce the cost, settlement risk and operational risk of clearing and settling multiple transactions among multiple parties. In addition to the above services, central counterparty clearing (CCP) takes on counterparty risk by stepping in between the original buyer and seller of a financial contract, such as a derivative. The role of the CCP is to perform t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Live Mint

''Mint'' is an Indian financial daily newspaper published by HT Media, a Delhi-based media group which is controlled by the K. K. Birla family that also publishes ''Hindustan Times''. It mostly targets readers who are business executives and policy makers. It has been in circulation since 2007. Of the five business dailies published in India, Mint rose to the number two position immediately after its launch and has remained there (behind The Economic Times ever since. It publishes a single national edition that is printed and distributed in New Delhi, Mumbai, Bangalore, Hyderabad, Chennai, Kolkata, Pune, Ahmedabad and Chandigarh. Unlike most mainstream newspapers from India, Mint is not published on Sunday. It instead offers its readers Mint Lounge every Saturday, a weekend magazine focused on intelligent lifestyle, fashion, food, books, science and culture. Mint's editorial coverage and its style of presentation is noted for its refreshing clarity and accessibility - facets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit. It can also refer to a bank, or a division of a large bank, which deals with corporations or a large/middle-sized business to differentiate it from a retail bank and an investment bank. Commercial banks include private sector banks and public sector banks. History The name ''bank'' derives from the Italian word ''banco'' "desk/bench", used during the Italian Renaissance era by Florentine bankers, who used to carry out their transactions on a desk covered by a green tablecloth. However, traces of banking activity can be found even in ancient times. In the United States, the term commercial bank was often used to distinguish it from an investment bank due to differences in bank regulation. After the Great Depression, through the Glass–Steagall Act, the U.S. Congress required that commercial banks only engage in ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

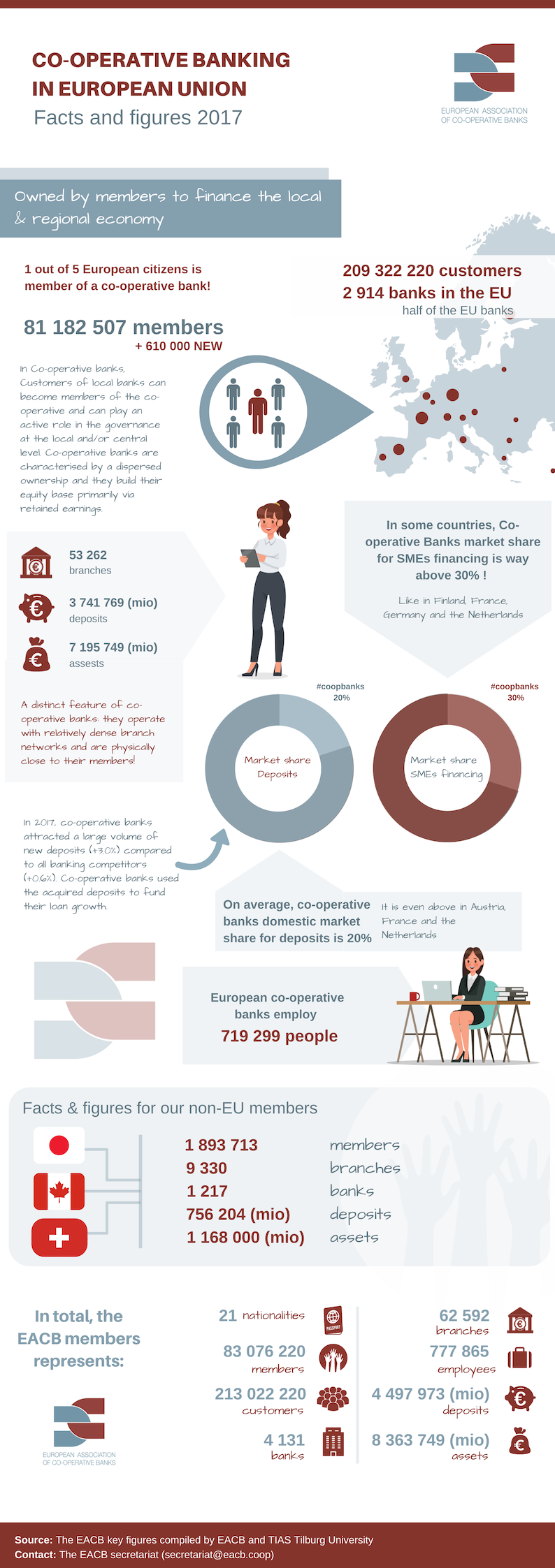

Cooperative Banking

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societies and cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. A 2013 report by ILO concluded that cooperative banks outperformed their competitors during the financial crisis of 2007–2008. The cooperative banking sector had 20% market share of the European banking sector, but accounted for only 7% of all the write-downs and losses between the third quarter of 2007 and first quarter of 2011. Cooperative banks were also over-represented in lending to small and medium-sized businesses in all of the 10 countries included in the report. Credit unions in the US had five times lower failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Bank

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Payments can be effected in a number of ways, for example: * the use of money, cheque, or debit, credit, or bank transfers, whether through mobile payment or otherwise * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly effected in the local currency of the payee unless the parties agree otherwise. Payment in another currency involves an additional foreign exchange transactio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Airtel Payments Bank

Airtel Payments Bank is an Indian payments bank with its headquarters in New Delhi. The company is a subsidiary of Bharti Airtel. On 5 January 2022, it was granted the scheduled bank status by Reserve Bank of India under second schedule of RBI Act, 1934. History In 2015, eleven companies received In-principle approval from the Reserve Bank of India to set up Payments Bank under the guidelines for Licensing of Payments Bank. On 11 April 2016, Airtel Payments Bank became the first company to receive the Payments Bank license from the Reserve Bank of India under Section 22 (1) of the Banking Regulation Act, 1949. Airtel Payments Bank started with an 80:20 partnership between Bharti Airtel and Kotak Mahindra Bank. Bharti Airtel launched Airtel Payments Bank in September 2016 and went live with its pilot project in Rajasthan in November 2016. It was launched nationally in January 2017 to support the cashless revolution promised by the Government of India. In August 2021, Kotak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

India Post Payments Bank

India Post Payments Bank, abbreviated as IPPB, is a division of India Post which is under the ownership of the Department of Post, a department under Ministry of Communications of the Government of India. Opened in 2018, as of January 2022, the bank has more than 5 crore customers. History On 19 August 2015, the India Post received licence to run a payments bank from the Reserve Bank of India. On 17 August 2016, it was registered as a public limited government company for setting up a payments bank. IPPB is operating with the Department of Posts under Ministry of Communications. The pilot project of IPPB was inaugurated on 30 January 2017 at Raipur and Ranchi. In August 2018, the Union Cabinet approved a cost of for setting up the bank. The first phase of the bank with 650 branches and 3,250 post offices as access points was inaugurated on 1 September 2018. Over ten thousand postmen have been roped into the first phase. By September 2020, the bank had acquired about 3.5 cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paytm Payments Bank

Paytm Payments Bank (PPBL) is an Indian payments bank, founded in 2015 and headquartered in Noida. In the same year, it received the license to run a payments bank from the Reserve Bank of India and was launched in November 2017. In 2021, the bank received a scheduled bank status from the RBI. Vijay Shekhar Sharma holds 51 per cent in the entity with One97 Communications Limited holding 49 per cent . Vijay Shekhar Sharma is the promoter of Paytm Payments Bank, and One97 Communications Limited is not categorized as one of its promoters. History In 2015, Paytm Payments Bank Limited had received in-principle approval from the Reserve Bank of India to set up a payments bank and was formally inaugurated on November 28, 2017. In the financial year 2020, the bank facilitated more than 485 crore transactions worth ₹4.6 lakh crore. It processed over 778 million UPI transactions amounting to ₹89,388 crore in June 2022 and continues to be India’s biggest UPI beneficiary bank wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |